| __timestamp | Teledyne Technologies Incorporated | Wipro Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 906900000 | 148261000000 |

| Thursday, January 1, 2015 | 870300000 | 155716000000 |

| Friday, January 1, 2016 | 831000000 | 158858000000 |

| Sunday, January 1, 2017 | 991600000 | 159296000000 |

| Monday, January 1, 2018 | 1110800000 | 172812000000 |

| Tuesday, January 1, 2019 | 1243300000 | 174147000000 |

| Wednesday, January 1, 2020 | 1180900000 | 196225000000 |

| Friday, January 1, 2021 | 1841400000 | 235062000000 |

| Saturday, January 1, 2022 | 2330300000 | 259430000000 |

| Sunday, January 1, 2023 | 2439400000 | 266106000000 |

| Monday, January 1, 2024 | 266106000000 |

Unleashing the power of data

In the ever-evolving landscape of global technology, Wipro Limited and Teledyne Technologies Incorporated stand as titans, each carving a unique path in the industry. From 2014 to 2023, Wipro's gross profit surged by approximately 80%, reflecting its robust growth and strategic market positioning. In contrast, Teledyne Technologies experienced a remarkable 170% increase in gross profit, showcasing its dynamic expansion and adaptability in a competitive market.

Wipro's consistent upward trajectory, peaking in 2023, underscores its resilience and innovation in the face of global challenges. Meanwhile, Teledyne's impressive growth, particularly from 2020 onwards, highlights its strategic acquisitions and technological advancements.

While 2024 data for Teledyne is unavailable, the trends from the past decade provide a compelling narrative of growth and potential for both companies. As these industry leaders continue to evolve, their financial trajectories offer valuable insights into the future of technology.

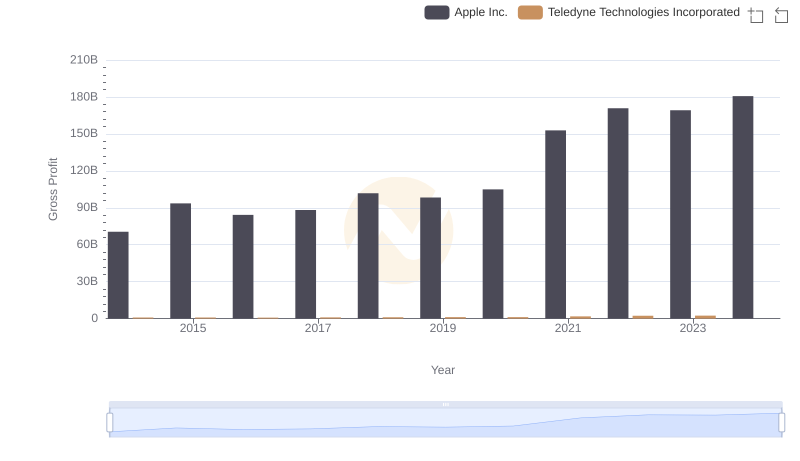

Apple Inc. and Teledyne Technologies Incorporated: A Detailed Gross Profit Analysis

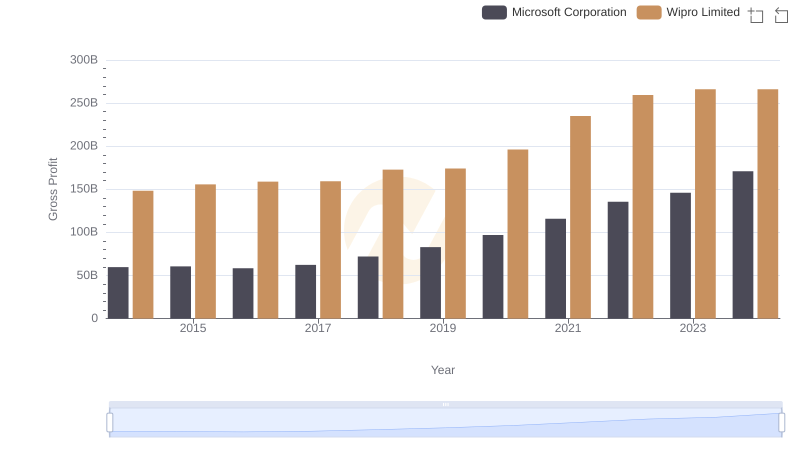

Gross Profit Analysis: Comparing Microsoft Corporation and Wipro Limited

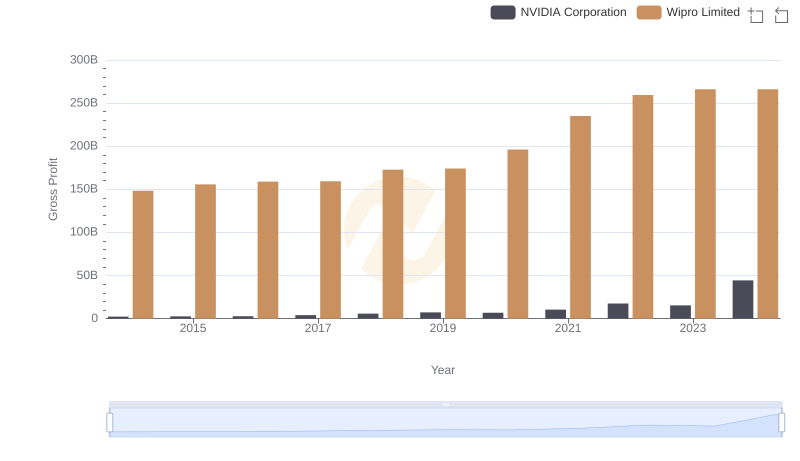

NVIDIA Corporation vs Wipro Limited: A Gross Profit Performance Breakdown

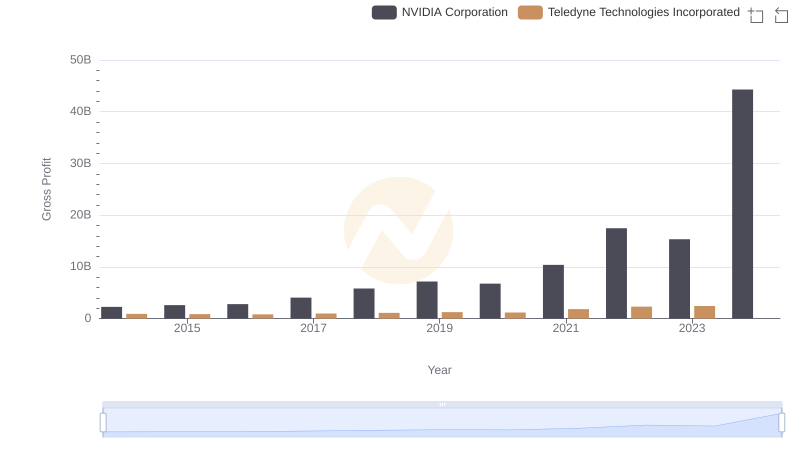

Gross Profit Trends Compared: NVIDIA Corporation vs Teledyne Technologies Incorporated

Gross Profit Comparison: Taiwan Semiconductor Manufacturing Company Limited and Wipro Limited Trends

Taiwan Semiconductor Manufacturing Company Limited and Teledyne Technologies Incorporated: A Detailed Gross Profit Analysis

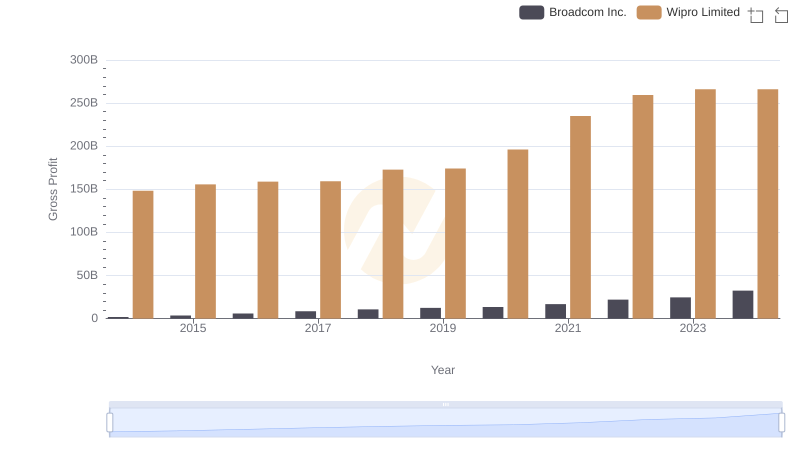

Gross Profit Trends Compared: Broadcom Inc. vs Wipro Limited

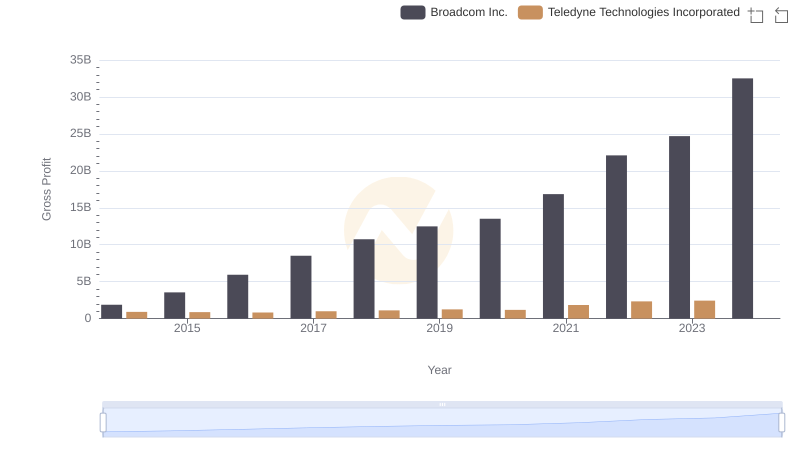

Key Insights on Gross Profit: Broadcom Inc. vs Teledyne Technologies Incorporated

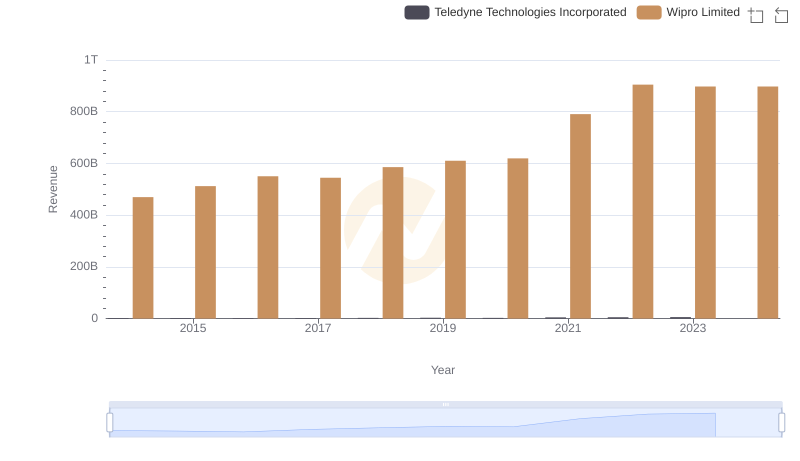

Revenue Showdown: Wipro Limited vs Teledyne Technologies Incorporated

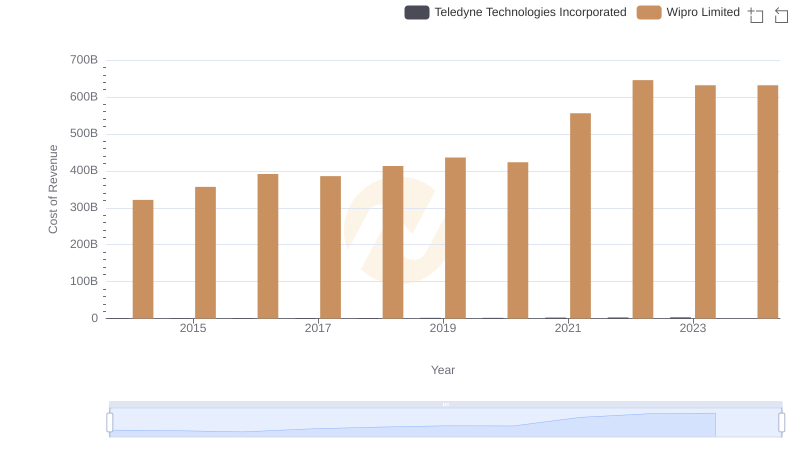

Cost of Revenue: Key Insights for Wipro Limited and Teledyne Technologies Incorporated

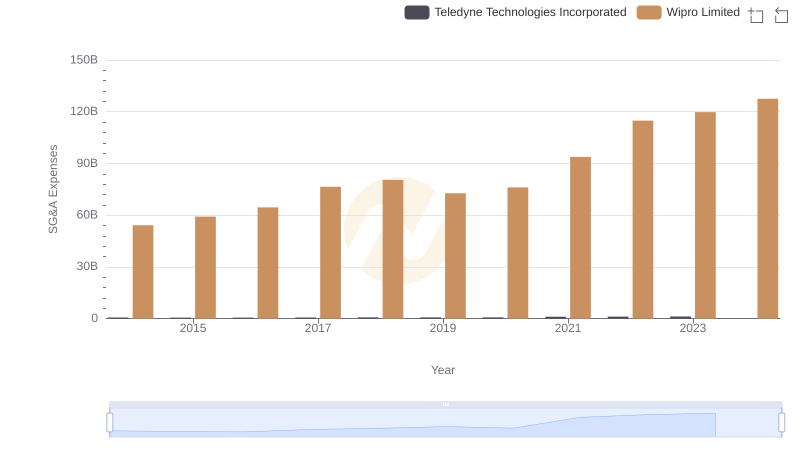

Selling, General, and Administrative Costs: Wipro Limited vs Teledyne Technologies Incorporated

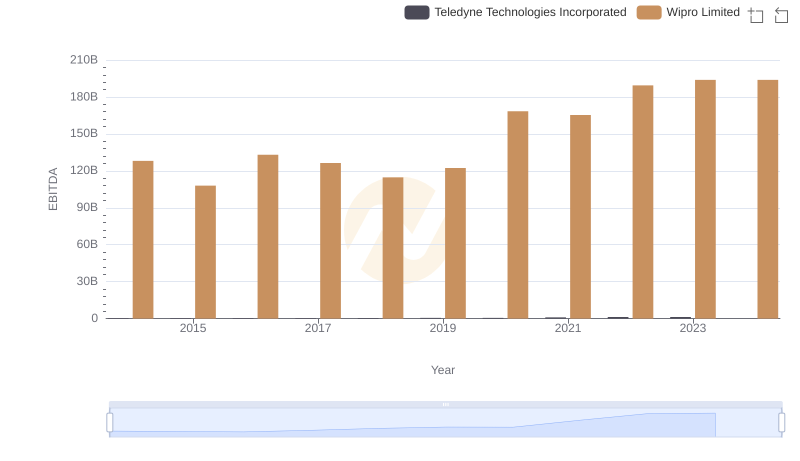

EBITDA Performance Review: Wipro Limited vs Teledyne Technologies Incorporated