| __timestamp | Canadian Pacific Railway Limited | Eaton Corporation plc |

|---|---|---|

| Wednesday, January 1, 2014 | 3300000000 | 15646000000 |

| Thursday, January 1, 2015 | 3032000000 | 14292000000 |

| Friday, January 1, 2016 | 2749000000 | 13400000000 |

| Sunday, January 1, 2017 | 2979000000 | 13756000000 |

| Monday, January 1, 2018 | 3413000000 | 14511000000 |

| Tuesday, January 1, 2019 | 3475000000 | 14338000000 |

| Wednesday, January 1, 2020 | 3349000000 | 12408000000 |

| Friday, January 1, 2021 | 3571000000 | 13293000000 |

| Saturday, January 1, 2022 | 4223000000 | 13865000000 |

| Sunday, January 1, 2023 | 5968000000 | 14763000000 |

| Monday, January 1, 2024 | 7003000000 | 15375000000 |

Igniting the spark of knowledge

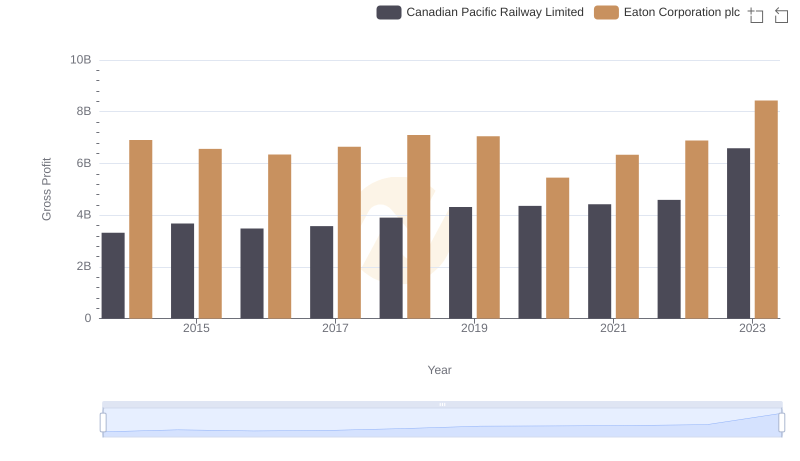

In the ever-evolving landscape of industrial giants, Eaton Corporation plc and Canadian Pacific Railway Limited stand as titans in their respective fields. Over the past decade, from 2014 to 2023, these companies have showcased distinct trajectories in cost of revenue efficiency. Eaton Corporation, a leader in power management, consistently maintained a higher cost of revenue, peaking at approximately $14.8 billion in 2023. This reflects its expansive operations and global reach. In contrast, Canadian Pacific Railway, a key player in North American rail transport, demonstrated a significant surge, with a 100% increase from 2014 to 2023, reaching nearly $6 billion. This growth underscores its strategic expansions and operational efficiencies. As these companies continue to innovate, their financial strategies offer valuable insights into managing costs in dynamic markets.

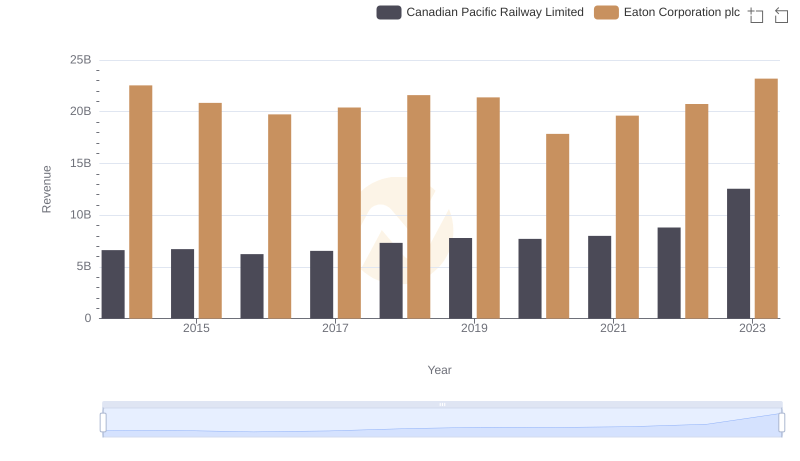

Revenue Showdown: Eaton Corporation plc vs Canadian Pacific Railway Limited

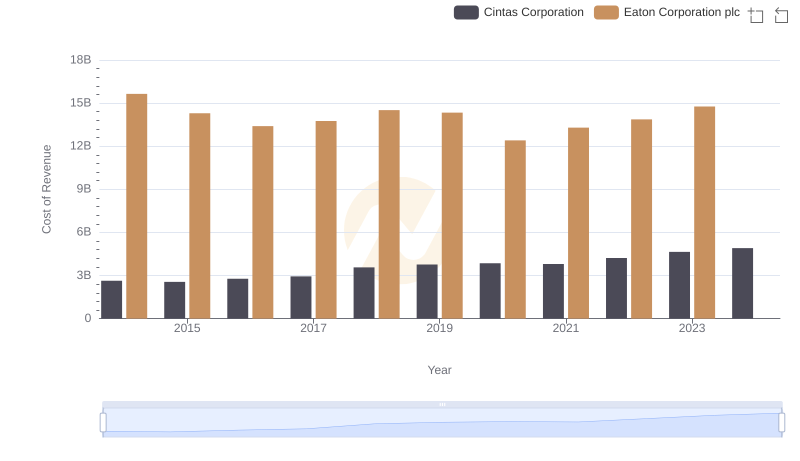

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs Cintas Corporation

Cost of Revenue Comparison: Eaton Corporation plc vs Parker-Hannifin Corporation

Key Insights on Gross Profit: Eaton Corporation plc vs Canadian Pacific Railway Limited

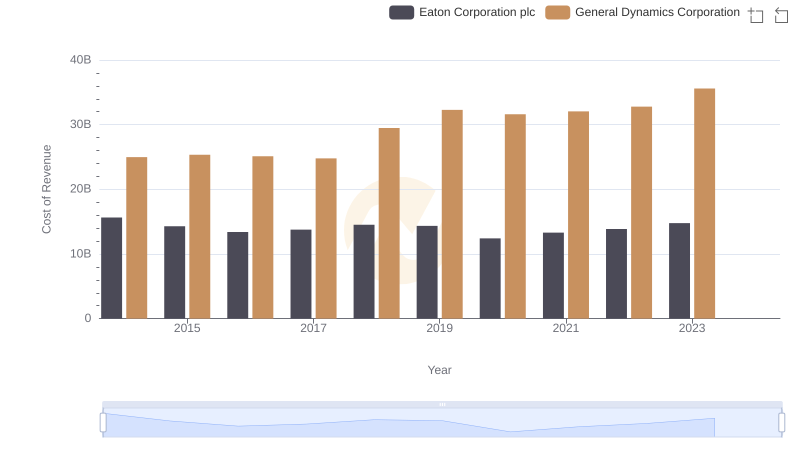

Cost of Revenue: Key Insights for Eaton Corporation plc and General Dynamics Corporation

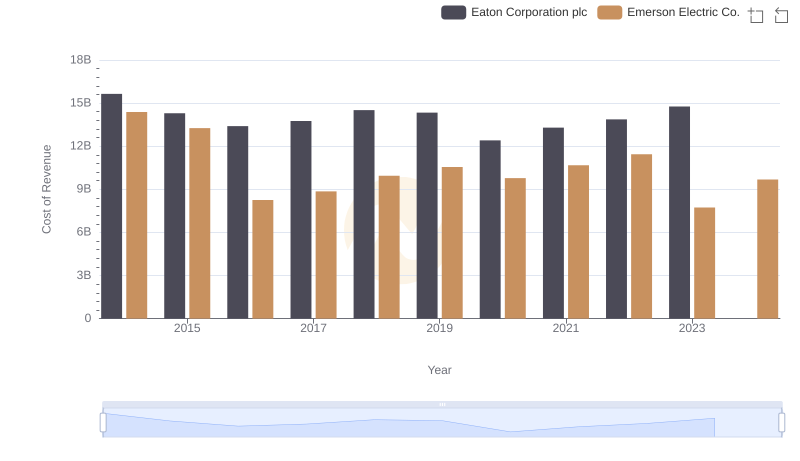

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs Emerson Electric Co.