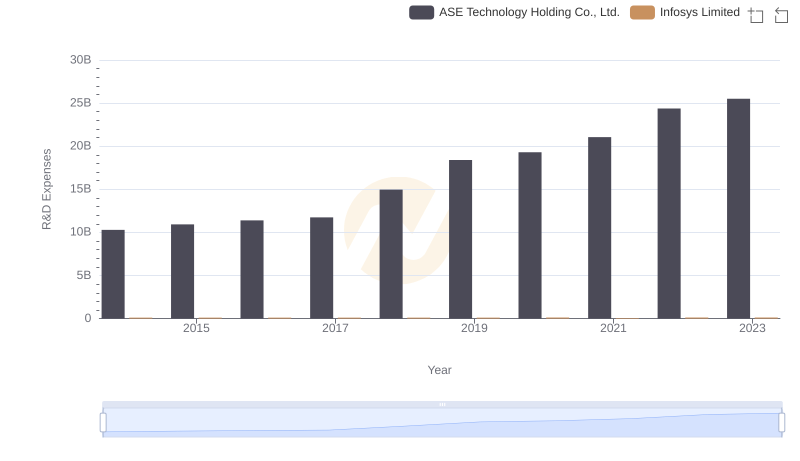

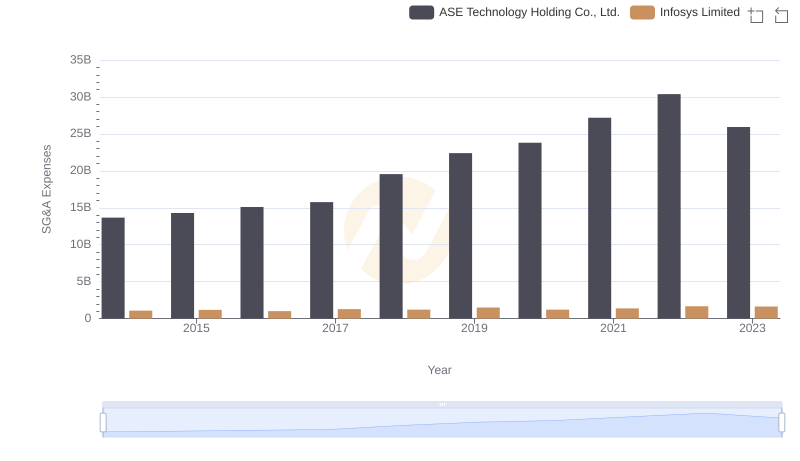

| __timestamp | ASE Technology Holding Co., Ltd. | Infosys Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 203051000000 | 5374000000 |

| Thursday, January 1, 2015 | 233153000000 | 5950000000 |

| Friday, January 1, 2016 | 221690000000 | 6446000000 |

| Sunday, January 1, 2017 | 237709000000 | 7001000000 |

| Monday, January 1, 2018 | 309929000000 | 7687000000 |

| Tuesday, January 1, 2019 | 348871000000 | 8552000000 |

| Wednesday, January 1, 2020 | 398994000000 | 8828000000 |

| Friday, January 1, 2021 | 459628000000 | 10996000000 |

| Saturday, January 1, 2022 | 535943000000 | 12709000000 |

| Sunday, January 1, 2023 | 490157339000 | 13096000000 |

| Monday, January 1, 2024 | 499722880000 |

Data in motion

In the ever-evolving landscape of global technology, understanding the cost of revenue is crucial for evaluating a company's financial health. This analysis focuses on two industry giants: Infosys Limited and ASE Technology Holding Co., Ltd. Over the past decade, ASE Technology has seen a remarkable 141% increase in its cost of revenue, peaking in 2022. In contrast, Infosys Limited has experienced a steady growth of 144% in the same period, reflecting its strategic expansion and operational efficiency.

These trends highlight the dynamic nature of the tech industry and the strategic maneuvers companies employ to maintain competitiveness.

Comparing Revenue Performance: Infosys Limited or ASE Technology Holding Co., Ltd.?

Cost of Revenue: Key Insights for Infosys Limited and ON Semiconductor Corporation

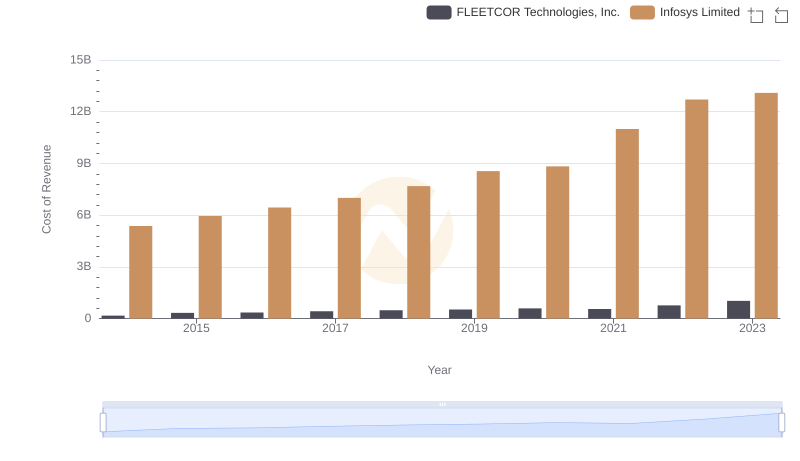

Comparing Cost of Revenue Efficiency: Infosys Limited vs FLEETCOR Technologies, Inc.

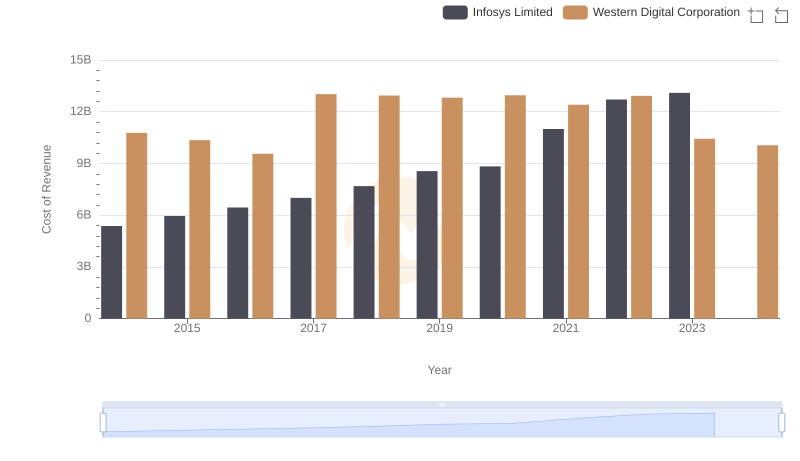

Cost Insights: Breaking Down Infosys Limited and Western Digital Corporation's Expenses

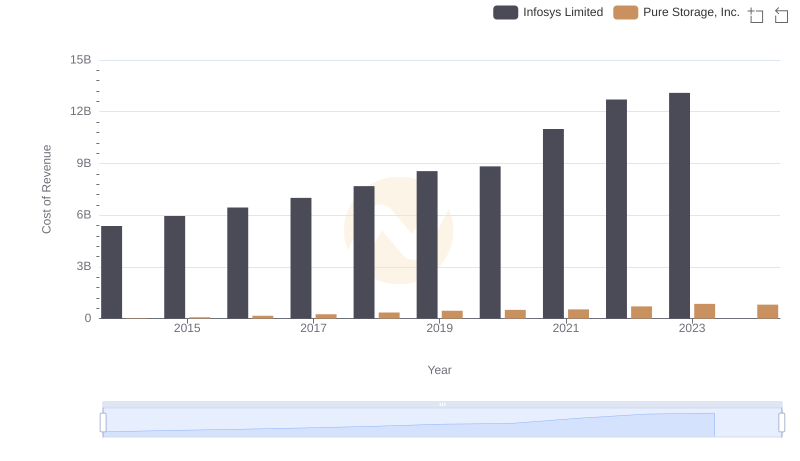

Analyzing Cost of Revenue: Infosys Limited and Pure Storage, Inc.

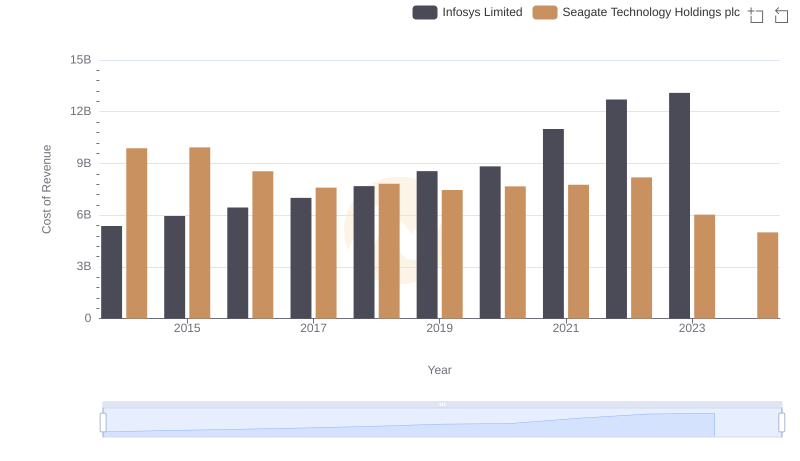

Infosys Limited vs Seagate Technology Holdings plc: Efficiency in Cost of Revenue Explored

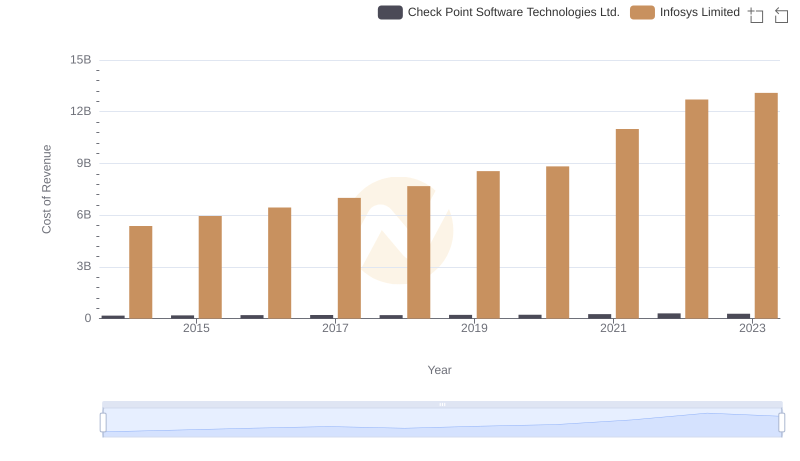

Cost of Revenue Comparison: Infosys Limited vs Check Point Software Technologies Ltd.

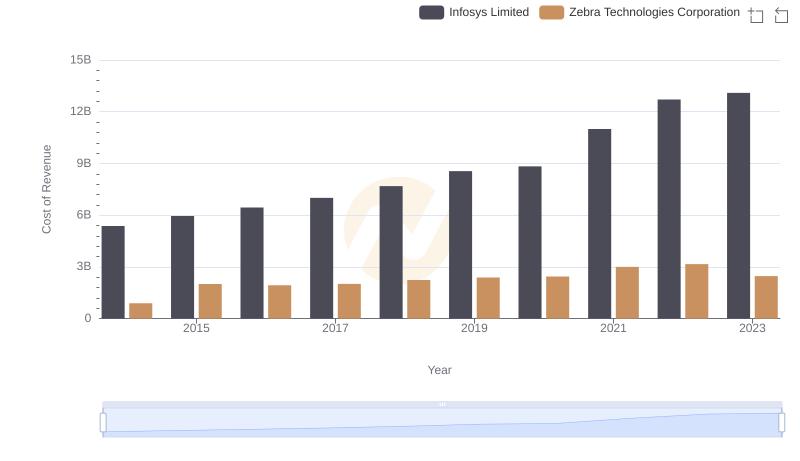

Cost Insights: Breaking Down Infosys Limited and Zebra Technologies Corporation's Expenses

Gross Profit Trends Compared: Infosys Limited vs ASE Technology Holding Co., Ltd.

Research and Development: Comparing Key Metrics for Infosys Limited and ASE Technology Holding Co., Ltd.

Selling, General, and Administrative Costs: Infosys Limited vs ASE Technology Holding Co., Ltd.

Infosys Limited and ASE Technology Holding Co., Ltd.: A Detailed Examination of EBITDA Performance