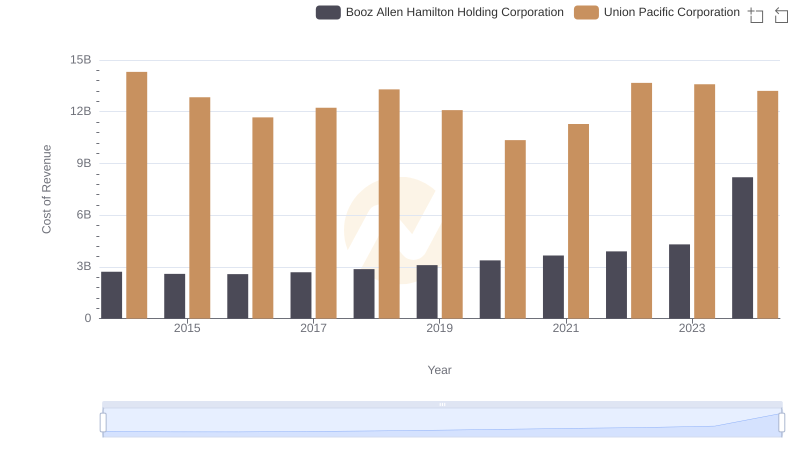

| __timestamp | Booz Allen Hamilton Holding Corporation | Union Pacific Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 531144000 | 10808000000 |

| Thursday, January 1, 2015 | 520410000 | 10290000000 |

| Friday, January 1, 2016 | 506120000 | 9502000000 |

| Sunday, January 1, 2017 | 561524000 | 10456000000 |

| Monday, January 1, 2018 | 577061000 | 10802000000 |

| Tuesday, January 1, 2019 | 663731000 | 11013000000 |

| Wednesday, January 1, 2020 | 745424000 | 10331000000 |

| Friday, January 1, 2021 | 834449000 | 11843000000 |

| Saturday, January 1, 2022 | 826865000 | 12636000000 |

| Sunday, January 1, 2023 | 958150000 | 11928000000 |

| Monday, January 1, 2024 | 1199992000 | 12461000000 |

Data in motion

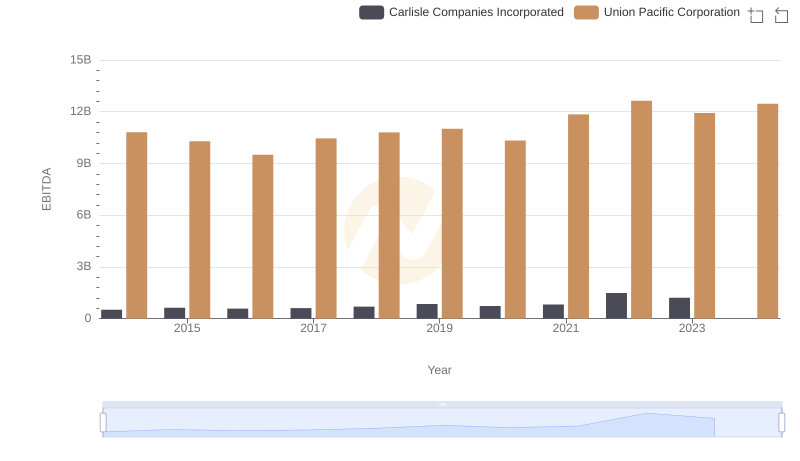

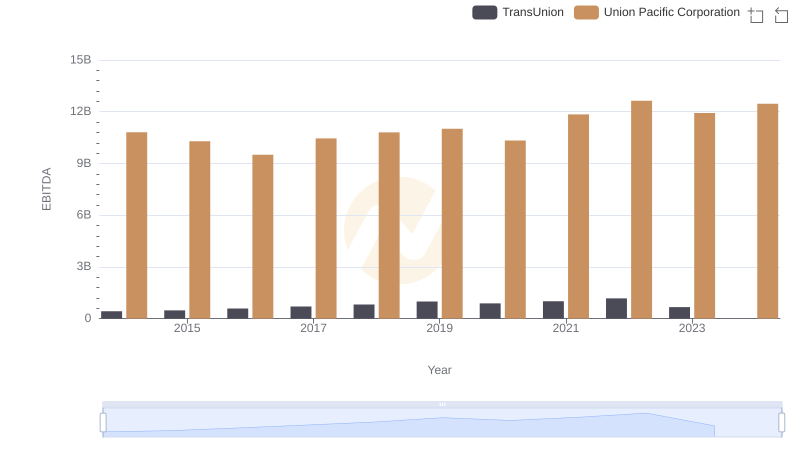

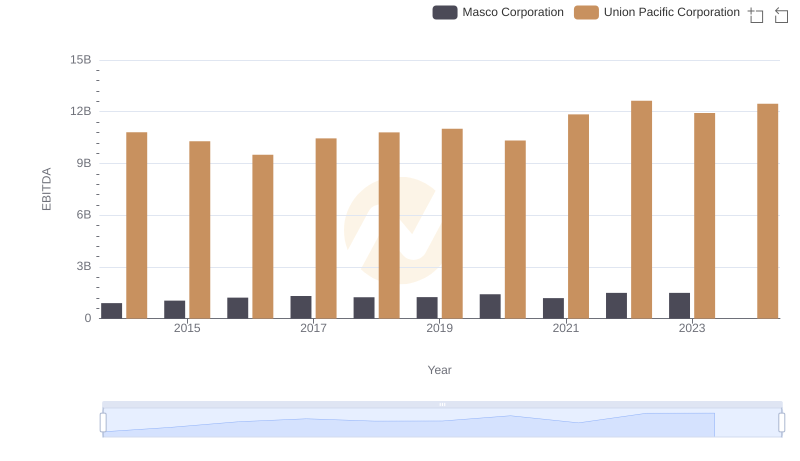

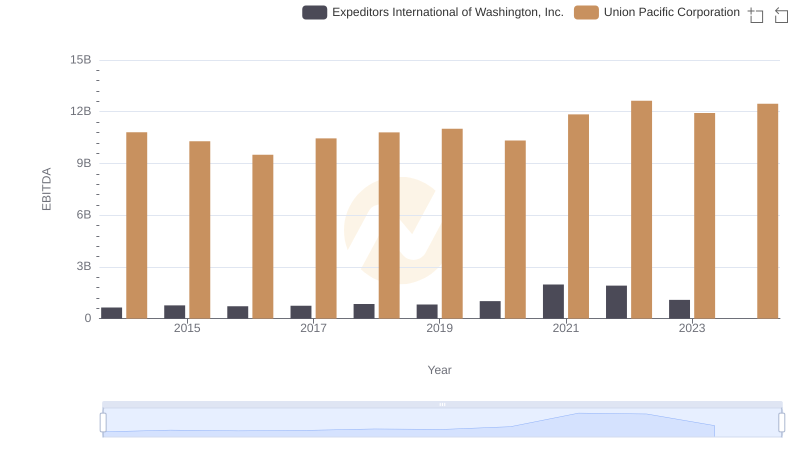

In the ever-evolving landscape of American business, Union Pacific Corporation and Booz Allen Hamilton Holding Corporation stand as titans in their respective industries. From 2014 to 2024, Union Pacific consistently outperformed Booz Allen Hamilton in terms of EBITDA, showcasing a robust growth trajectory. Union Pacific's EBITDA peaked in 2022, reaching approximately $12.6 billion, marking a 33% increase from its 2016 low. Meanwhile, Booz Allen Hamilton demonstrated a steady upward trend, culminating in a 137% rise in EBITDA by 2024, compared to its 2014 figures.

This side-by-side analysis highlights Union Pacific's dominance in the transportation sector, while Booz Allen Hamilton's strategic growth in consulting services is noteworthy. As we look to the future, these trends offer valuable insights into the financial health and strategic direction of these industry leaders.

Cost of Revenue Comparison: Union Pacific Corporation vs Booz Allen Hamilton Holding Corporation

A Side-by-Side Analysis of EBITDA: Union Pacific Corporation and Carlisle Companies Incorporated

EBITDA Analysis: Evaluating Union Pacific Corporation Against TransUnion

A Professional Review of EBITDA: Union Pacific Corporation Compared to Masco Corporation

Comprehensive EBITDA Comparison: Union Pacific Corporation vs Jacobs Engineering Group Inc.

A Professional Review of EBITDA: Union Pacific Corporation Compared to Expeditors International of Washington, Inc.