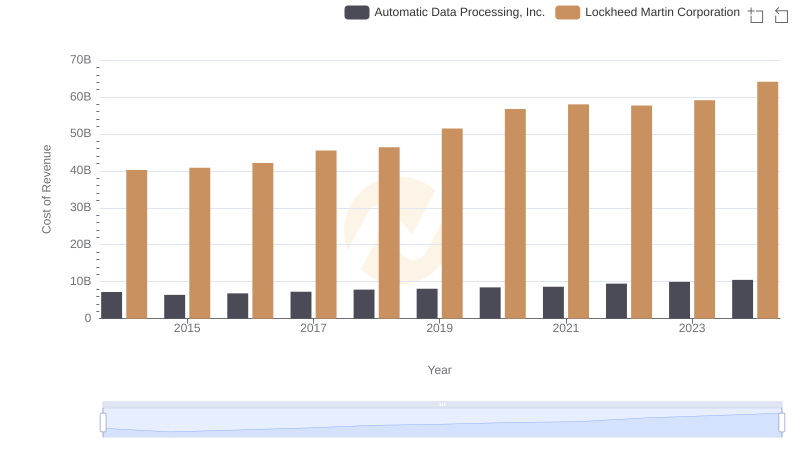

| __timestamp | Automatic Data Processing, Inc. | Lockheed Martin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 4611400000 | 5374000000 |

| Thursday, January 1, 2015 | 4133200000 | 5302000000 |

| Friday, January 1, 2016 | 4450200000 | 5142000000 |

| Sunday, January 1, 2017 | 4712600000 | 5548000000 |

| Monday, January 1, 2018 | 5016700000 | 7370000000 |

| Tuesday, January 1, 2019 | 5526700000 | 8367000000 |

| Wednesday, January 1, 2020 | 6144700000 | 8654000000 |

| Friday, January 1, 2021 | 6365100000 | 9061000000 |

| Saturday, January 1, 2022 | 7036400000 | 8287000000 |

| Sunday, January 1, 2023 | 8058800000 | 8479000000 |

| Monday, January 1, 2024 | 8725900000 | 6930000000 |

In pursuit of knowledge

In the ever-evolving landscape of corporate finance, understanding the gross profit trends of industry giants like Automatic Data Processing, Inc. (ADP) and Lockheed Martin Corporation is crucial. Over the past decade, from 2014 to 2024, these two titans have showcased distinct trajectories in their financial performance.

ADP, a leader in human capital management, has seen a remarkable 112% increase in gross profit, peaking in 2024. This growth reflects its strategic investments in technology and client services. In contrast, Lockheed Martin, a defense and aerospace powerhouse, experienced a 29% rise until 2021, followed by a decline, highlighting the volatile nature of defense contracts and geopolitical influences.

This comparative analysis not only underscores the resilience and adaptability of these corporations but also offers valuable insights into the broader economic trends shaping their industries.

Cost of Revenue Trends: Automatic Data Processing, Inc. vs Lockheed Martin Corporation

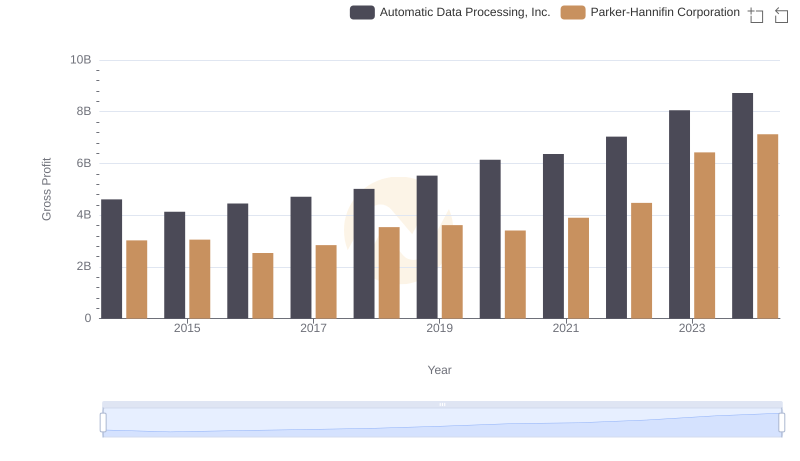

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Parker-Hannifin Corporation

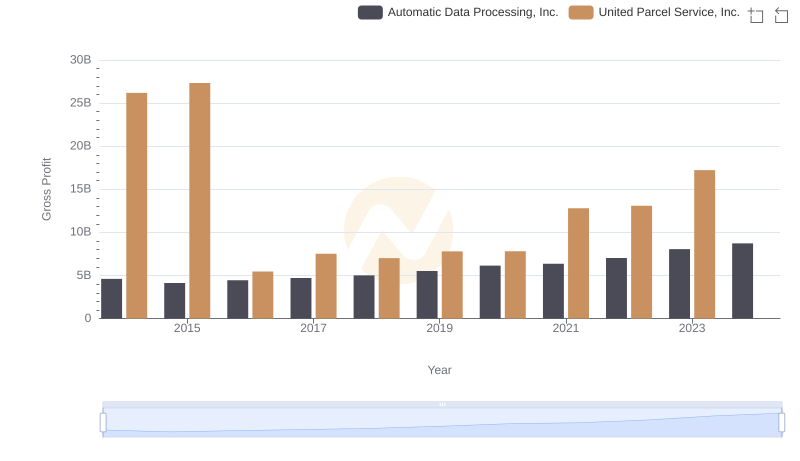

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or United Parcel Service, Inc.

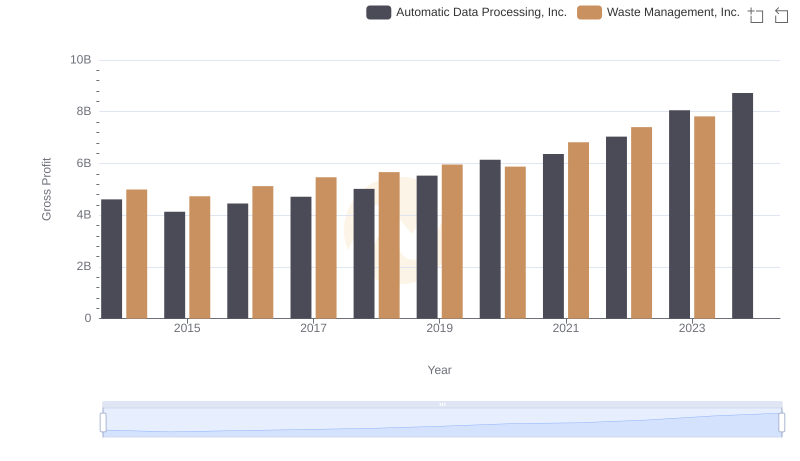

Automatic Data Processing, Inc. vs Waste Management, Inc.: A Gross Profit Performance Breakdown

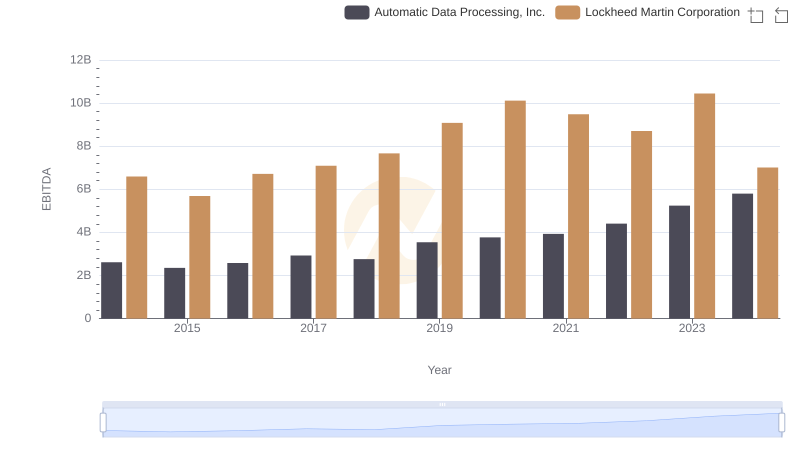

EBITDA Metrics Evaluated: Automatic Data Processing, Inc. vs Lockheed Martin Corporation

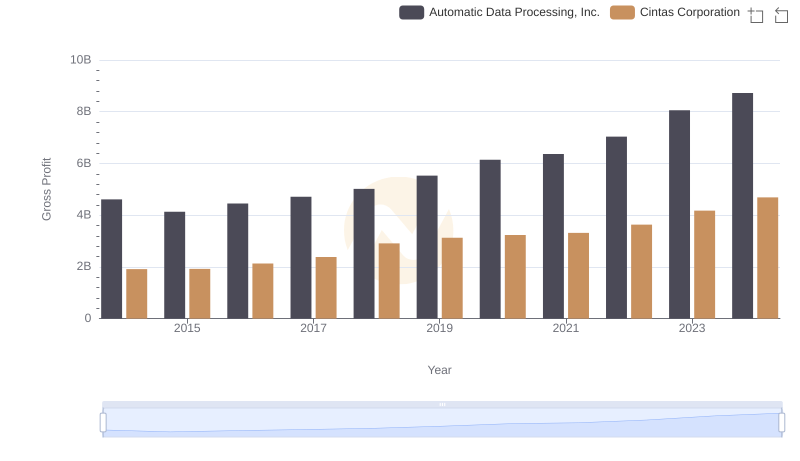

Gross Profit Comparison: Automatic Data Processing, Inc. and Cintas Corporation Trends

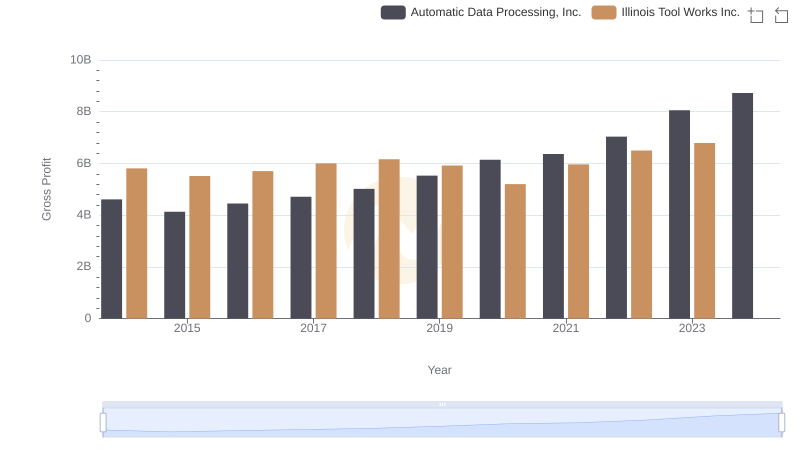

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Illinois Tool Works Inc.