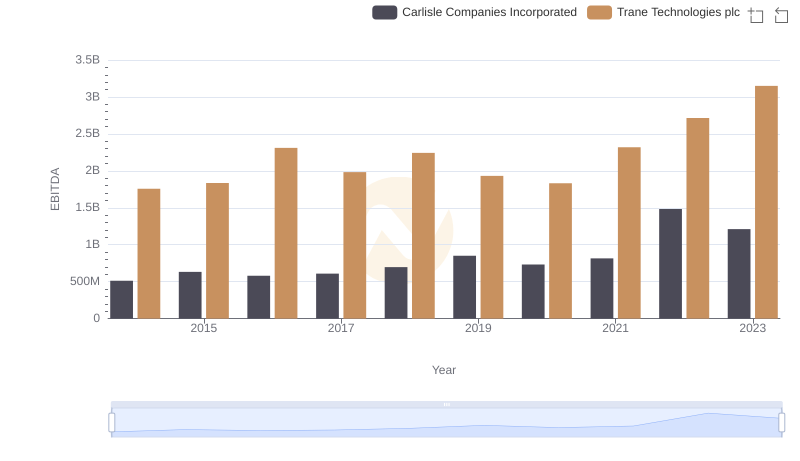

| __timestamp | Carlisle Companies Incorporated | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 33800000 | 212300000 |

| Thursday, January 1, 2015 | 42800000 | 205900000 |

| Friday, January 1, 2016 | 48100000 | 207900000 |

| Sunday, January 1, 2017 | 54900000 | 210800000 |

| Monday, January 1, 2018 | 55100000 | 228700000 |

| Tuesday, January 1, 2019 | 60900000 | 174200000 |

| Wednesday, January 1, 2020 | 45400000 | 165000000 |

| Friday, January 1, 2021 | 49900000 | 193500000 |

| Saturday, January 1, 2022 | 50800000 | 211200000 |

| Sunday, January 1, 2023 | 28700000 | 252300000 |

| Monday, January 1, 2024 | 35400000 | 0 |

Data in motion

In the competitive landscape of industrial innovation, research and development (R&D) spending is a critical indicator of a company's commitment to future growth. Over the past decade, Trane Technologies plc and Carlisle Companies Incorporated have demonstrated contrasting strategies in their R&D investments.

From 2014 to 2023, Trane Technologies consistently allocated a significant portion of its resources to R&D, peaking in 2023 with a 20% increase from its 2014 levels. This strategic focus underscores Trane's dedication to maintaining its edge in the market. In contrast, Carlisle Companies showed a more fluctuating pattern, with a notable dip in 2023, reducing its R&D spending by nearly 50% compared to its 2019 peak.

These trends highlight the divergent paths these companies are taking in their quest for innovation, with Trane Technologies leading the charge in sustained R&D investment.

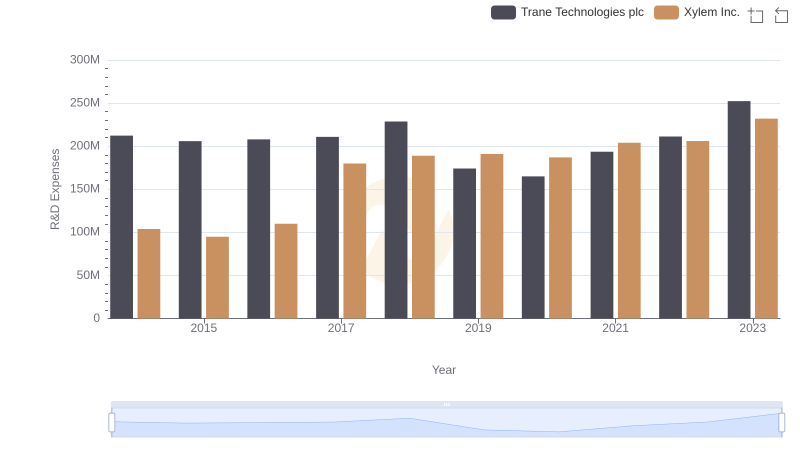

Research and Development Expenses Breakdown: Trane Technologies plc vs Xylem Inc.

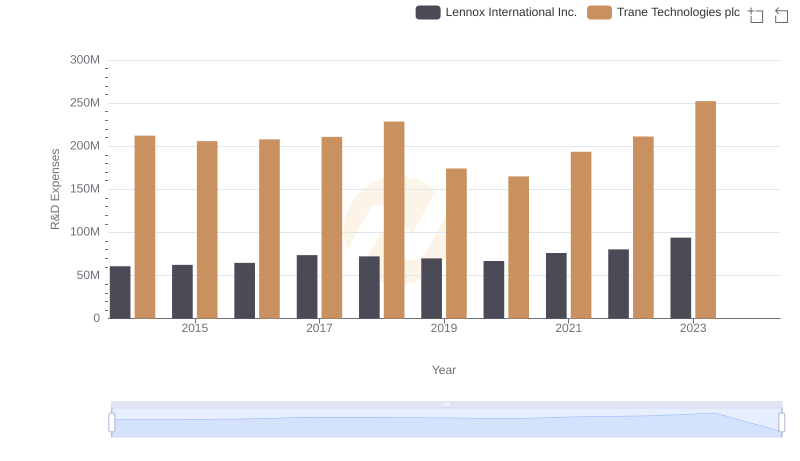

R&D Spending Showdown: Trane Technologies plc vs Lennox International Inc.

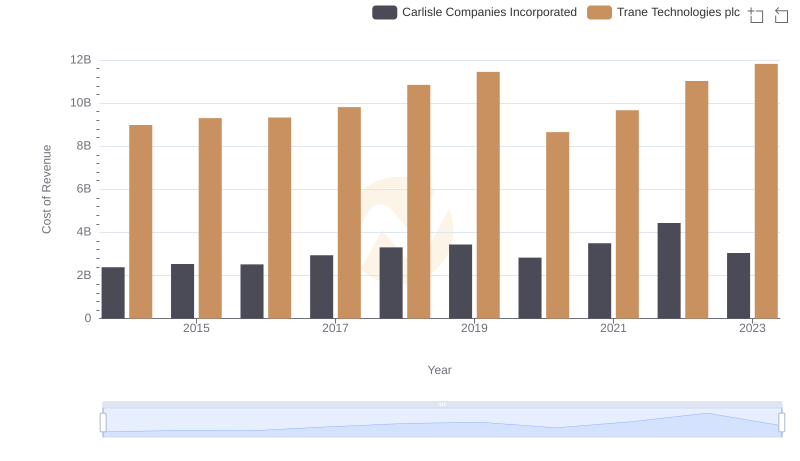

Comparing Cost of Revenue Efficiency: Trane Technologies plc vs Carlisle Companies Incorporated

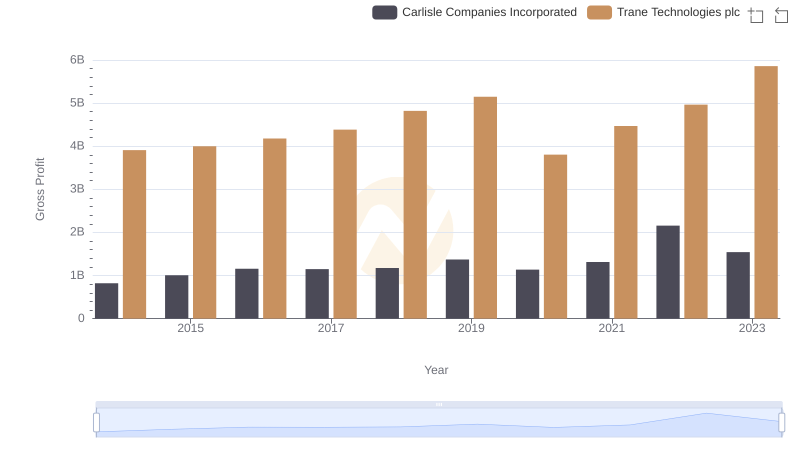

Key Insights on Gross Profit: Trane Technologies plc vs Carlisle Companies Incorporated

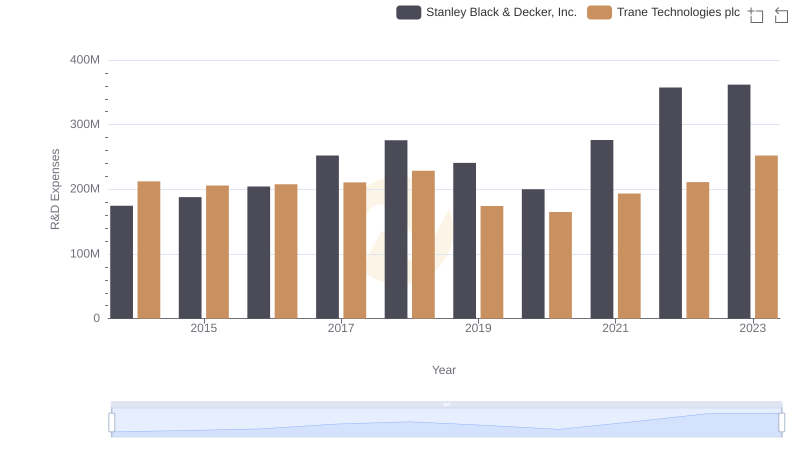

Who Prioritizes Innovation? R&D Spending Compared for Trane Technologies plc and Stanley Black & Decker, Inc.

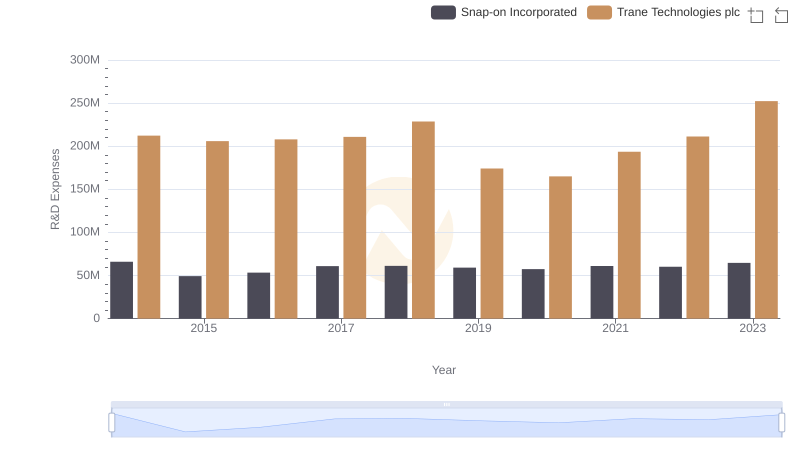

Who Prioritizes Innovation? R&D Spending Compared for Trane Technologies plc and Snap-on Incorporated

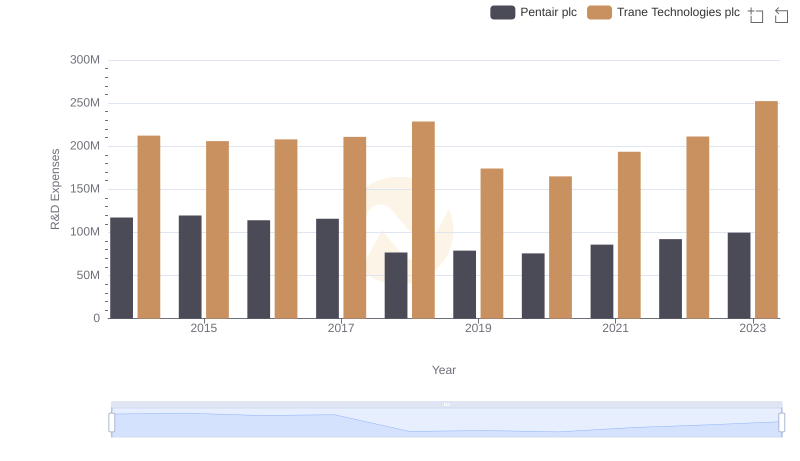

Research and Development: Comparing Key Metrics for Trane Technologies plc and Pentair plc

A Professional Review of EBITDA: Trane Technologies plc Compared to Carlisle Companies Incorporated

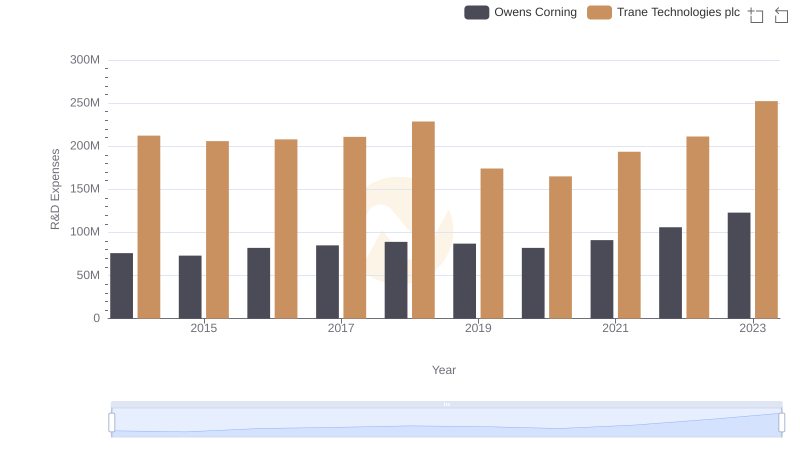

Trane Technologies plc vs Owens Corning: Strategic Focus on R&D Spending

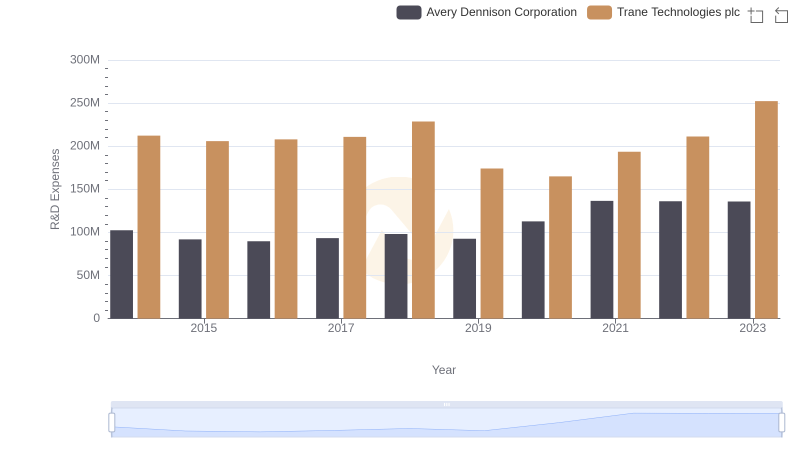

Analyzing R&D Budgets: Trane Technologies plc vs Avery Dennison Corporation