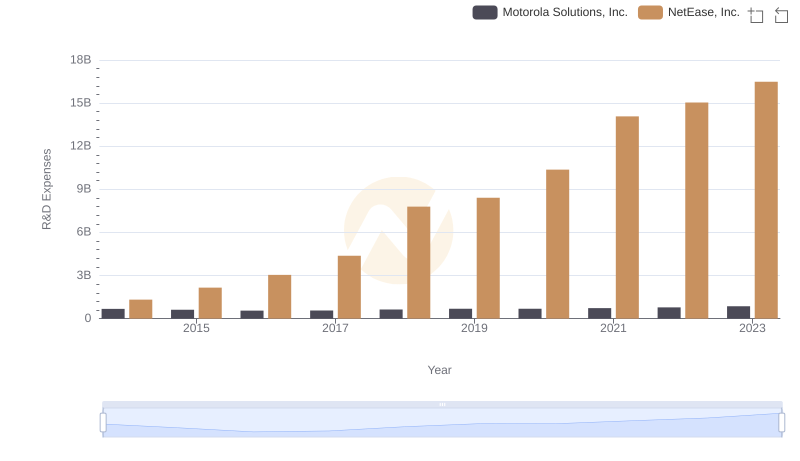

| __timestamp | Motorola Solutions, Inc. | NetEase, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1184000000 | 2362667000 |

| Thursday, January 1, 2015 | 1021000000 | 3972624000 |

| Friday, January 1, 2016 | 1000000000 | 5987969000 |

| Sunday, January 1, 2017 | 979000000 | 9387454000 |

| Monday, January 1, 2018 | 1254000000 | 12718007000 |

| Tuesday, January 1, 2019 | 1403000000 | 9351425000 |

| Wednesday, January 1, 2020 | 1293000000 | 14075615000 |

| Friday, January 1, 2021 | 1353000000 | 16477740000 |

| Saturday, January 1, 2022 | 1450000000 | 18098519000 |

| Sunday, January 1, 2023 | 1561000000 | 18869340000 |

| Monday, January 1, 2024 | 1752000000 |

Igniting the spark of knowledge

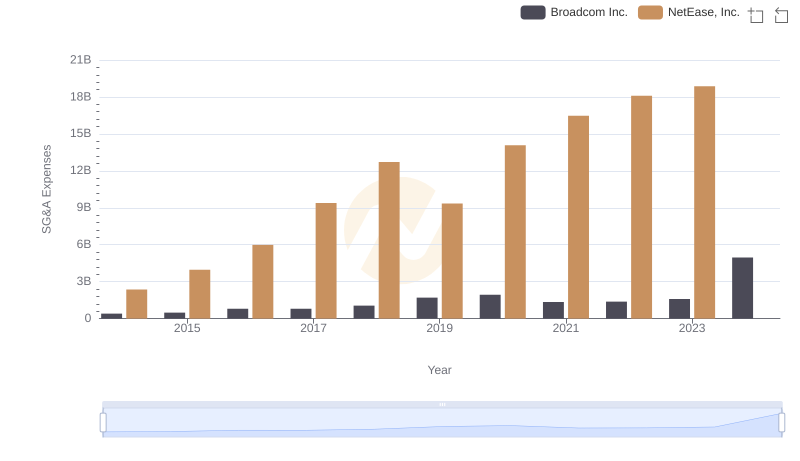

In the ever-evolving landscape of corporate finance, understanding cost management is crucial. Over the past decade, Motorola Solutions, Inc. and NetEase, Inc. have showcased contrasting strategies in managing their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2023, Motorola Solutions saw a steady increase in SG&A expenses, peaking at approximately 1.56 billion in 2023, marking a 32% rise from 2014. In contrast, NetEase, Inc. experienced a staggering 700% surge, reaching nearly 18.87 billion in 2023. This dramatic growth reflects NetEase's aggressive expansion and investment strategies. The data highlights the importance of strategic cost management in maintaining competitive advantage and profitability. As businesses navigate the complexities of the global market, these insights offer valuable lessons in balancing growth with fiscal responsibility.

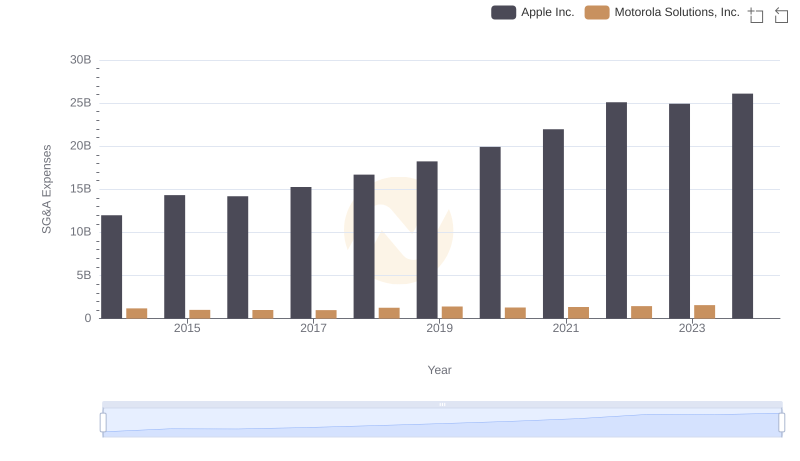

Apple Inc. or Motorola Solutions, Inc.: Who Manages SG&A Costs Better?

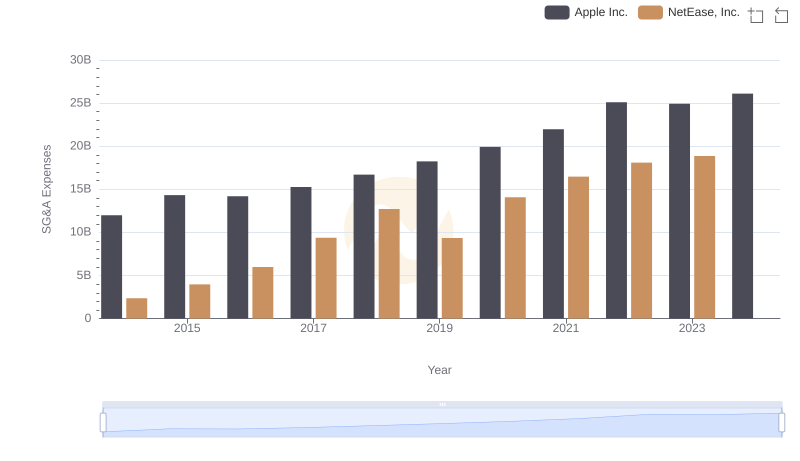

Apple Inc. vs NetEase, Inc.: SG&A Expense Trends

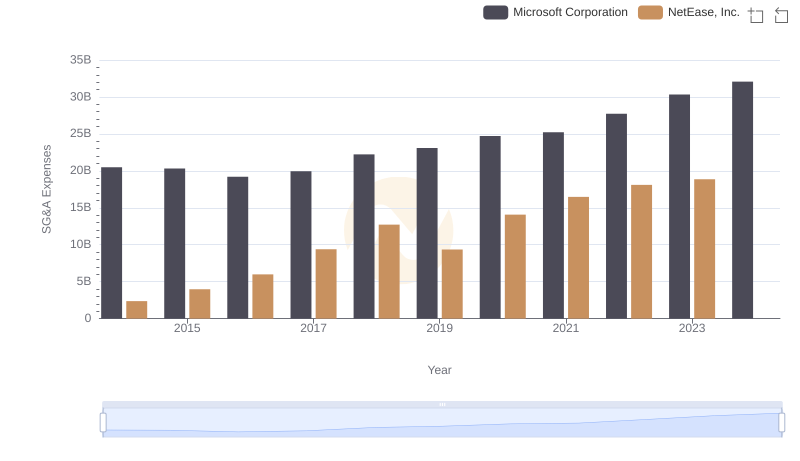

Selling, General, and Administrative Costs: Microsoft Corporation vs NetEase, Inc.

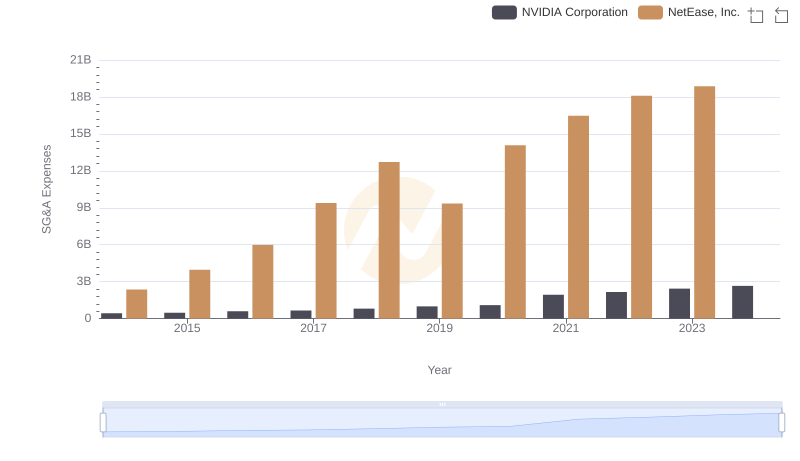

Breaking Down SG&A Expenses: NVIDIA Corporation vs NetEase, Inc.

Operational Costs Compared: SG&A Analysis of Taiwan Semiconductor Manufacturing Company Limited and NetEase, Inc.

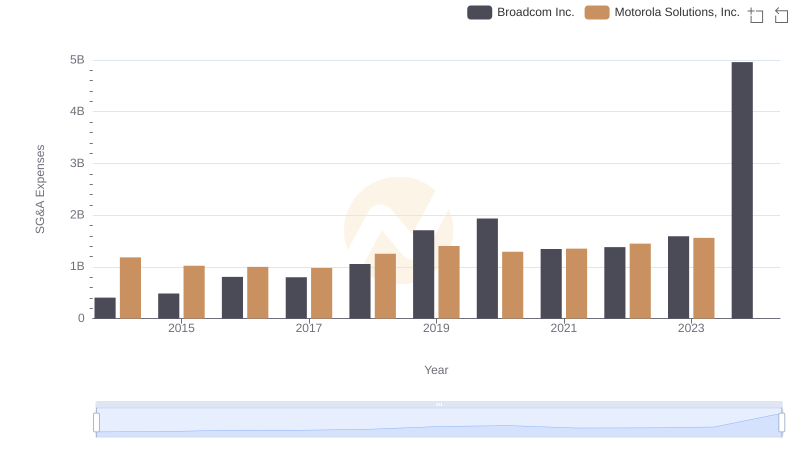

Cost Management Insights: SG&A Expenses for Broadcom Inc. and Motorola Solutions, Inc.

Broadcom Inc. vs NetEase, Inc.: SG&A Expense Trends

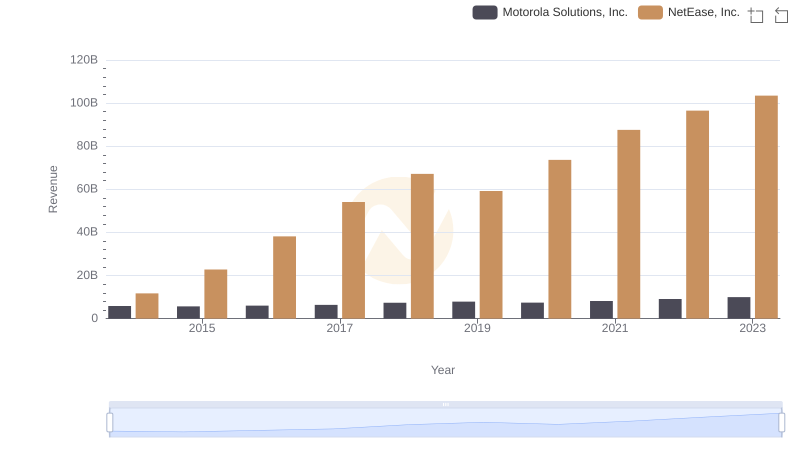

Motorola Solutions, Inc. vs NetEase, Inc.: Annual Revenue Growth Compared

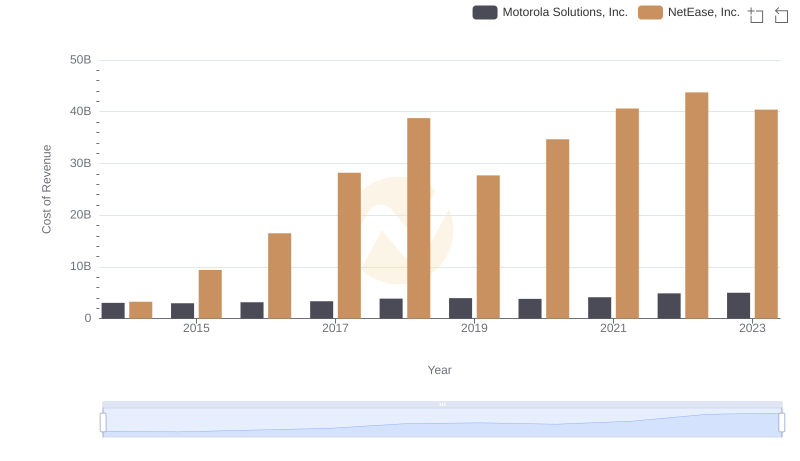

Cost of Revenue Trends: Motorola Solutions, Inc. vs NetEase, Inc.

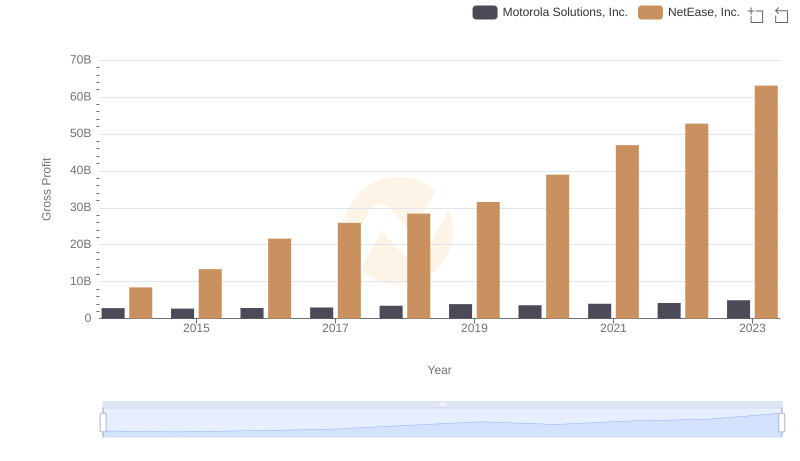

Gross Profit Analysis: Comparing Motorola Solutions, Inc. and NetEase, Inc.

Research and Development Investment: Motorola Solutions, Inc. vs NetEase, Inc.