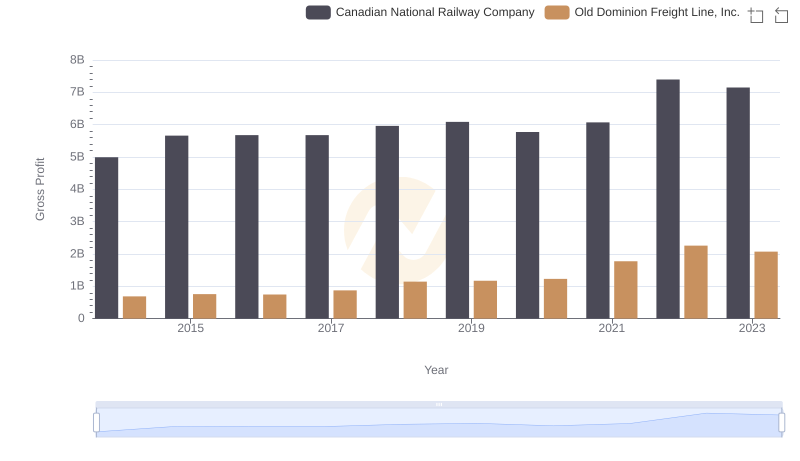

| __timestamp | Canadian National Railway Company | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5674000000 | 585590000 |

| Thursday, January 1, 2015 | 6424000000 | 660570000 |

| Friday, January 1, 2016 | 6537000000 | 671786000 |

| Sunday, January 1, 2017 | 6839000000 | 783749000 |

| Monday, January 1, 2018 | 7124000000 | 1046059000 |

| Tuesday, January 1, 2019 | 7999000000 | 1078007000 |

| Wednesday, January 1, 2020 | 7652000000 | 1168149000 |

| Friday, January 1, 2021 | 7607000000 | 1651501000 |

| Saturday, January 1, 2022 | 9067000000 | 2118962000 |

| Sunday, January 1, 2023 | 9027000000 | 1972689000 |

Unleashing the power of data

In the world of transportation, Canadian National Railway Company and Old Dominion Freight Line, Inc. have been pivotal players. Over the past decade, Canadian National Railway has consistently outperformed Old Dominion in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, Canadian National Railway's EBITDA surged by approximately 59%, peaking in 2022. In contrast, Old Dominion Freight Line, while starting at a lower base, demonstrated an impressive growth of around 237% over the same period, reflecting its dynamic expansion strategy.

The year 2022 marked a significant milestone for both companies, with Canadian National Railway reaching its highest EBITDA, while Old Dominion also achieved a record high. This comparative analysis highlights the resilience and strategic prowess of these industry leaders, offering valuable insights into their financial health and market positioning.

Canadian National Railway Company and Old Dominion Freight Line, Inc.: A Comprehensive Revenue Analysis

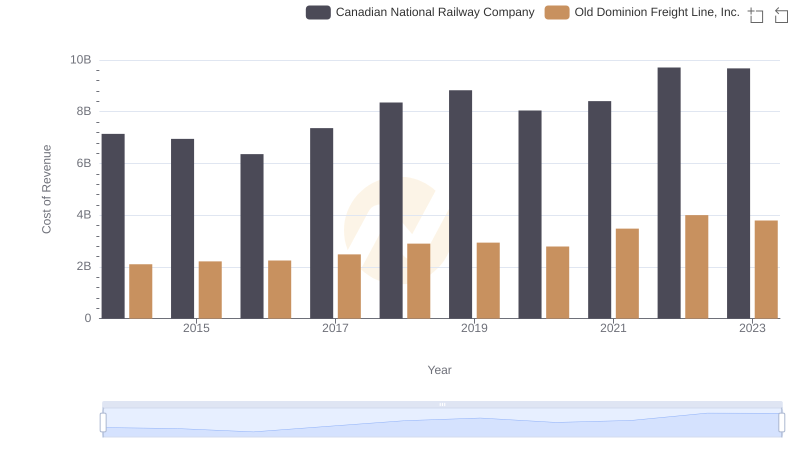

Cost Insights: Breaking Down Canadian National Railway Company and Old Dominion Freight Line, Inc.'s Expenses

Canadian National Railway Company and Westinghouse Air Brake Technologies Corporation: A Detailed Examination of EBITDA Performance

Key Insights on Gross Profit: Canadian National Railway Company vs Old Dominion Freight Line, Inc.