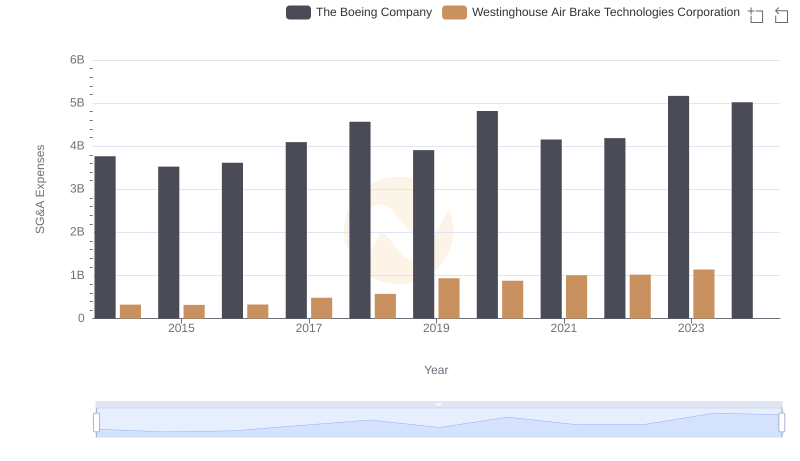

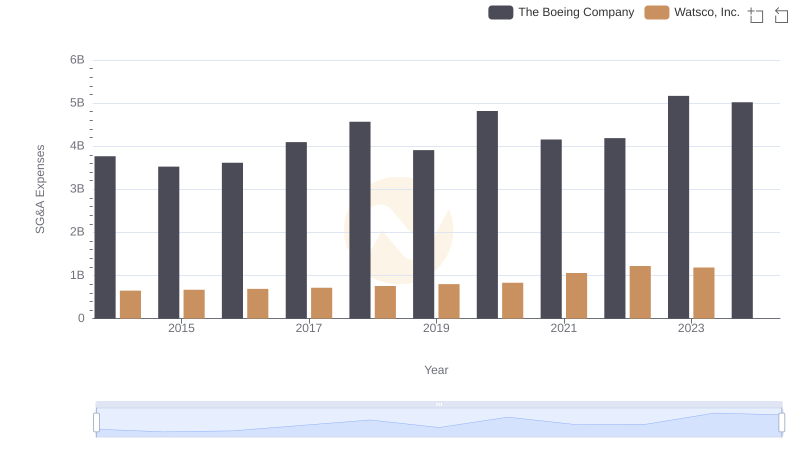

| __timestamp | The Boeing Company | Xylem Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3767000000 | 920000000 |

| Thursday, January 1, 2015 | 3525000000 | 854000000 |

| Friday, January 1, 2016 | 3616000000 | 915000000 |

| Sunday, January 1, 2017 | 4094000000 | 1090000000 |

| Monday, January 1, 2018 | 4567000000 | 1161000000 |

| Tuesday, January 1, 2019 | 3909000000 | 1158000000 |

| Wednesday, January 1, 2020 | 4817000000 | 1143000000 |

| Friday, January 1, 2021 | 4157000000 | 1179000000 |

| Saturday, January 1, 2022 | 4187000000 | 1227000000 |

| Sunday, January 1, 2023 | 5168000000 | 1757000000 |

| Monday, January 1, 2024 | 5021000000 |

In pursuit of knowledge

In the competitive world of aerospace and water technology, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, The Boeing Company and Xylem Inc. have showcased contrasting strategies in optimizing these costs.

From 2014 to 2023, Boeing's SG&A expenses fluctuated, peaking in 2023 with a 37% increase from 2015. This reflects Boeing's strategic investments in innovation and market expansion. In contrast, Xylem Inc. maintained a more consistent approach, with a notable 105% rise in 2023 compared to 2015, indicating a strategic pivot towards growth and sustainability.

While Boeing's expenses are significantly higher, Xylem's steady increase suggests a focused strategy on scaling operations. Missing data for 2024 hints at potential shifts in strategy or reporting. As these industry leaders navigate economic challenges, their SG&A management will be pivotal in defining their competitive edge.

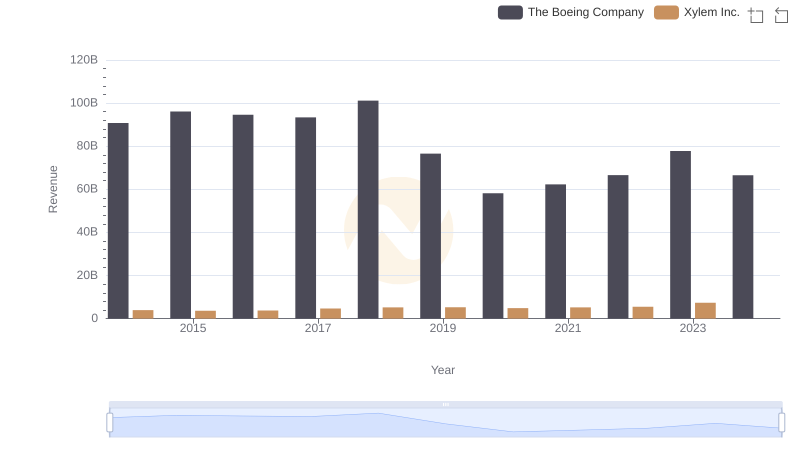

Annual Revenue Comparison: The Boeing Company vs Xylem Inc.

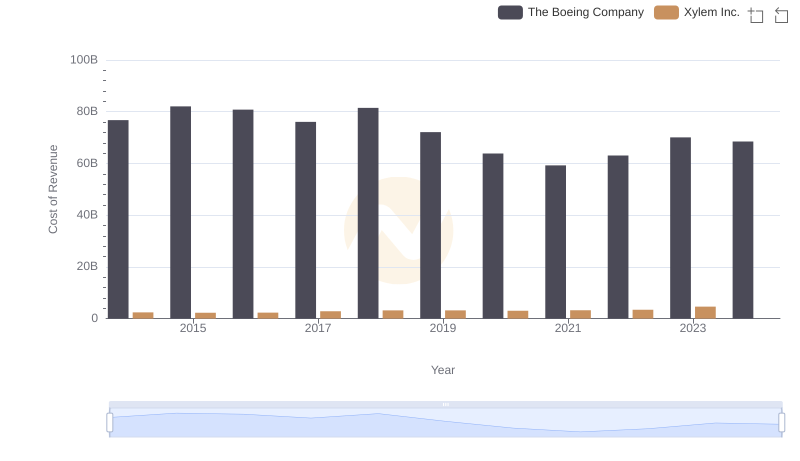

Cost of Revenue Trends: The Boeing Company vs Xylem Inc.

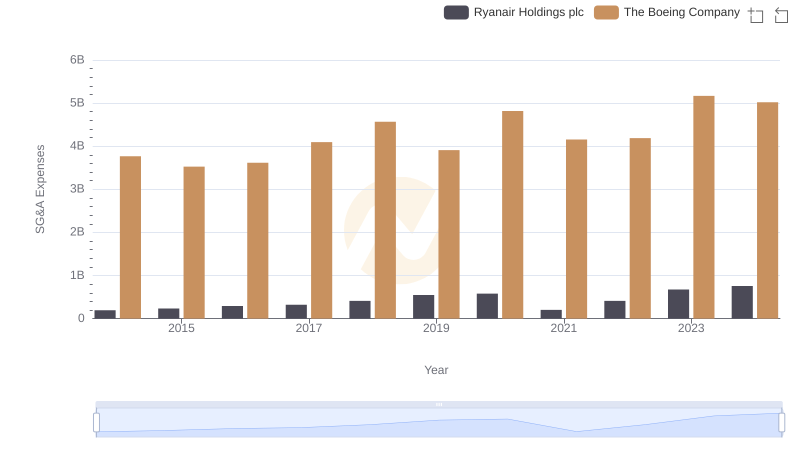

Breaking Down SG&A Expenses: The Boeing Company vs Ryanair Holdings plc

Who Optimizes SG&A Costs Better? The Boeing Company or Westinghouse Air Brake Technologies Corporation

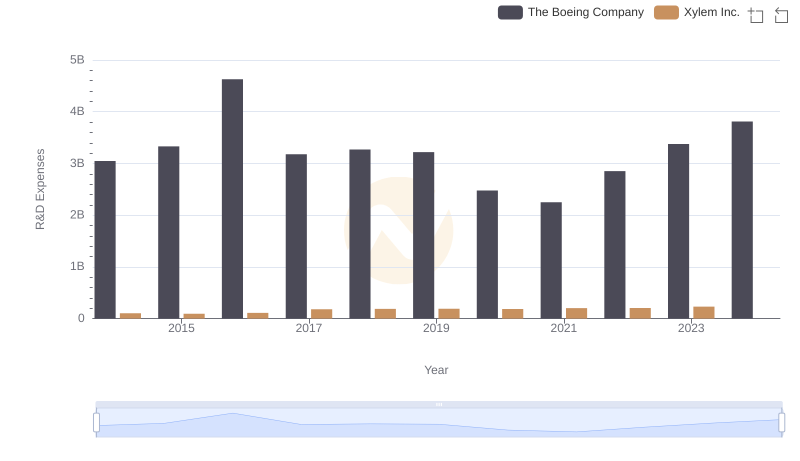

Comparing Innovation Spending: The Boeing Company and Xylem Inc.

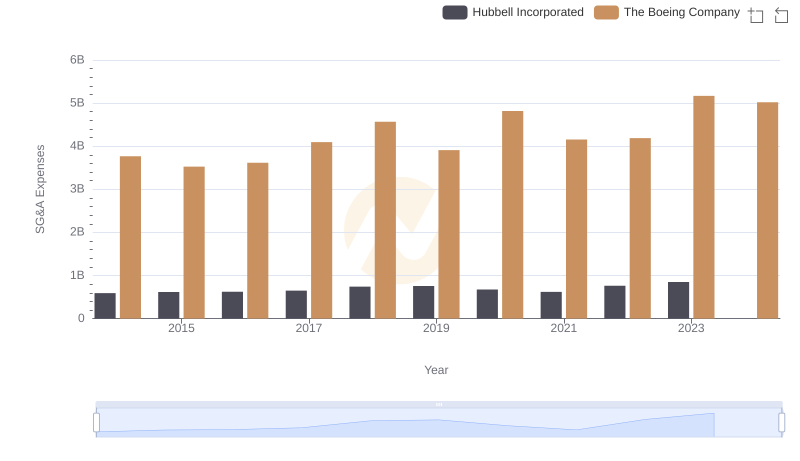

The Boeing Company vs Hubbell Incorporated: SG&A Expense Trends

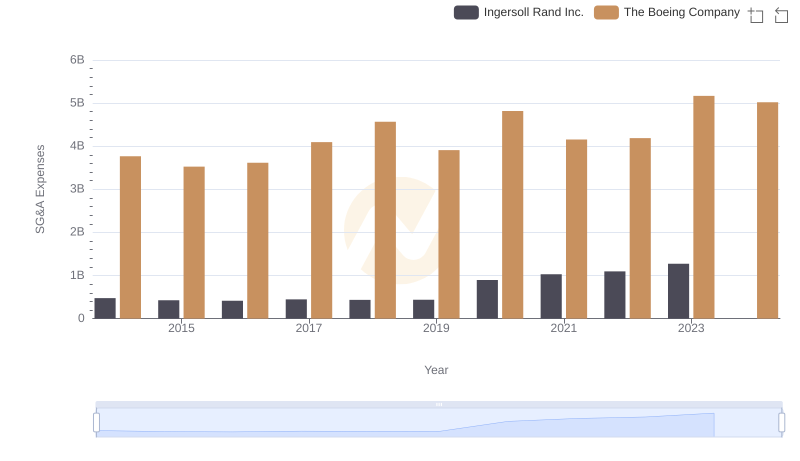

SG&A Efficiency Analysis: Comparing The Boeing Company and Ingersoll Rand Inc.

The Boeing Company vs Watsco, Inc.: SG&A Expense Trends