| __timestamp | Automatic Data Processing, Inc. | Lockheed Martin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 40226000000 |

| Thursday, January 1, 2015 | 6427600000 | 40830000000 |

| Friday, January 1, 2016 | 6840300000 | 42106000000 |

| Sunday, January 1, 2017 | 7269800000 | 45500000000 |

| Monday, January 1, 2018 | 7842600000 | 46392000000 |

| Tuesday, January 1, 2019 | 8086600000 | 51445000000 |

| Wednesday, January 1, 2020 | 8445100000 | 56744000000 |

| Friday, January 1, 2021 | 8640300000 | 57983000000 |

| Saturday, January 1, 2022 | 9461900000 | 57697000000 |

| Sunday, January 1, 2023 | 9953400000 | 59092000000 |

| Monday, January 1, 2024 | 10476700000 | 64113000000 |

Unleashing the power of data

In the ever-evolving landscape of American industry, Automatic Data Processing, Inc. (ADP) and Lockheed Martin Corporation stand as titans in their respective fields. Over the past decade, from 2014 to 2024, these companies have showcased distinct trends in their cost of revenue, reflecting their strategic priorities and market dynamics.

ADP, a leader in human resources management, has seen a steady increase in its cost of revenue, growing by approximately 45% over the period. This growth underscores ADP's expanding service offerings and its commitment to innovation in workforce solutions.

Conversely, Lockheed Martin, a defense and aerospace behemoth, has experienced a more pronounced rise, with its cost of revenue surging by nearly 60%. This increase highlights the company's pivotal role in national defense and its response to global security demands.

These trends not only reveal the financial strategies of these corporations but also mirror broader economic and geopolitical shifts.

Automatic Data Processing, Inc. vs Waste Management, Inc.: Efficiency in Cost of Revenue Explored

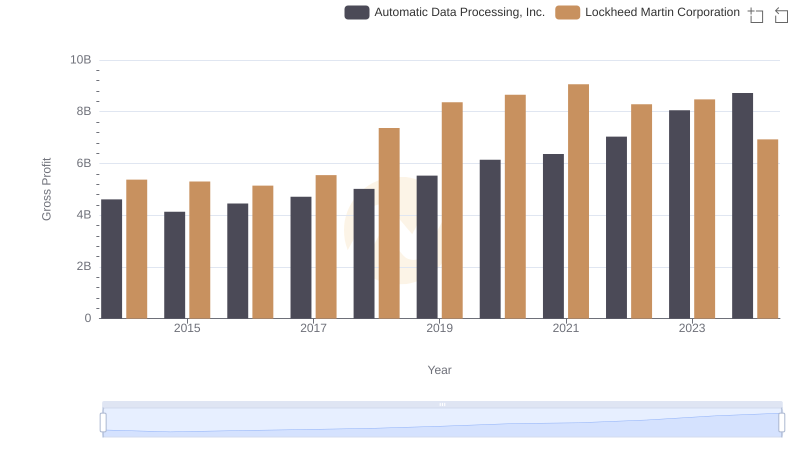

Automatic Data Processing, Inc. vs Lockheed Martin Corporation: A Gross Profit Performance Breakdown

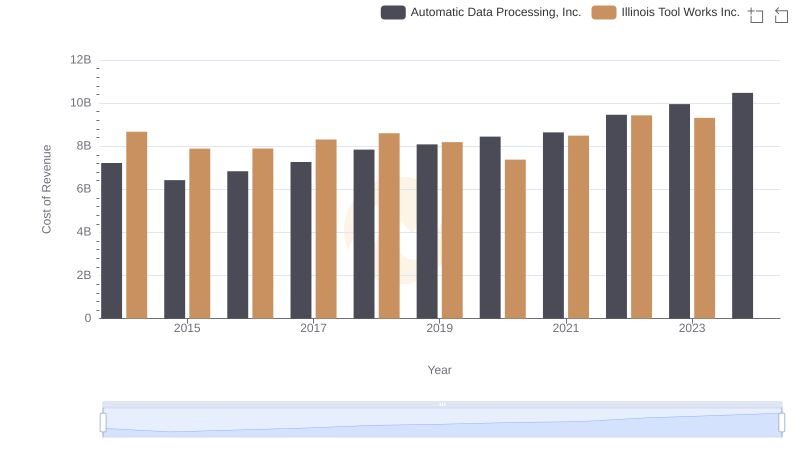

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs Illinois Tool Works Inc.

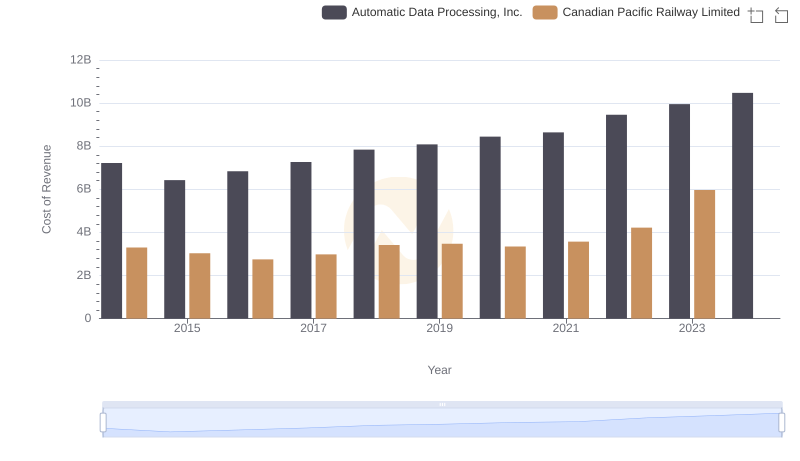

Cost Insights: Breaking Down Automatic Data Processing, Inc. and Canadian Pacific Railway Limited's Expenses

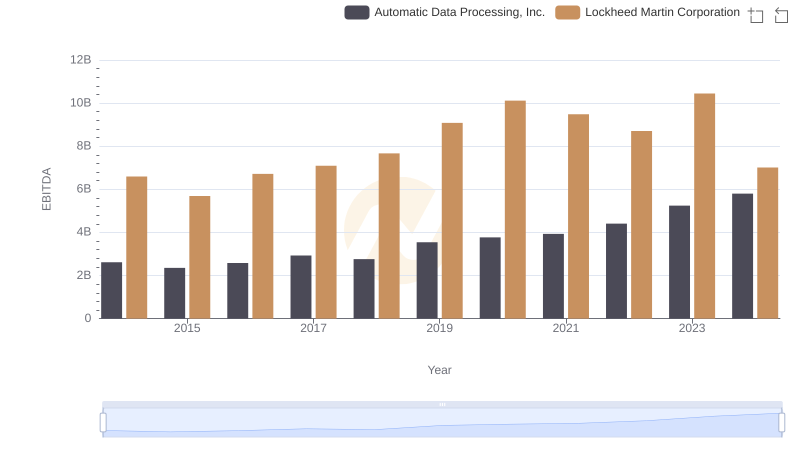

EBITDA Metrics Evaluated: Automatic Data Processing, Inc. vs Lockheed Martin Corporation

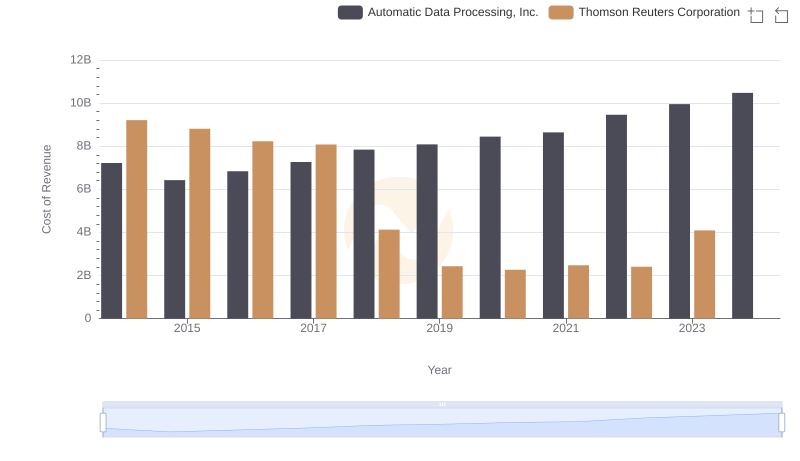

Cost of Revenue Comparison: Automatic Data Processing, Inc. vs Thomson Reuters Corporation