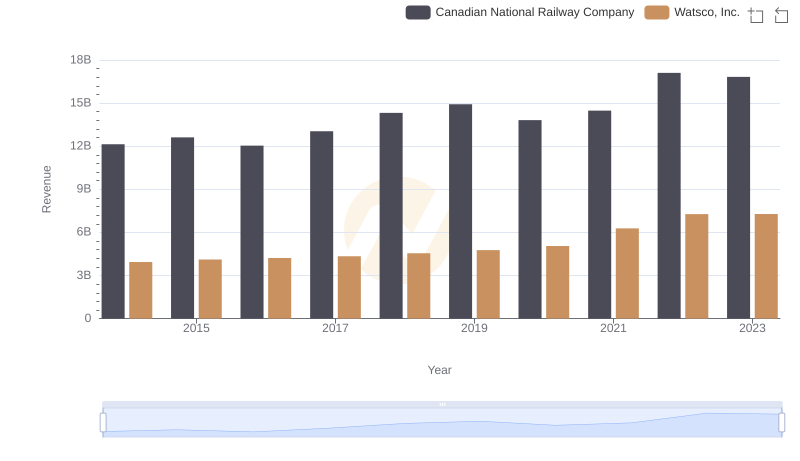

| __timestamp | Canadian National Railway Company | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5674000000 | 323674000 |

| Thursday, January 1, 2015 | 6424000000 | 355865000 |

| Friday, January 1, 2016 | 6537000000 | 365698000 |

| Sunday, January 1, 2017 | 6839000000 | 375907000 |

| Monday, January 1, 2018 | 7124000000 | 394177000 |

| Tuesday, January 1, 2019 | 7999000000 | 391396000 |

| Wednesday, January 1, 2020 | 7652000000 | 426942000 |

| Friday, January 1, 2021 | 7607000000 | 656655000 |

| Saturday, January 1, 2022 | 9067000000 | 863261000 |

| Sunday, January 1, 2023 | 9027000000 | 829900000 |

| Monday, January 1, 2024 | 781775000 |

Unleashing the power of data

In the ever-evolving landscape of North American industries, Canadian National Railway Company (CNR) and Watsco, Inc. have demonstrated remarkable financial resilience over the past decade. From 2014 to 2023, CNR's EBITDA surged by approximately 59%, reflecting its robust operational efficiency and strategic expansions. Meanwhile, Watsco, Inc., a leader in HVAC distribution, showcased a commendable 156% increase in EBITDA, underscoring its adaptability and market penetration.

These trends not only reflect the companies' individual strategies but also provide a lens into the broader economic shifts impacting the transportation and HVAC sectors.

Breaking Down Revenue Trends: Canadian National Railway Company vs Watsco, Inc.

Canadian National Railway Company vs Watsco, Inc.: A Gross Profit Performance Breakdown

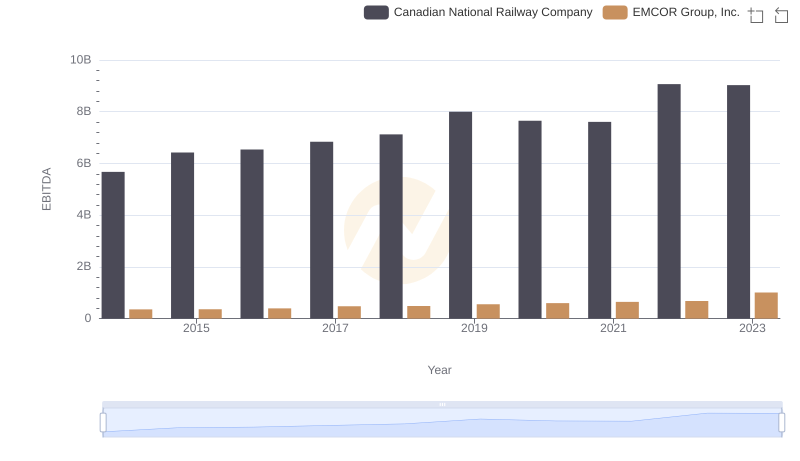

Comparative EBITDA Analysis: Canadian National Railway Company vs EMCOR Group, Inc.

EBITDA Metrics Evaluated: Canadian National Railway Company vs Hubbell Incorporated

Canadian National Railway Company vs Builders FirstSource, Inc.: In-Depth EBITDA Performance Comparison

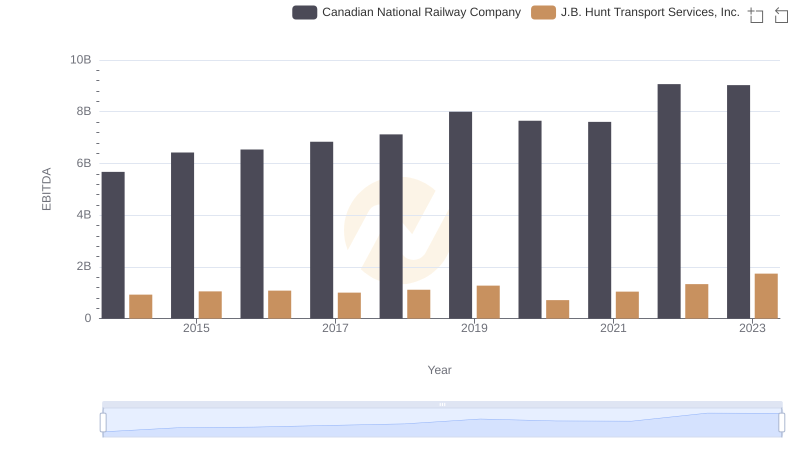

EBITDA Analysis: Evaluating Canadian National Railway Company Against J.B. Hunt Transport Services, Inc.