| __timestamp | Teledyne Technologies Incorporated | Wipro Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 395400000 | 128105000000 |

| Thursday, January 1, 2015 | 372500000 | 107958000000 |

| Friday, January 1, 2016 | 351700000 | 133082000000 |

| Sunday, January 1, 2017 | 436800000 | 126406000000 |

| Monday, January 1, 2018 | 540100000 | 114648000000 |

| Tuesday, January 1, 2019 | 610800000 | 122279000000 |

| Wednesday, January 1, 2020 | 604100000 | 168413000000 |

| Friday, January 1, 2021 | 982000000 | 165303000000 |

| Saturday, January 1, 2022 | 1335200000 | 189377000000 |

| Sunday, January 1, 2023 | 1360800000 | 193833000000 |

| Monday, January 1, 2024 | 193833000000 |

Infusing magic into the data realm

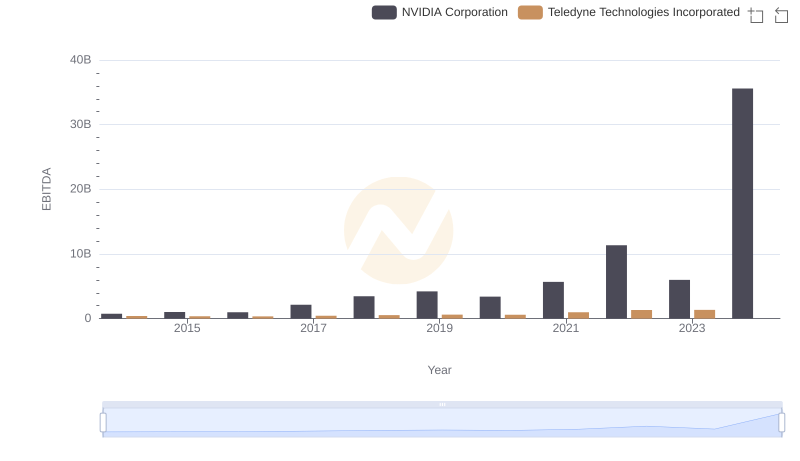

In the ever-evolving landscape of global technology, Wipro Limited and Teledyne Technologies Incorporated stand as titans of industry. Over the past decade, Wipro has consistently outperformed Teledyne in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, Wipro's EBITDA surged by approximately 51%, peaking at nearly 194 billion in 2023. In contrast, Teledyne's EBITDA, while showing a commendable increase of around 244%, reached its zenith at 1.36 billion in the same year.

Wipro's dominance is evident, with its EBITDA figures consistently dwarfing those of Teledyne. However, Teledyne's impressive growth rate highlights its potential in the competitive tech sector. The data for 2024 remains incomplete, leaving room for speculation on future trends. This analysis underscores the dynamic nature of the tech industry and the varying strategies of these two giants.

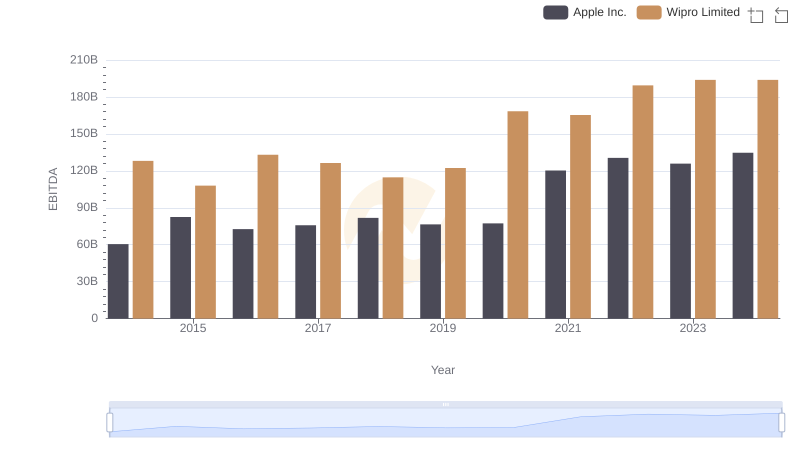

EBITDA Analysis: Evaluating Apple Inc. Against Wipro Limited

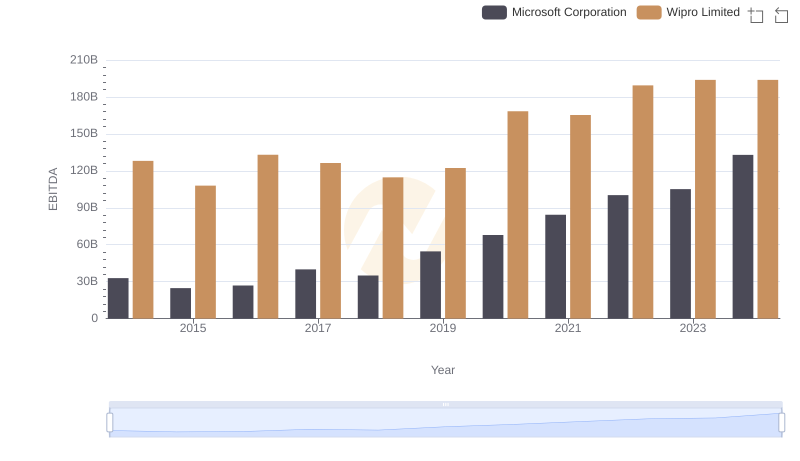

Professional EBITDA Benchmarking: Microsoft Corporation vs Wipro Limited

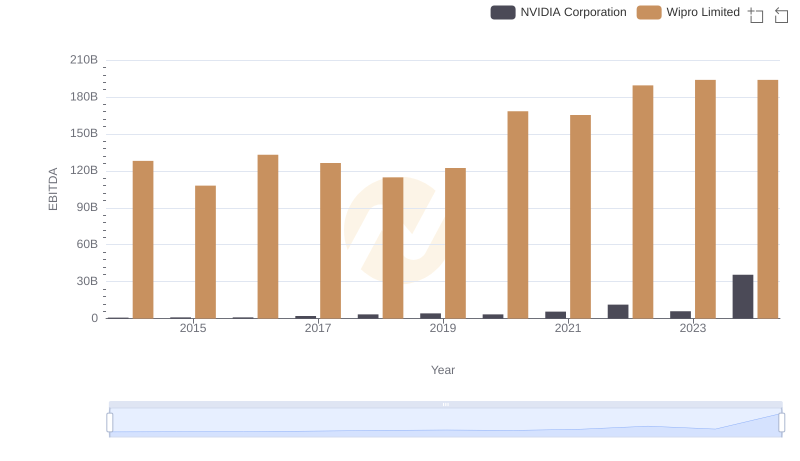

NVIDIA Corporation and Wipro Limited: A Detailed Examination of EBITDA Performance

NVIDIA Corporation vs Teledyne Technologies Incorporated: In-Depth EBITDA Performance Comparison

EBITDA Metrics Evaluated: Taiwan Semiconductor Manufacturing Company Limited vs Wipro Limited

Taiwan Semiconductor Manufacturing Company Limited vs Teledyne Technologies Incorporated: In-Depth EBITDA Performance Comparison

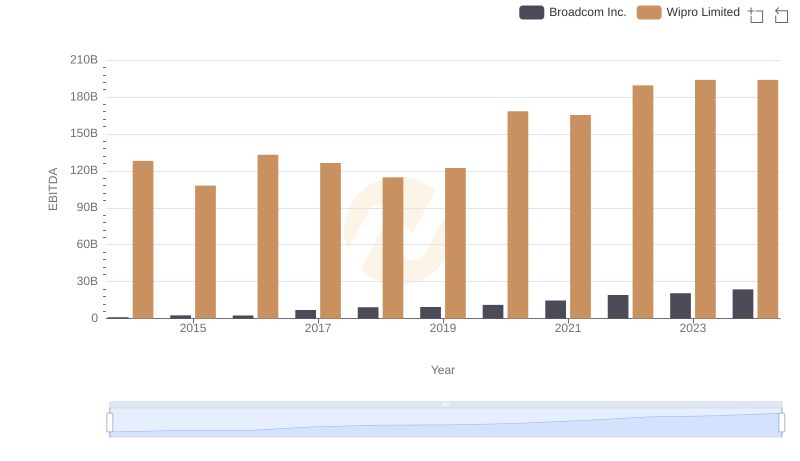

Broadcom Inc. and Wipro Limited: A Detailed Examination of EBITDA Performance

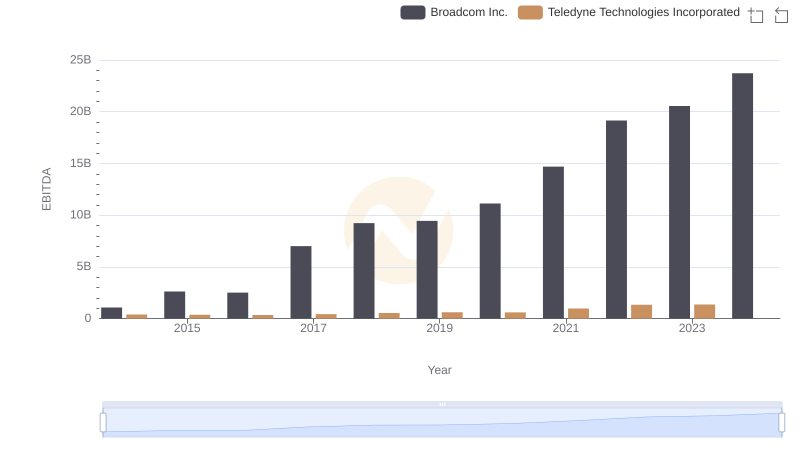

Professional EBITDA Benchmarking: Broadcom Inc. vs Teledyne Technologies Incorporated

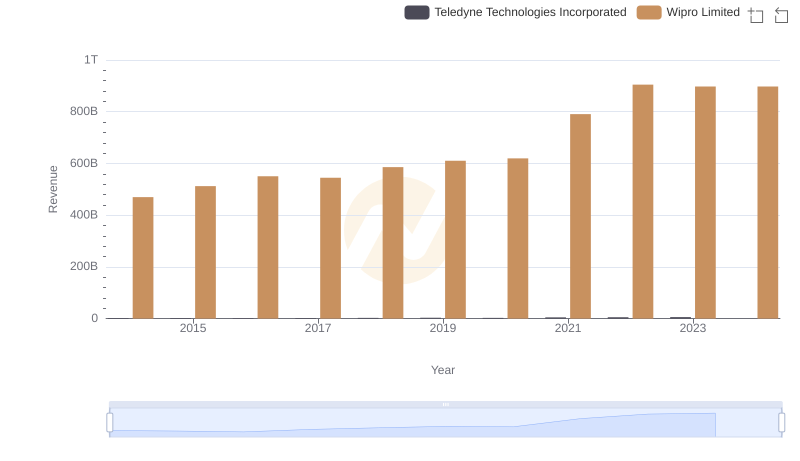

Revenue Showdown: Wipro Limited vs Teledyne Technologies Incorporated

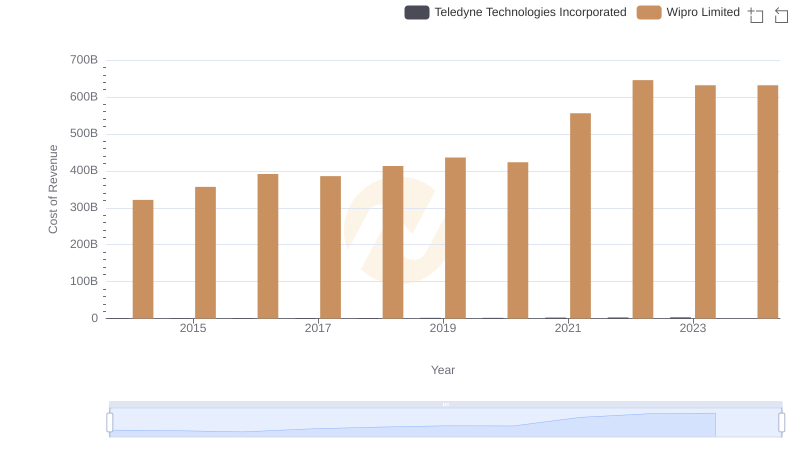

Cost of Revenue: Key Insights for Wipro Limited and Teledyne Technologies Incorporated

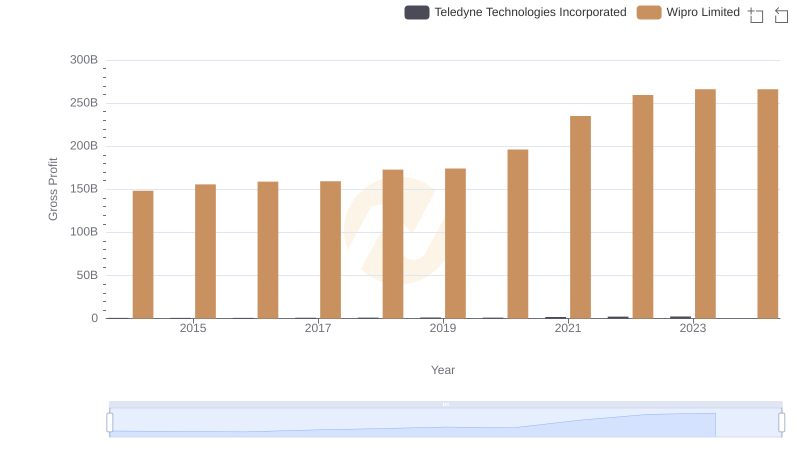

Gross Profit Trends Compared: Wipro Limited vs Teledyne Technologies Incorporated

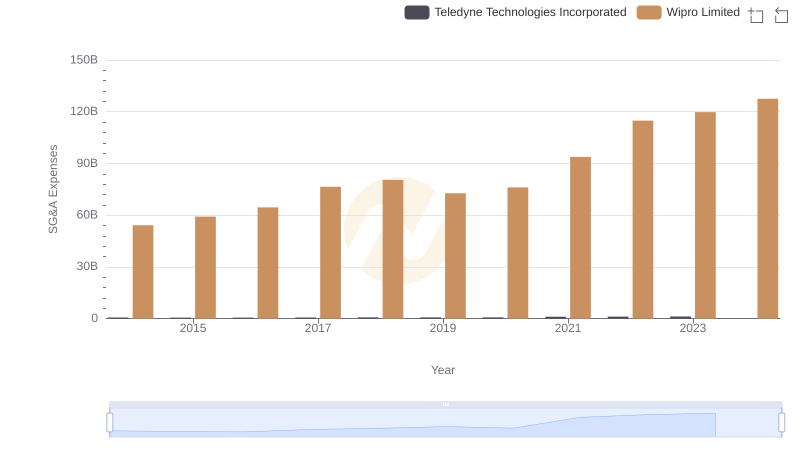

Selling, General, and Administrative Costs: Wipro Limited vs Teledyne Technologies Incorporated