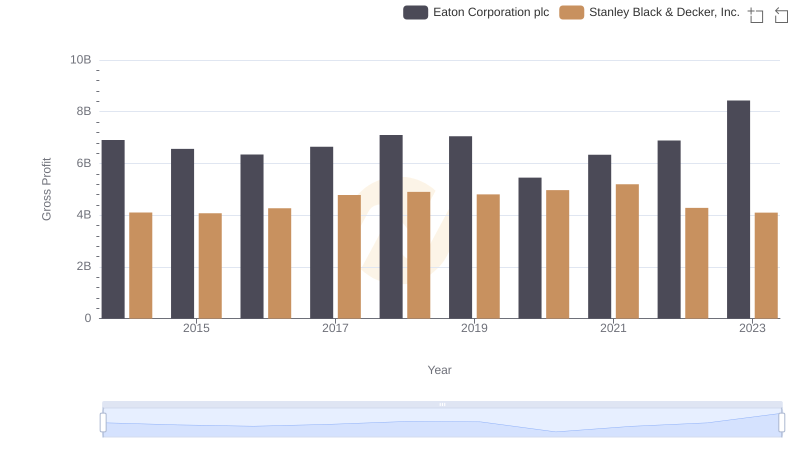

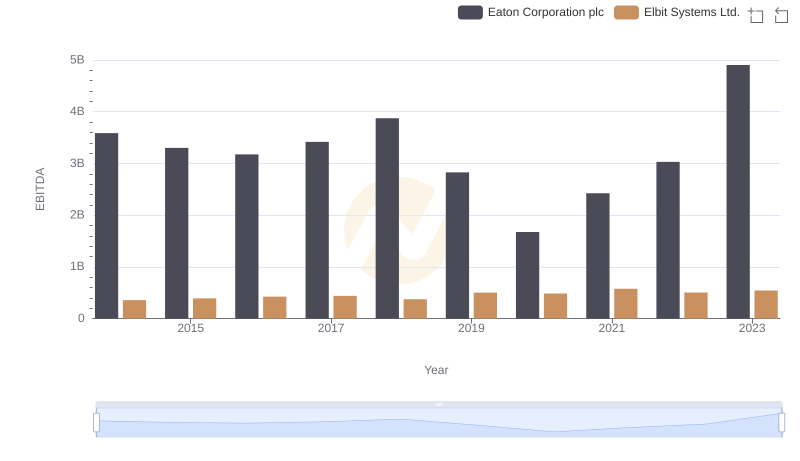

| __timestamp | Eaton Corporation plc | Elbit Systems Ltd. |

|---|---|---|

| Wednesday, January 1, 2014 | 6906000000 | 825097000 |

| Thursday, January 1, 2015 | 6563000000 | 897053000 |

| Friday, January 1, 2016 | 6347000000 | 959583000 |

| Sunday, January 1, 2017 | 6648000000 | 997920000 |

| Monday, January 1, 2018 | 7098000000 | 976179000 |

| Tuesday, January 1, 2019 | 7052000000 | 1136467000 |

| Wednesday, January 1, 2020 | 5450000000 | 1165107000 |

| Friday, January 1, 2021 | 6335000000 | 1358048000 |

| Saturday, January 1, 2022 | 6887000000 | 1373283000 |

| Sunday, January 1, 2023 | 8433000000 | 1482954000 |

| Monday, January 1, 2024 | 9503000000 |

Unlocking the unknown

In the competitive landscape of global corporations, Eaton Corporation plc and Elbit Systems Ltd. have showcased remarkable financial trajectories over the past decade. From 2014 to 2023, Eaton Corporation's gross profit surged by approximately 22%, peaking in 2023 with a notable increase to $8.43 billion. This growth reflects Eaton's strategic initiatives and market adaptability.

Conversely, Elbit Systems Ltd. demonstrated a steady upward trend, with its gross profit climbing by nearly 80% over the same period, reaching $1.48 billion in 2023. This impressive growth underscores Elbit's robust performance in the defense sector.

While Eaton's gross profit experienced a dip in 2020, likely due to global economic challenges, it rebounded strongly in subsequent years. Elbit Systems, however, maintained consistent growth, highlighting its resilience and strategic market positioning. These insights offer a compelling narrative of financial resilience and strategic growth in diverse industries.

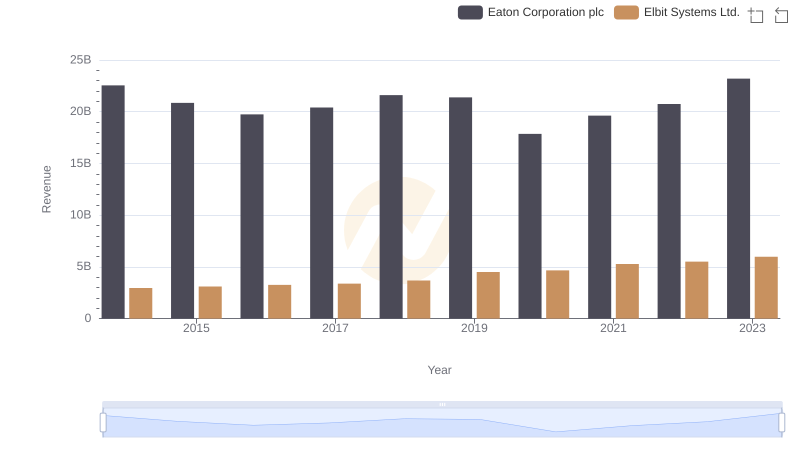

Eaton Corporation plc vs Elbit Systems Ltd.: Examining Key Revenue Metrics

Gross Profit Trends Compared: Eaton Corporation plc vs Stanley Black & Decker, Inc.

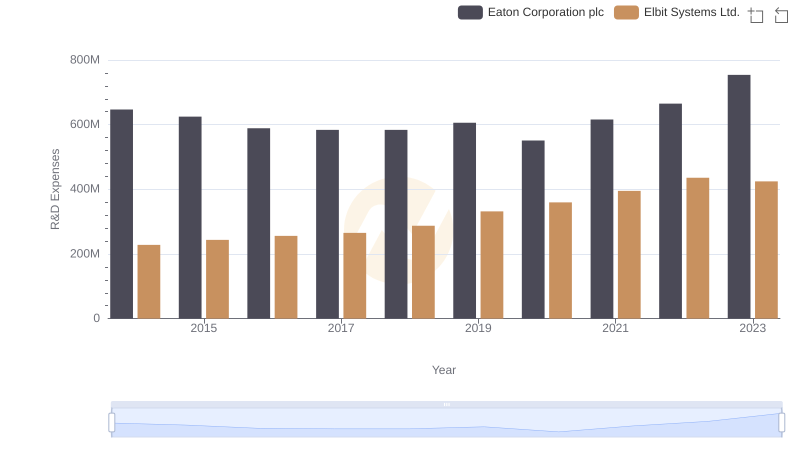

Research and Development Expenses Breakdown: Eaton Corporation plc vs Elbit Systems Ltd.

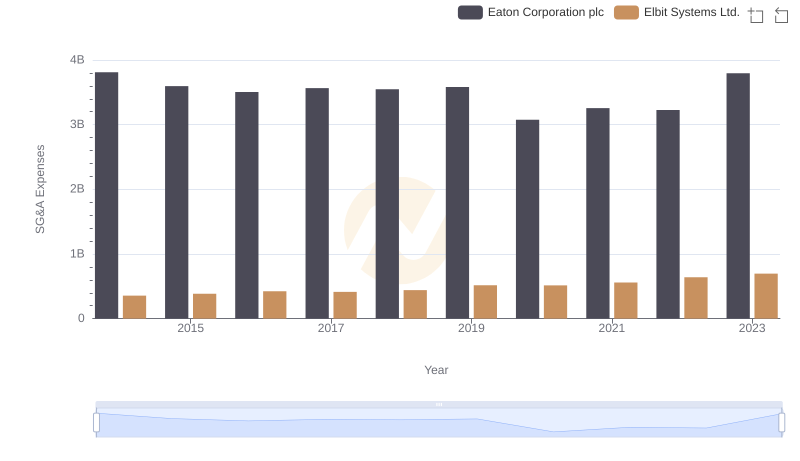

Comparing SG&A Expenses: Eaton Corporation plc vs Elbit Systems Ltd. Trends and Insights

Professional EBITDA Benchmarking: Eaton Corporation plc vs Elbit Systems Ltd.