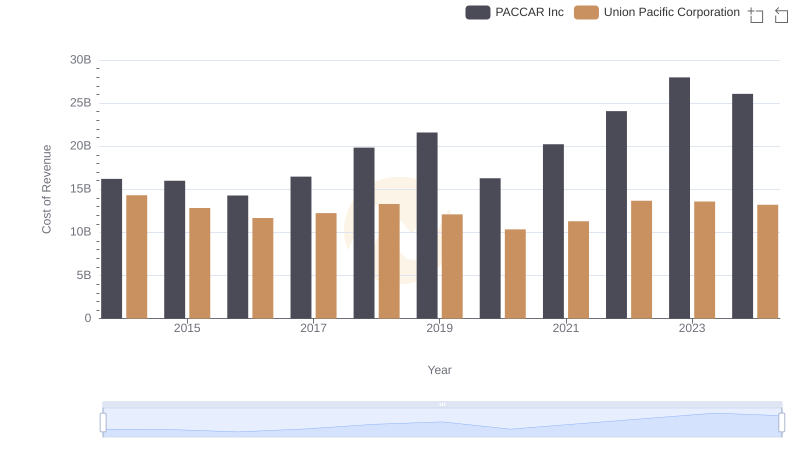

| __timestamp | PACCAR Inc | Union Pacific Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2896200000 | 10808000000 |

| Thursday, January 1, 2015 | 3212900000 | 10290000000 |

| Friday, January 1, 2016 | 3745900000 | 9502000000 |

| Sunday, January 1, 2017 | 3215800000 | 10456000000 |

| Monday, January 1, 2018 | 3681700000 | 10802000000 |

| Tuesday, January 1, 2019 | 3969900000 | 11013000000 |

| Wednesday, January 1, 2020 | 2581000000 | 10331000000 |

| Friday, January 1, 2021 | 3268200000 | 11843000000 |

| Saturday, January 1, 2022 | 4407800000 | 12636000000 |

| Sunday, January 1, 2023 | 6626900000 | 11928000000 |

| Monday, January 1, 2024 | 4456800000 | 12461000000 |

Infusing magic into the data realm

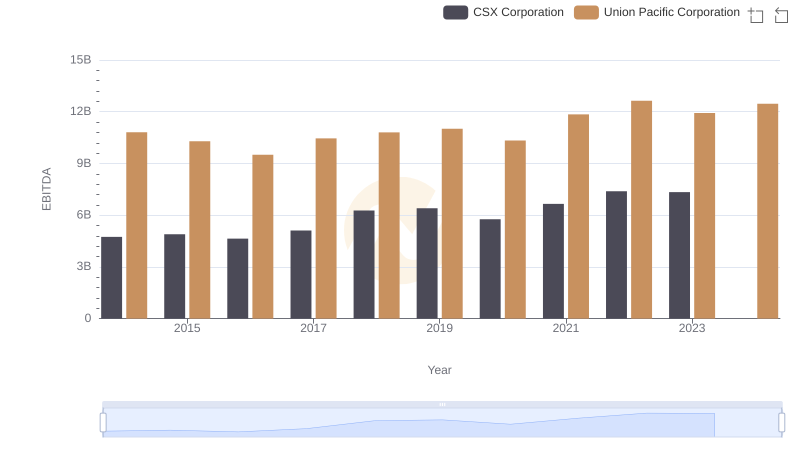

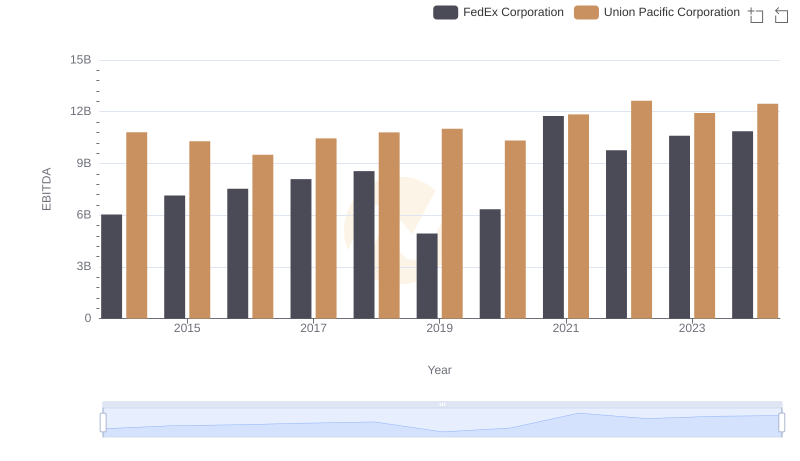

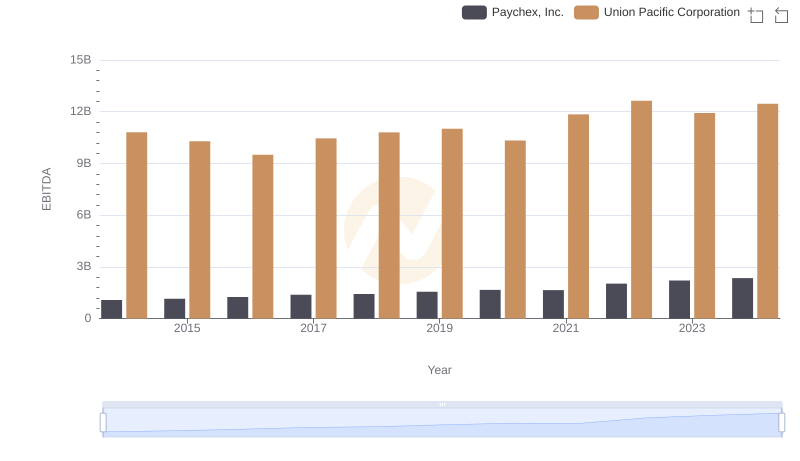

In the world of transportation and logistics, Union Pacific Corporation and PACCAR Inc have been titans of industry. Over the past decade, from 2014 to 2024, these companies have showcased their financial prowess through EBITDA, a key indicator of operational performance.

Union Pacific Corporation consistently outperformed PACCAR Inc, with an average EBITDA nearly three times higher. In 2022, Union Pacific reached a peak, boasting a 15% increase from 2014, while PACCAR saw a remarkable 53% surge in the same period. Notably, 2023 marked a significant year for PACCAR, with a 50% jump in EBITDA compared to the previous year, highlighting its resilience and growth potential.

This financial narrative underscores the dynamic nature of these industry leaders, offering insights into their strategic maneuvers and market adaptability.

Analyzing Cost of Revenue: Union Pacific Corporation and PACCAR Inc

A Side-by-Side Analysis of EBITDA: Union Pacific Corporation and CSX Corporation

A Professional Review of EBITDA: Union Pacific Corporation Compared to FedEx Corporation

Union Pacific Corporation vs Paychex, Inc.: In-Depth EBITDA Performance Comparison