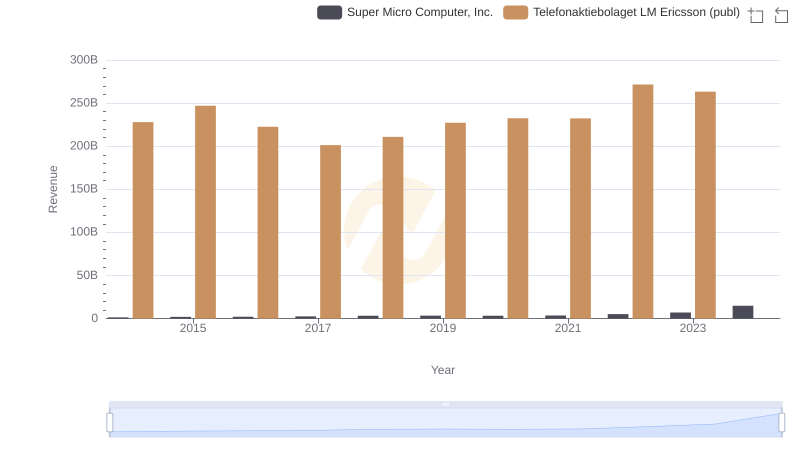

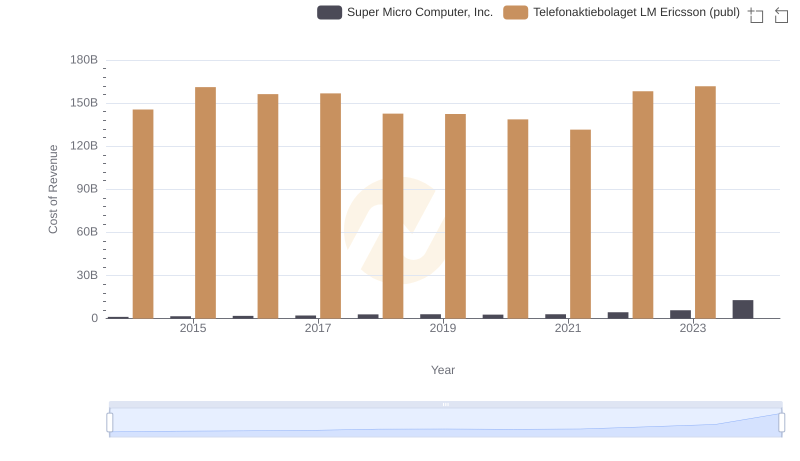

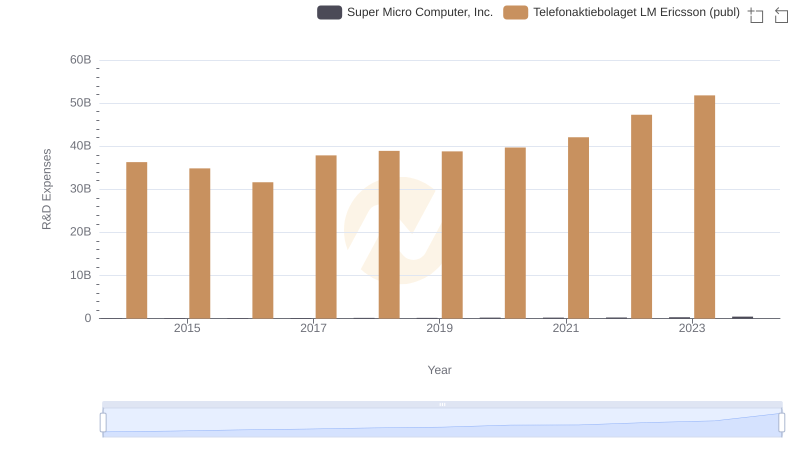

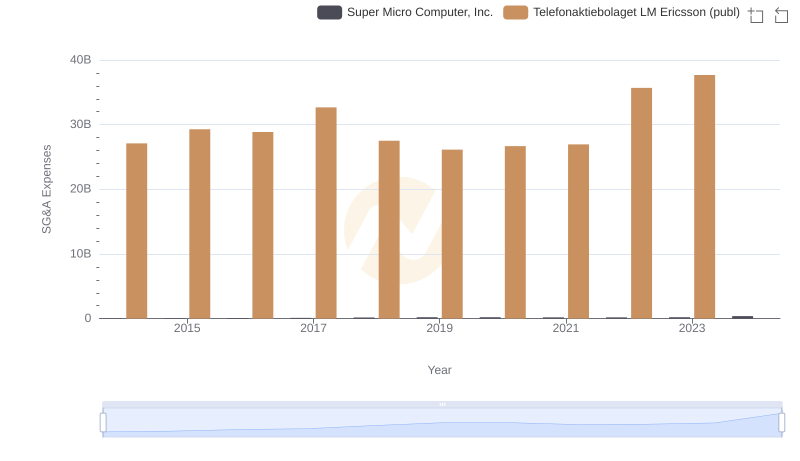

| __timestamp | Super Micro Computer, Inc. | Telefonaktiebolaget LM Ericsson (publ) |

|---|---|---|

| Wednesday, January 1, 2014 | 225545000 | 82427000000 |

| Thursday, January 1, 2015 | 320231000 | 85819000000 |

| Friday, January 1, 2016 | 331525000 | 66365000000 |

| Sunday, January 1, 2017 | 358566000 | 44545000000 |

| Monday, January 1, 2018 | 429994000 | 68200000000 |

| Tuesday, January 1, 2019 | 495522000 | 84824000000 |

| Wednesday, January 1, 2020 | 526210000 | 93724000000 |

| Friday, January 1, 2021 | 534538000 | 100749000000 |

| Saturday, January 1, 2022 | 800001000 | 113295000000 |

| Sunday, January 1, 2023 | 1283012000 | 101602000000 |

| Monday, January 1, 2024 | 2111729000 |

Data in motion

In the ever-evolving landscape of global technology, the financial performance of industry leaders offers a window into broader market trends. Over the past decade, Telefonaktiebolaget LM Ericsson and Super Micro Computer, Inc. have showcased contrasting trajectories in gross profit. Ericsson, a stalwart in telecommunications, saw its gross profit peak in 2022, reaching approximately 13% higher than its 2014 figures. Meanwhile, Super Micro Computer, a key player in high-performance computing, experienced a staggering 837% increase in gross profit from 2014 to 2024, highlighting its rapid growth and market adaptation.

While Ericsson's profits dipped in 2017, they rebounded strongly, underscoring resilience in a competitive sector. Super Micro's consistent upward trend, especially post-2020, reflects its strategic positioning in the burgeoning tech landscape. Missing data for Ericsson in 2024 suggests potential shifts or reporting changes, inviting further analysis.

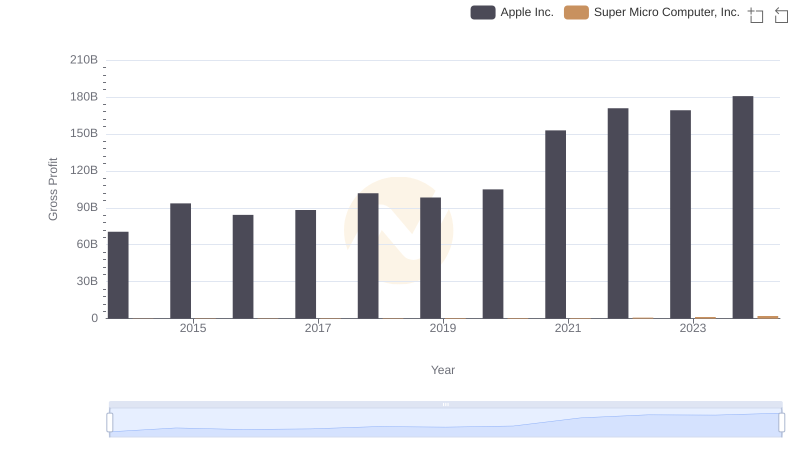

Who Generates Higher Gross Profit? Apple Inc. or Super Micro Computer, Inc.

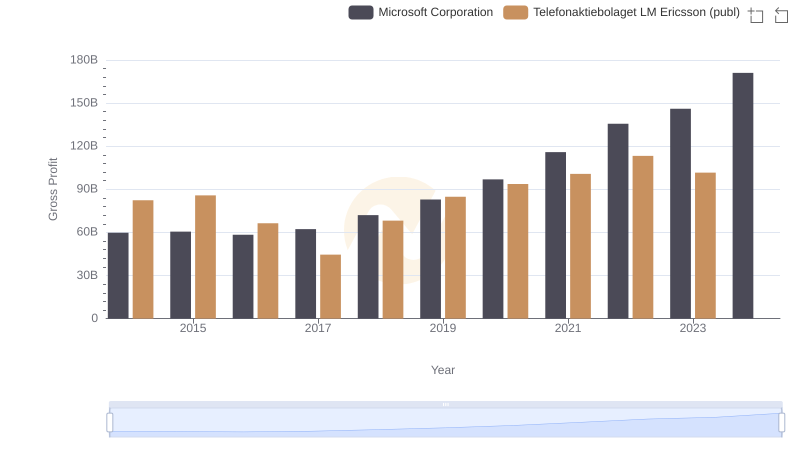

Gross Profit Analysis: Comparing Microsoft Corporation and Telefonaktiebolaget LM Ericsson (publ)

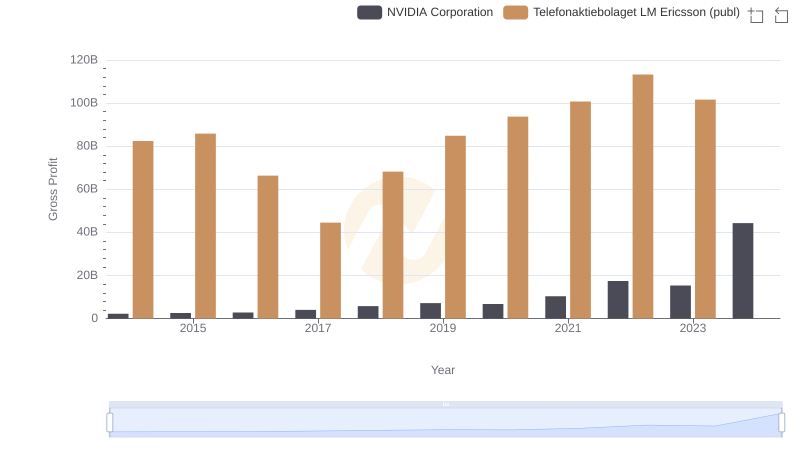

Key Insights on Gross Profit: NVIDIA Corporation vs Telefonaktiebolaget LM Ericsson (publ)

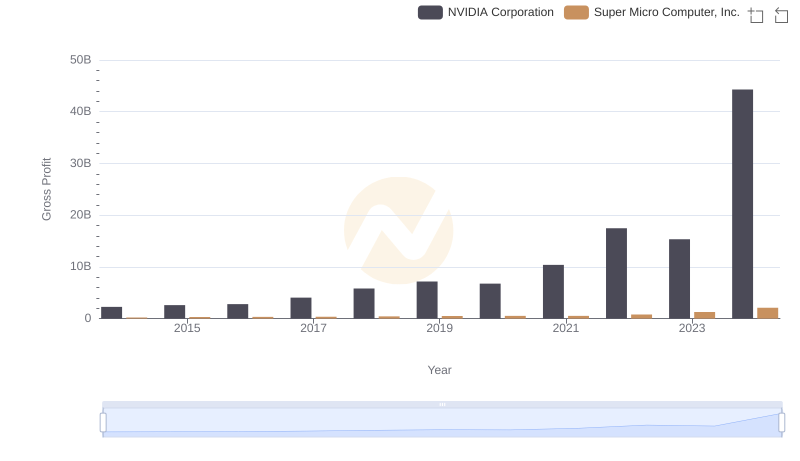

Gross Profit Comparison: NVIDIA Corporation and Super Micro Computer, Inc. Trends

Key Insights on Gross Profit: Taiwan Semiconductor Manufacturing Company Limited vs Super Micro Computer, Inc.

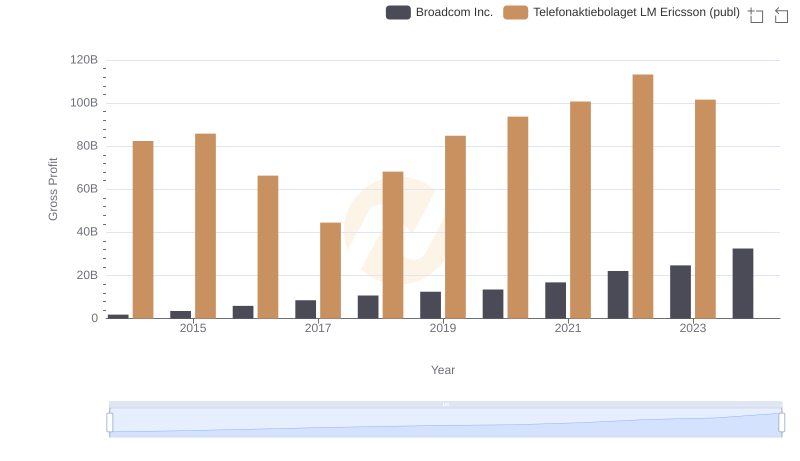

Gross Profit Analysis: Comparing Broadcom Inc. and Telefonaktiebolaget LM Ericsson (publ)

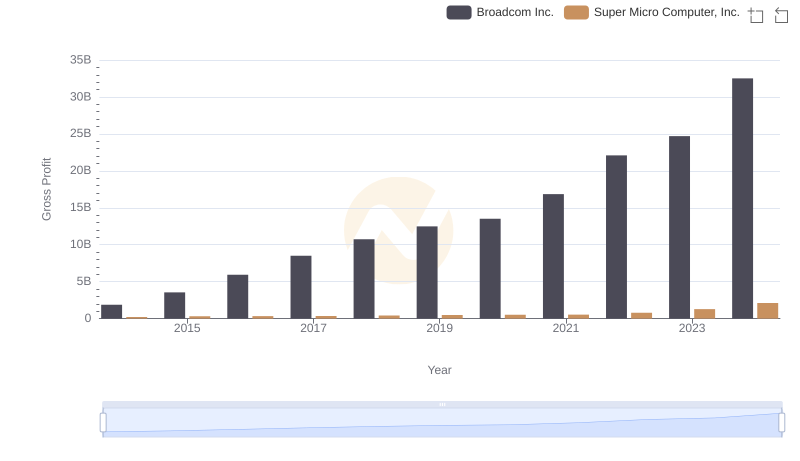

Gross Profit Analysis: Comparing Broadcom Inc. and Super Micro Computer, Inc.

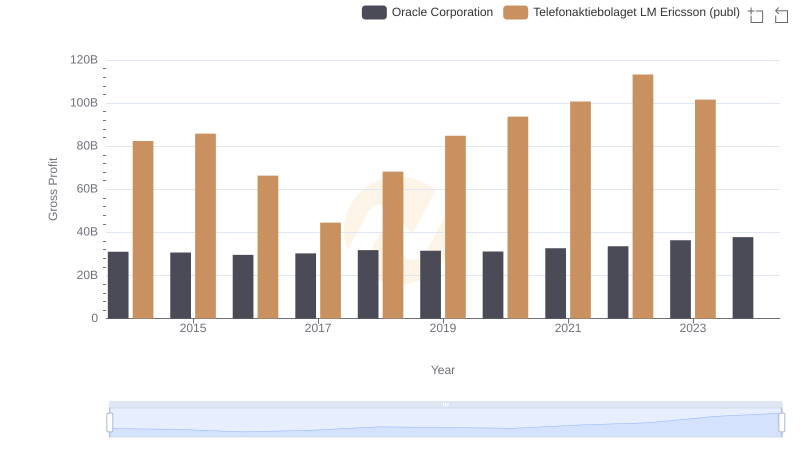

Oracle Corporation and Telefonaktiebolaget LM Ericsson (publ): A Detailed Gross Profit Analysis

Annual Revenue Comparison: Telefonaktiebolaget LM Ericsson (publ) vs Super Micro Computer, Inc.

Cost of Revenue: Key Insights for Telefonaktiebolaget LM Ericsson (publ) and Super Micro Computer, Inc.

Research and Development Investment: Telefonaktiebolaget LM Ericsson (publ) vs Super Micro Computer, Inc.

Operational Costs Compared: SG&A Analysis of Telefonaktiebolaget LM Ericsson (publ) and Super Micro Computer, Inc.