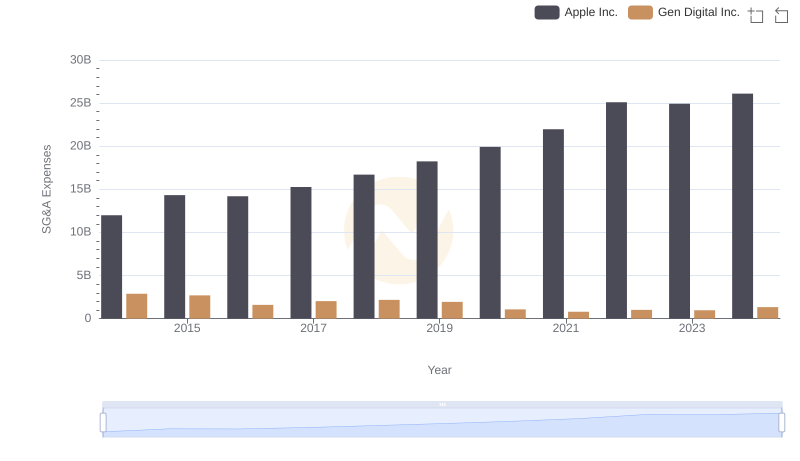

| __timestamp | Gen Digital Inc. | Super Micro Computer, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2880000000 | 61029000 |

| Thursday, January 1, 2015 | 2702000000 | 73228000 |

| Friday, January 1, 2016 | 1587000000 | 100681000 |

| Sunday, January 1, 2017 | 2023000000 | 115331000 |

| Monday, January 1, 2018 | 2171000000 | 170176000 |

| Tuesday, January 1, 2019 | 1940000000 | 218382000 |

| Wednesday, January 1, 2020 | 1069000000 | 219078000 |

| Friday, January 1, 2021 | 791000000 | 186222000 |

| Saturday, January 1, 2022 | 1014000000 | 192561000 |

| Sunday, January 1, 2023 | 968000000 | 214610000 |

| Monday, January 1, 2024 | 1337000000 | 383111000 |

Infusing magic into the data realm

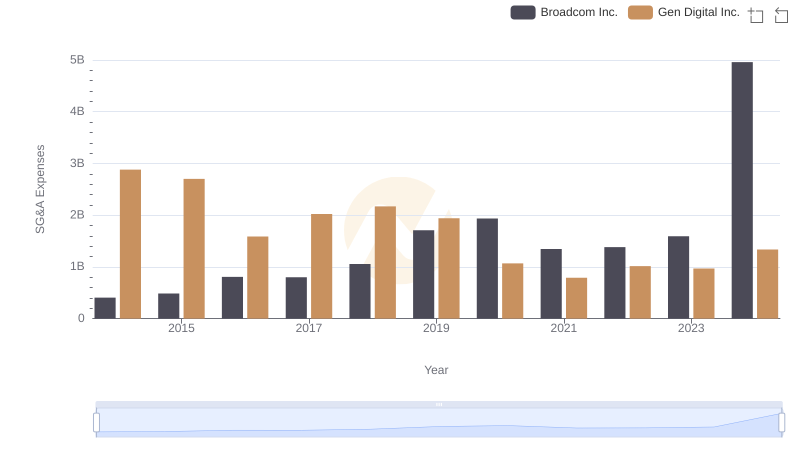

In the competitive landscape of technology companies, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Super Micro Computer, Inc. and Gen Digital Inc. have shown contrasting approaches. From 2014 to 2024, Gen Digital Inc. consistently reported higher SG&A expenses, peaking in 2014 with nearly 2.9 billion USD. However, by 2023, they managed to reduce these costs by approximately 66%, showcasing a strategic shift towards efficiency. In contrast, Super Micro Computer, Inc. maintained a more stable SG&A expense profile, with a notable increase in 2024, reaching 383 million USD. This represents a 528% increase from their 2014 figures, indicating a potential investment in growth or restructuring. As these companies navigate the evolving tech industry, their ability to manage SG&A costs will be pivotal in maintaining competitive advantage and shareholder value.

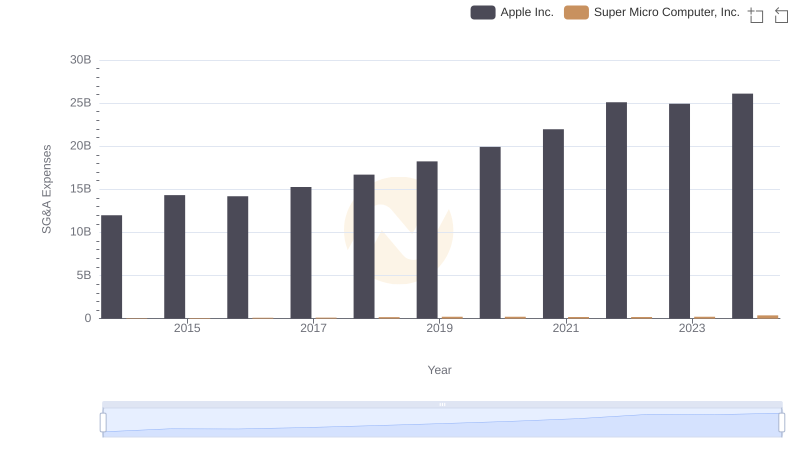

Apple Inc. vs Super Micro Computer, Inc.: SG&A Expense Trends

SG&A Efficiency Analysis: Comparing Apple Inc. and Gen Digital Inc.

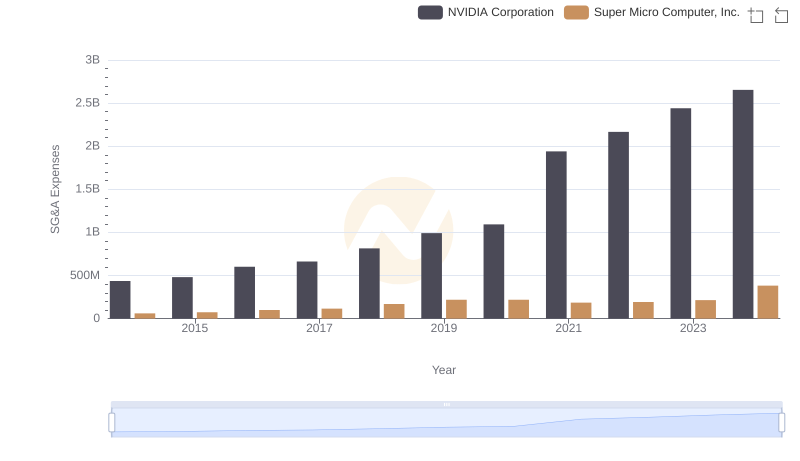

Breaking Down SG&A Expenses: NVIDIA Corporation vs Super Micro Computer, Inc.

Selling, General, and Administrative Costs: Taiwan Semiconductor Manufacturing Company Limited vs Super Micro Computer, Inc.

SG&A Efficiency Analysis: Comparing Taiwan Semiconductor Manufacturing Company Limited and Gen Digital Inc.

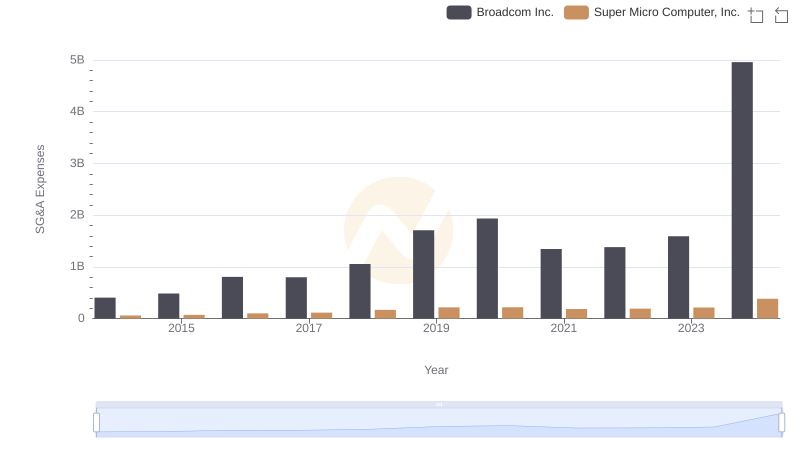

SG&A Efficiency Analysis: Comparing Broadcom Inc. and Super Micro Computer, Inc.

Selling, General, and Administrative Costs: Broadcom Inc. vs Gen Digital Inc.

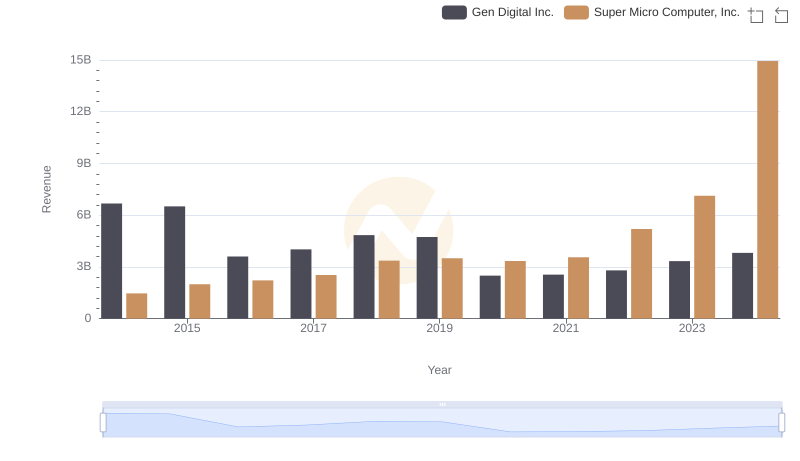

Breaking Down Revenue Trends: Super Micro Computer, Inc. vs Gen Digital Inc.

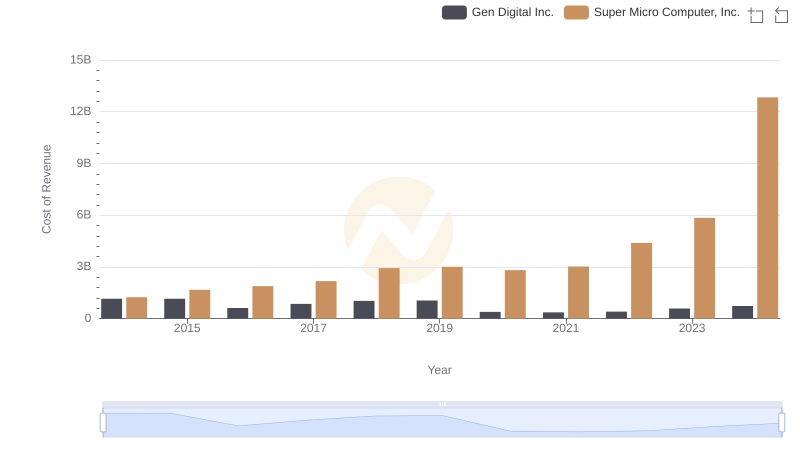

Cost of Revenue Comparison: Super Micro Computer, Inc. vs Gen Digital Inc.

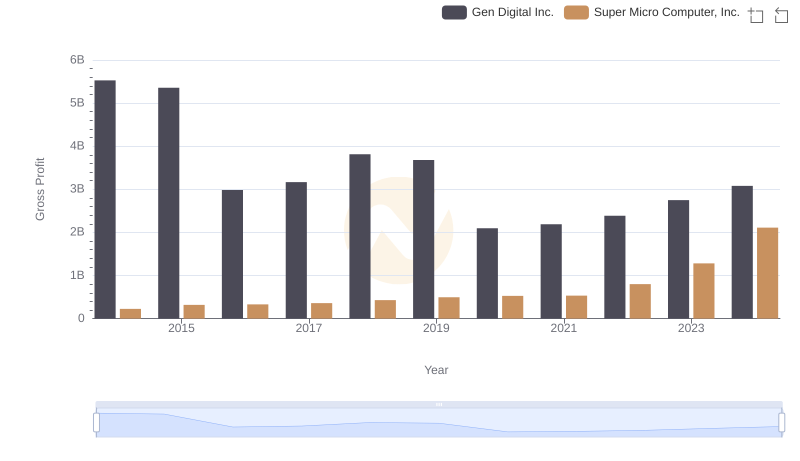

Gross Profit Trends Compared: Super Micro Computer, Inc. vs Gen Digital Inc.

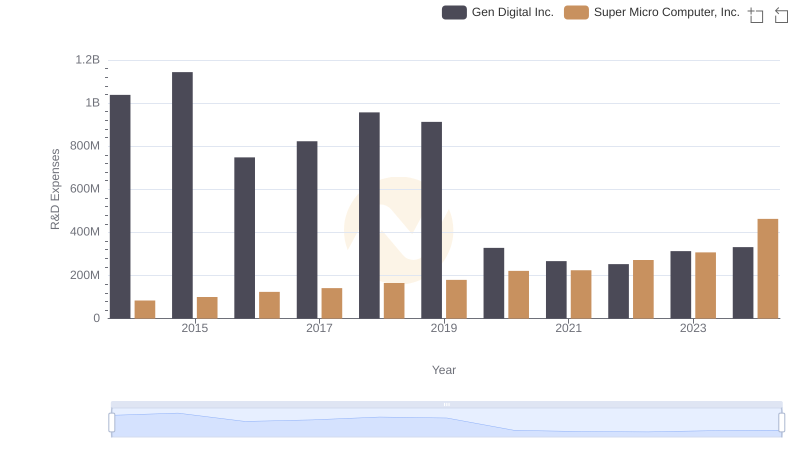

Research and Development: Comparing Key Metrics for Super Micro Computer, Inc. and Gen Digital Inc.

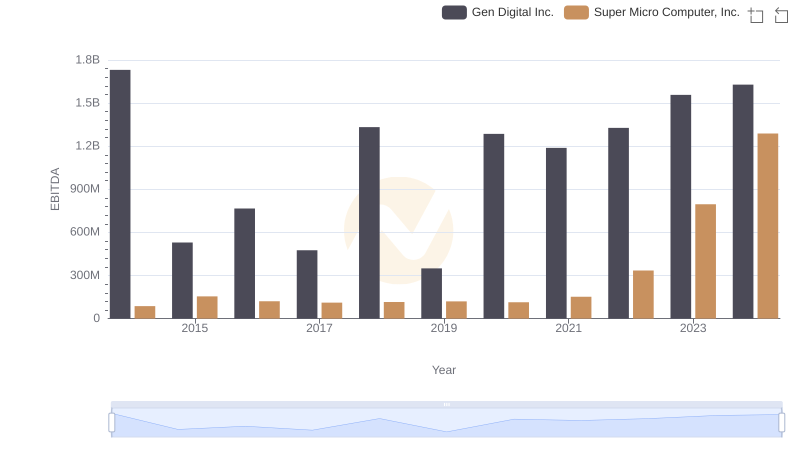

A Side-by-Side Analysis of EBITDA: Super Micro Computer, Inc. and Gen Digital Inc.