| __timestamp | The Boeing Company | U-Haul Holding Company |

|---|---|---|

| Wednesday, January 1, 2014 | 76752000000 | 127270000 |

| Thursday, January 1, 2015 | 82088000000 | 146072000 |

| Friday, January 1, 2016 | 80790000000 | 144990000 |

| Sunday, January 1, 2017 | 76066000000 | 152485000 |

| Monday, January 1, 2018 | 81490000000 | 160489000 |

| Tuesday, January 1, 2019 | 72093000000 | 162142000 |

| Wednesday, January 1, 2020 | 63843000000 | 164018000 |

| Friday, January 1, 2021 | 59237000000 | 214059000 |

| Saturday, January 1, 2022 | 63078000000 | 259585000 |

| Sunday, January 1, 2023 | 70070000000 | 844894000 |

| Monday, January 1, 2024 | 68508000000 | 3976040000 |

Unleashing insights

In the world of aerospace and transportation, The Boeing Company and U-Haul Holding Company stand as titans, each with its unique challenges and triumphs. Over the past decade, Boeing's cost of revenue has seen a rollercoaster ride, peaking in 2015 with a 14% increase from the previous year, before experiencing a significant dip in 2020, likely due to global disruptions. Meanwhile, U-Haul's cost of revenue has steadily climbed, with a remarkable 1,200% increase from 2014 to 2024, reflecting its expanding footprint in the moving and storage industry.

From 2014 to 2024, Boeing's cost of revenue fluctuated, highlighting the volatile nature of the aerospace sector. In contrast, U-Haul's consistent growth underscores its resilience and adaptability. As we look to the future, these trends offer valuable insights into the strategic maneuvers of these industry leaders.

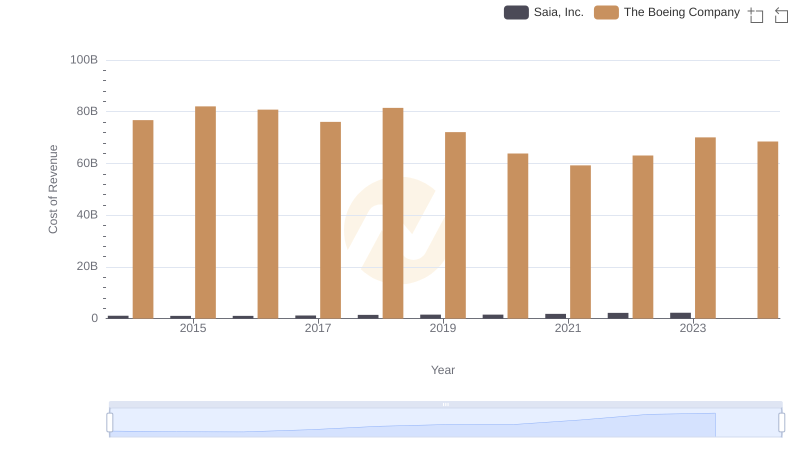

Cost of Revenue Trends: The Boeing Company vs Saia, Inc.

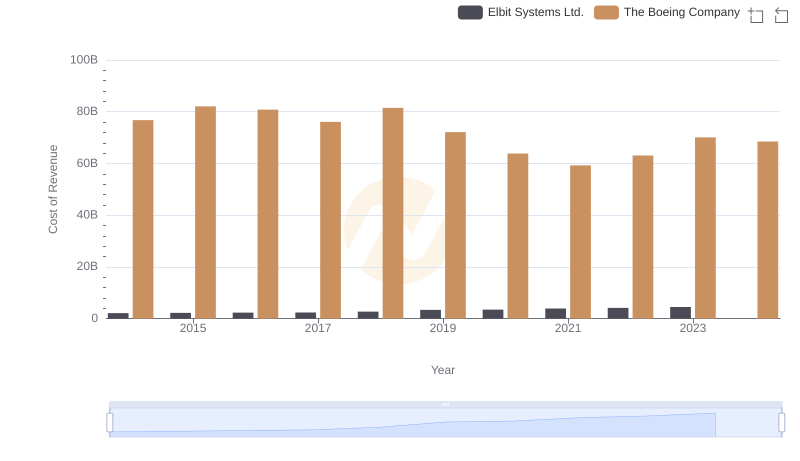

Cost Insights: Breaking Down The Boeing Company and Elbit Systems Ltd.'s Expenses

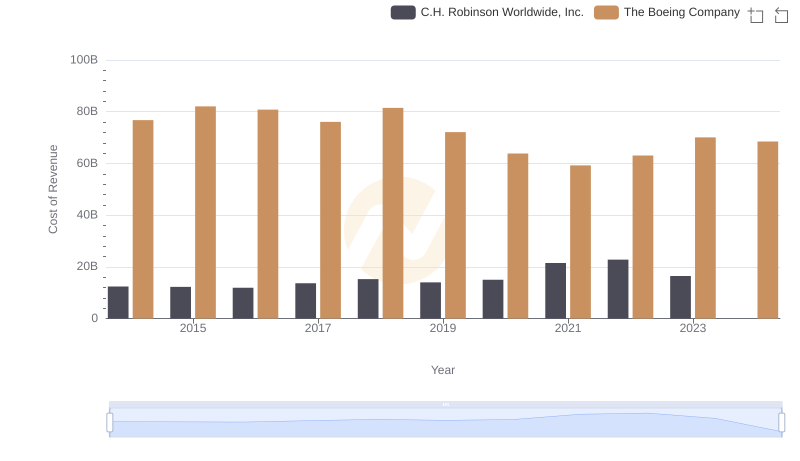

Cost Insights: Breaking Down The Boeing Company and C.H. Robinson Worldwide, Inc.'s Expenses

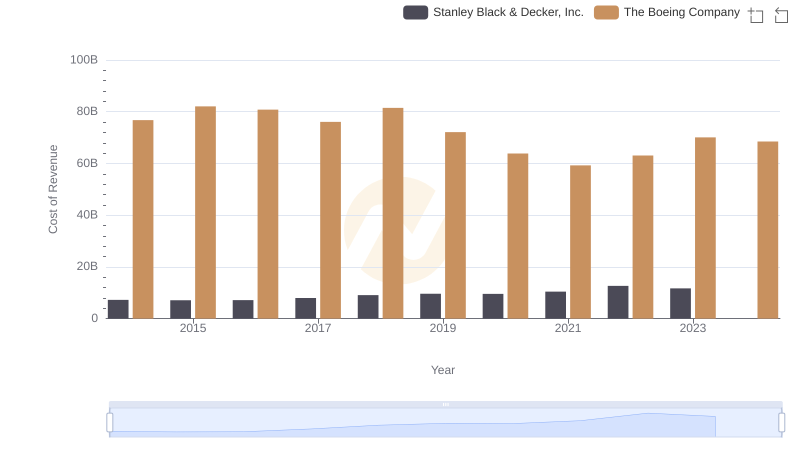

Cost of Revenue Comparison: The Boeing Company vs Stanley Black & Decker, Inc.