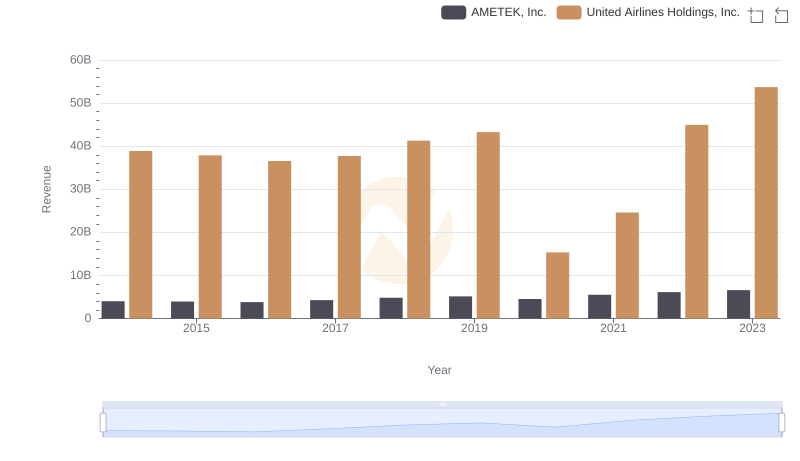

| __timestamp | AMETEK, Inc. | United Airlines Holdings, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2597017000 | 29569000000 |

| Thursday, January 1, 2015 | 2549280000 | 25952000000 |

| Friday, January 1, 2016 | 2575220000 | 24856000000 |

| Sunday, January 1, 2017 | 2851431000 | 27056000000 |

| Monday, January 1, 2018 | 3186310000 | 30165000000 |

| Tuesday, January 1, 2019 | 3370897000 | 30786000000 |

| Wednesday, January 1, 2020 | 2996515000 | 20385000000 |

| Friday, January 1, 2021 | 3633900000 | 23913000000 |

| Saturday, January 1, 2022 | 4005261000 | 34315000000 |

| Sunday, January 1, 2023 | 4212484999 | 38518000000 |

| Monday, January 1, 2024 | 0 | 37643000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of corporate finance, understanding cost structures is crucial. This analysis juxtaposes the cost of revenue trends for AMETEK, Inc., a leader in electronic instruments, and United Airlines Holdings, Inc., a giant in the aviation sector, from 2014 to 2023.

AMETEK's cost of revenue has shown a consistent upward trajectory, growing approximately 62% over the decade. This reflects the company's strategic investments in technology and innovation, ensuring a robust supply chain and operational efficiency.

United Airlines, on the other hand, experienced a more volatile cost pattern, with a notable dip in 2020 due to the pandemic's impact on air travel. However, by 2023, costs surged by 89% from their 2020 low, indicating a strong recovery and adaptation to new market dynamics.

This comparative analysis highlights the diverse challenges and strategies in managing costs across different industries.

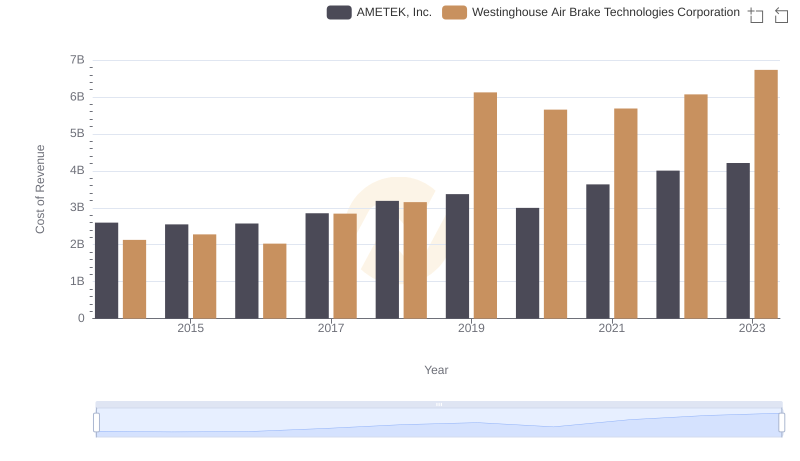

Cost Insights: Breaking Down AMETEK, Inc. and Westinghouse Air Brake Technologies Corporation's Expenses

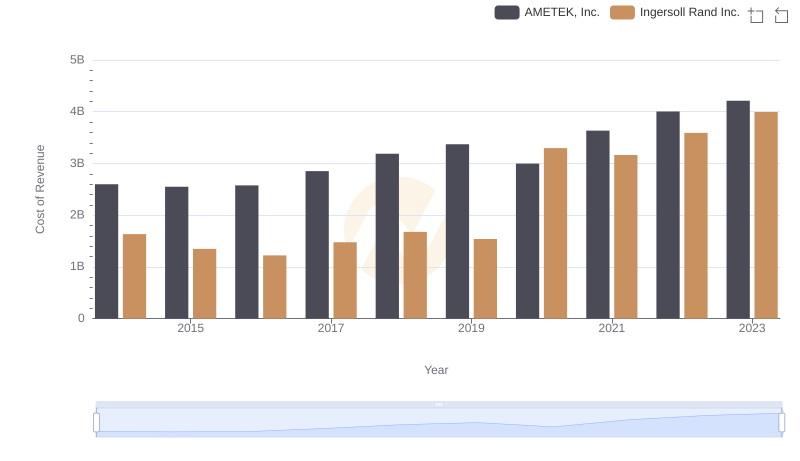

Cost of Revenue: Key Insights for AMETEK, Inc. and Ingersoll Rand Inc.

Breaking Down Revenue Trends: AMETEK, Inc. vs United Airlines Holdings, Inc.

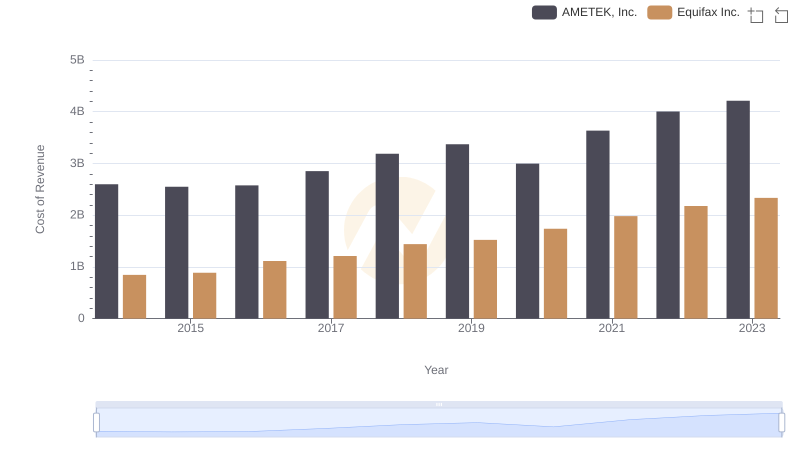

AMETEK, Inc. vs Equifax Inc.: Efficiency in Cost of Revenue Explored

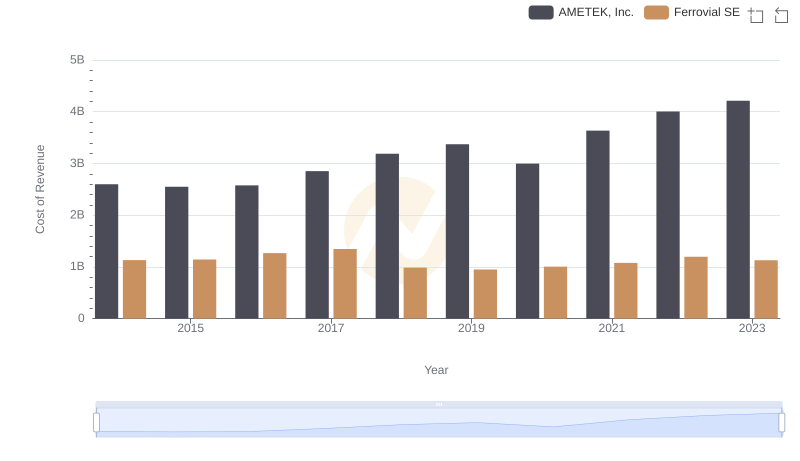

Cost of Revenue Trends: AMETEK, Inc. vs Ferrovial SE

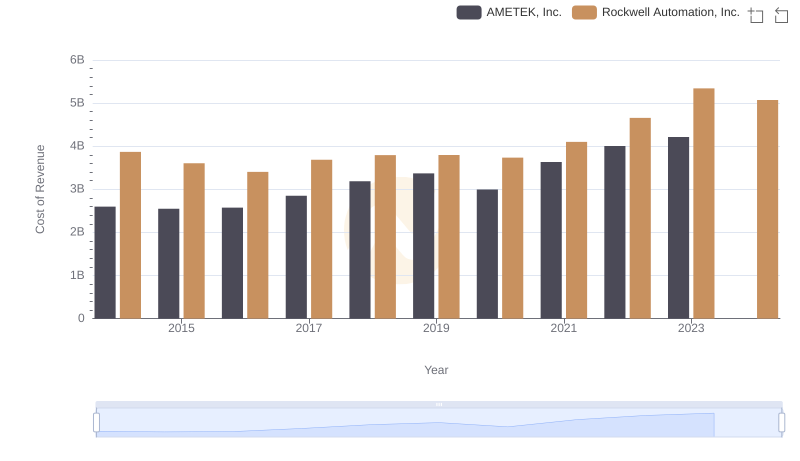

Cost of Revenue Trends: AMETEK, Inc. vs Rockwell Automation, Inc.

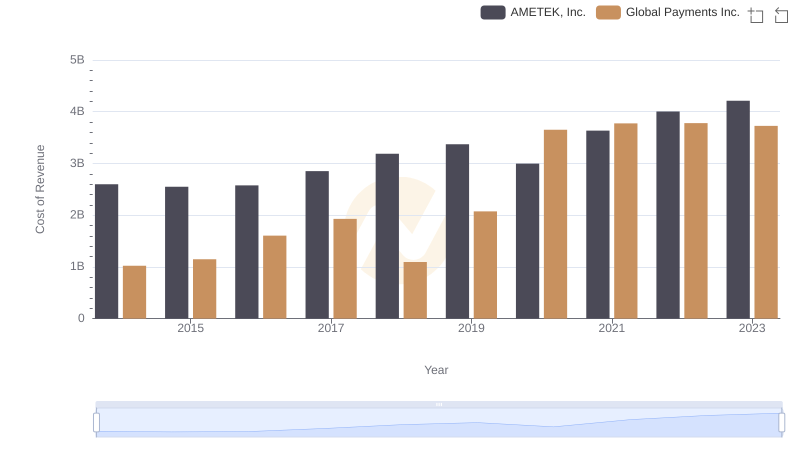

Cost of Revenue Comparison: AMETEK, Inc. vs Global Payments Inc.

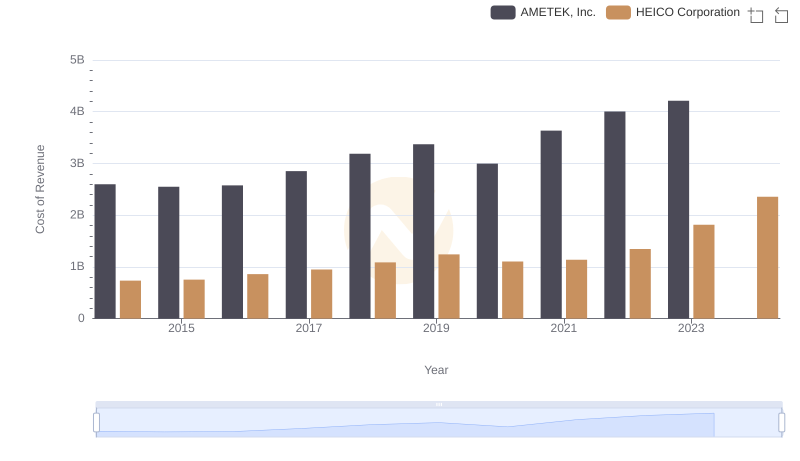

Cost of Revenue Comparison: AMETEK, Inc. vs HEICO Corporation

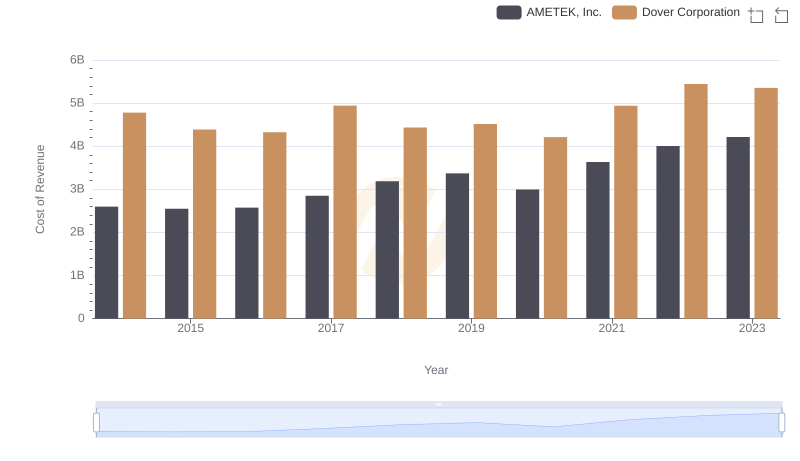

Cost of Revenue: Key Insights for AMETEK, Inc. and Dover Corporation

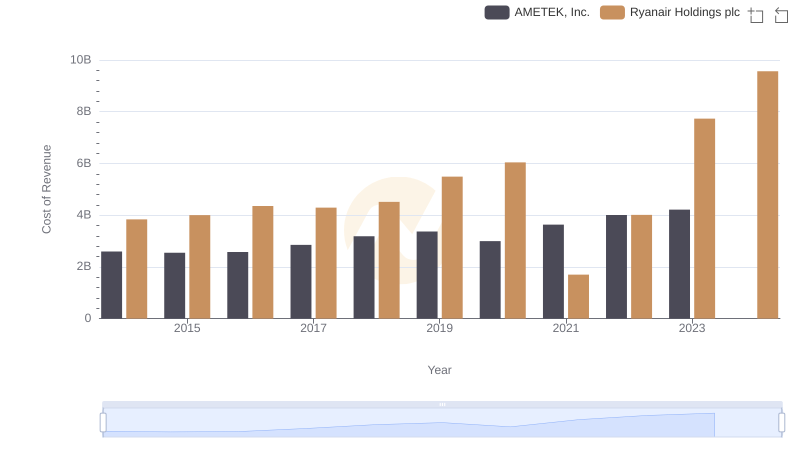

AMETEK, Inc. vs Ryanair Holdings plc: Efficiency in Cost of Revenue Explored