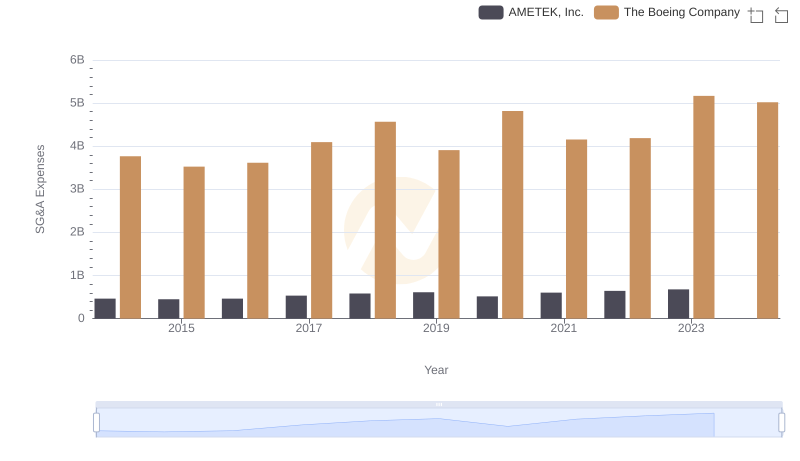

| __timestamp | The Boeing Company | Verisk Analytics, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3767000000 | 227306000 |

| Thursday, January 1, 2015 | 3525000000 | 312690000 |

| Friday, January 1, 2016 | 3616000000 | 301600000 |

| Sunday, January 1, 2017 | 4094000000 | 322800000 |

| Monday, January 1, 2018 | 4567000000 | 378700000 |

| Tuesday, January 1, 2019 | 3909000000 | 603500000 |

| Wednesday, January 1, 2020 | 4817000000 | 413900000 |

| Friday, January 1, 2021 | 4157000000 | 422700000 |

| Saturday, January 1, 2022 | 4187000000 | 381500000 |

| Sunday, January 1, 2023 | 5168000000 | 389300000 |

| Monday, January 1, 2024 | 5021000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of corporate finance, effective cost management is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry titans: The Boeing Company and Verisk Analytics, Inc., from 2014 to 2023.

Boeing's SG&A expenses have seen a steady climb, peaking in 2023 with a 37% increase from 2014. This upward trend reflects Boeing's strategic investments in innovation and market expansion, despite the challenges posed by global economic fluctuations.

Verisk Analytics, Inc. presents a contrasting narrative. While their SG&A expenses peaked in 2019, they have since stabilized, showcasing a disciplined approach to cost management. This stability underscores Verisk's commitment to maintaining operational efficiency while navigating the complexities of the data analytics industry.

Notably, data for Verisk in 2024 is unavailable, highlighting the dynamic nature of financial reporting and the need for continuous monitoring.

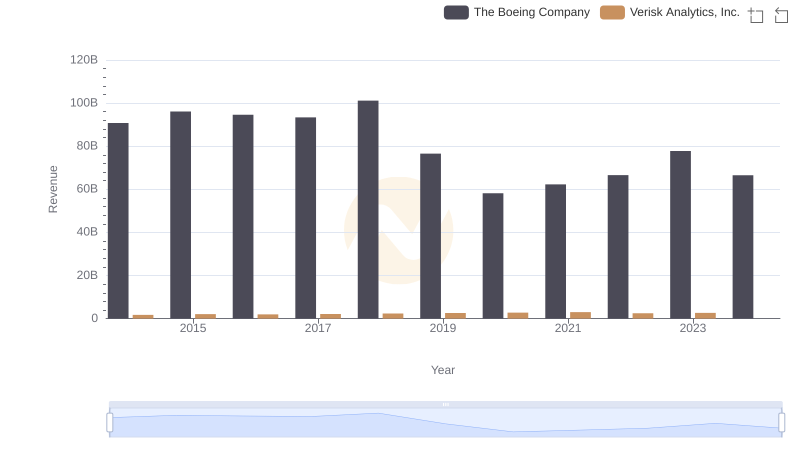

The Boeing Company vs Verisk Analytics, Inc.: Annual Revenue Growth Compared

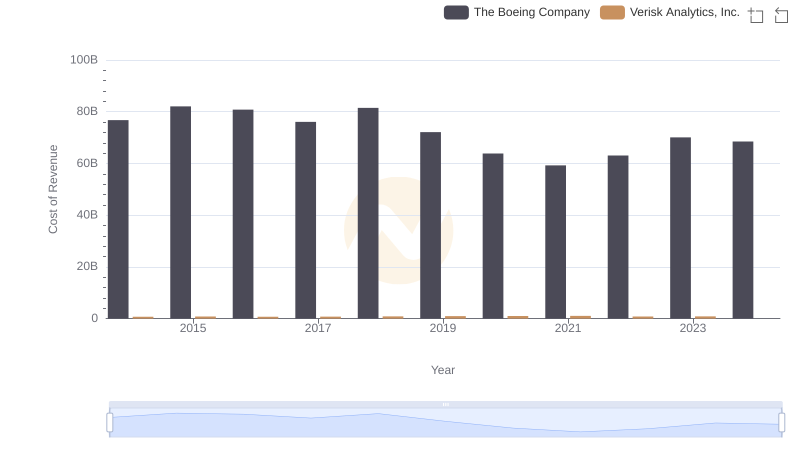

The Boeing Company vs Verisk Analytics, Inc.: Efficiency in Cost of Revenue Explored

Comparing SG&A Expenses: The Boeing Company vs Quanta Services, Inc. Trends and Insights

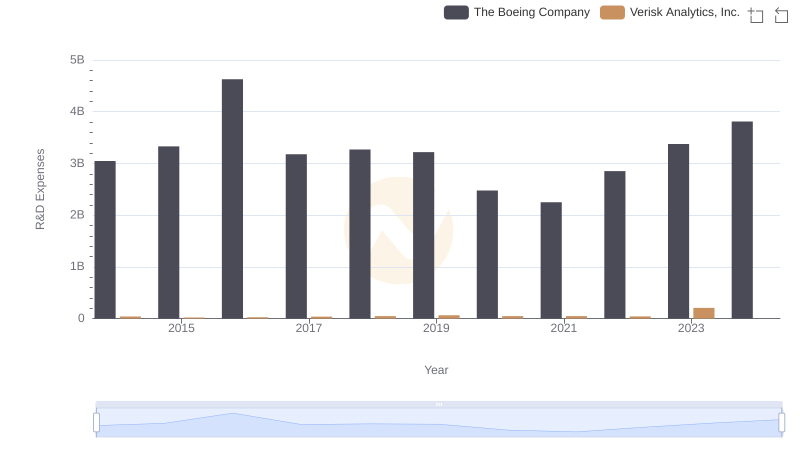

Comparing Innovation Spending: The Boeing Company and Verisk Analytics, Inc.

Selling, General, and Administrative Costs: The Boeing Company vs AMETEK, Inc.

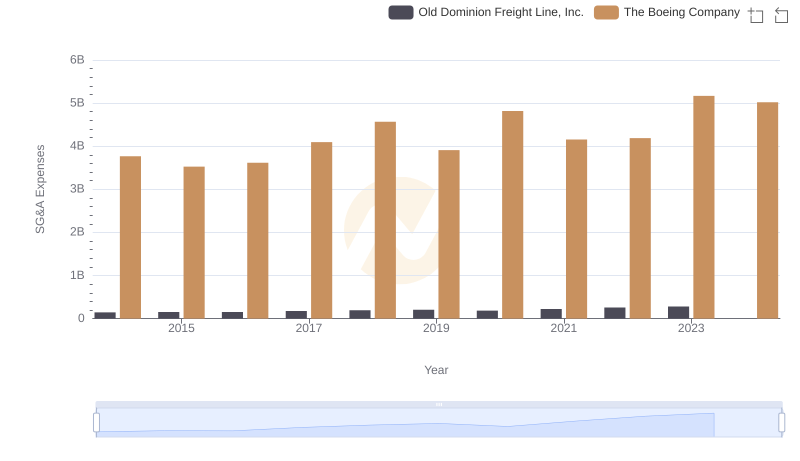

The Boeing Company vs Old Dominion Freight Line, Inc.: SG&A Expense Trends

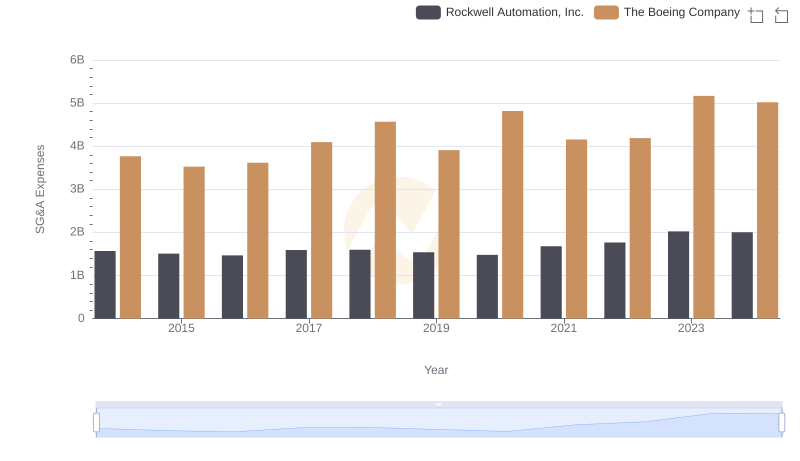

Who Optimizes SG&A Costs Better? The Boeing Company or Rockwell Automation, Inc.