| __timestamp | Canadian National Railway Company | Hubbell Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 5674000000 | 594700000 |

| Thursday, January 1, 2015 | 6424000000 | 533600000 |

| Friday, January 1, 2016 | 6537000000 | 564700000 |

| Sunday, January 1, 2017 | 6839000000 | 585600000 |

| Monday, January 1, 2018 | 7124000000 | 677500000 |

| Tuesday, January 1, 2019 | 7999000000 | 740900000 |

| Wednesday, January 1, 2020 | 7652000000 | 671400000 |

| Friday, January 1, 2021 | 7607000000 | 661000000 |

| Saturday, January 1, 2022 | 9067000000 | 854300000 |

| Sunday, January 1, 2023 | 9027000000 | 1169700000 |

| Monday, January 1, 2024 | 1291200000 |

Igniting the spark of knowledge

In the world of industrial giants, Canadian National Railway Company and Hubbell Incorporated stand as titans in their respective fields. Over the past decade, from 2014 to 2023, these companies have showcased remarkable financial resilience and growth. Canadian National Railway, a leader in the transportation sector, has seen its EBITDA grow by approximately 59%, peaking in 2022 with a staggering 9.07 billion. Meanwhile, Hubbell Incorporated, a key player in electrical products, has demonstrated a steady upward trajectory, with its EBITDA increasing by nearly 97% over the same period, reaching 1.17 billion in 2023. This comparison not only highlights the robust performance of these companies but also underscores the diverse strategies employed by different industries to achieve financial success. As we delve into these metrics, it becomes evident that both companies have adeptly navigated economic challenges, setting benchmarks for future growth.

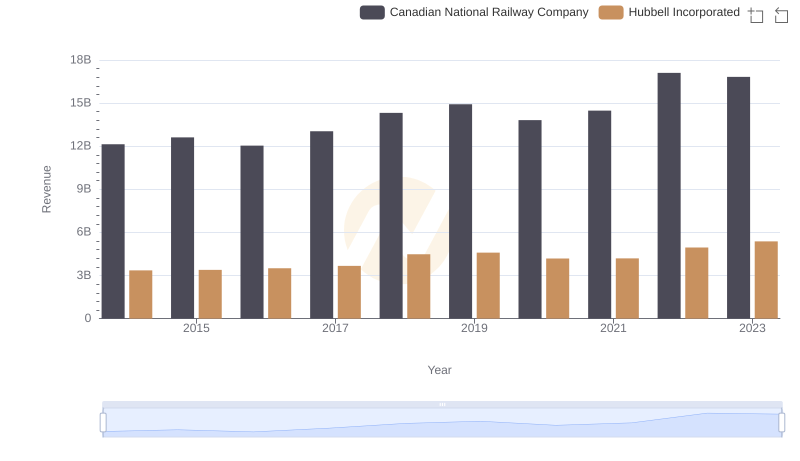

Canadian National Railway Company and Hubbell Incorporated: A Comprehensive Revenue Analysis

Cost of Revenue: Key Insights for Canadian National Railway Company and Hubbell Incorporated

Comprehensive EBITDA Comparison: Canadian National Railway Company vs Dover Corporation

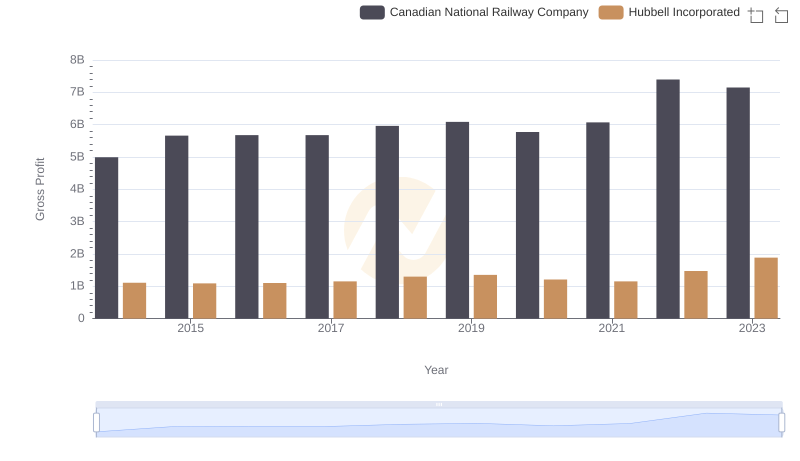

Who Generates Higher Gross Profit? Canadian National Railway Company or Hubbell Incorporated

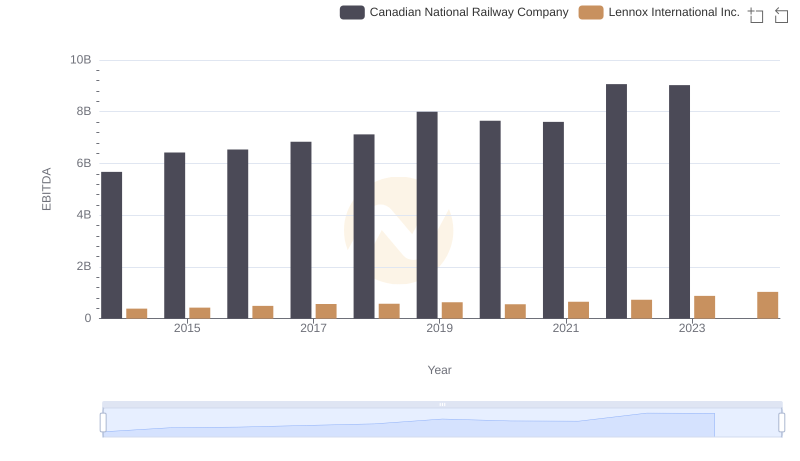

Comparative EBITDA Analysis: Canadian National Railway Company vs Lennox International Inc.

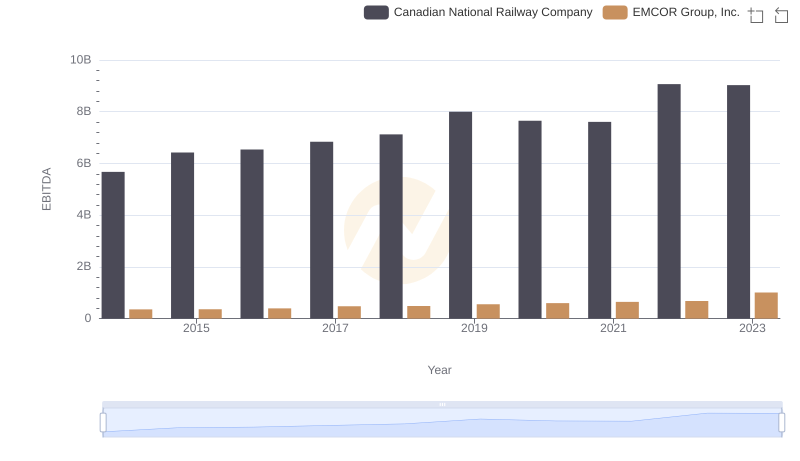

Comparative EBITDA Analysis: Canadian National Railway Company vs EMCOR Group, Inc.

Canadian National Railway Company vs Builders FirstSource, Inc.: In-Depth EBITDA Performance Comparison

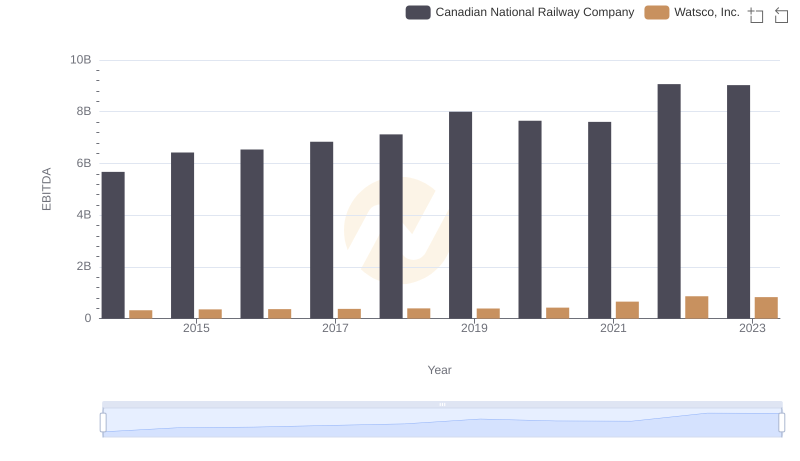

Comparative EBITDA Analysis: Canadian National Railway Company vs Watsco, Inc.

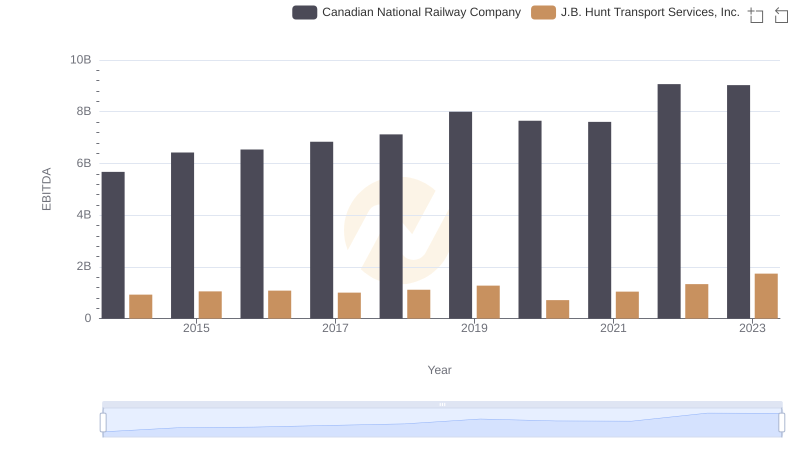

EBITDA Analysis: Evaluating Canadian National Railway Company Against J.B. Hunt Transport Services, Inc.