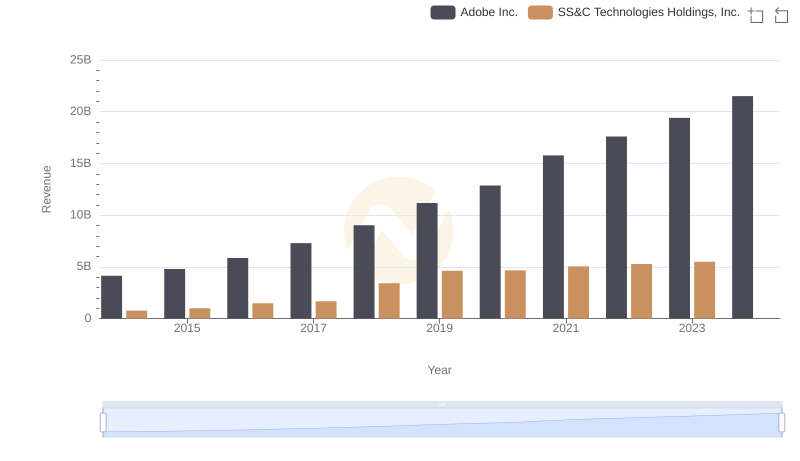

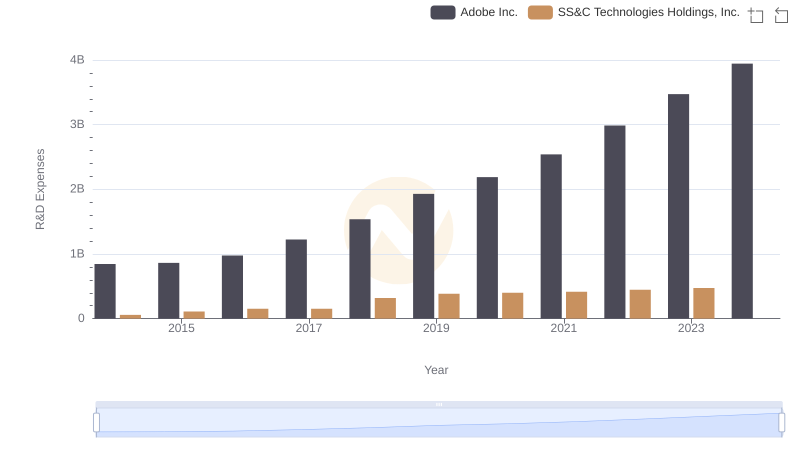

| __timestamp | Adobe Inc. | SS&C Technologies Holdings, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3524985000 | 357130000 |

| Thursday, January 1, 2015 | 4051194000 | 467935000 |

| Friday, January 1, 2016 | 5034522000 | 680947000 |

| Sunday, January 1, 2017 | 6291014000 | 788870000 |

| Monday, January 1, 2018 | 7835009000 | 1370000000 |

| Tuesday, January 1, 2019 | 9498577000 | 2021200000 |

| Wednesday, January 1, 2020 | 11146000000 | 2093800000 |

| Friday, January 1, 2021 | 13920000000 | 2409300000 |

| Saturday, January 1, 2022 | 15441000000 | 2515300000 |

| Sunday, January 1, 2023 | 17055000000 | 2651800000 |

| Monday, January 1, 2024 | 19147000000 | 2863600000 |

Igniting the spark of knowledge

In the dynamic landscape of technology and software services, understanding the financial health of leading companies is crucial for investors and stakeholders alike. This article delves into the gross profit trends of two prominent players in the industry: Adobe Inc. and SS&C Technologies Holdings, Inc. Over the past decade, these companies have exhibited distinct trajectories in their financial performance, reflecting their strategic decisions and market positioning.

From 2014 to 2023, Adobe Inc. has demonstrated remarkable growth in gross profit, starting from approximately $3.5 billion in 2014 and skyrocketing to around $19.1 billion by 2024. This represents an impressive increase of nearly 440% over ten years. Such growth can be attributed to Adobe's robust transition to a subscription-based model, particularly with its Creative Cloud services, which have significantly expanded its customer base and recurring revenue.

In contrast, SS&C Technologies has also shown positive growth, albeit on a smaller scale. The company’s gross profit rose from about $357 million in 2014 to approximately $2.7 billion in 2023, marking a growth of around 650%. This growth reflects SS&C's strategic acquisitions and its focus on providing comprehensive software solutions for the financial services sector. However, compared to Adobe, SS&C's growth rate, while commendable, highlights the challenges of scaling in a more niche market.

Examining the yearly data reveals that Adobe consistently outperformed SS&C in gross profit across most years. For instance, in 2019, Adobe's gross profit peaked at approximately $9.5 billion, compared to SS&C's $2.0 billion. This disparity underscores Adobe's dominance in the creative software space and its ability to leverage brand loyalty and innovation.

Interestingly, while Adobe's growth trajectory appears stable, SS&C's gross profit has shown more volatility, particularly in the earlier years of the decade. The company experienced a significant jump in gross profit in 2018, reaching $1.37 billion, but has since plateaued, indicating potential market saturation or increased competition.

As we look towards the future, Adobe is poised for continued growth, with projections indicating that its gross profit could exceed $20 billion by 2025. This optimistic outlook is supported by ongoing innovations in artificial intelligence and machine learning, which are expected to enhance its product offerings further.

On the other hand, SS&C Technologies must navigate a competitive landscape and explore new growth avenues to sustain its upward trajectory. The absence of data for 2024 raises questions about its future performance, emphasizing the need for strategic planning and adaptability in an ever-evolving market.

In summary, the financial performance of Adobe Inc. and SS&C Technologies Holdings, Inc. over the past decade illustrates the diverse paths technology companies can take. With Adobe leading the charge in gross profit growth, the insights gleaned from this analysis provide valuable lessons for investors and industry analysts alike. As these companies continue to evolve, monitoring their financial health will remain essential for understanding the broader trends in the technology sector.

Comparing Revenue Performance: Adobe Inc. or SS&C Technologies Holdings, Inc.?

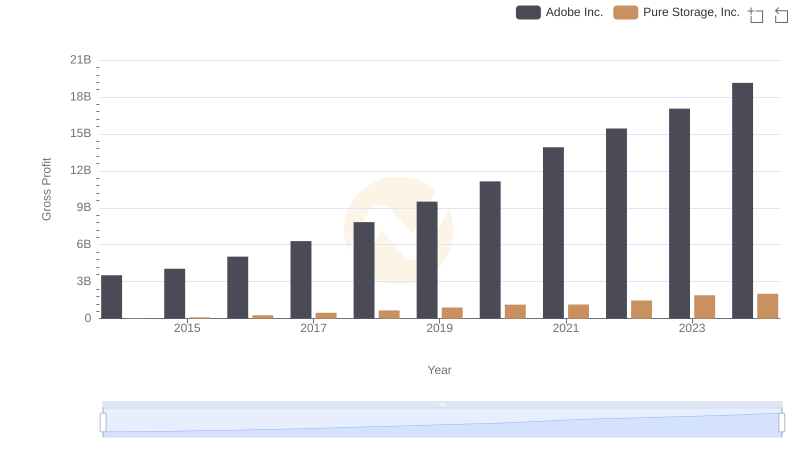

Gross Profit Comparison: Adobe Inc. and Pure Storage, Inc. Trends

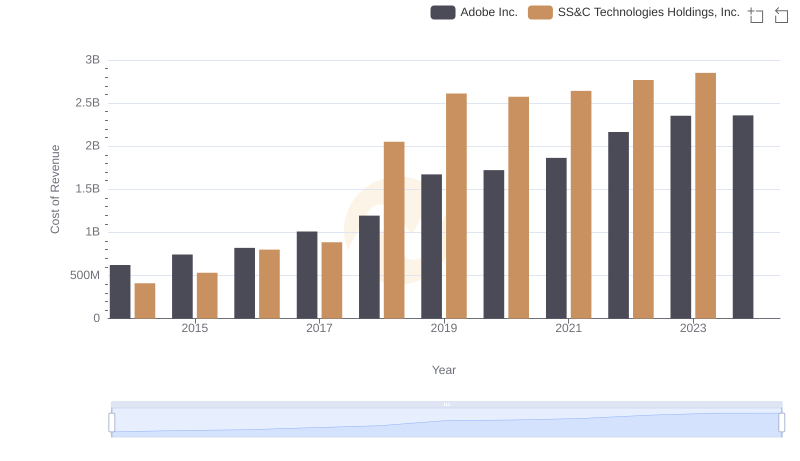

Comparing Cost of Revenue Efficiency: Adobe Inc. vs SS&C Technologies Holdings, Inc.

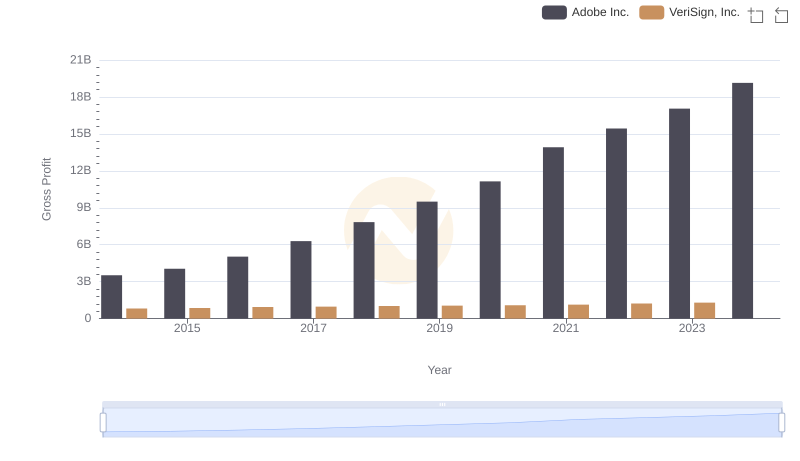

Gross Profit Trends Compared: Adobe Inc. vs VeriSign, Inc.

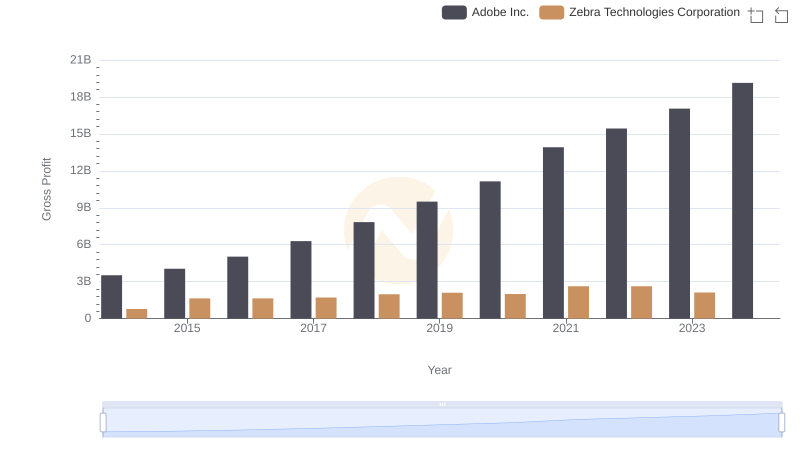

Gross Profit Analysis: Comparing Adobe Inc. and Zebra Technologies Corporation

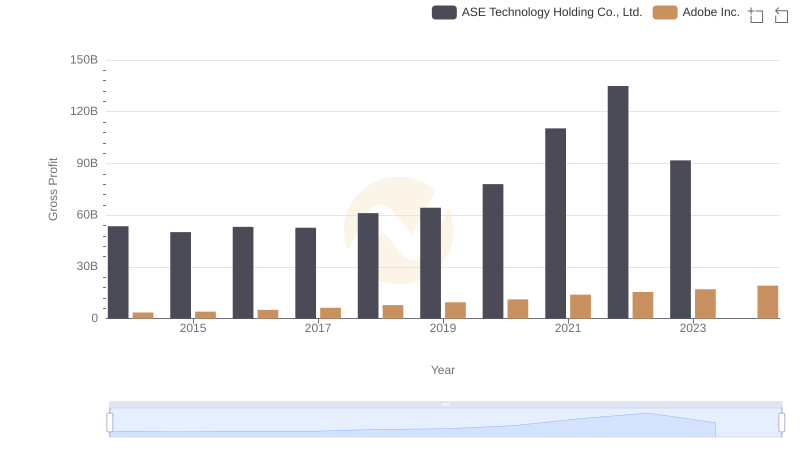

Adobe Inc. vs ASE Technology Holding Co., Ltd.: A Gross Profit Performance Breakdown

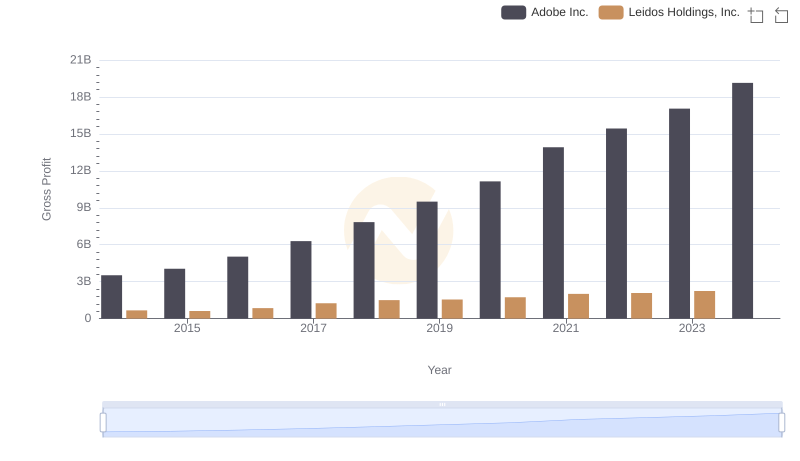

Who Generates Higher Gross Profit? Adobe Inc. or Leidos Holdings, Inc.

Adobe Inc. or SS&C Technologies Holdings, Inc.: Who Invests More in Innovation?

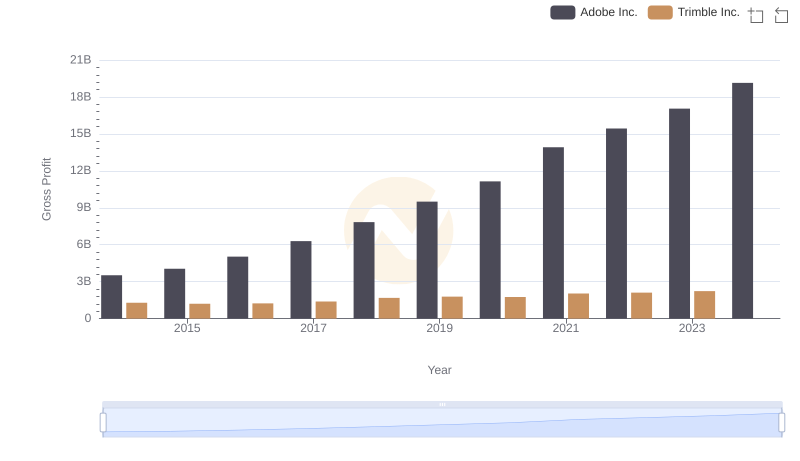

Who Generates Higher Gross Profit? Adobe Inc. or Trimble Inc.

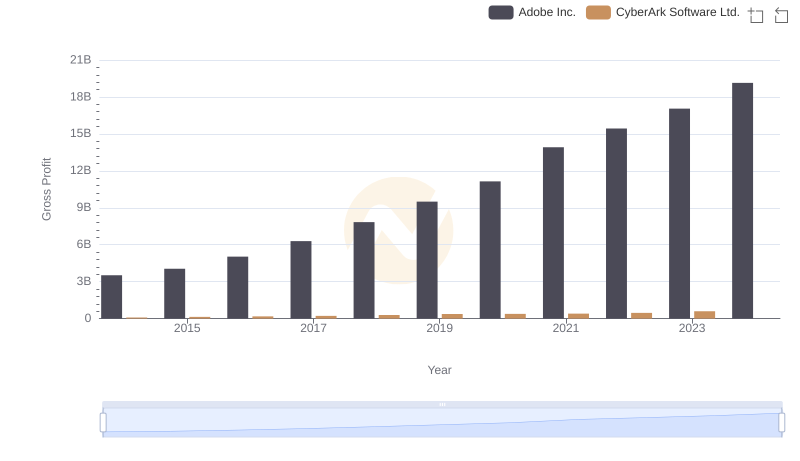

Who Generates Higher Gross Profit? Adobe Inc. or CyberArk Software Ltd.

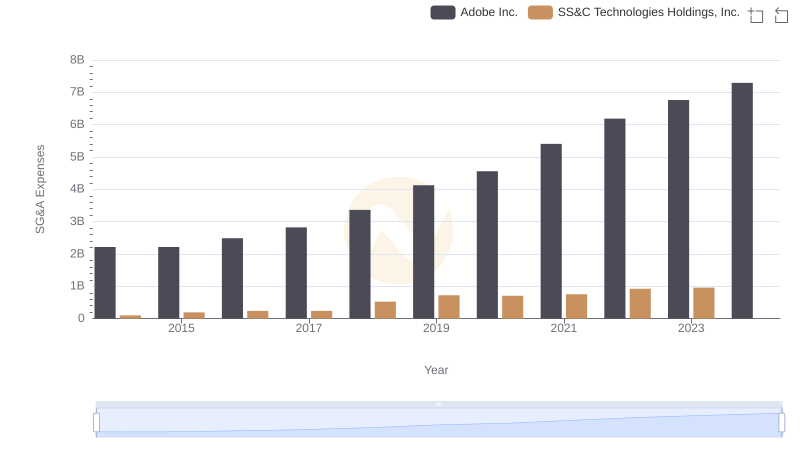

Comparing SG&A Expenses: Adobe Inc. vs SS&C Technologies Holdings, Inc. Trends and Insights

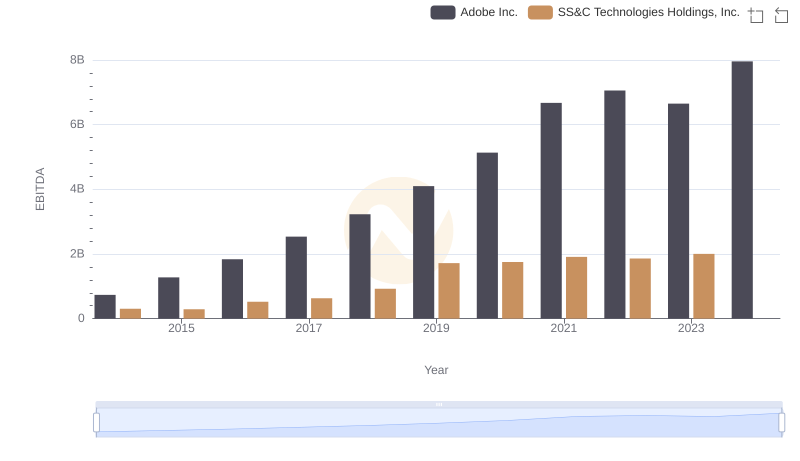

EBITDA Performance Review: Adobe Inc. vs SS&C Technologies Holdings, Inc.