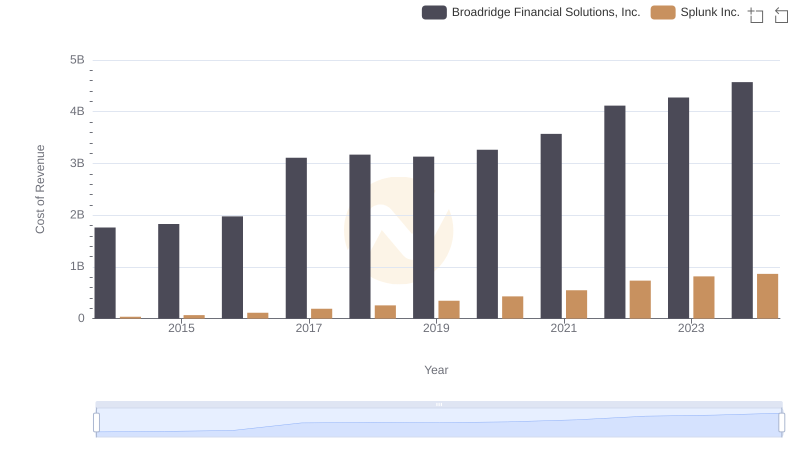

| __timestamp | Broadridge Financial Solutions, Inc. | Splunk Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2558000000 | 302623000 |

| Thursday, January 1, 2015 | 2694200000 | 450875000 |

| Friday, January 1, 2016 | 2897000000 | 668435000 |

| Sunday, January 1, 2017 | 4142600000 | 949955000 |

| Monday, January 1, 2018 | 4329900000 | 1270788000 |

| Tuesday, January 1, 2019 | 4362200000 | 1803010000 |

| Wednesday, January 1, 2020 | 4529000000 | 2358926000 |

| Friday, January 1, 2021 | 4993700000 | 2229385000 |

| Saturday, January 1, 2022 | 5709100000 | 2673664000 |

| Sunday, January 1, 2023 | 6060900000 | 3653708000 |

| Monday, January 1, 2024 | 6506800000 | 4215595000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of financial technology, Broadridge Financial Solutions, Inc. and Splunk Inc. have emerged as key players. Over the past decade, Broadridge has consistently outpaced Splunk in terms of revenue growth. From 2014 to 2024, Broadridge's revenue surged by approximately 154%, reaching a peak of $6.5 billion in 2024. In contrast, Splunk's revenue, while impressive, grew by about 1,292% over the same period, culminating in $4.2 billion in 2024.

Broadridge's steady growth reflects its robust business model and strategic acquisitions, while Splunk's rapid ascent highlights its innovative approach to data analytics. Despite starting with a lower revenue base, Splunk's aggressive growth strategy has allowed it to close the gap significantly.

As both companies continue to innovate, the competition for market leadership remains fierce. Investors and industry watchers will be keenly observing how these trends evolve in the coming years.

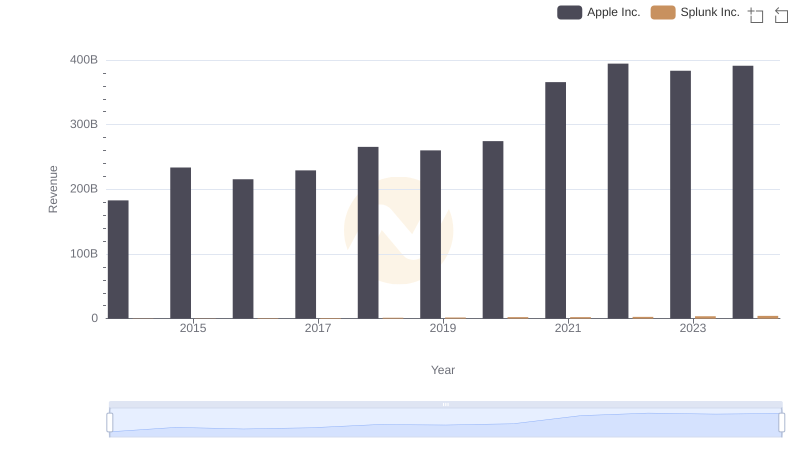

Revenue Insights: Apple Inc. and Splunk Inc. Performance Compared

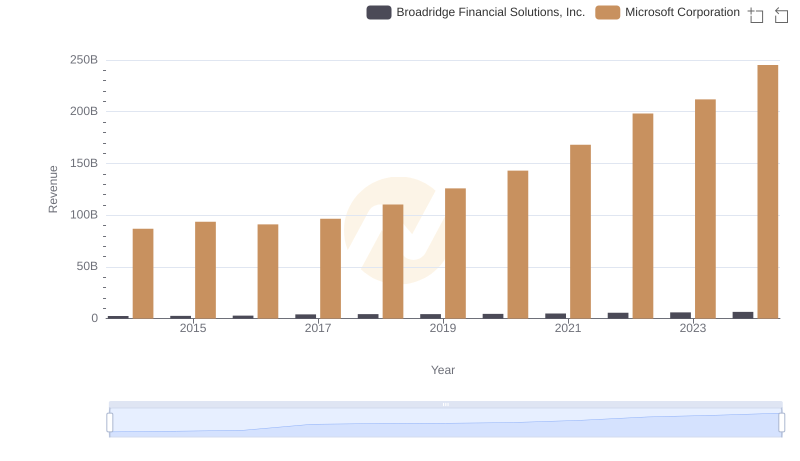

Microsoft Corporation and Broadridge Financial Solutions, Inc.: A Comprehensive Revenue Analysis

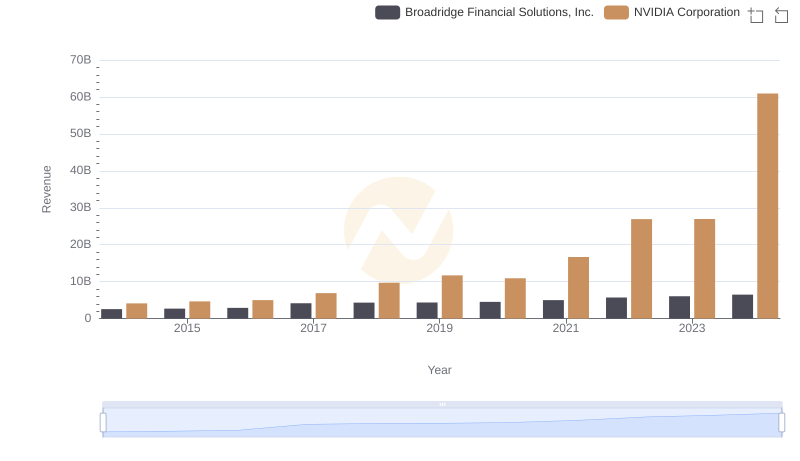

NVIDIA Corporation and Broadridge Financial Solutions, Inc.: A Comprehensive Revenue Analysis

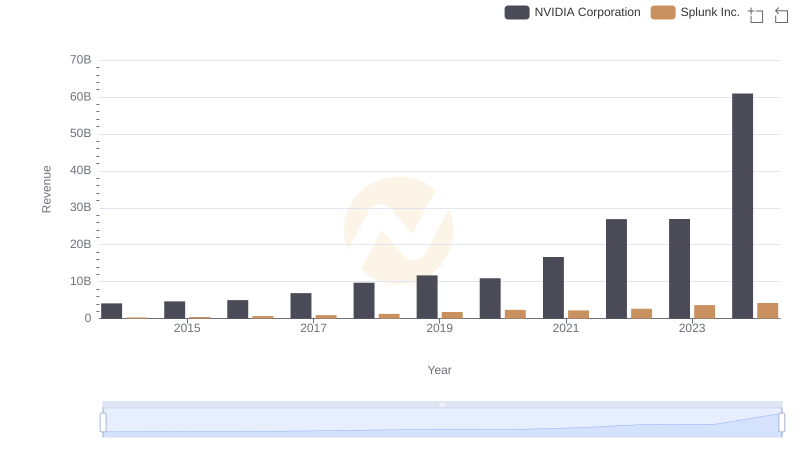

Who Generates More Revenue? NVIDIA Corporation or Splunk Inc.

Taiwan Semiconductor Manufacturing Company Limited or Broadridge Financial Solutions, Inc.: Who Leads in Yearly Revenue?

Revenue Insights: Taiwan Semiconductor Manufacturing Company Limited and Splunk Inc. Performance Compared

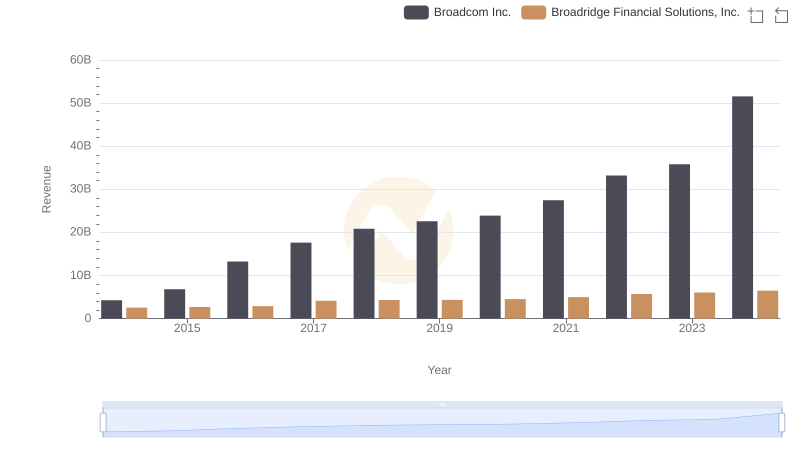

Broadcom Inc. or Broadridge Financial Solutions, Inc.: Who Leads in Yearly Revenue?

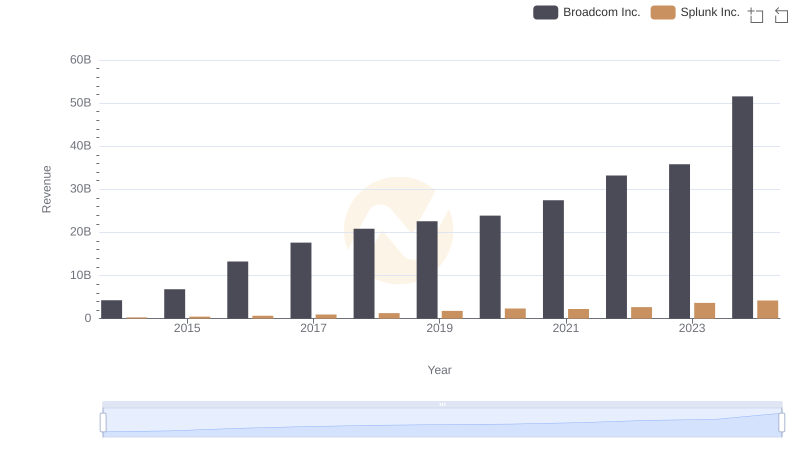

Broadcom Inc. and Splunk Inc.: A Comprehensive Revenue Analysis

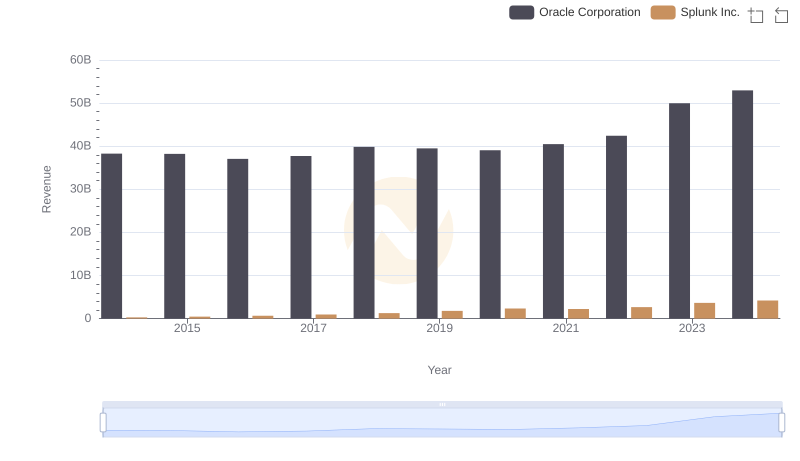

Revenue Insights: Oracle Corporation and Splunk Inc. Performance Compared

Cost of Revenue Comparison: Broadridge Financial Solutions, Inc. vs Splunk Inc.

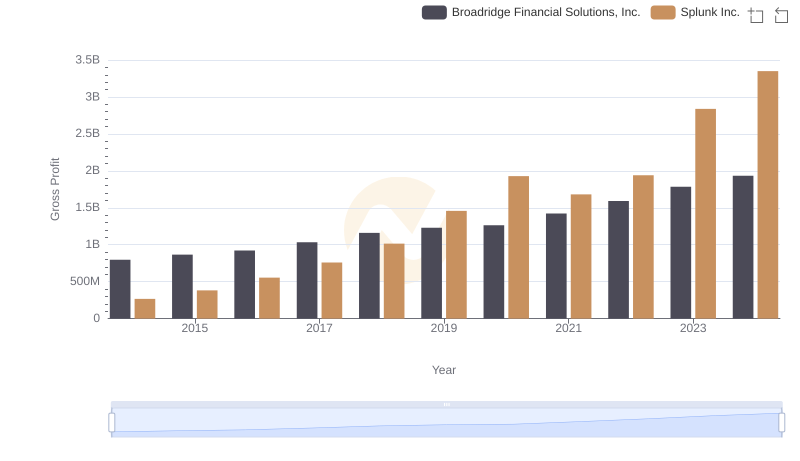

Key Insights on Gross Profit: Broadridge Financial Solutions, Inc. vs Splunk Inc.

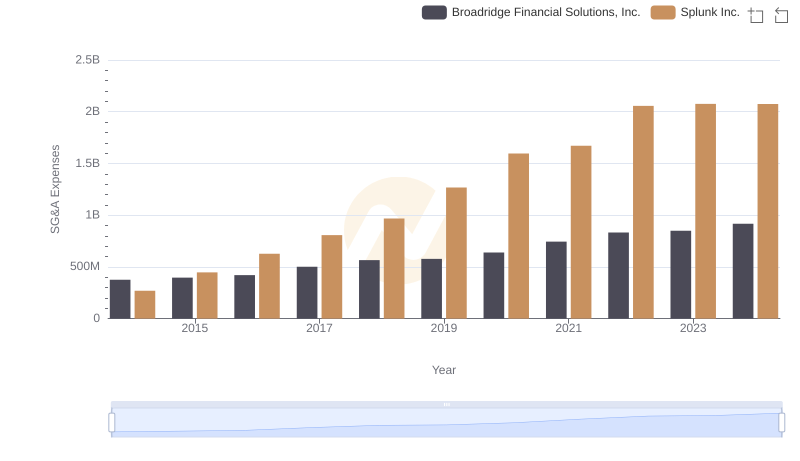

Selling, General, and Administrative Costs: Broadridge Financial Solutions, Inc. vs Splunk Inc.