| __timestamp | Super Micro Computer, Inc. | Telefonaktiebolaget LM Ericsson (publ) |

|---|---|---|

| Wednesday, January 1, 2014 | 61029000 | 27100000000 |

| Thursday, January 1, 2015 | 73228000 | 29285000000 |

| Friday, January 1, 2016 | 100681000 | 28866000000 |

| Sunday, January 1, 2017 | 115331000 | 32676000000 |

| Monday, January 1, 2018 | 170176000 | 27519000000 |

| Tuesday, January 1, 2019 | 218382000 | 26137000000 |

| Wednesday, January 1, 2020 | 219078000 | 26684000000 |

| Friday, January 1, 2021 | 186222000 | 26957000000 |

| Saturday, January 1, 2022 | 192561000 | 35692000000 |

| Sunday, January 1, 2023 | 214610000 | 37682000000 |

| Monday, January 1, 2024 | 383111000 |

Unleashing insights

In the ever-evolving landscape of global telecommunications and computing, operational efficiency is paramount. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: Telefonaktiebolaget LM Ericsson and Super Micro Computer, Inc., from 2014 to 2023.

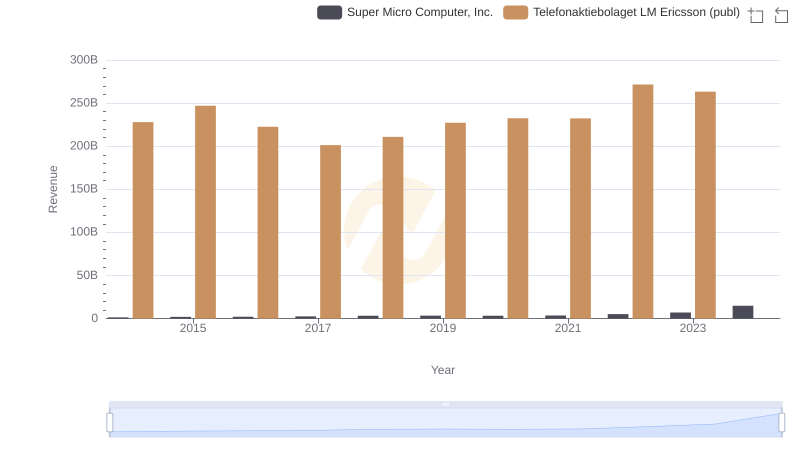

Ericsson, a leader in telecommunications, consistently reported SG&A expenses averaging around $29.9 billion annually. Notably, in 2023, their expenses peaked at approximately $37.7 billion, marking a 39% increase from 2014. In contrast, Super Micro, a prominent player in computing solutions, exhibited a more dynamic growth trajectory. Their SG&A expenses surged by over 500% from 2014 to 2024, reaching $383 million.

While Ericsson's expenses reflect stability, Super Micro's rapid growth underscores its aggressive market expansion. This comparison highlights the diverse strategies employed by these companies in managing operational costs.

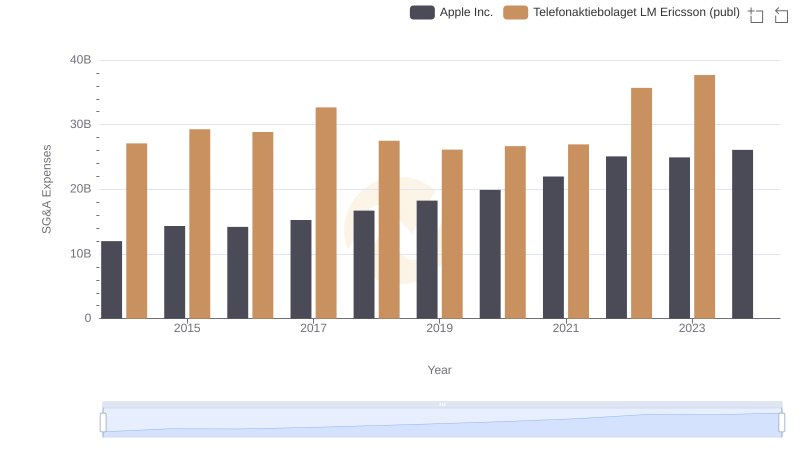

Apple Inc. and Telefonaktiebolaget LM Ericsson (publ): SG&A Spending Patterns Compared

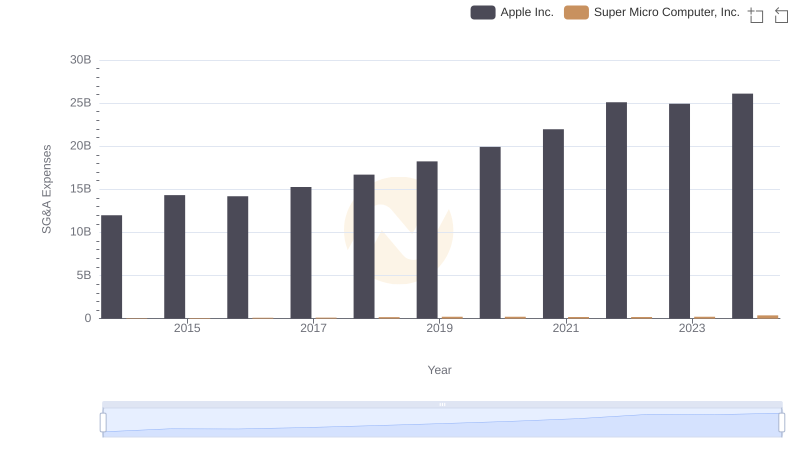

Apple Inc. vs Super Micro Computer, Inc.: SG&A Expense Trends

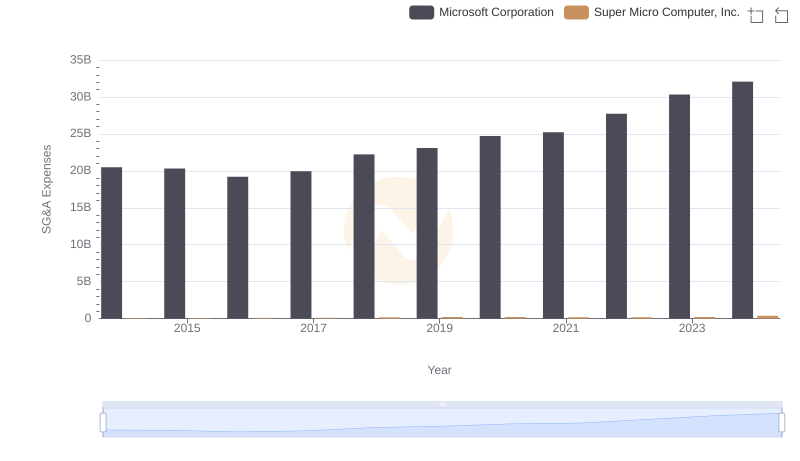

Microsoft Corporation vs Super Micro Computer, Inc.: SG&A Expense Trends

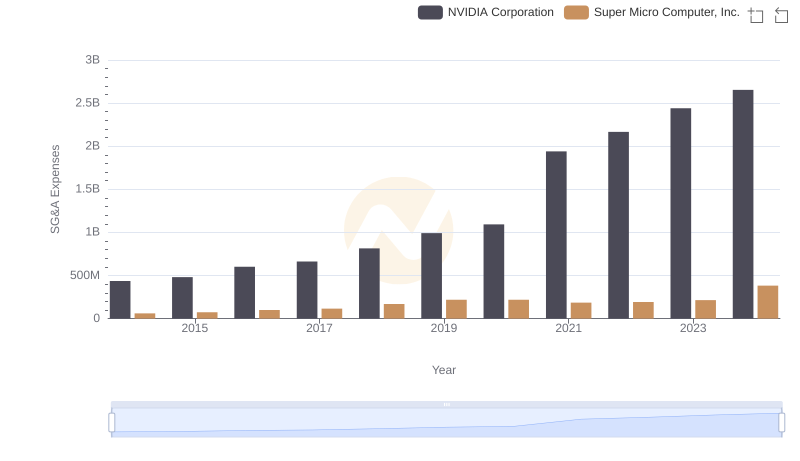

Breaking Down SG&A Expenses: NVIDIA Corporation vs Super Micro Computer, Inc.

Selling, General, and Administrative Costs: Taiwan Semiconductor Manufacturing Company Limited vs Super Micro Computer, Inc.

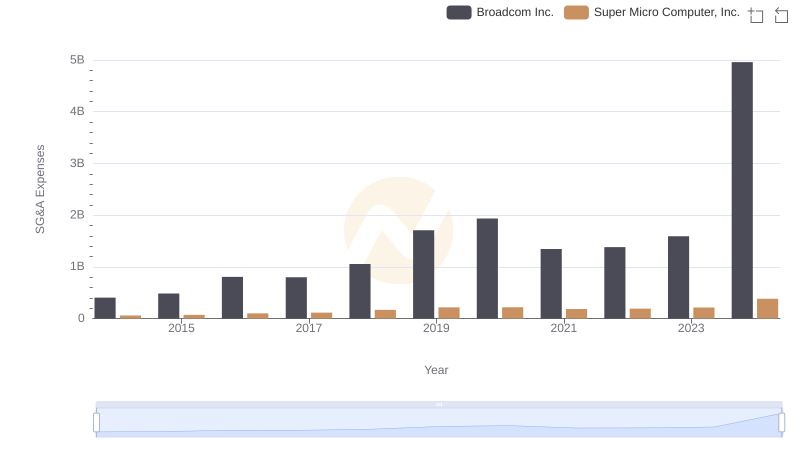

Broadcom Inc. or Telefonaktiebolaget LM Ericsson (publ): Who Manages SG&A Costs Better?

SG&A Efficiency Analysis: Comparing Broadcom Inc. and Super Micro Computer, Inc.

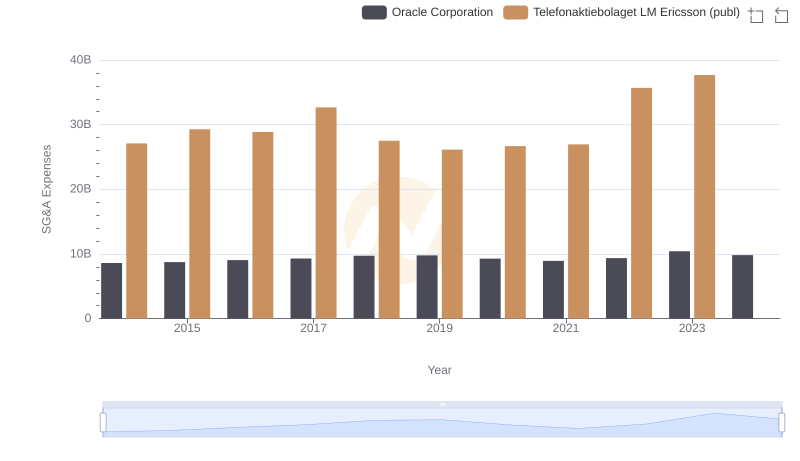

Who Optimizes SG&A Costs Better? Oracle Corporation or Telefonaktiebolaget LM Ericsson (publ)

Annual Revenue Comparison: Telefonaktiebolaget LM Ericsson (publ) vs Super Micro Computer, Inc.

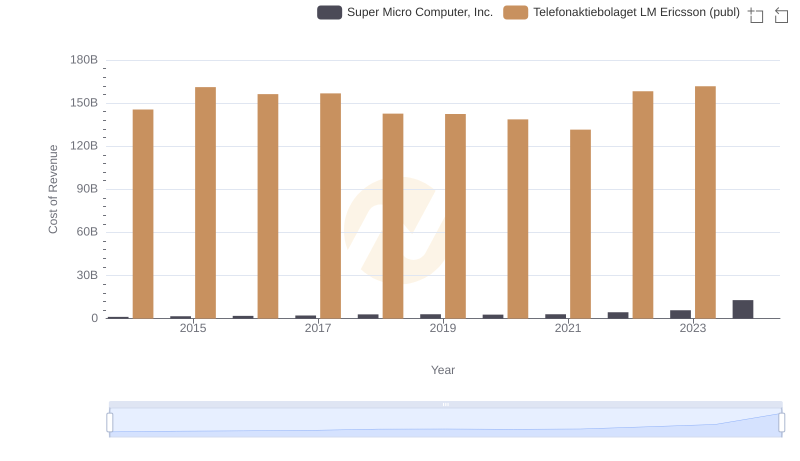

Cost of Revenue: Key Insights for Telefonaktiebolaget LM Ericsson (publ) and Super Micro Computer, Inc.

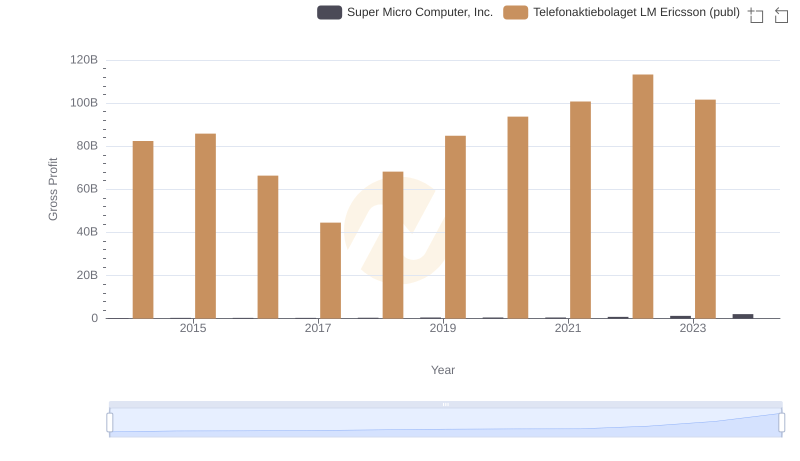

Gross Profit Trends Compared: Telefonaktiebolaget LM Ericsson (publ) vs Super Micro Computer, Inc.

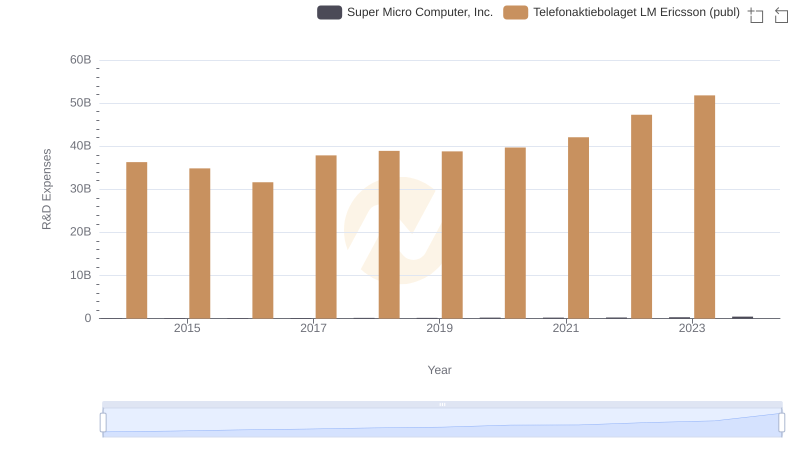

Research and Development Investment: Telefonaktiebolaget LM Ericsson (publ) vs Super Micro Computer, Inc.