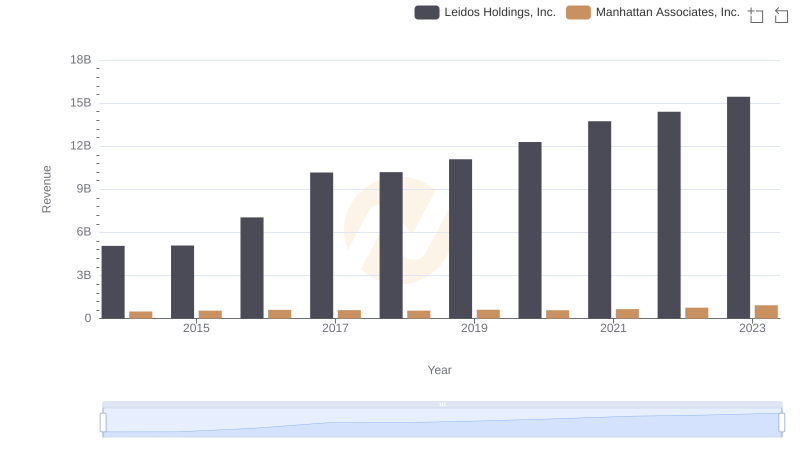

| __timestamp | Leidos Holdings, Inc. | Manhattan Associates, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 671000000 | 279526000 |

| Thursday, January 1, 2015 | 618000000 | 320943000 |

| Friday, January 1, 2016 | 852000000 | 354678000 |

| Sunday, January 1, 2017 | 1247000000 | 348866000 |

| Monday, January 1, 2018 | 1504000000 | 318276000 |

| Tuesday, January 1, 2019 | 1548000000 | 332982000 |

| Wednesday, January 1, 2020 | 1737000000 | 316485000 |

| Friday, January 1, 2021 | 2014000000 | 365816000 |

| Saturday, January 1, 2022 | 2084000000 | 408847000 |

| Sunday, January 1, 2023 | 2244000000 | 498111000 |

| Monday, January 1, 2024 | 2798000000 | 571372000 |

Igniting the spark of knowledge

In the ever-evolving landscape of corporate finance, understanding gross profit trends is crucial. Leidos Holdings, Inc. and Manhattan Associates, Inc. offer a fascinating study in contrasts. From 2014 to 2023, Leidos Holdings saw a remarkable growth in gross profit, increasing by over 230%, from approximately $670 million to $2.24 billion. This growth underscores Leidos' strategic prowess in expanding its market share and optimizing operations.

Conversely, Manhattan Associates, Inc. experienced a more modest increase of around 78% in the same period, from $280 million to nearly $500 million. This steady growth reflects Manhattan's consistent performance in the software sector, despite the competitive pressures.

Interestingly, the data for 2024 shows a significant jump for Manhattan Associates, with gross profit reaching over $1 billion, indicating a potential breakthrough year. However, data for Leidos Holdings in 2024 is missing, leaving room for speculation on its future trajectory.

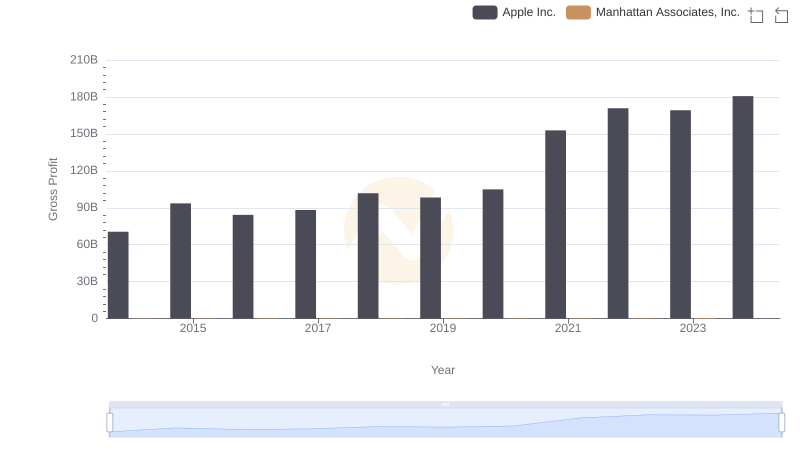

Apple Inc. and Manhattan Associates, Inc.: A Detailed Gross Profit Analysis

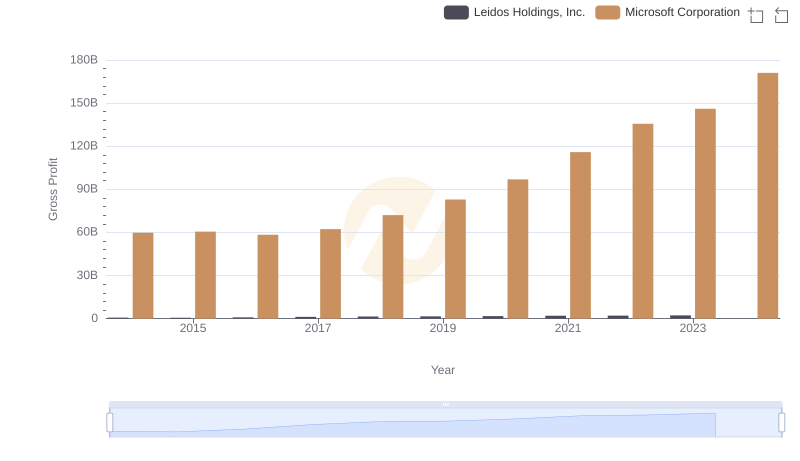

Gross Profit Trends Compared: Microsoft Corporation vs Leidos Holdings, Inc.

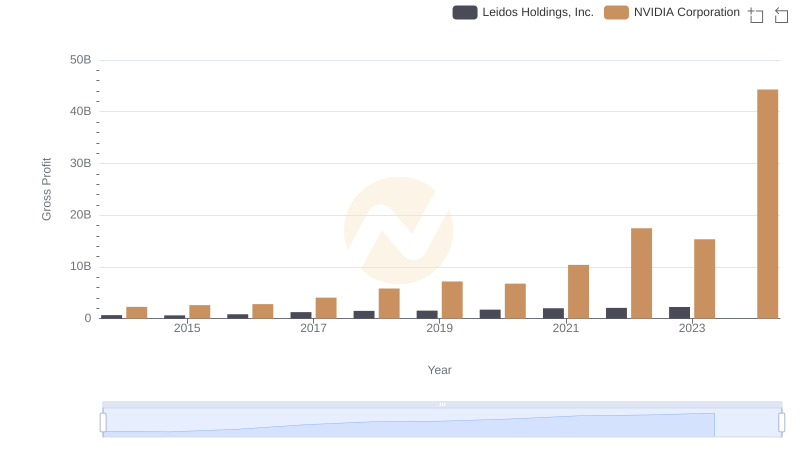

NVIDIA Corporation and Leidos Holdings, Inc.: A Detailed Gross Profit Analysis

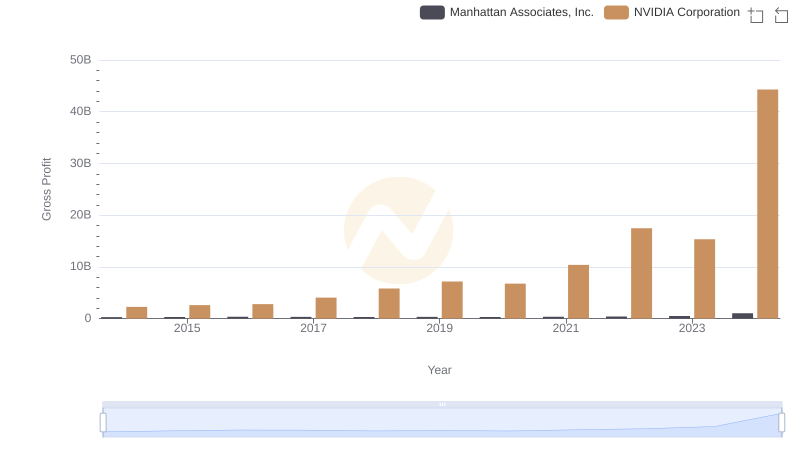

NVIDIA Corporation and Manhattan Associates, Inc.: A Detailed Gross Profit Analysis

Key Insights on Gross Profit: Taiwan Semiconductor Manufacturing Company Limited vs Leidos Holdings, Inc.

Key Insights on Gross Profit: Taiwan Semiconductor Manufacturing Company Limited vs Manhattan Associates, Inc.

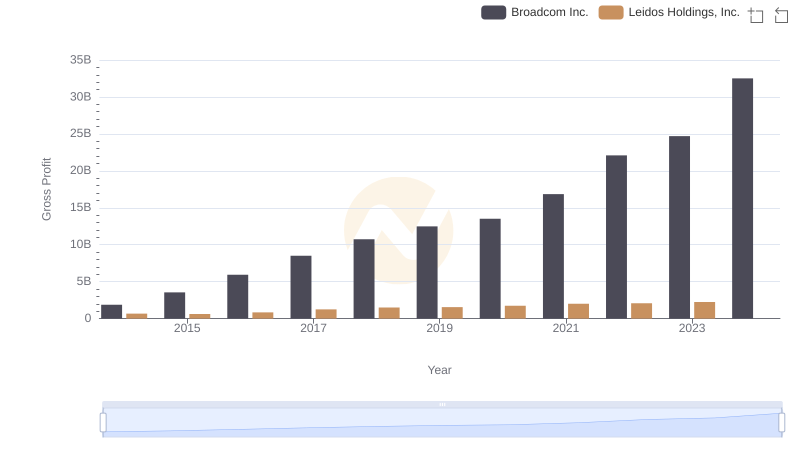

Broadcom Inc. and Leidos Holdings, Inc.: A Detailed Gross Profit Analysis

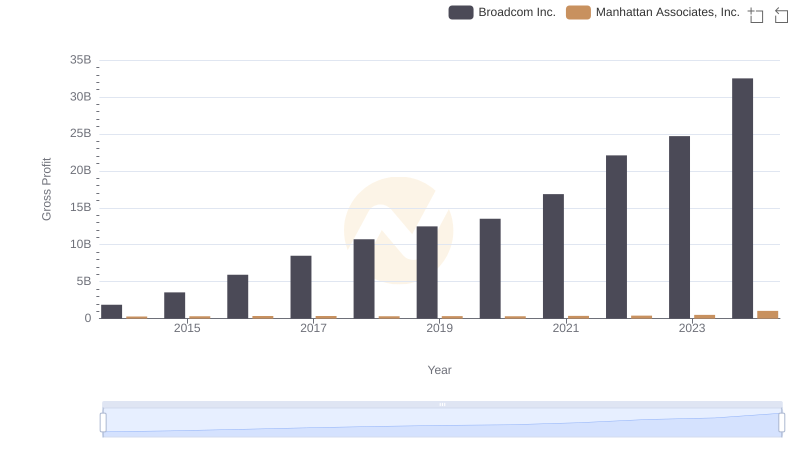

Broadcom Inc. vs Manhattan Associates, Inc.: A Gross Profit Performance Breakdown

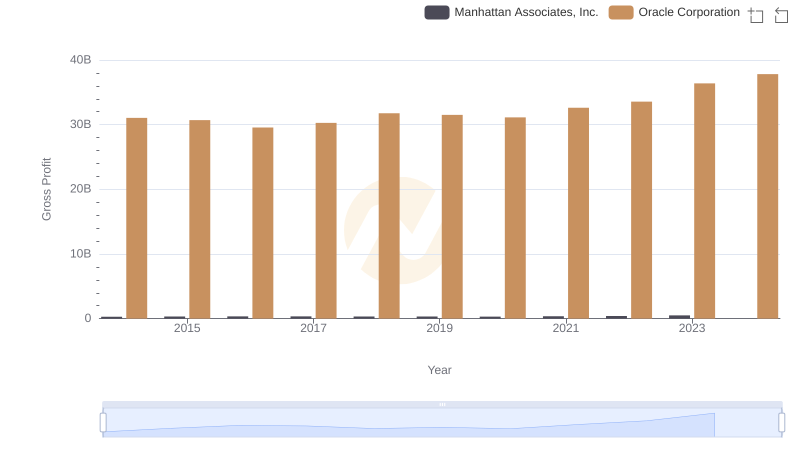

Key Insights on Gross Profit: Oracle Corporation vs Manhattan Associates, Inc.

Leidos Holdings, Inc. vs Manhattan Associates, Inc.: Examining Key Revenue Metrics

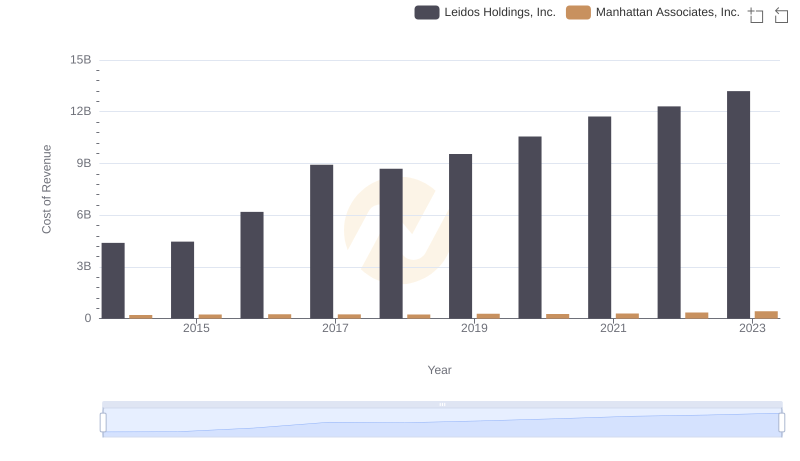

Cost Insights: Breaking Down Leidos Holdings, Inc. and Manhattan Associates, Inc.'s Expenses

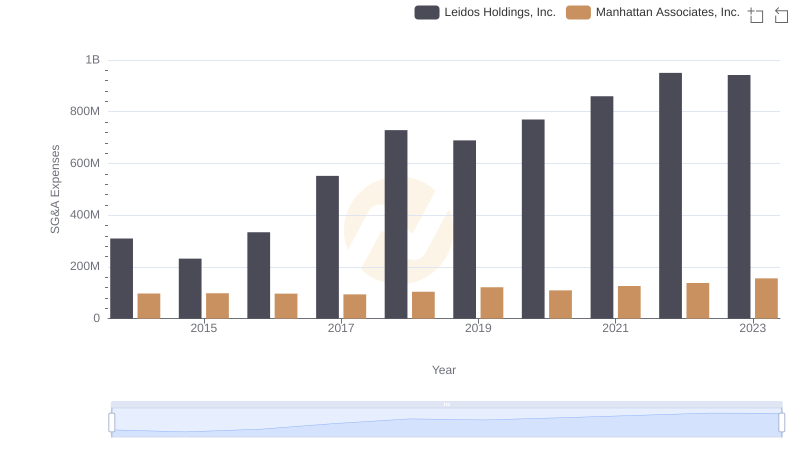

Operational Costs Compared: SG&A Analysis of Leidos Holdings, Inc. and Manhattan Associates, Inc.