| __timestamp | Block, Inc. | Keysight Technologies, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 206797000 | 790000000 |

| Thursday, January 1, 2015 | 289084000 | 793000000 |

| Friday, January 1, 2016 | 425869000 | 818000000 |

| Sunday, January 1, 2017 | 503723000 | 1049000000 |

| Monday, January 1, 2018 | 750396000 | 1205000000 |

| Tuesday, January 1, 2019 | 1061082000 | 1155000000 |

| Wednesday, January 1, 2020 | 1688873000 | 1097000000 |

| Friday, January 1, 2021 | 2600515000 | 1195000000 |

| Saturday, January 1, 2022 | 3744800000 | 1283000000 |

| Sunday, January 1, 2023 | 4228199000 | 1307000000 |

| Monday, January 1, 2024 | 1395000000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, Selling, General, and Administrative (SG&A) expenses serve as a critical indicator of a company's operational efficiency. This analysis juxtaposes Block, Inc. and Keysight Technologies, Inc., two giants in their respective fields, from 2014 to 2023.

Block, Inc. has witnessed a staggering increase in SG&A expenses, surging by over 1,900% from 2014 to 2023. This growth reflects the company's aggressive expansion and investment in infrastructure, as it scales its operations to meet burgeoning market demands.

In contrast, Keysight Technologies, Inc. has maintained a more stable trajectory, with SG&A expenses growing by approximately 76% over the same period. This steadiness underscores Keysight's strategic focus on sustainable growth and operational efficiency.

Note that data for Block, Inc. in 2024 is unavailable, highlighting the dynamic nature of financial reporting.

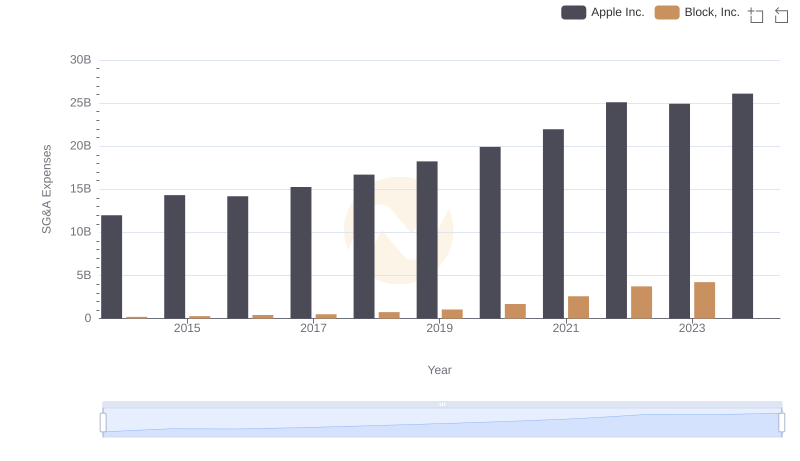

Selling, General, and Administrative Costs: Apple Inc. vs Block, Inc.

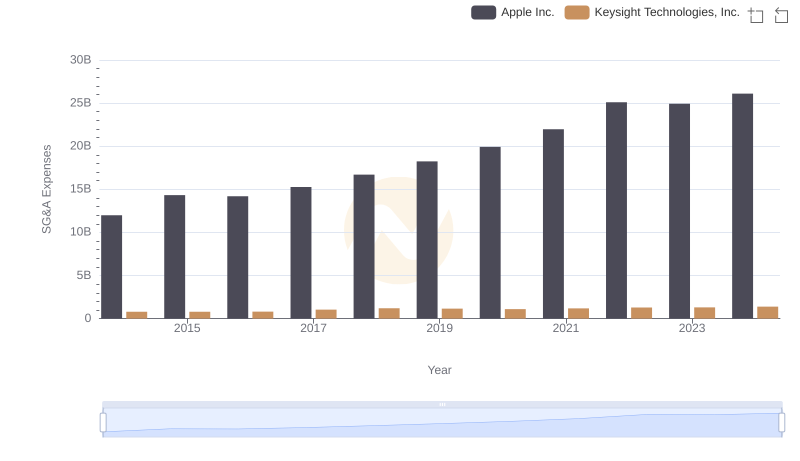

Apple Inc. or Keysight Technologies, Inc.: Who Manages SG&A Costs Better?

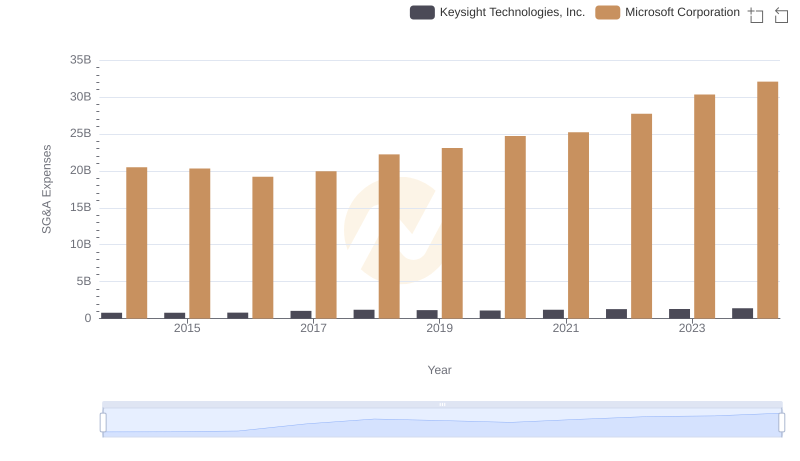

Operational Costs Compared: SG&A Analysis of Microsoft Corporation and Keysight Technologies, Inc.

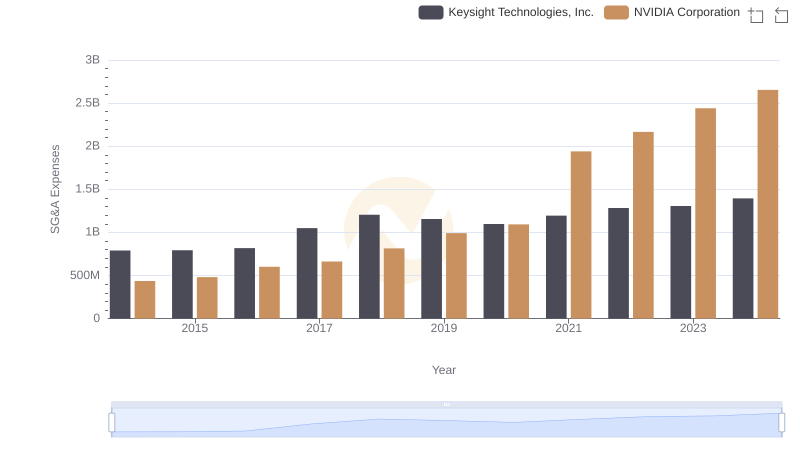

Who Optimizes SG&A Costs Better? NVIDIA Corporation or Keysight Technologies, Inc.

Taiwan Semiconductor Manufacturing Company Limited or Block, Inc.: Who Manages SG&A Costs Better?

Breaking Down SG&A Expenses: Taiwan Semiconductor Manufacturing Company Limited vs Keysight Technologies, Inc.

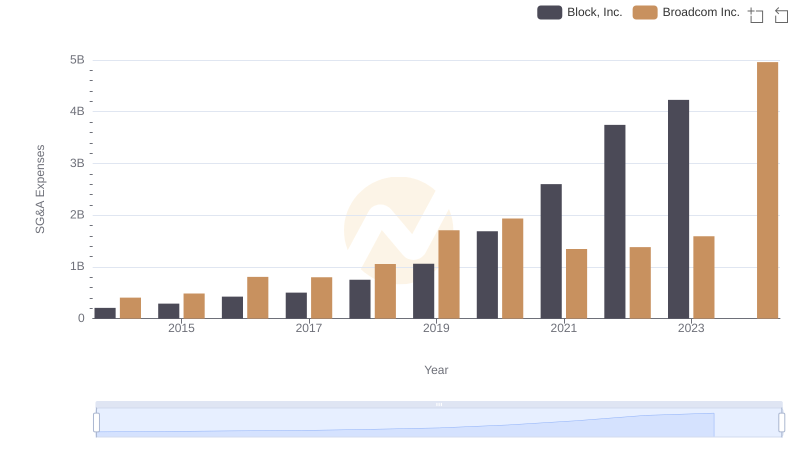

Broadcom Inc. vs Block, Inc.: SG&A Expense Trends

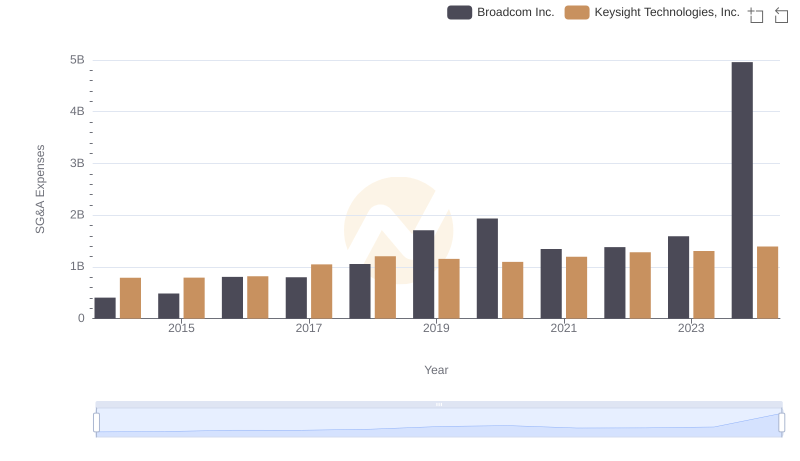

Selling, General, and Administrative Costs: Broadcom Inc. vs Keysight Technologies, Inc.

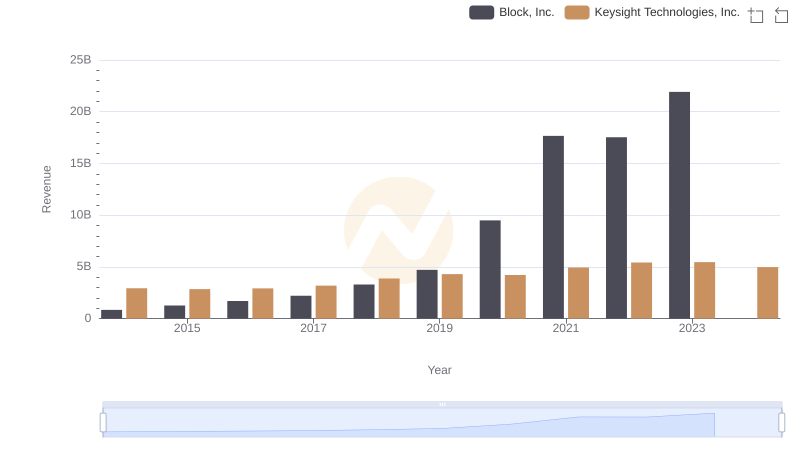

Block, Inc. and Keysight Technologies, Inc.: A Comprehensive Revenue Analysis

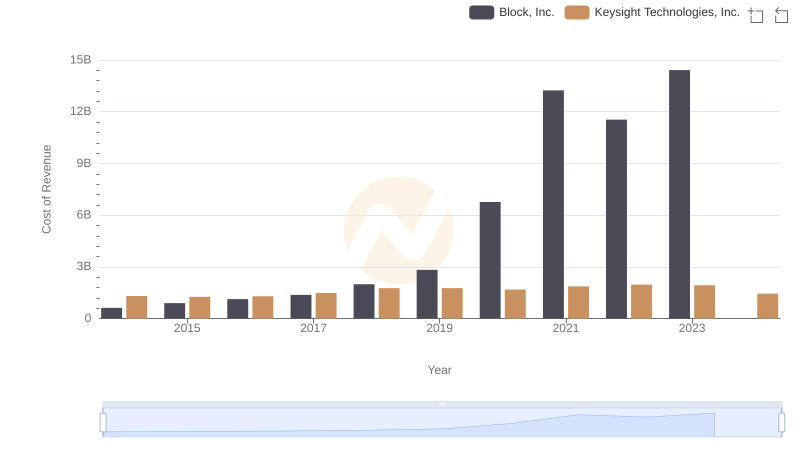

Comparing Cost of Revenue Efficiency: Block, Inc. vs Keysight Technologies, Inc.

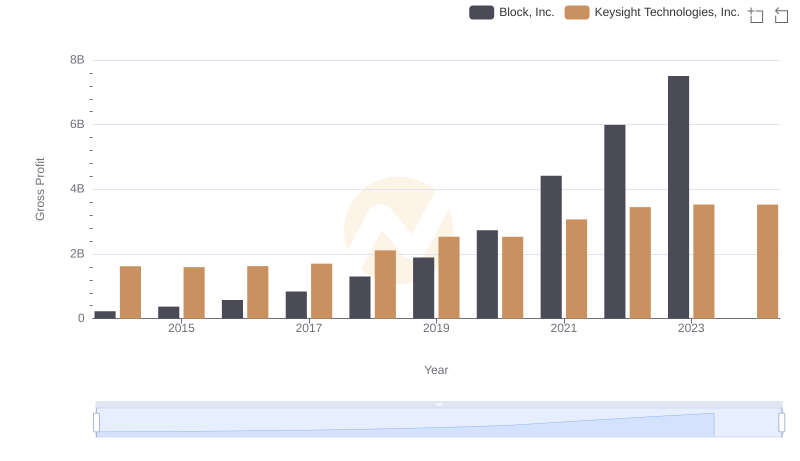

Key Insights on Gross Profit: Block, Inc. vs Keysight Technologies, Inc.

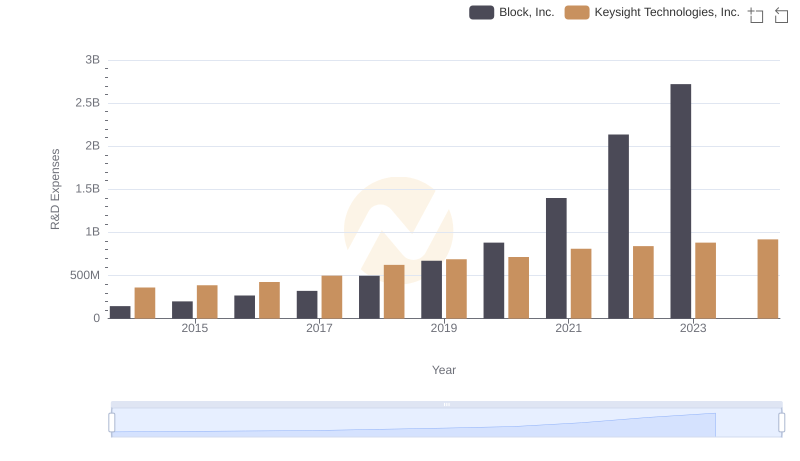

Research and Development Investment: Block, Inc. vs Keysight Technologies, Inc.