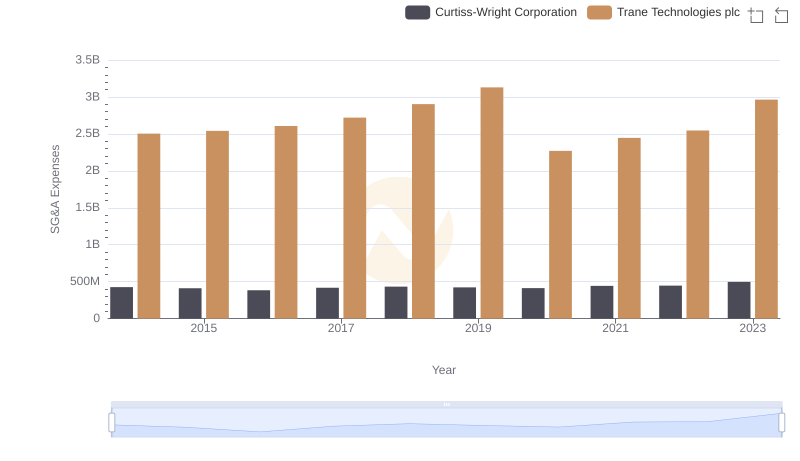

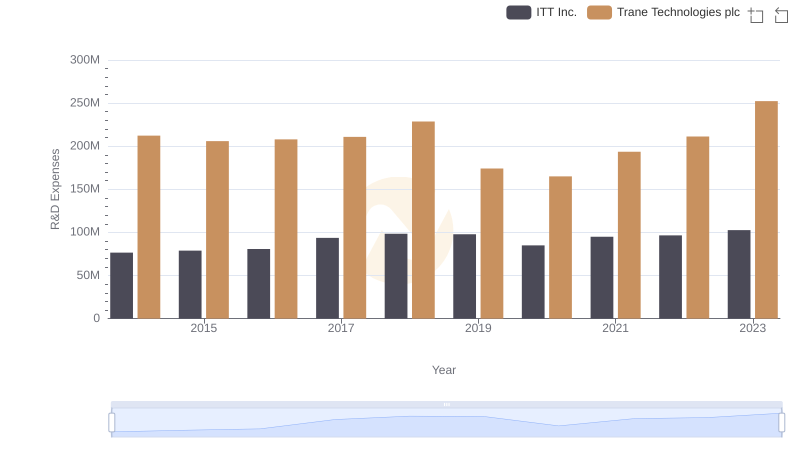

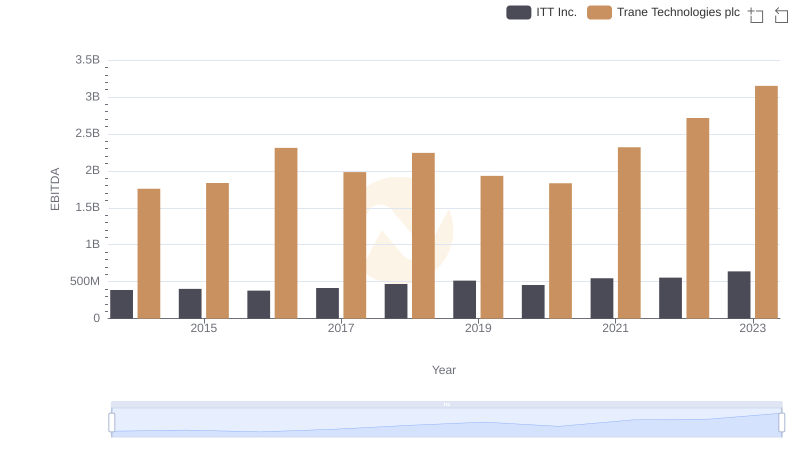

| __timestamp | ITT Inc. | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 519500000 | 2503900000 |

| Thursday, January 1, 2015 | 441500000 | 2541100000 |

| Friday, January 1, 2016 | 444100000 | 2606500000 |

| Sunday, January 1, 2017 | 433700000 | 2720700000 |

| Monday, January 1, 2018 | 427300000 | 2903200000 |

| Tuesday, January 1, 2019 | 420000000 | 3129800000 |

| Wednesday, January 1, 2020 | 347200000 | 2270600000 |

| Friday, January 1, 2021 | 365100000 | 2446300000 |

| Saturday, January 1, 2022 | 368500000 | 2545900000 |

| Sunday, January 1, 2023 | 476600000 | 2963200000 |

| Monday, January 1, 2024 | 502300000 | 3580400000 |

In pursuit of knowledge

In the competitive landscape of industrial manufacturing, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Trane Technologies plc and ITT Inc. have shown distinct trends in their SG&A expenditures from 2014 to 2023. Trane Technologies, with a consistent upward trajectory, saw its SG&A expenses grow by approximately 18% over the decade, peaking in 2019. In contrast, ITT Inc. experienced a more volatile pattern, with a notable dip in 2020, reflecting a 33% decrease from its 2014 peak. This divergence highlights Trane's strategic investment in administrative efficiency, while ITT's fluctuations suggest adaptive cost management in response to market conditions. As businesses navigate economic uncertainties, these insights into SG&A efficiency offer valuable lessons in balancing growth and operational costs.

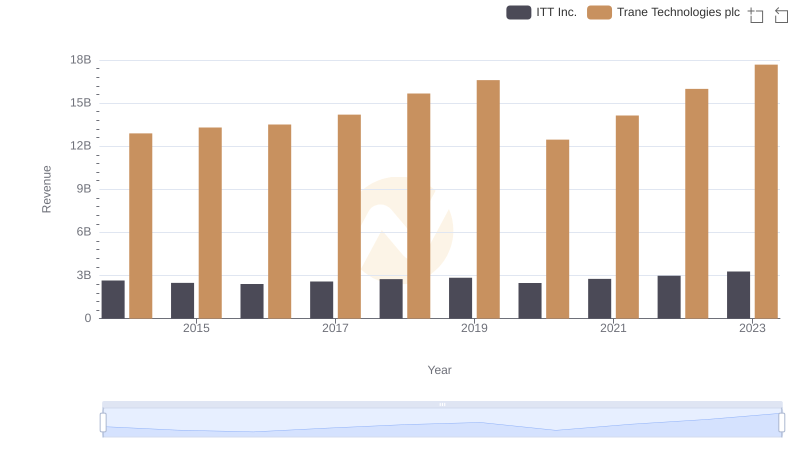

Comparing Revenue Performance: Trane Technologies plc or ITT Inc.?

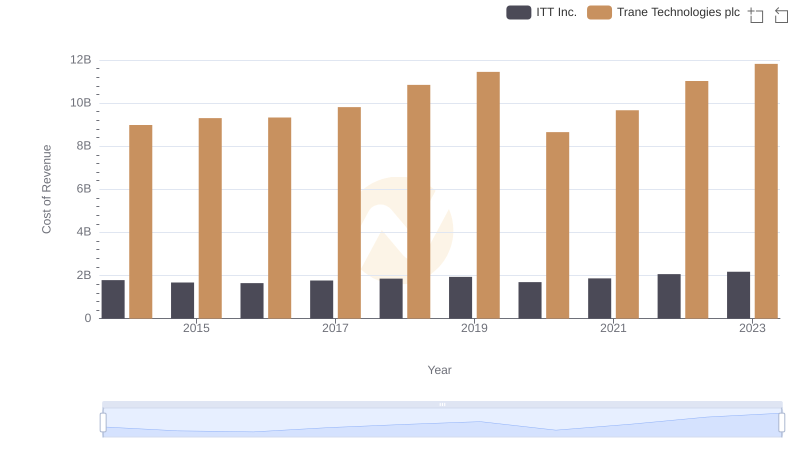

Cost of Revenue: Key Insights for Trane Technologies plc and ITT Inc.

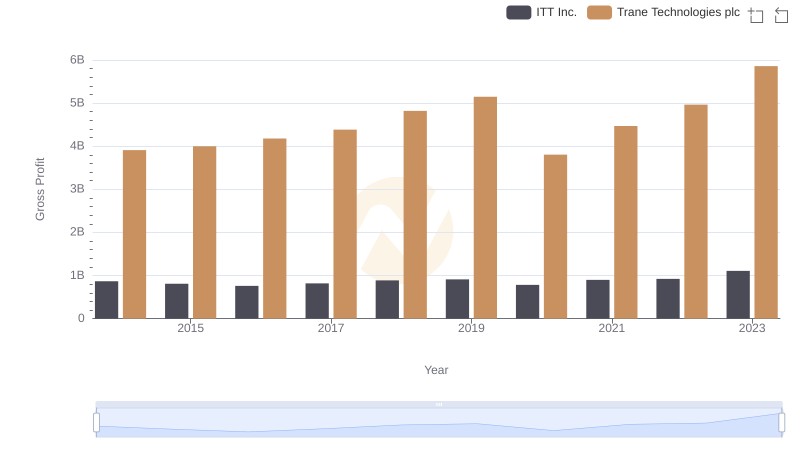

Gross Profit Analysis: Comparing Trane Technologies plc and ITT Inc.

Trane Technologies plc vs Curtiss-Wright Corporation: SG&A Expense Trends

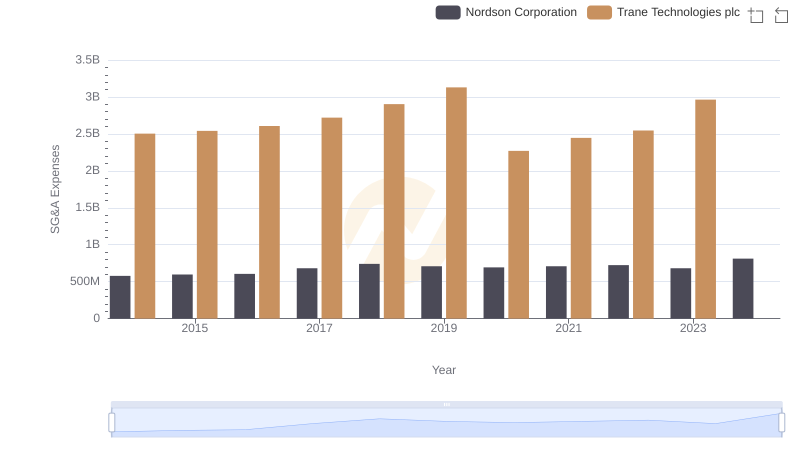

Trane Technologies plc or Nordson Corporation: Who Manages SG&A Costs Better?

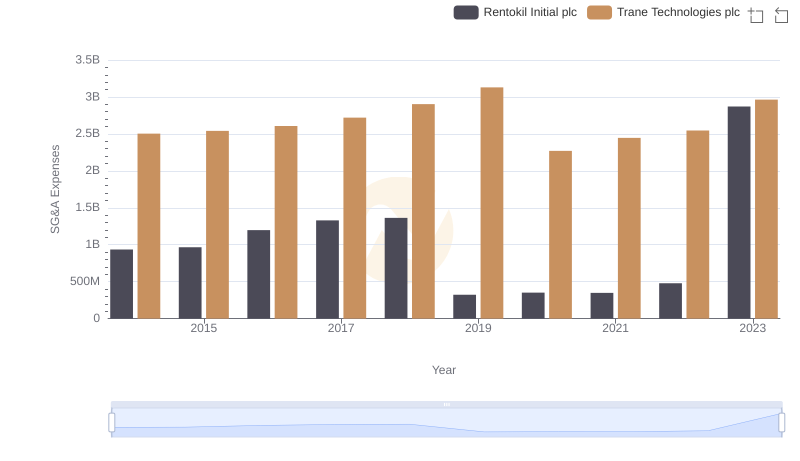

Cost Management Insights: SG&A Expenses for Trane Technologies plc and Rentokil Initial plc

R&D Spending Showdown: Trane Technologies plc vs ITT Inc.

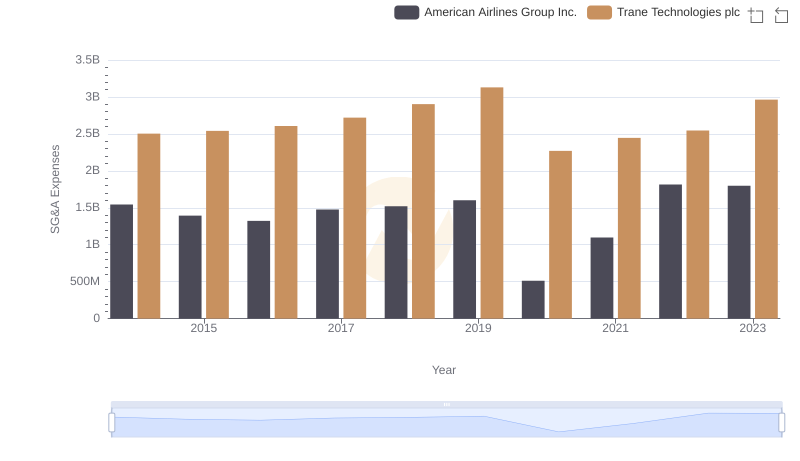

Selling, General, and Administrative Costs: Trane Technologies plc vs American Airlines Group Inc.

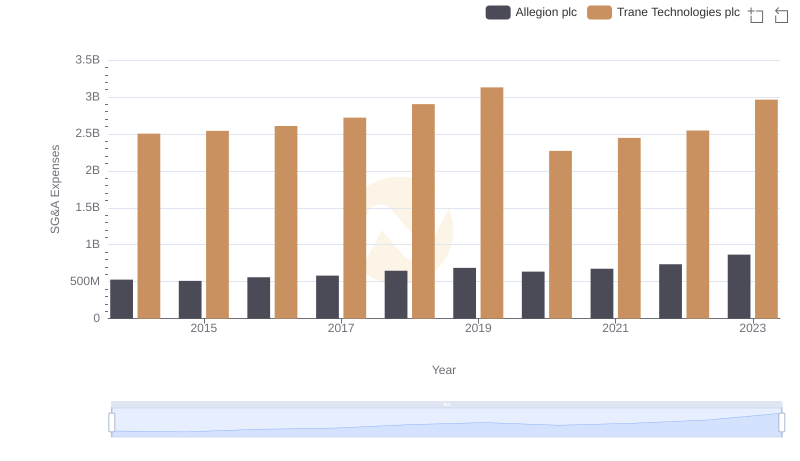

SG&A Efficiency Analysis: Comparing Trane Technologies plc and Allegion plc

Trane Technologies plc vs ITT Inc.: In-Depth EBITDA Performance Comparison