| __timestamp | Canadian National Railway Company | Dover Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 5674000000 | 1533084000 |

| Thursday, January 1, 2015 | 6424000000 | 1259375000 |

| Friday, January 1, 2016 | 6537000000 | 1186472000 |

| Sunday, January 1, 2017 | 6839000000 | 1304041000 |

| Monday, January 1, 2018 | 7124000000 | 1138930000 |

| Tuesday, January 1, 2019 | 7999000000 | 1241114000 |

| Wednesday, January 1, 2020 | 7652000000 | 1232722000 |

| Friday, January 1, 2021 | 7607000000 | 1797268000 |

| Saturday, January 1, 2022 | 9067000000 | 1711499000 |

| Sunday, January 1, 2023 | 9027000000 | 1718774000 |

| Monday, January 1, 2024 | 1206355000 |

Unleashing insights

In the world of industrial giants, Canadian National Railway Company and Dover Corporation stand as titans of their respective fields. Over the past decade, Canadian National Railway has consistently outperformed Dover Corporation in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, Canadian National Railway's EBITDA surged by approximately 59%, peaking in 2022 with a remarkable 9.07 billion USD. In contrast, Dover Corporation, while experiencing fluctuations, saw a more modest increase of around 12% over the same period, reaching its highest EBITDA in 2021 at 1.80 billion USD.

This comparison highlights the resilience and strategic prowess of Canadian National Railway in navigating economic challenges and capitalizing on opportunities. As we delve into these financial narratives, it becomes evident that strategic investments and operational efficiencies are key drivers of success in the competitive landscape of industrial corporations.

Breaking Down Revenue Trends: Canadian National Railway Company vs Dover Corporation

Comparative EBITDA Analysis: Canadian National Railway Company vs Old Dominion Freight Line, Inc.

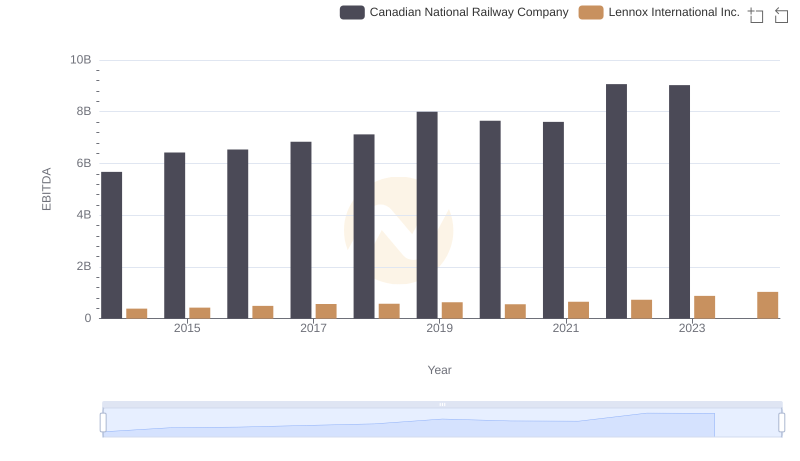

Comparative EBITDA Analysis: Canadian National Railway Company vs Lennox International Inc.

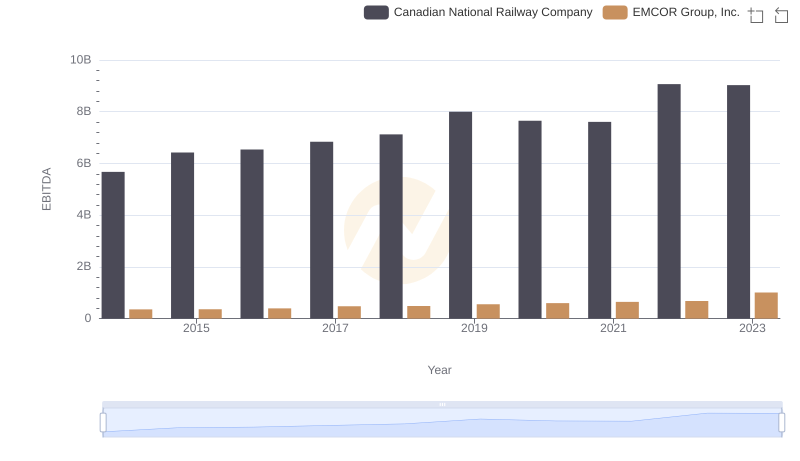

Comparative EBITDA Analysis: Canadian National Railway Company vs EMCOR Group, Inc.

EBITDA Metrics Evaluated: Canadian National Railway Company vs Hubbell Incorporated