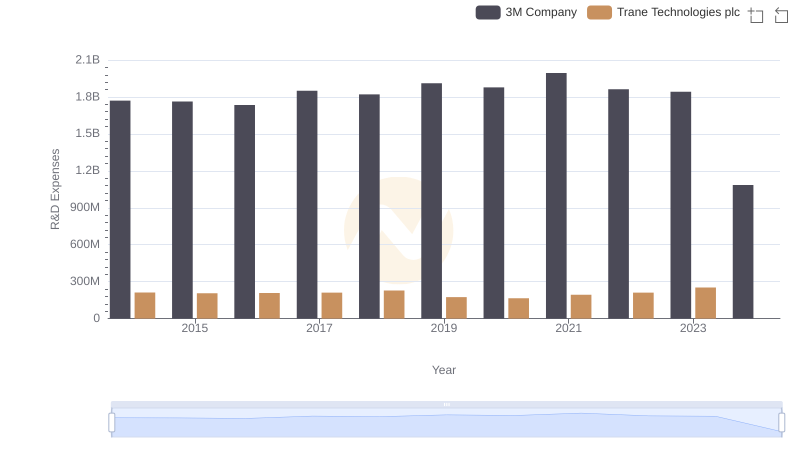

| __timestamp | Illinois Tool Works Inc. | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 2678000000 | 212300000 |

| Thursday, January 1, 2015 | 2417000000 | 205900000 |

| Friday, January 1, 2016 | 2415000000 | 207900000 |

| Sunday, January 1, 2017 | 2400000000 | 210800000 |

| Monday, January 1, 2018 | 2391000000 | 228700000 |

| Tuesday, January 1, 2019 | 2361000000 | 174200000 |

| Wednesday, January 1, 2020 | 2163000000 | 165000000 |

| Friday, January 1, 2021 | 2356000000 | 193500000 |

| Saturday, January 1, 2022 | 2579000000 | 211200000 |

| Sunday, January 1, 2023 | 284000000 | 252300000 |

| Monday, January 1, 2024 | 2675000000 | 0 |

Igniting the spark of knowledge

In the competitive landscape of industrial innovation, research and development (R&D) spending is a critical indicator of a company's commitment to future growth. Over the past decade, Illinois Tool Works Inc. (ITW) and Trane Technologies plc have demonstrated contrasting strategies in their R&D investments.

From 2014 to 2023, ITW's R&D expenses have shown a fluctuating trend, peaking in 2014 with a significant 2.7 billion USD, before experiencing a notable decline to 284 million USD in 2023. This represents a dramatic reduction of nearly 90%, suggesting a strategic shift or reallocation of resources.

Conversely, Trane Technologies has maintained a more consistent R&D investment, with a slight increase from 212 million USD in 2014 to 252 million USD in 2023. This steady approach underscores their commitment to innovation, even amidst economic uncertainties.

These trends highlight the diverse strategies companies adopt in navigating the ever-evolving industrial sector.

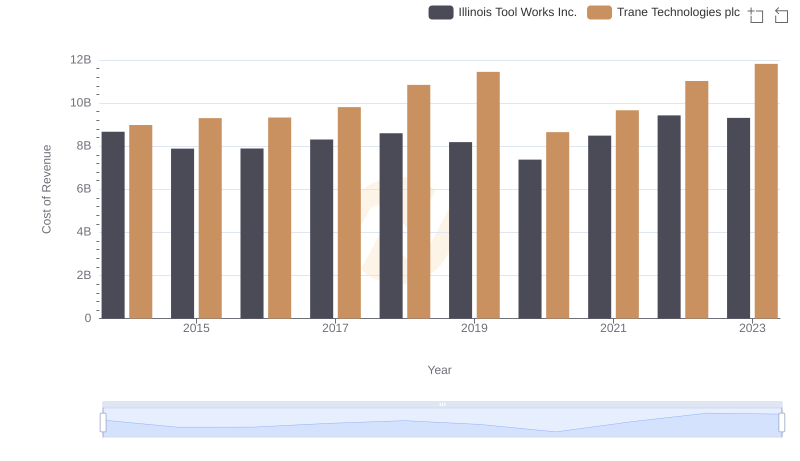

Trane Technologies plc vs Illinois Tool Works Inc.: Efficiency in Cost of Revenue Explored

Trane Technologies plc or 3M Company: Who Invests More in Innovation?

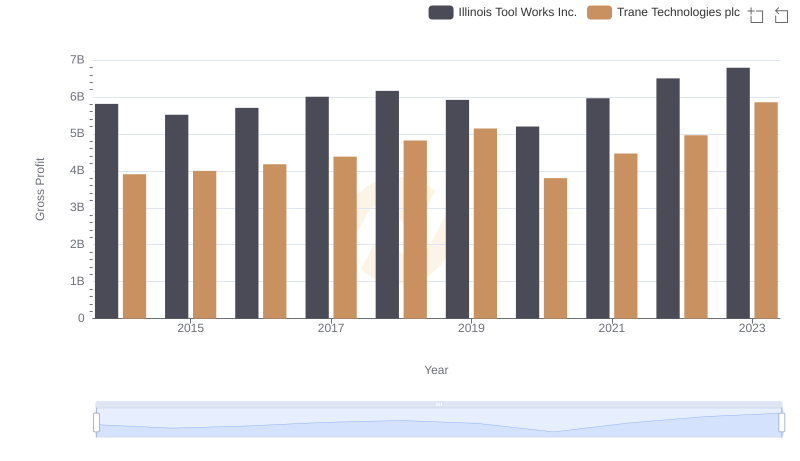

Trane Technologies plc and Illinois Tool Works Inc.: A Detailed Gross Profit Analysis

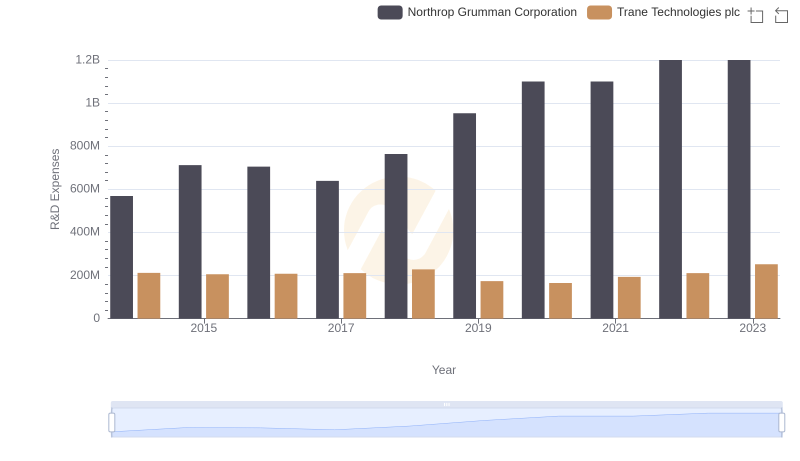

Who Prioritizes Innovation? R&D Spending Compared for Trane Technologies plc and Northrop Grumman Corporation

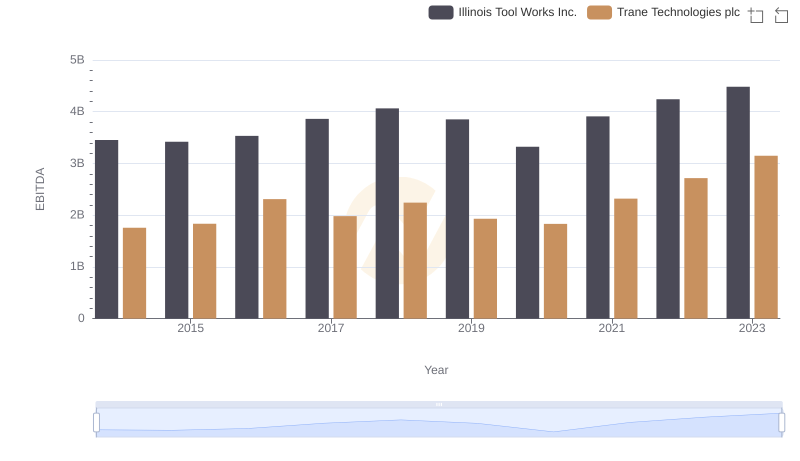

EBITDA Performance Review: Trane Technologies plc vs Illinois Tool Works Inc.

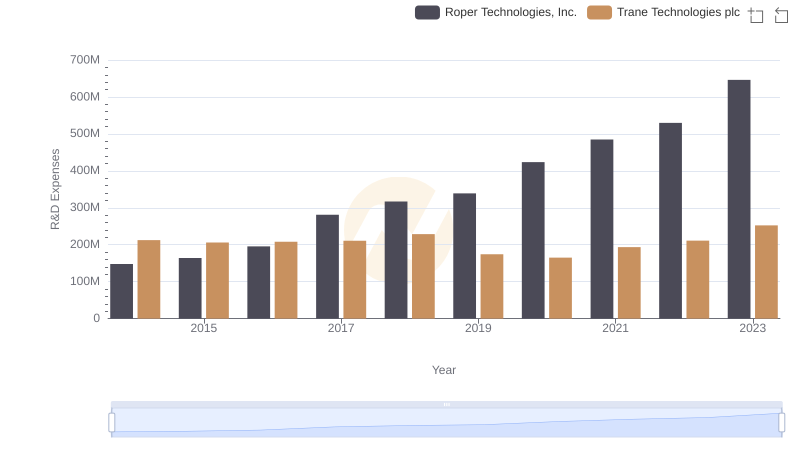

Trane Technologies plc or Roper Technologies, Inc.: Who Invests More in Innovation?

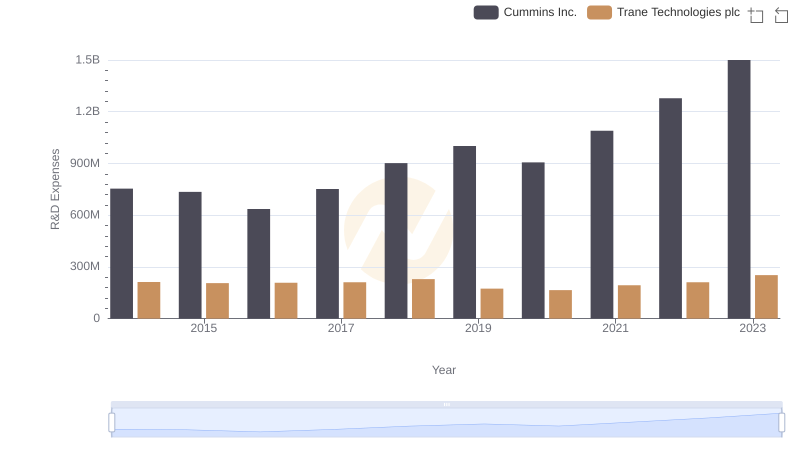

Trane Technologies plc or Cummins Inc.: Who Invests More in Innovation?

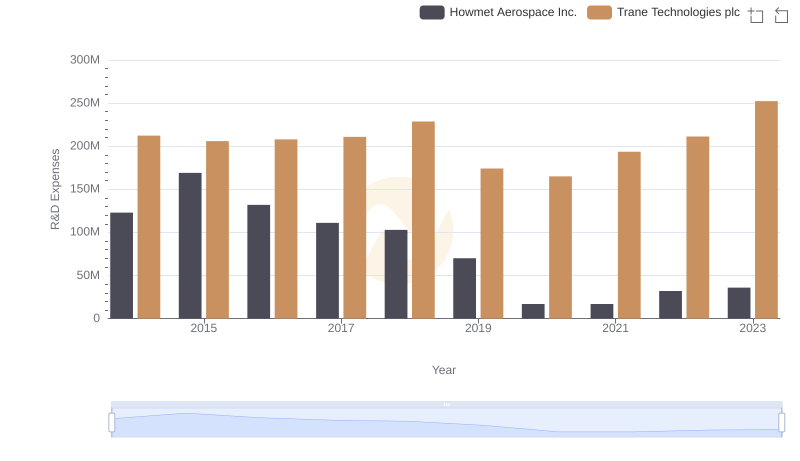

Analyzing R&D Budgets: Trane Technologies plc vs Howmet Aerospace Inc.