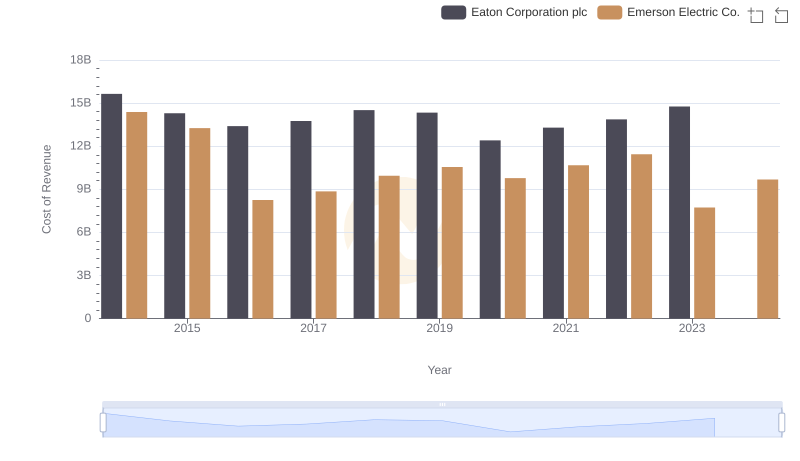

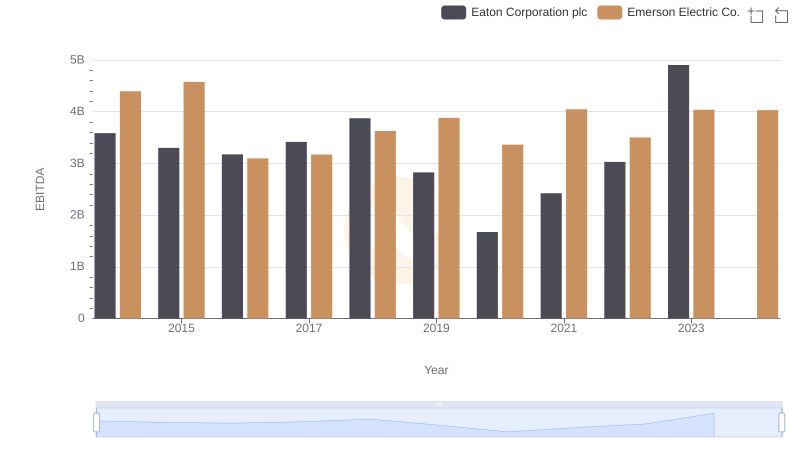

| __timestamp | Eaton Corporation plc | Emerson Electric Co. |

|---|---|---|

| Wednesday, January 1, 2014 | 6906000000 | 10158000000 |

| Thursday, January 1, 2015 | 6563000000 | 9048000000 |

| Friday, January 1, 2016 | 6347000000 | 6262000000 |

| Sunday, January 1, 2017 | 6648000000 | 6404000000 |

| Monday, January 1, 2018 | 7098000000 | 7460000000 |

| Tuesday, January 1, 2019 | 7052000000 | 7815000000 |

| Wednesday, January 1, 2020 | 5450000000 | 7009000000 |

| Friday, January 1, 2021 | 6335000000 | 7563000000 |

| Saturday, January 1, 2022 | 6887000000 | 8188000000 |

| Sunday, January 1, 2023 | 8433000000 | 7427000000 |

| Monday, January 1, 2024 | 9503000000 | 7808000000 |

Unleashing insights

In the competitive landscape of industrial giants, Eaton Corporation plc and Emerson Electric Co. have showcased intriguing financial trajectories over the past decade. From 2014 to 2023, Emerson Electric Co. consistently outperformed Eaton in gross profit, peaking in 2014 with a 30% higher margin. However, Eaton's strategic maneuvers have paid off, culminating in a remarkable 23% increase in gross profit by 2023, surpassing Emerson for the first time in this period.

The year 2020 marked a challenging phase for both companies, with Eaton experiencing a significant dip, reflecting broader economic disruptions. Yet, Eaton's recovery was swift, achieving its highest gross profit in 2023. Emerson, while maintaining stability, faced a slight decline in 2023. The data for 2024 remains incomplete, leaving room for speculation on future trends. This analysis underscores the dynamic nature of industrial competition and the resilience of these corporate titans.

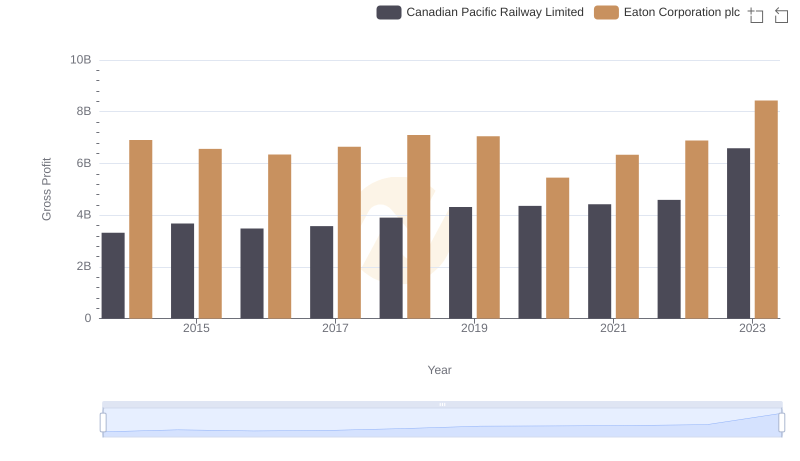

Key Insights on Gross Profit: Eaton Corporation plc vs Canadian Pacific Railway Limited

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs Emerson Electric Co.

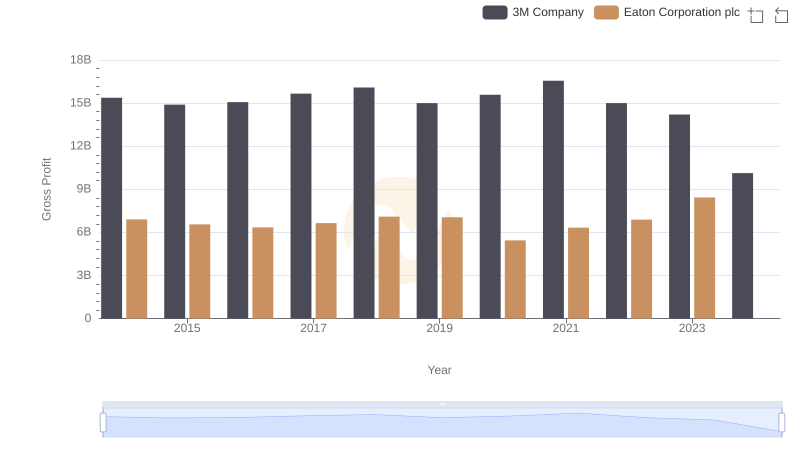

Key Insights on Gross Profit: Eaton Corporation plc vs 3M Company

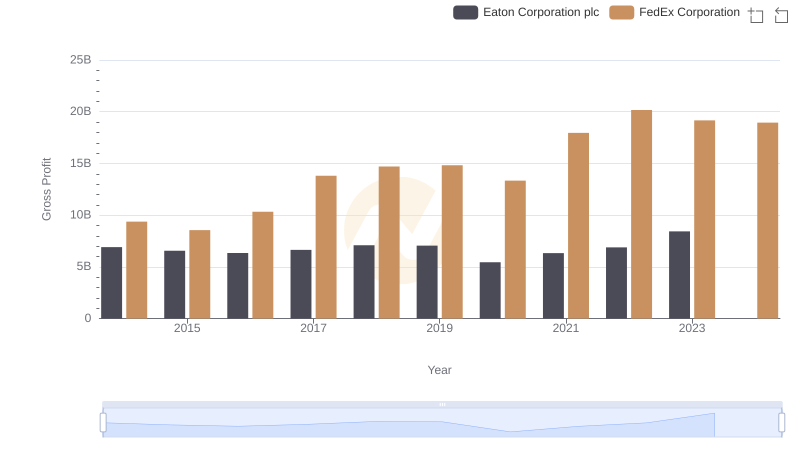

Key Insights on Gross Profit: Eaton Corporation plc vs FedEx Corporation

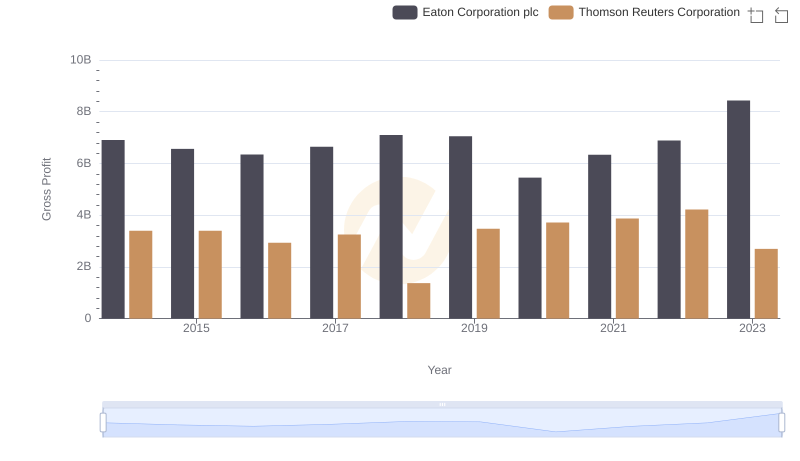

Eaton Corporation plc and Thomson Reuters Corporation: A Detailed Gross Profit Analysis

EBITDA Performance Review: Eaton Corporation plc vs Emerson Electric Co.