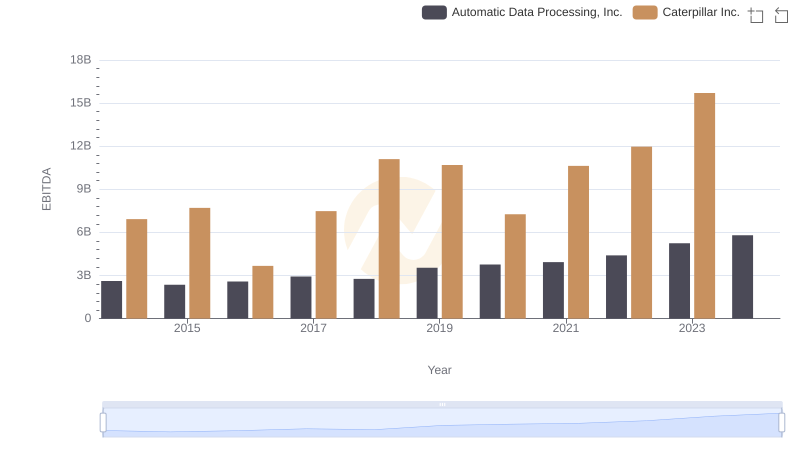

| __timestamp | Automatic Data Processing, Inc. | Caterpillar Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 5697000000 |

| Thursday, January 1, 2015 | 2496900000 | 4951000000 |

| Friday, January 1, 2016 | 2637000000 | 4686000000 |

| Sunday, January 1, 2017 | 2783200000 | 5177000000 |

| Monday, January 1, 2018 | 2971500000 | 5478000000 |

| Tuesday, January 1, 2019 | 3064200000 | 5162000000 |

| Wednesday, January 1, 2020 | 3003000000 | 4642000000 |

| Friday, January 1, 2021 | 3040500000 | 5365000000 |

| Saturday, January 1, 2022 | 3233200000 | 5651000000 |

| Sunday, January 1, 2023 | 3551400000 | 6371000000 |

| Monday, January 1, 2024 | 3778900000 | 6667000000 |

Unleashing insights

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. This analysis pits two industry titans, Caterpillar Inc. and Automatic Data Processing, Inc. (ADP), against each other over a decade, from 2014 to 2023.

ADP has consistently demonstrated a leaner approach, with SG&A expenses averaging around 3 billion annually, showing a modest increase of approximately 36% over the period. In contrast, Caterpillar's SG&A costs have been more volatile, peaking at 6.37 billion in 2023, marking a 36% rise from its lowest point in 2020.

While ADP's expenses have grown steadily, Caterpillar's fluctuations suggest a more reactive strategy. This comparison highlights the importance of strategic cost management in maintaining competitive advantage. As businesses navigate economic uncertainties, the ability to optimize SG&A costs remains a key differentiator.

Caterpillar Inc. vs Automatic Data Processing, Inc.: Efficiency in Cost of Revenue Explored

Who Generates Higher Gross Profit? Caterpillar Inc. or Automatic Data Processing, Inc.

Cost Management Insights: SG&A Expenses for Caterpillar Inc. and The Boeing Company

SG&A Efficiency Analysis: Comparing Caterpillar Inc. and Honeywell International Inc.

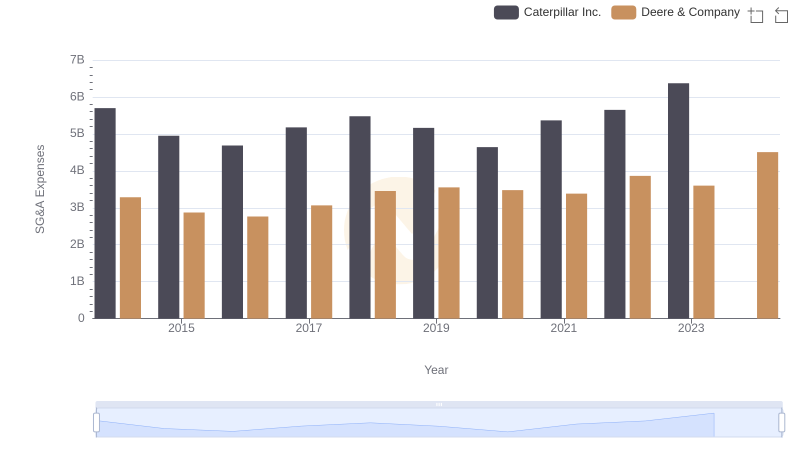

Operational Costs Compared: SG&A Analysis of Caterpillar Inc. and Deere & Company

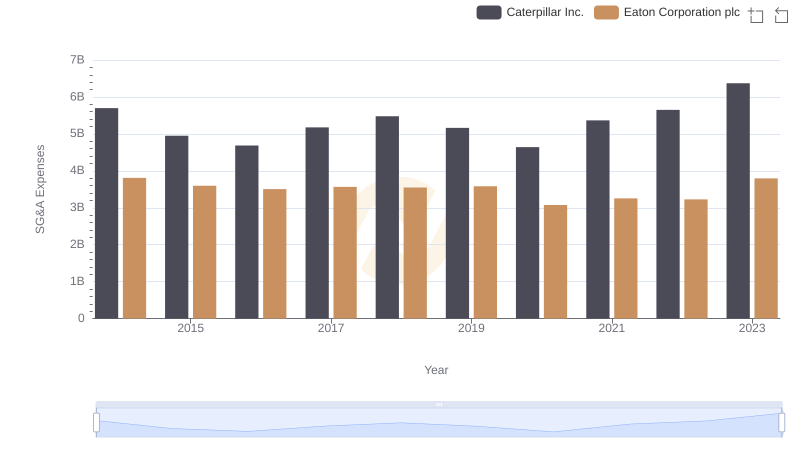

Caterpillar Inc. or Eaton Corporation plc: Who Manages SG&A Costs Better?

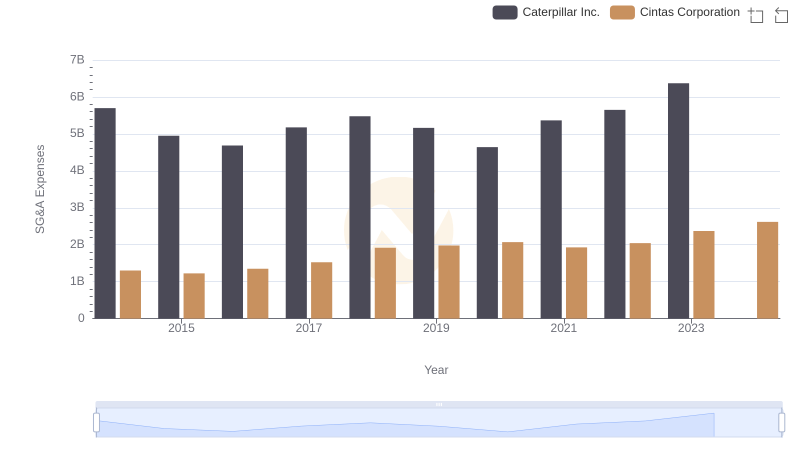

Comparing SG&A Expenses: Caterpillar Inc. vs Cintas Corporation Trends and Insights

Professional EBITDA Benchmarking: Caterpillar Inc. vs Automatic Data Processing, Inc.