| __timestamp | Super Micro Computer, Inc. | Telefonaktiebolaget LM Ericsson (publ) |

|---|---|---|

| Wednesday, January 1, 2014 | 1467202000 | 227983000000 |

| Thursday, January 1, 2015 | 1991155000 | 246920000000 |

| Friday, January 1, 2016 | 2215573000 | 222608000000 |

| Sunday, January 1, 2017 | 2529915000 | 201303000000 |

| Monday, January 1, 2018 | 3360492000 | 210838000000 |

| Tuesday, January 1, 2019 | 3500360000 | 227216000000 |

| Wednesday, January 1, 2020 | 3339281000 | 232390000000 |

| Friday, January 1, 2021 | 3557422000 | 232314000000 |

| Saturday, January 1, 2022 | 5196099000 | 271546000000 |

| Sunday, January 1, 2023 | 7123482000 | 263351000000 |

| Monday, January 1, 2024 | 14942854000 |

In pursuit of knowledge

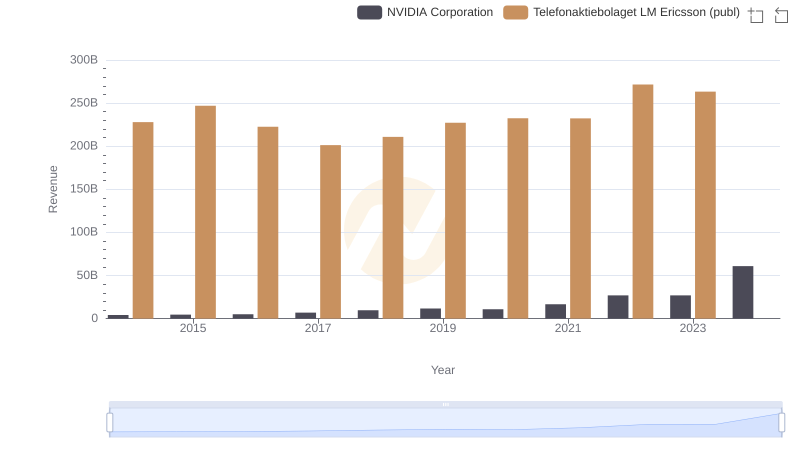

In the ever-evolving landscape of global technology, two companies stand out for their contrasting revenue trajectories over the past decade. Telefonaktiebolaget LM Ericsson, a stalwart in telecommunications, has consistently generated substantial revenue, peaking at approximately 272 billion in 2022. However, its growth has been relatively stable, with fluctuations reflecting the industry's challenges and opportunities.

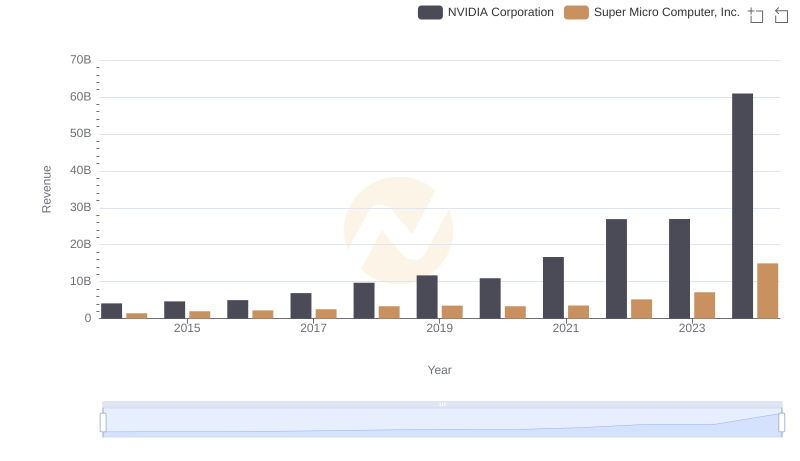

On the other hand, Super Micro Computer, Inc., a rising star in the server and storage solutions sector, has experienced a remarkable revenue surge. From 2014 to 2023, Super Micro's revenue skyrocketed by over 900%, reaching nearly 15 billion in 2024. This growth underscores the increasing demand for high-performance computing solutions in a digital-first world.

While Ericsson's revenue remains significantly higher, Super Micro's rapid ascent highlights the dynamic shifts within the tech industry, where innovation and adaptability are key to success.

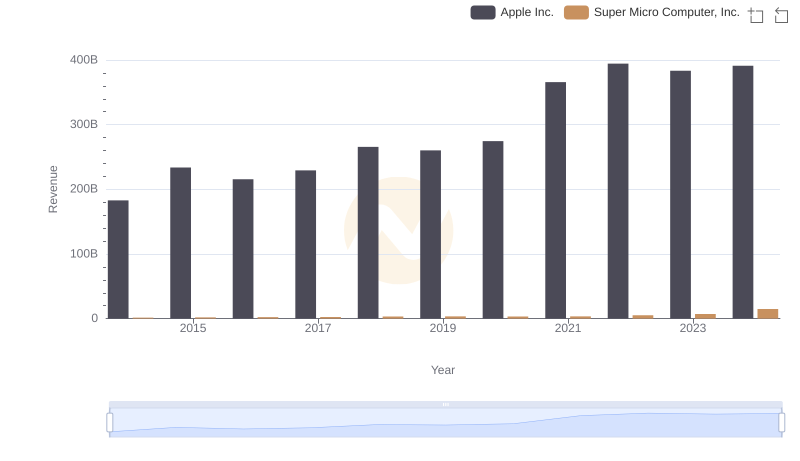

Annual Revenue Comparison: Apple Inc. vs Super Micro Computer, Inc.

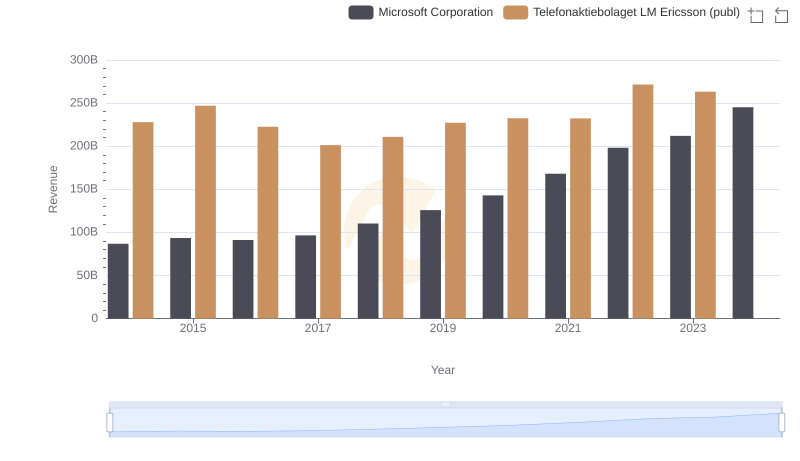

Annual Revenue Comparison: Microsoft Corporation vs Telefonaktiebolaget LM Ericsson (publ)

Who Generates More Revenue? NVIDIA Corporation or Telefonaktiebolaget LM Ericsson (publ)

Who Generates More Revenue? NVIDIA Corporation or Super Micro Computer, Inc.

Revenue Insights: Taiwan Semiconductor Manufacturing Company Limited and Super Micro Computer, Inc. Performance Compared

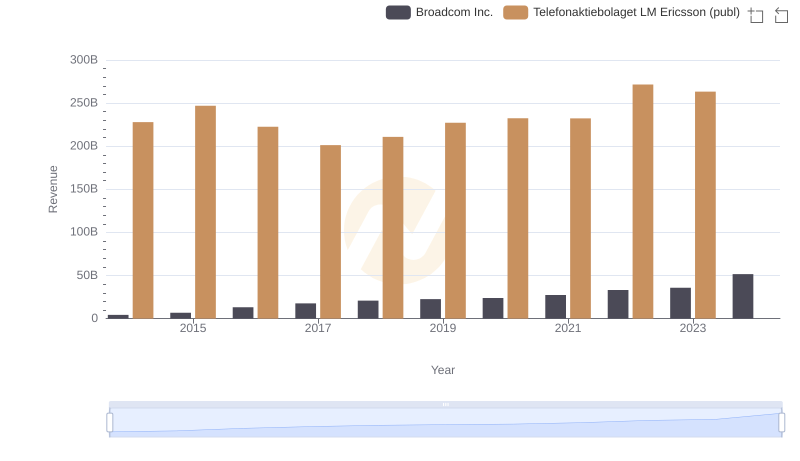

Broadcom Inc. and Telefonaktiebolaget LM Ericsson (publ): A Comprehensive Revenue Analysis

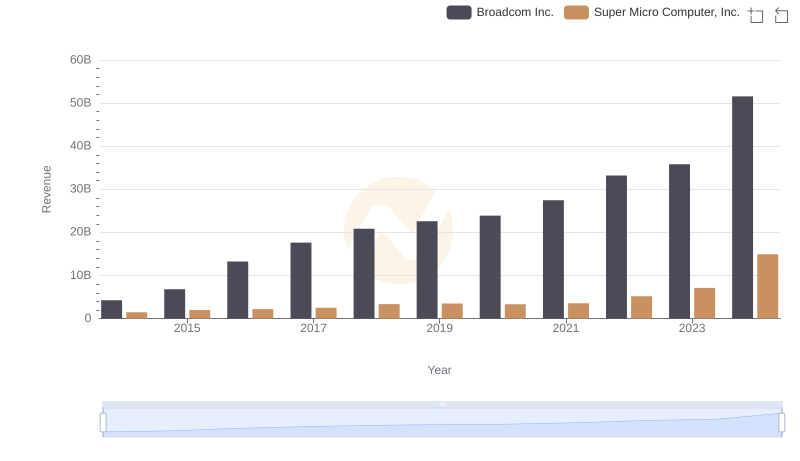

Broadcom Inc. vs Super Micro Computer, Inc.: Examining Key Revenue Metrics

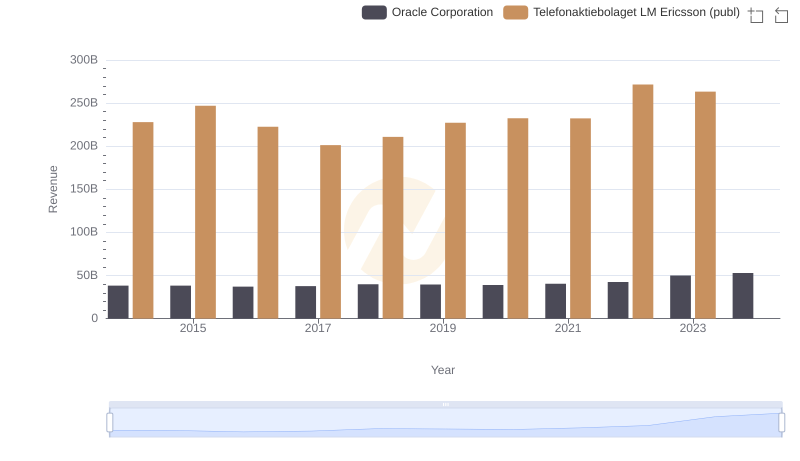

Breaking Down Revenue Trends: Oracle Corporation vs Telefonaktiebolaget LM Ericsson (publ)

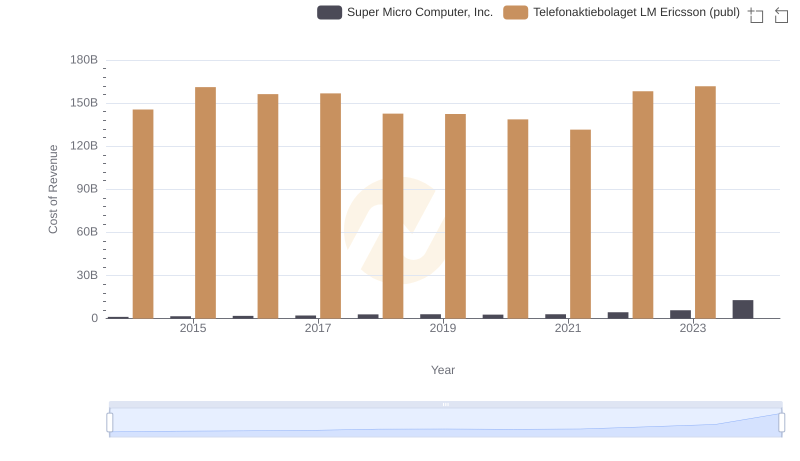

Cost of Revenue: Key Insights for Telefonaktiebolaget LM Ericsson (publ) and Super Micro Computer, Inc.

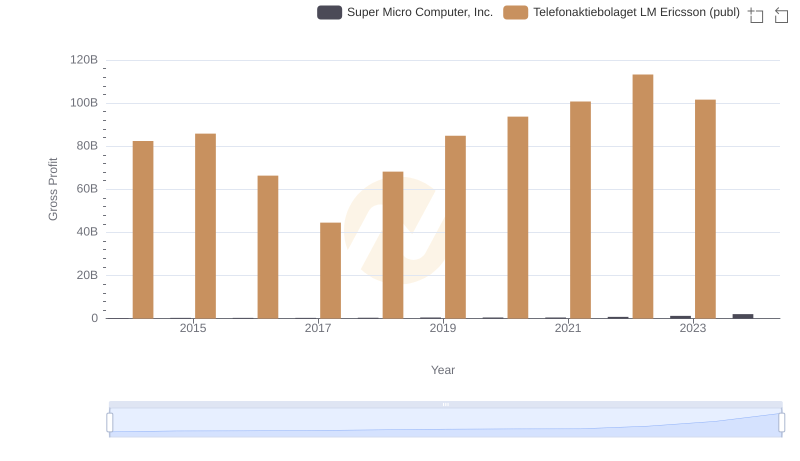

Gross Profit Trends Compared: Telefonaktiebolaget LM Ericsson (publ) vs Super Micro Computer, Inc.

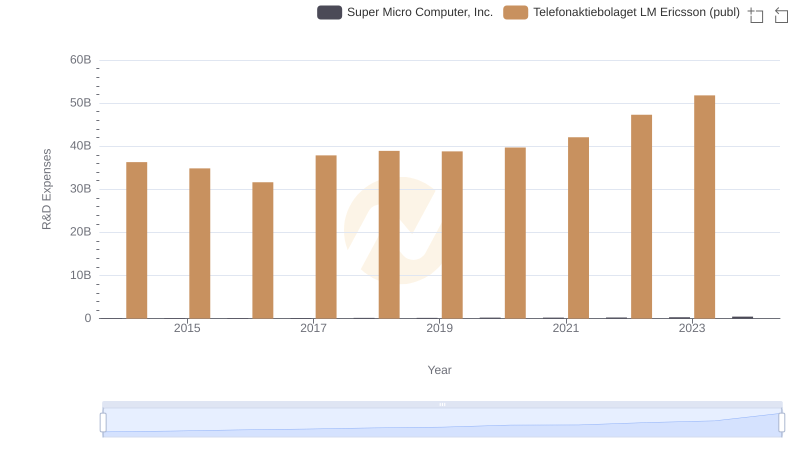

Research and Development Investment: Telefonaktiebolaget LM Ericsson (publ) vs Super Micro Computer, Inc.

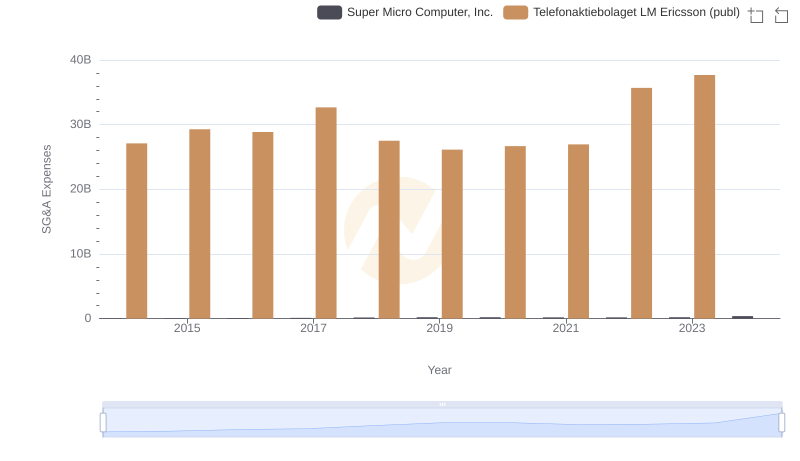

Operational Costs Compared: SG&A Analysis of Telefonaktiebolaget LM Ericsson (publ) and Super Micro Computer, Inc.