| __timestamp | Canadian National Railway Company | Johnson Controls International plc |

|---|---|---|

| Wednesday, January 1, 2014 | 7142000000 | 36201000000 |

| Thursday, January 1, 2015 | 6951000000 | 30732000000 |

| Friday, January 1, 2016 | 6362000000 | 15183000000 |

| Sunday, January 1, 2017 | 7366000000 | 20833000000 |

| Monday, January 1, 2018 | 8359000000 | 22020000000 |

| Tuesday, January 1, 2019 | 8832000000 | 16275000000 |

| Wednesday, January 1, 2020 | 8048000000 | 14906000000 |

| Friday, January 1, 2021 | 8408000000 | 15609000000 |

| Saturday, January 1, 2022 | 9711000000 | 16956000000 |

| Sunday, January 1, 2023 | 9677000000 | 17822000000 |

| Monday, January 1, 2024 | 14875000000 |

In pursuit of knowledge

In the ever-evolving landscape of corporate efficiency, the cost of revenue serves as a critical metric. From 2014 to 2023, Canadian National Railway Company (CNR) and Johnson Controls International plc (JCI) have showcased distinct trajectories in managing their cost of revenue. CNR's cost efficiency has seen a steady increase, peaking in 2022 with a 36% rise from 2016. Meanwhile, JCI experienced a significant reduction in cost of revenue by over 50% from 2014 to 2016, followed by a more stable trend. Notably, 2023 data reveals CNR's cost of revenue at approximately 9.7 billion, while JCI's stands at 17.8 billion, highlighting a strategic divergence in operational efficiency. The absence of 2024 data for CNR suggests a potential shift or anomaly, inviting further analysis. This comparison underscores the dynamic nature of cost management strategies in the global market.

Revenue Insights: Canadian National Railway Company and Johnson Controls International plc Performance Compared

Cost of Revenue Comparison: Canadian National Railway Company vs Roper Technologies, Inc.

Cost Insights: Breaking Down Canadian National Railway Company and W.W. Grainger, Inc.'s Expenses

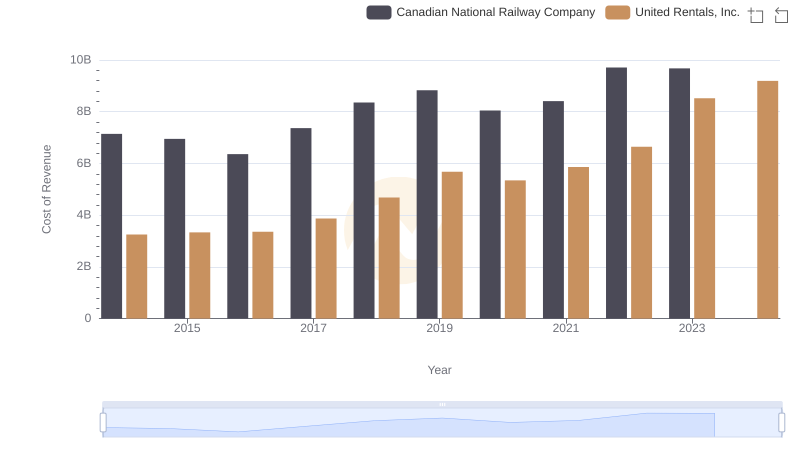

Comparing Cost of Revenue Efficiency: Canadian National Railway Company vs United Rentals, Inc.

Cost of Revenue: Key Insights for Canadian National Railway Company and Axon Enterprise, Inc.