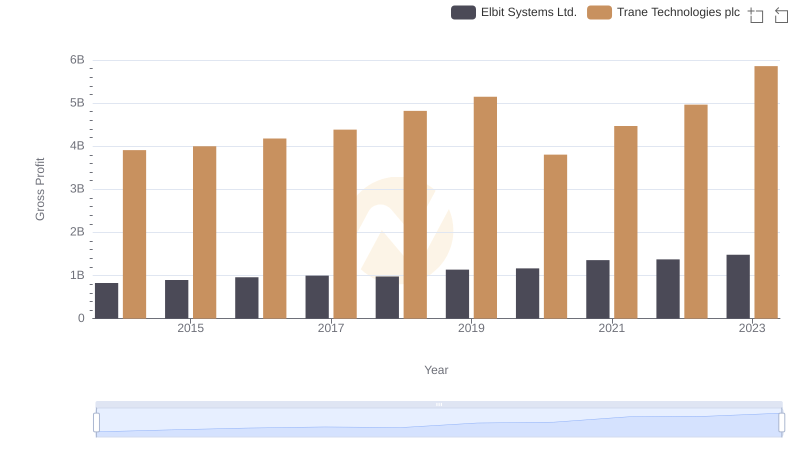

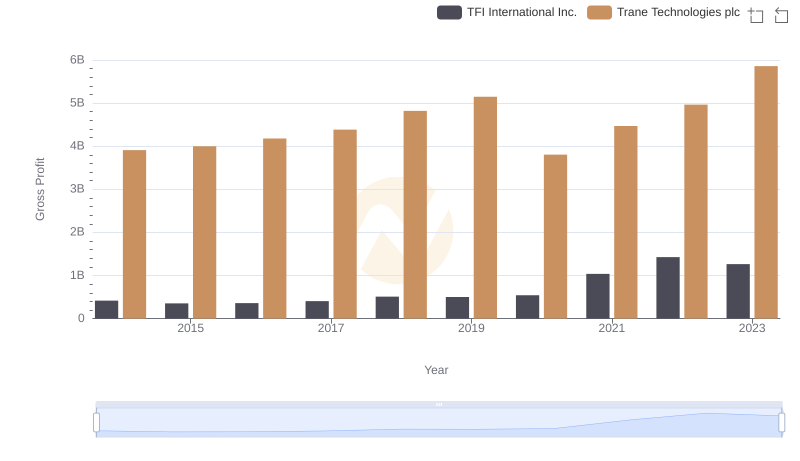

| __timestamp | ITT Inc. | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 866400000 | 3908600000 |

| Thursday, January 1, 2015 | 809100000 | 3999100000 |

| Friday, January 1, 2016 | 758200000 | 4179600000 |

| Sunday, January 1, 2017 | 817200000 | 4386000000 |

| Monday, January 1, 2018 | 887200000 | 4820600000 |

| Tuesday, January 1, 2019 | 910100000 | 5147400000 |

| Wednesday, January 1, 2020 | 782200000 | 3803400000 |

| Friday, January 1, 2021 | 899500000 | 4469600000 |

| Saturday, January 1, 2022 | 922300000 | 4964800000 |

| Sunday, January 1, 2023 | 1107300000 | 5857200000 |

| Monday, January 1, 2024 | 1247300000 | 7080500000 |

Cracking the code

In the ever-evolving landscape of industrial innovation, Trane Technologies plc and ITT Inc. have emerged as key players. Over the past decade, from 2014 to 2023, these companies have demonstrated remarkable growth in gross profit, reflecting their strategic prowess and market adaptability.

Trane Technologies plc has consistently outperformed ITT Inc., with its gross profit peaking at approximately 5.86 billion in 2023, marking a 50% increase from 2014. In contrast, ITT Inc. saw a more modest growth, with its gross profit reaching around 1.11 billion in 2023, a 28% rise from its 2014 figures.

This data underscores Trane Technologies' robust market strategies and innovative solutions, which have propelled its financial success. Meanwhile, ITT Inc.'s steady growth highlights its resilience and commitment to maintaining a competitive edge in the industrial sector.

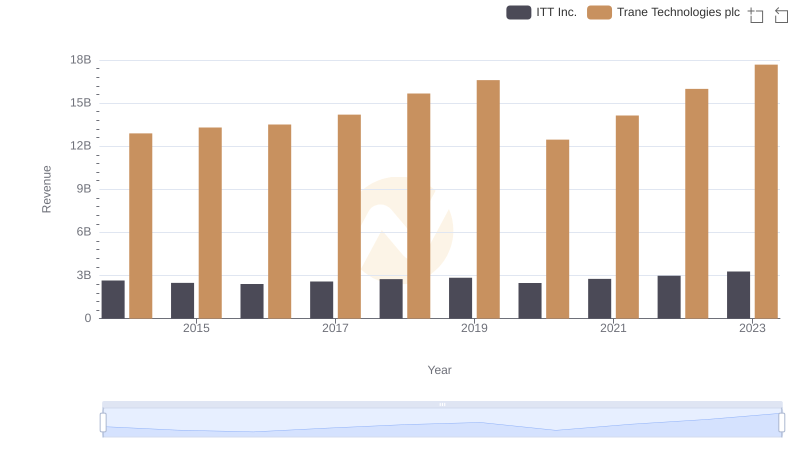

Comparing Revenue Performance: Trane Technologies plc or ITT Inc.?

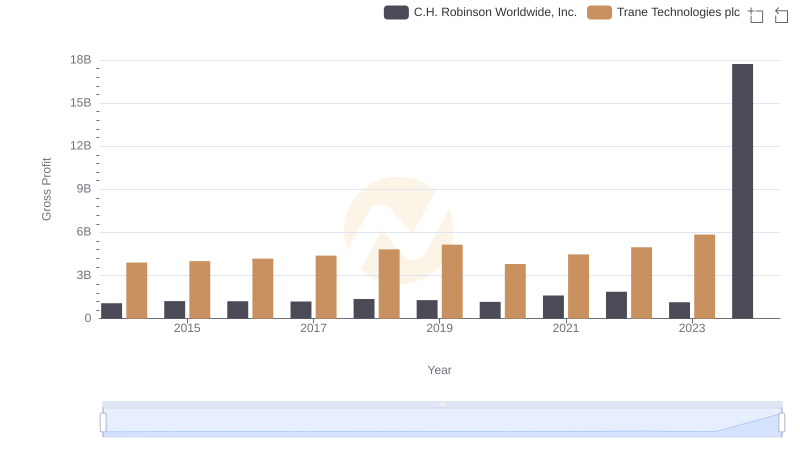

Who Generates Higher Gross Profit? Trane Technologies plc or C.H. Robinson Worldwide, Inc.

Key Insights on Gross Profit: Trane Technologies plc vs Elbit Systems Ltd.

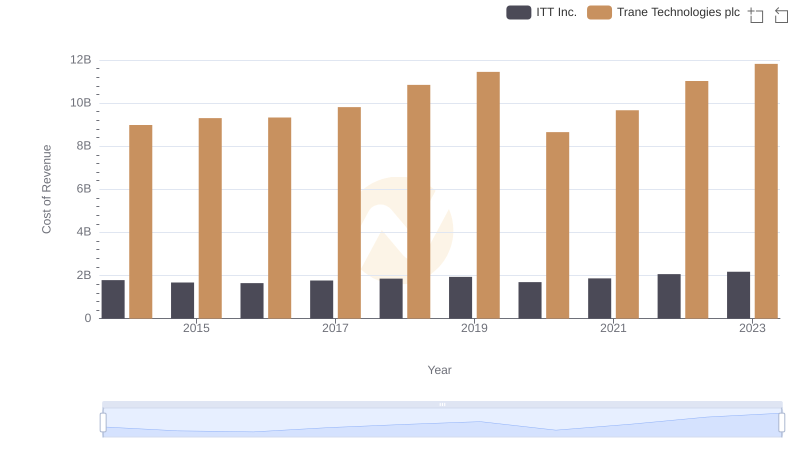

Cost of Revenue: Key Insights for Trane Technologies plc and ITT Inc.

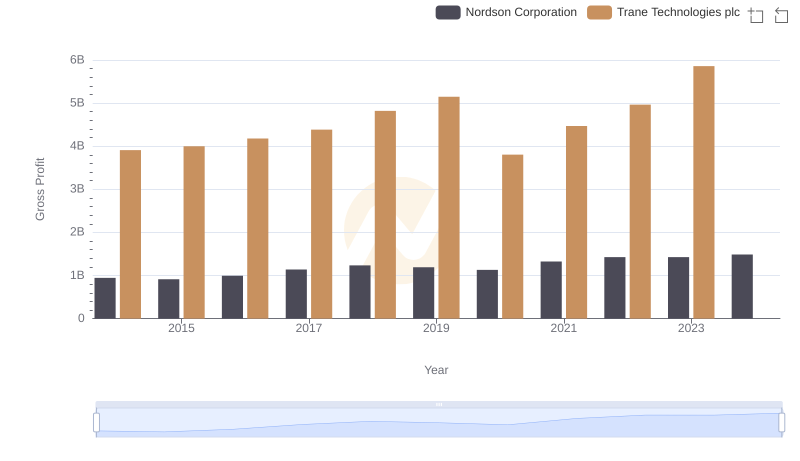

Key Insights on Gross Profit: Trane Technologies plc vs Nordson Corporation

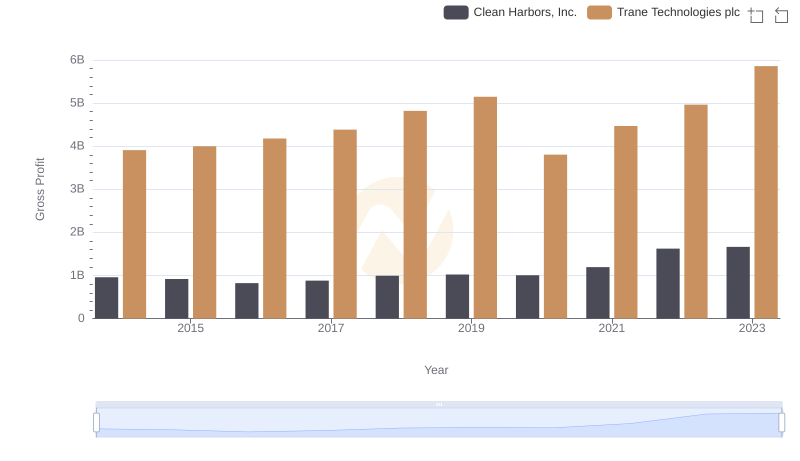

Key Insights on Gross Profit: Trane Technologies plc vs Clean Harbors, Inc.

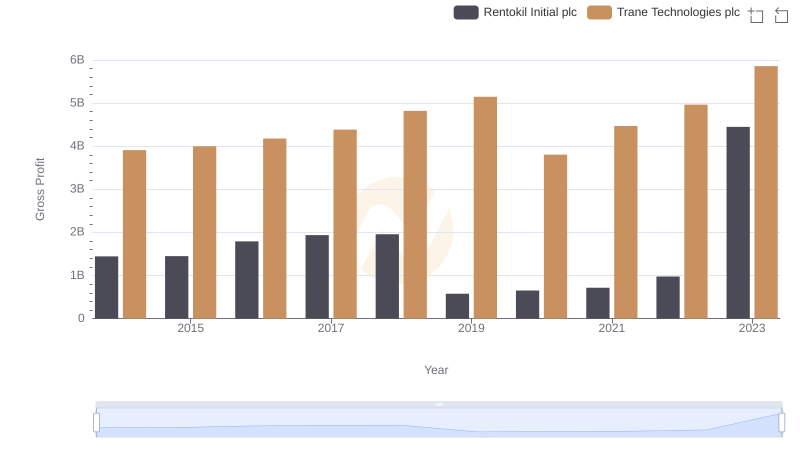

Gross Profit Comparison: Trane Technologies plc and Rentokil Initial plc Trends

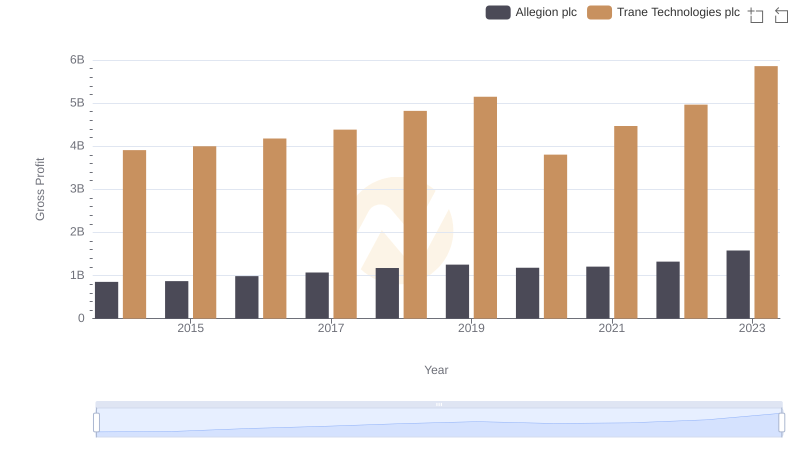

Gross Profit Analysis: Comparing Trane Technologies plc and Allegion plc

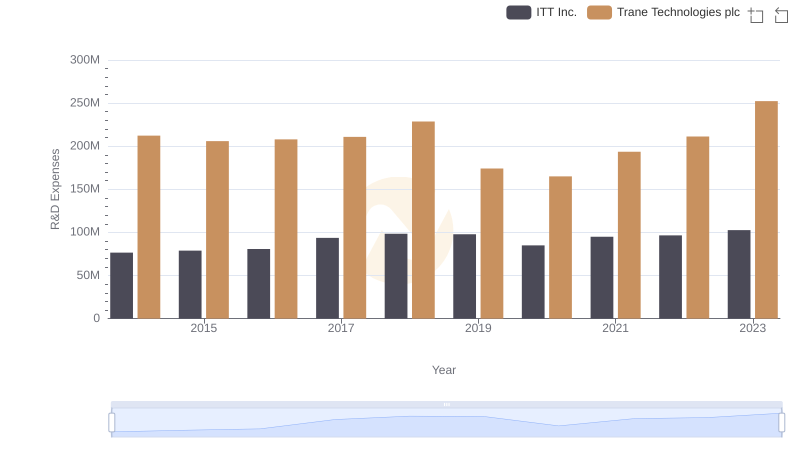

R&D Spending Showdown: Trane Technologies plc vs ITT Inc.

Trane Technologies plc vs TFI International Inc.: A Gross Profit Performance Breakdown

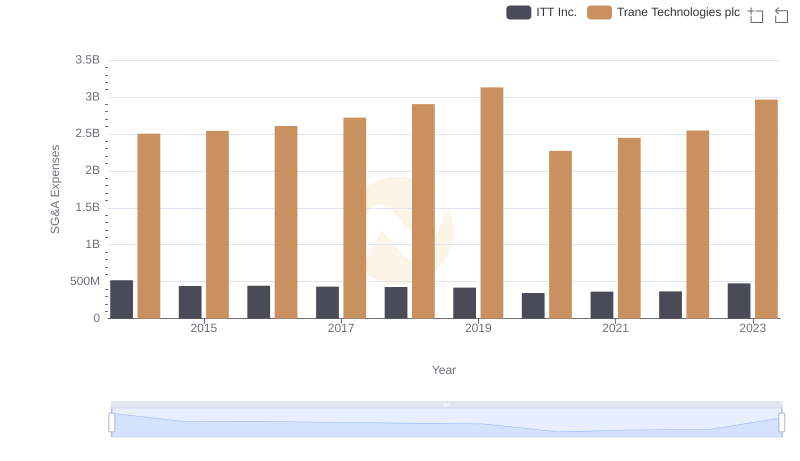

SG&A Efficiency Analysis: Comparing Trane Technologies plc and ITT Inc.

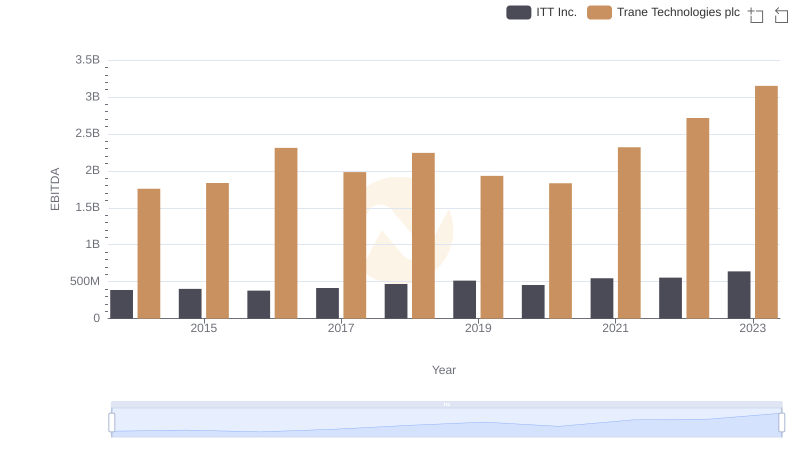

Trane Technologies plc vs ITT Inc.: In-Depth EBITDA Performance Comparison