| __timestamp | 3M Company | Snap-on Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 1770000000 | 66000000 |

| Thursday, January 1, 2015 | 1763000000 | 49300000 |

| Friday, January 1, 2016 | 1735000000 | 53400000 |

| Sunday, January 1, 2017 | 1850000000 | 60900000 |

| Monday, January 1, 2018 | 1821000000 | 61200000 |

| Tuesday, January 1, 2019 | 1911000000 | 59100000 |

| Wednesday, January 1, 2020 | 1878000000 | 57400000 |

| Friday, January 1, 2021 | 1994000000 | 61100000 |

| Saturday, January 1, 2022 | 1862000000 | 60100000 |

| Sunday, January 1, 2023 | 1842000000 | 64700000 |

| Monday, January 1, 2024 | 1085000000 | 0 |

Unlocking the unknown

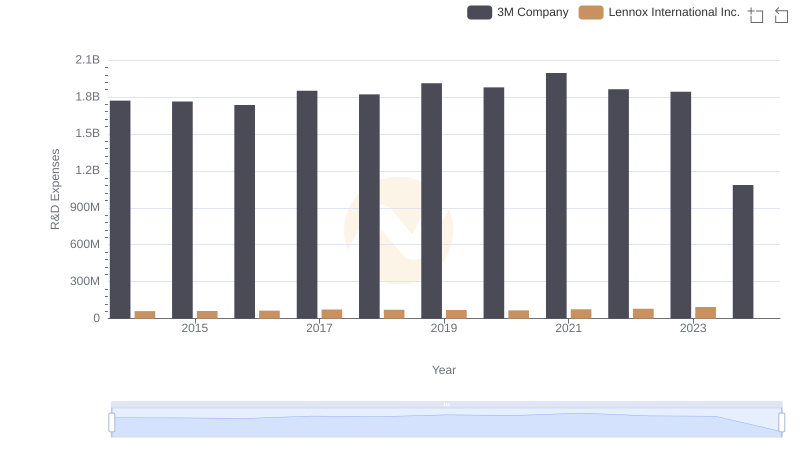

In the ever-evolving landscape of corporate innovation, research and development (R&D) spending is a critical indicator of a company's commitment to future growth. Over the past decade, 3M Company has consistently demonstrated its dedication to innovation, with R&D expenses averaging around $1.77 billion annually. This investment underscores 3M's strategy to maintain its competitive edge through technological advancements and product development.

In contrast, Snap-on Incorporated, a leader in the tool manufacturing industry, has allocated a more modest budget to R&D, averaging approximately $59 million per year. This figure represents a fraction of 3M's spending, highlighting a different strategic focus.

From 2014 to 2023, 3M's R&D spending peaked in 2021, reaching nearly $2 billion, while Snap-on's highest expenditure was $66 million in 2014. The data reveals a clear disparity in innovation priorities, with 3M investing nearly 30 times more than Snap-on annually.

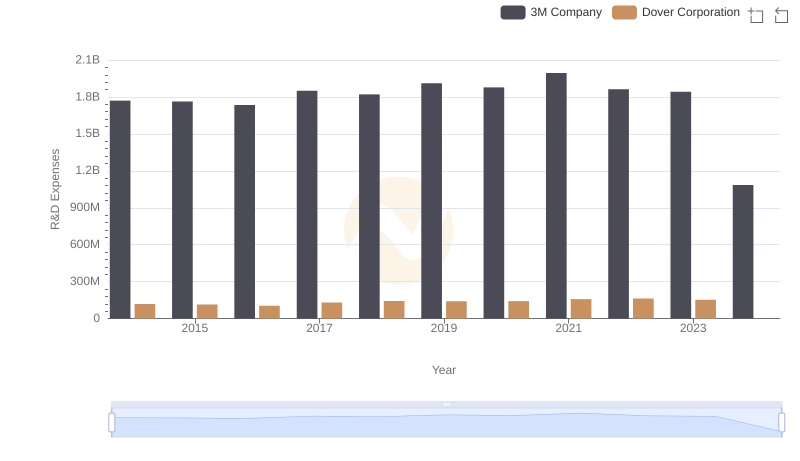

3M Company vs Dover Corporation: Strategic Focus on R&D Spending

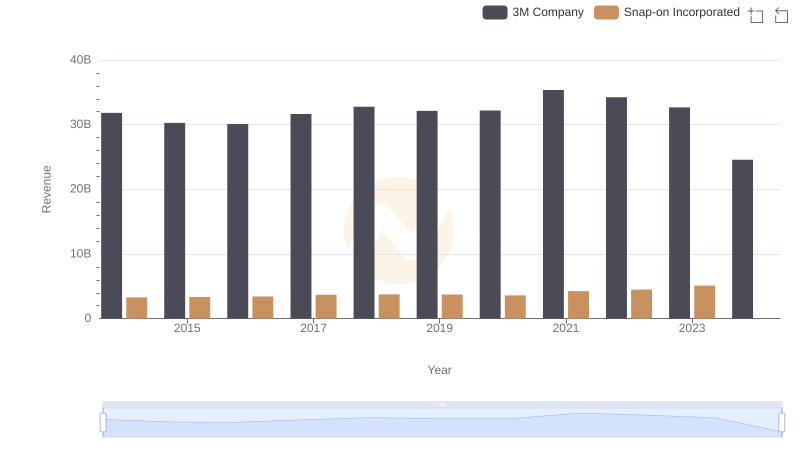

Revenue Showdown: 3M Company vs Snap-on Incorporated

Research and Development Investment: 3M Company vs Lennox International Inc.

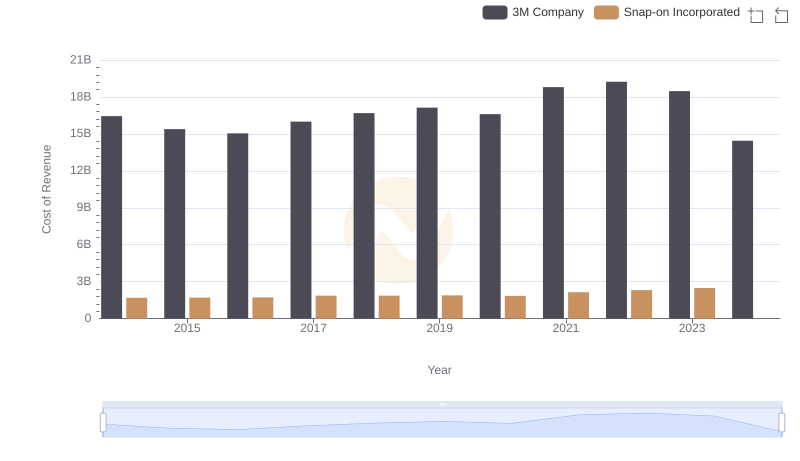

Cost of Revenue Comparison: 3M Company vs Snap-on Incorporated

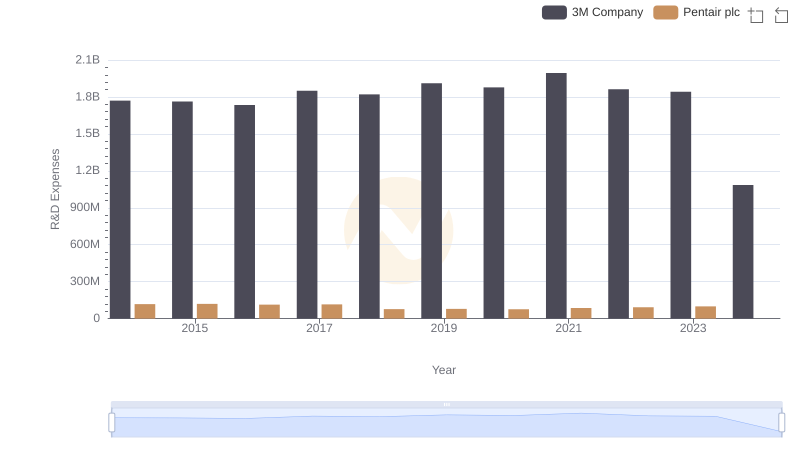

Comparing Innovation Spending: 3M Company and Pentair plc

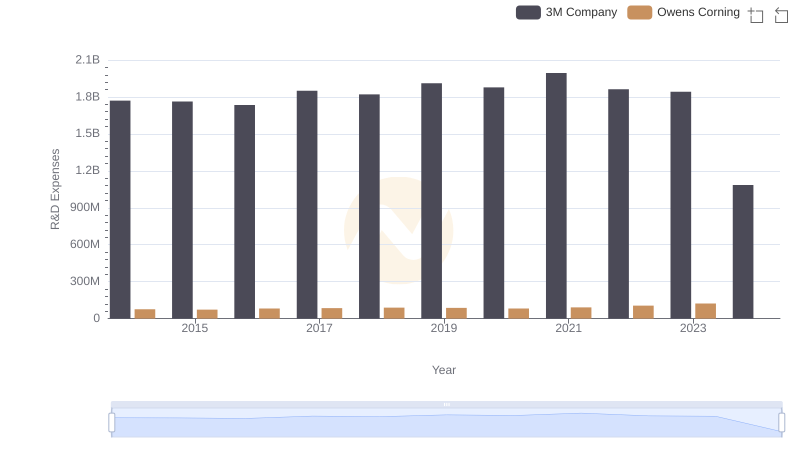

Research and Development Investment: 3M Company vs Owens Corning