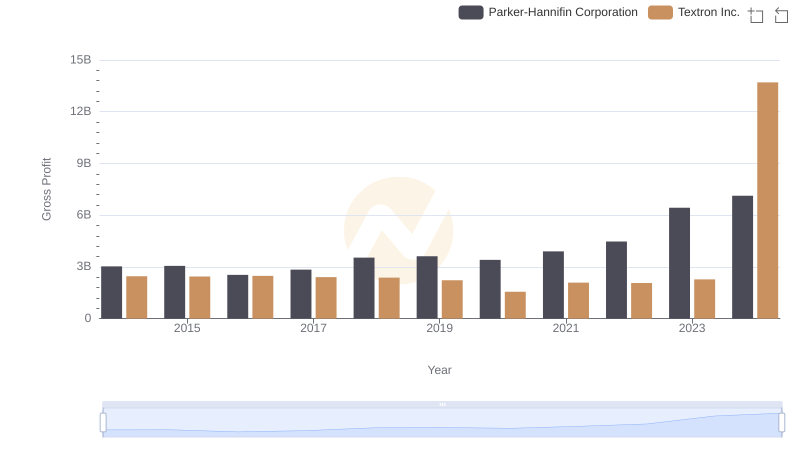

| __timestamp | Parker-Hannifin Corporation | Textron Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 13215971000 | 13878000000 |

| Thursday, January 1, 2015 | 12711744000 | 13423000000 |

| Friday, January 1, 2016 | 11360753000 | 13788000000 |

| Sunday, January 1, 2017 | 12029312000 | 14198000000 |

| Monday, January 1, 2018 | 14302392000 | 13972000000 |

| Tuesday, January 1, 2019 | 14320324000 | 13630000000 |

| Wednesday, January 1, 2020 | 13695520000 | 11651000000 |

| Friday, January 1, 2021 | 14347640000 | 12382000000 |

| Saturday, January 1, 2022 | 15861608000 | 12869000000 |

| Sunday, January 1, 2023 | 19065194000 | 13683000000 |

| Monday, January 1, 2024 | 19929606000 | 13702000000 |

Unlocking the unknown

In the competitive landscape of industrial giants, Parker-Hannifin Corporation and Textron Inc. have been vying for revenue supremacy over the past decade. From 2014 to 2024, Parker-Hannifin has shown a remarkable growth trajectory, with its revenue surging by approximately 51%, reaching nearly $20 billion in 2024. In contrast, Textron's revenue has remained relatively stable, peaking at around $14 billion in 2017 and maintaining a steady course thereafter.

Parker-Hannifin's revenue growth is particularly notable from 2020 onwards, where it outpaced Textron by a significant margin. By 2023, Parker-Hannifin's revenue was about 39% higher than Textron's, highlighting its robust expansion strategy.

This data underscores the dynamic nature of the industrial sector, where strategic decisions and market conditions can lead to significant shifts in revenue generation. As we look to the future, the question remains: will Parker-Hannifin continue its upward trajectory, or will Textron find new avenues for growth?

Comparing Revenue Performance: Parker-Hannifin Corporation or Avery Dennison Corporation?

Revenue Insights: Parker-Hannifin Corporation and ZTO Express (Cayman) Inc. Performance Compared

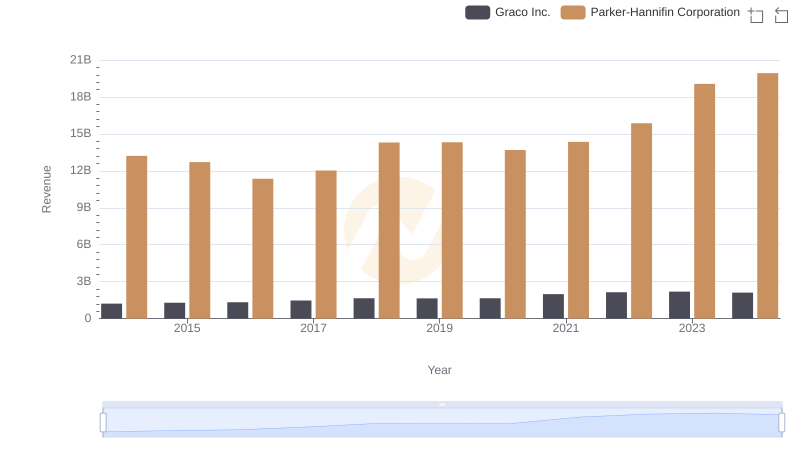

Comparing Revenue Performance: Parker-Hannifin Corporation or Graco Inc.?

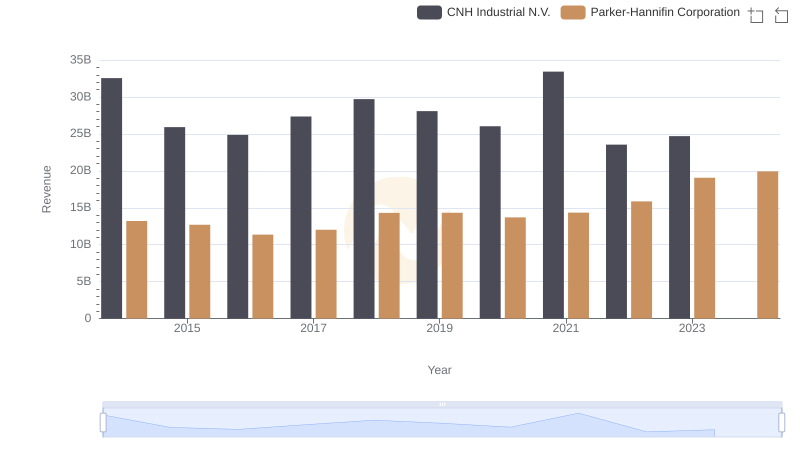

Breaking Down Revenue Trends: Parker-Hannifin Corporation vs CNH Industrial N.V.

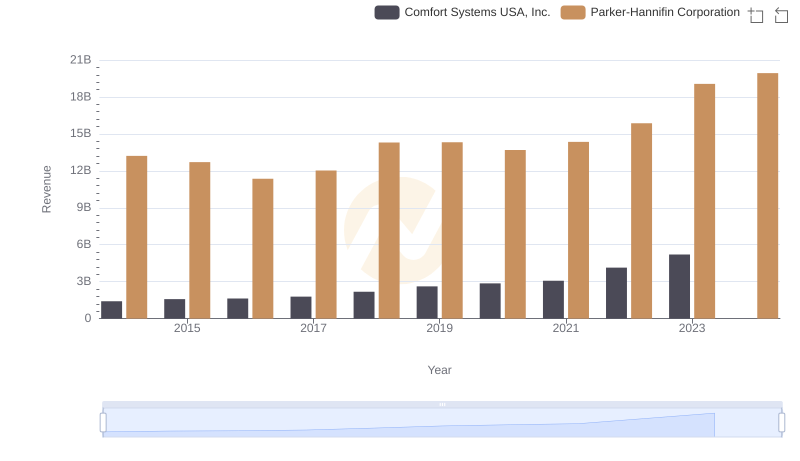

Revenue Insights: Parker-Hannifin Corporation and Comfort Systems USA, Inc. Performance Compared

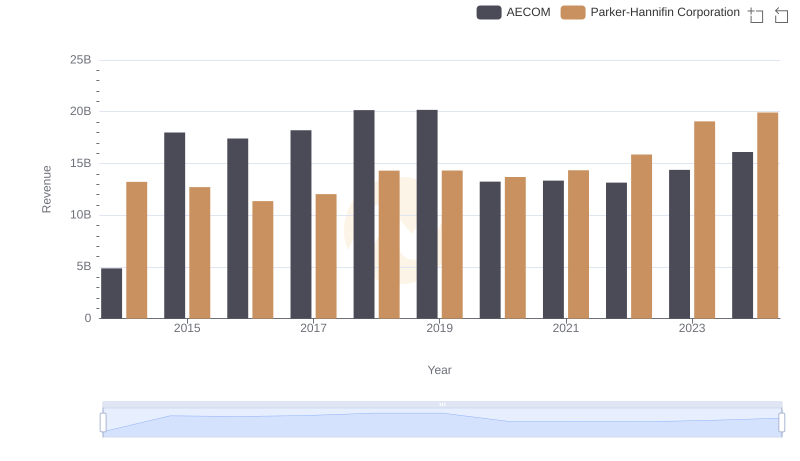

Who Generates More Revenue? Parker-Hannifin Corporation or AECOM

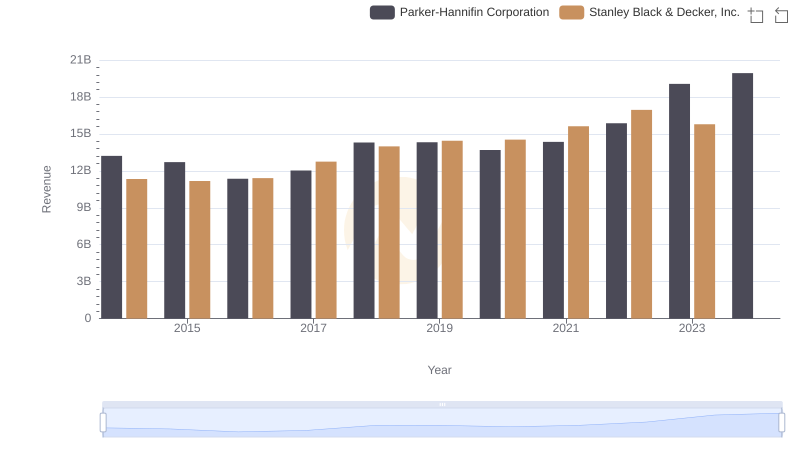

Parker-Hannifin Corporation and Stanley Black & Decker, Inc.: A Comprehensive Revenue Analysis

Who Generates Higher Gross Profit? Parker-Hannifin Corporation or Textron Inc.

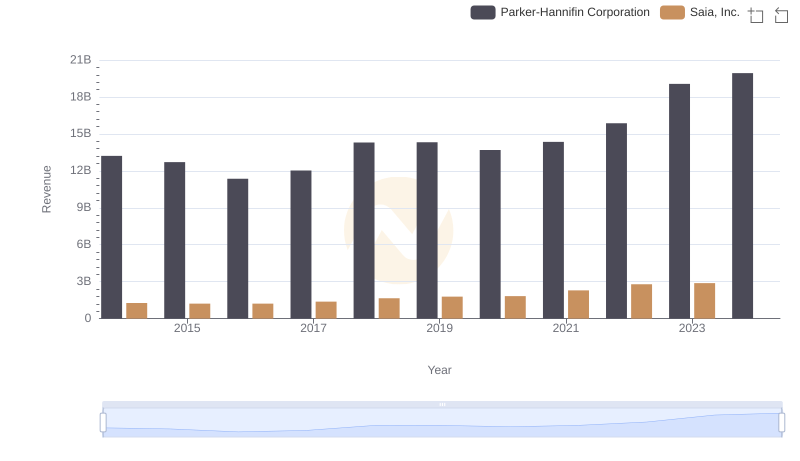

Breaking Down Revenue Trends: Parker-Hannifin Corporation vs Saia, Inc.

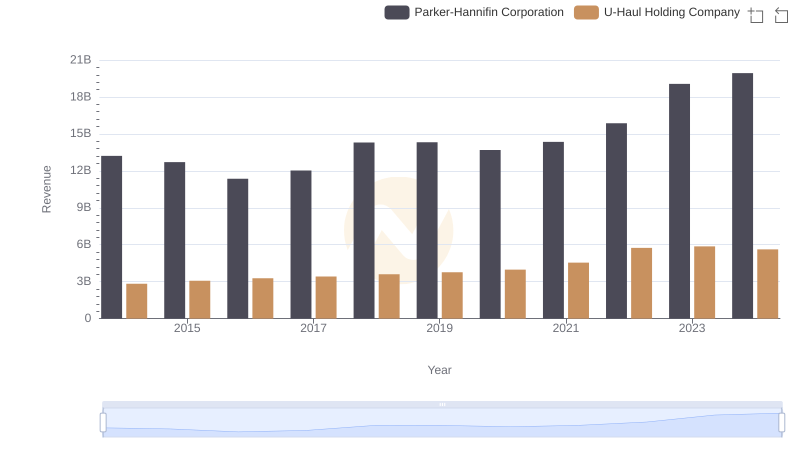

Parker-Hannifin Corporation vs U-Haul Holding Company: Annual Revenue Growth Compared