| __timestamp | Teledyne Technologies Incorporated | Wipro Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 612400000 | 54144000000 |

| Thursday, January 1, 2015 | 588600000 | 59142000000 |

| Friday, January 1, 2016 | 574100000 | 64514000000 |

| Sunday, January 1, 2017 | 656000000 | 76490000000 |

| Monday, January 1, 2018 | 694200000 | 80461000000 |

| Tuesday, January 1, 2019 | 751600000 | 72730000000 |

| Wednesday, January 1, 2020 | 700800000 | 76086000000 |

| Friday, January 1, 2021 | 1067800000 | 93805000000 |

| Saturday, January 1, 2022 | 1156600000 | 114803000000 |

| Sunday, January 1, 2023 | 1208300000 | 119755000000 |

| Monday, January 1, 2024 | 127509000000 |

Infusing magic into the data realm

In the ever-evolving landscape of global business, understanding the financial strategies of industry leaders is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two prominent companies: Wipro Limited and Teledyne Technologies Incorporated, from 2014 to 2023.

Wipro, a titan in the IT sector, has consistently demonstrated robust growth in its SG&A expenses, peaking at approximately 127.5 billion in 2024, marking a 135% increase from 2014. This trend reflects Wipro's strategic investments in expanding its global footprint and enhancing operational efficiencies.

Conversely, Teledyne, a leader in the aerospace and defense industry, shows a more modest growth trajectory, with SG&A expenses increasing by about 97% over the same period. The data highlights Teledyne's focus on maintaining lean operations while navigating the complexities of its sector.

This comparative insight underscores the diverse financial strategies employed by these industry giants, offering valuable lessons for businesses worldwide.

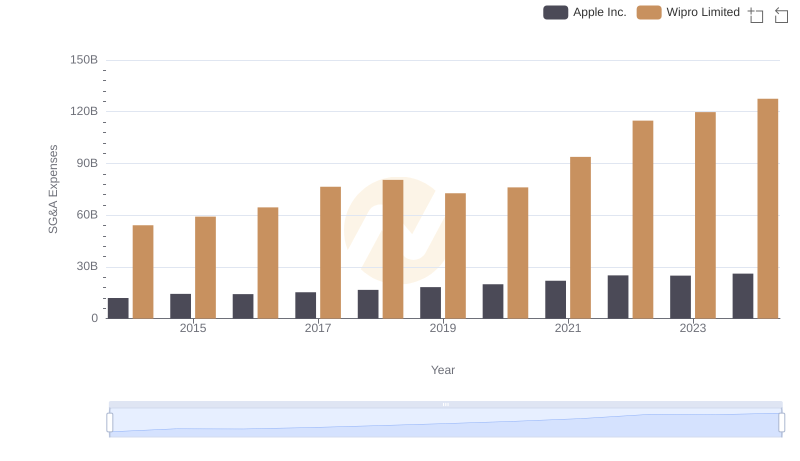

Comparing SG&A Expenses: Apple Inc. vs Wipro Limited Trends and Insights

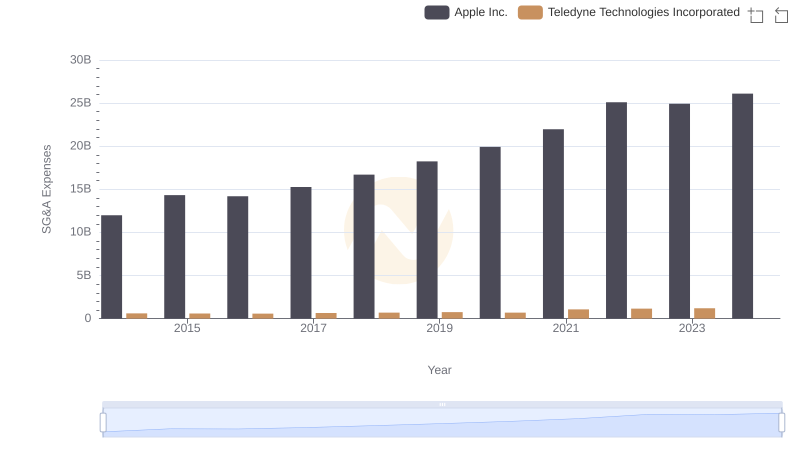

Breaking Down SG&A Expenses: Apple Inc. vs Teledyne Technologies Incorporated

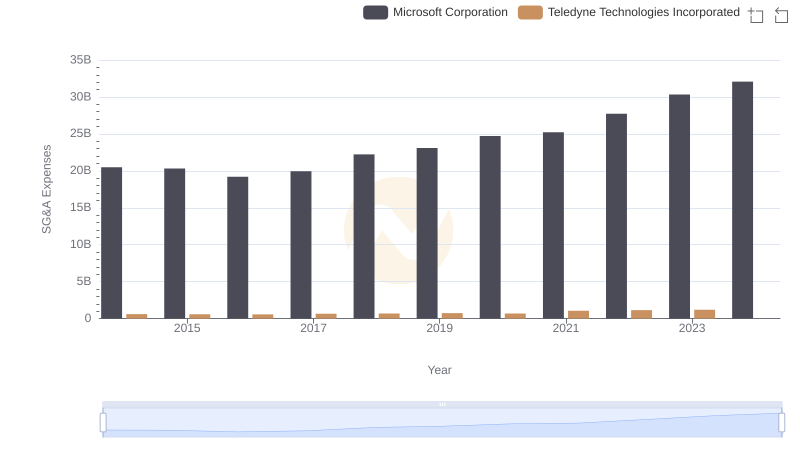

SG&A Efficiency Analysis: Comparing Microsoft Corporation and Teledyne Technologies Incorporated

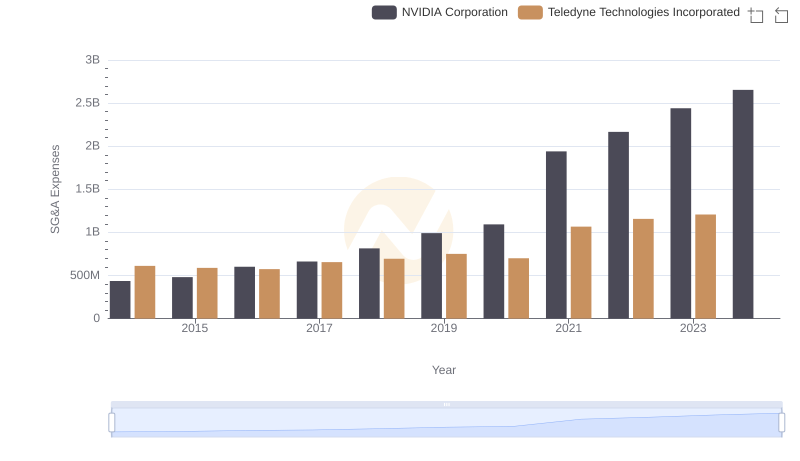

NVIDIA Corporation and Teledyne Technologies Incorporated: SG&A Spending Patterns Compared

Taiwan Semiconductor Manufacturing Company Limited and Wipro Limited: SG&A Spending Patterns Compared

Selling, General, and Administrative Costs: Taiwan Semiconductor Manufacturing Company Limited vs Teledyne Technologies Incorporated

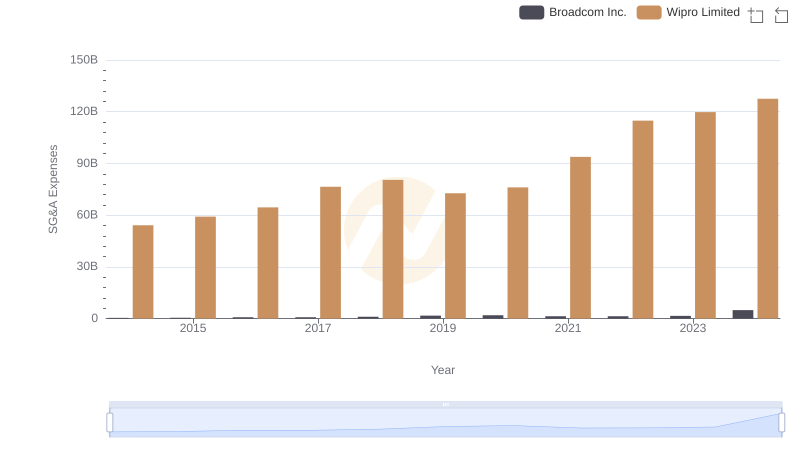

SG&A Efficiency Analysis: Comparing Broadcom Inc. and Wipro Limited

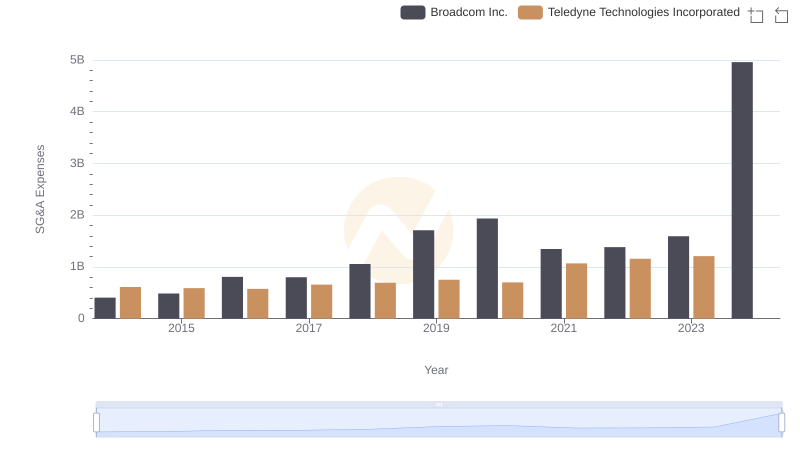

Comparing SG&A Expenses: Broadcom Inc. vs Teledyne Technologies Incorporated Trends and Insights

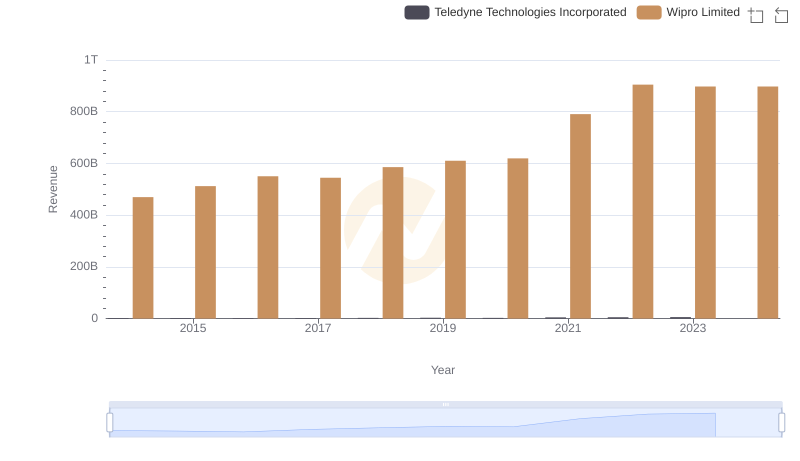

Revenue Showdown: Wipro Limited vs Teledyne Technologies Incorporated

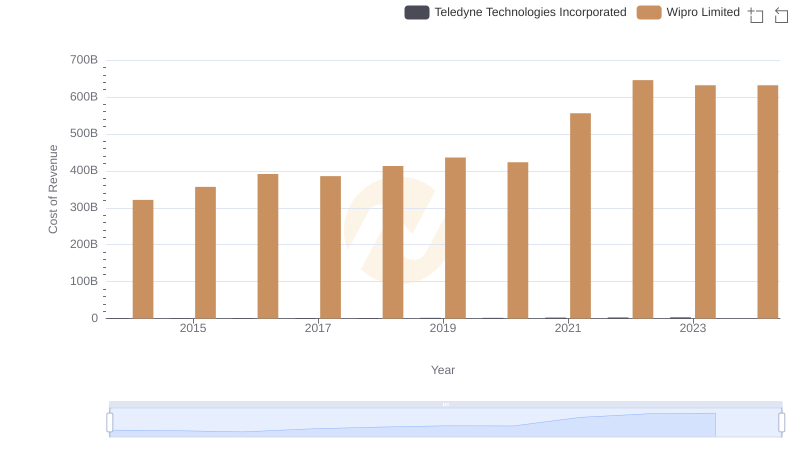

Cost of Revenue: Key Insights for Wipro Limited and Teledyne Technologies Incorporated

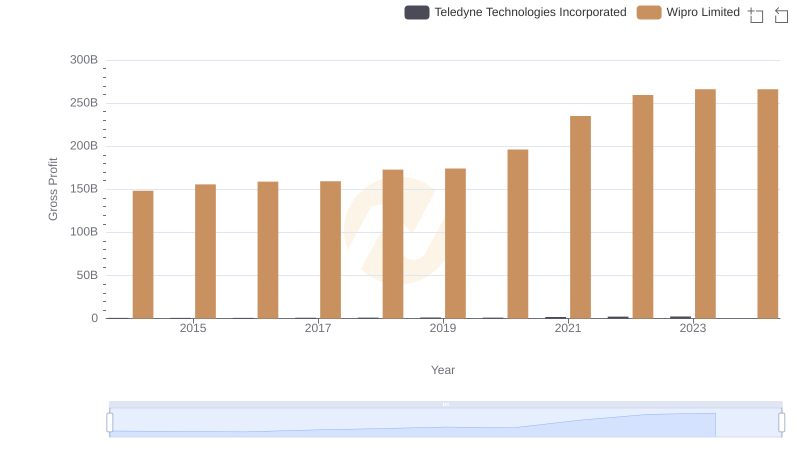

Gross Profit Trends Compared: Wipro Limited vs Teledyne Technologies Incorporated

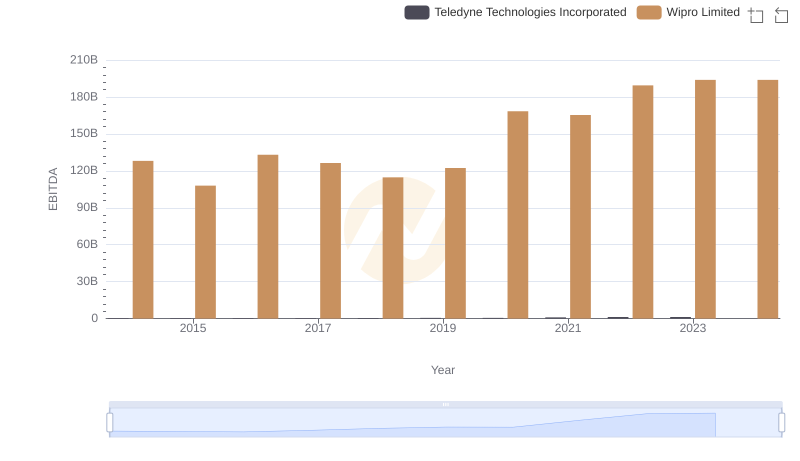

EBITDA Performance Review: Wipro Limited vs Teledyne Technologies Incorporated