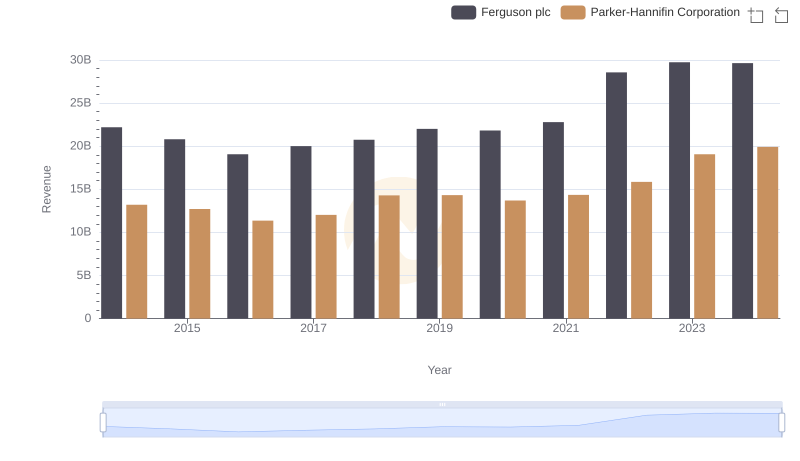

| __timestamp | Ferguson plc | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 15995739428 | 10188227000 |

| Thursday, January 1, 2015 | 14984241894 | 9655245000 |

| Friday, January 1, 2016 | 13677144858 | 8823384000 |

| Sunday, January 1, 2017 | 14215866673 | 9188962000 |

| Monday, January 1, 2018 | 14708000000 | 10762841000 |

| Tuesday, January 1, 2019 | 15552000000 | 10703484000 |

| Wednesday, January 1, 2020 | 15398000000 | 10286518000 |

| Friday, January 1, 2021 | 15812000000 | 10449680000 |

| Saturday, January 1, 2022 | 19810000000 | 11387267000 |

| Sunday, January 1, 2023 | 20709000000 | 12635892000 |

| Monday, January 1, 2024 | 20582000000 | 12801816000 |

Unveiling the hidden dimensions of data

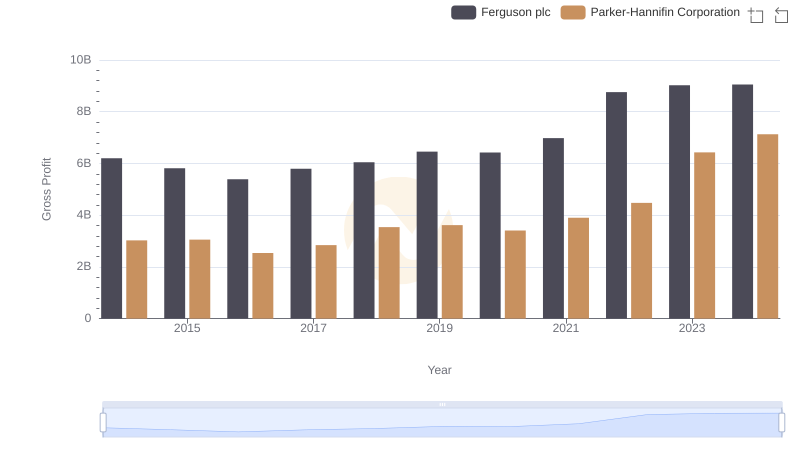

In the competitive landscape of industrial manufacturing, Parker-Hannifin Corporation and Ferguson plc stand as titans. Over the past decade, these companies have showcased a fascinating trend in their cost of revenue. From 2014 to 2024, Ferguson plc consistently outpaced Parker-Hannifin, with its cost of revenue growing by approximately 29%, peaking in 2023. Meanwhile, Parker-Hannifin saw a more modest increase of around 24% over the same period.

Ferguson plc's cost of revenue surged from 2014's baseline, reflecting its strategic expansions and market adaptations. By 2023, Ferguson's cost of revenue was nearly double that of Parker-Hannifin, highlighting its aggressive growth strategy. Parker-Hannifin, while trailing, demonstrated steady growth, particularly notable in 2023, where it reached its highest cost of revenue in the decade.

These trends underscore the differing strategies of these industrial giants. Ferguson's rapid growth suggests a focus on scaling operations, while Parker-Hannifin's steady increase indicates a more conservative, sustainable approach. As we look to the future, these strategies will continue to shape their market positions.

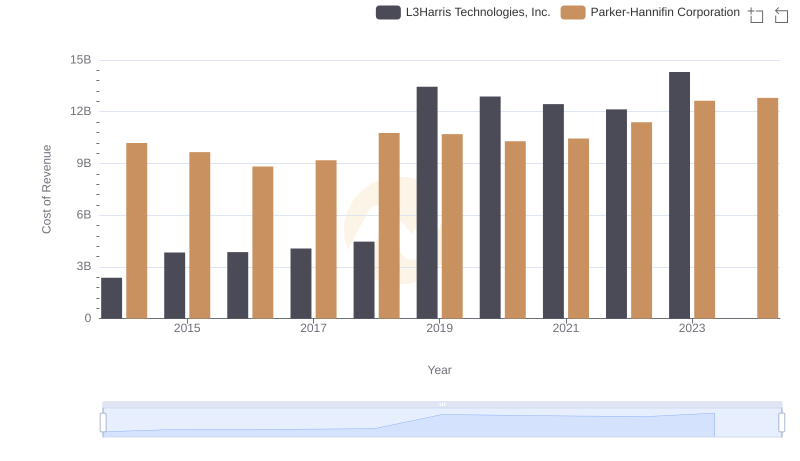

Cost of Revenue Comparison: Parker-Hannifin Corporation vs L3Harris Technologies, Inc.

Parker-Hannifin Corporation vs Ferguson plc: Annual Revenue Growth Compared

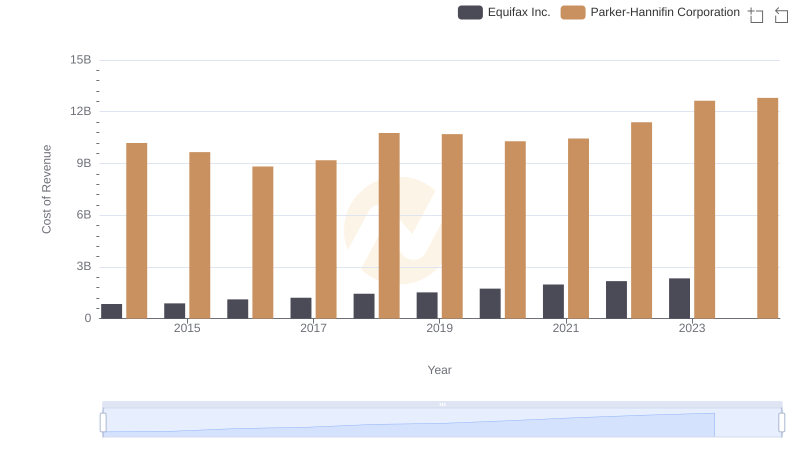

Analyzing Cost of Revenue: Parker-Hannifin Corporation and Equifax Inc.

Gross Profit Comparison: Parker-Hannifin Corporation and Ferguson plc Trends

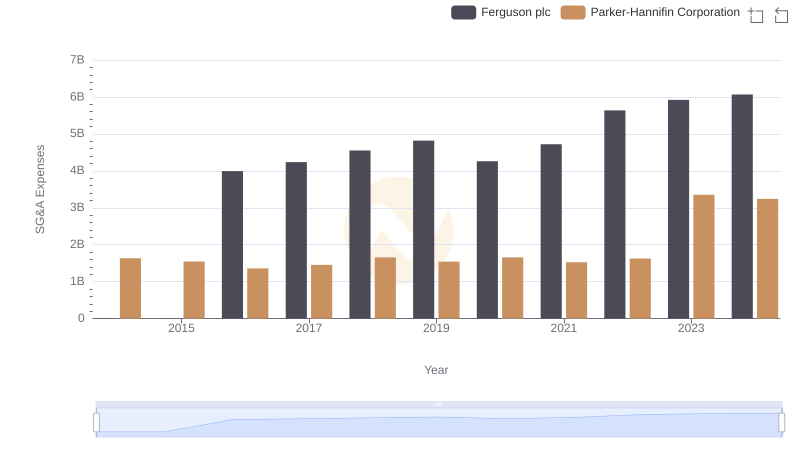

SG&A Efficiency Analysis: Comparing Parker-Hannifin Corporation and Ferguson plc

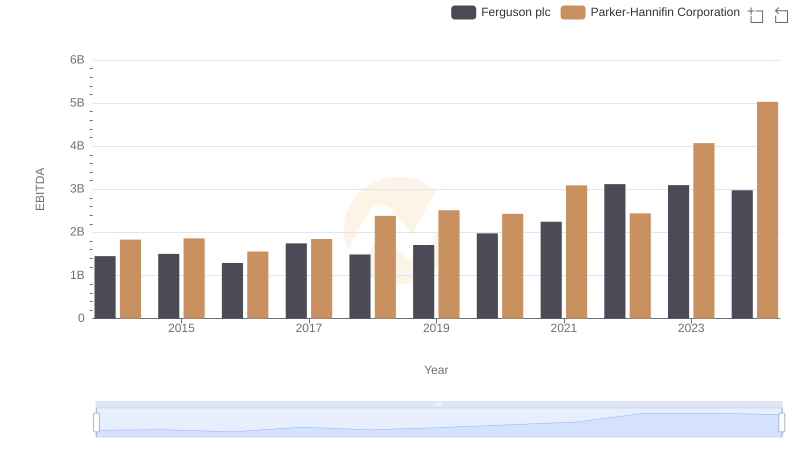

A Side-by-Side Analysis of EBITDA: Parker-Hannifin Corporation and Ferguson plc