| __timestamp | Block, Inc. | Keysight Technologies, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 226074000 | 1620000000 |

| Thursday, January 1, 2015 | 370030000 | 1592000000 |

| Friday, January 1, 2016 | 576038000 | 1624000000 |

| Sunday, January 1, 2017 | 839306000 | 1702000000 |

| Monday, January 1, 2018 | 1303700000 | 2111000000 |

| Tuesday, January 1, 2019 | 1889685000 | 2534000000 |

| Wednesday, January 1, 2020 | 2733409000 | 2533000000 |

| Friday, January 1, 2021 | 4419823000 | 3069000000 |

| Saturday, January 1, 2022 | 5991892000 | 3450000000 |

| Sunday, January 1, 2023 | 7504886000 | 3532000000 |

| Monday, January 1, 2024 | 3527000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of technology and finance, understanding the financial health of industry leaders is crucial. Over the past decade, Block, Inc. and Keysight Technologies, Inc. have showcased remarkable growth in their gross profits. From 2014 to 2023, Block, Inc. experienced a staggering increase of over 3,200%, starting from a modest $226 million to an impressive $7.5 billion. Meanwhile, Keysight Technologies, Inc. demonstrated steady growth, with gross profits rising by approximately 118%, from $1.62 billion to $3.53 billion.

This data highlights the dynamic nature of the tech industry, where innovation and strategic investments drive financial success. While Block, Inc. has shown explosive growth, Keysight Technologies, Inc. has maintained a consistent upward trajectory, reflecting its resilience and adaptability. As we look to the future, these trends offer valuable insights into the competitive landscape of technology giants.

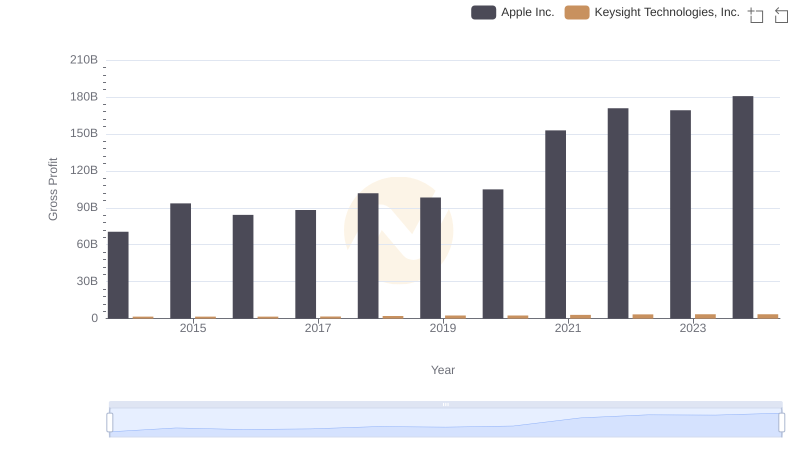

Apple Inc. vs Keysight Technologies, Inc.: A Gross Profit Performance Breakdown

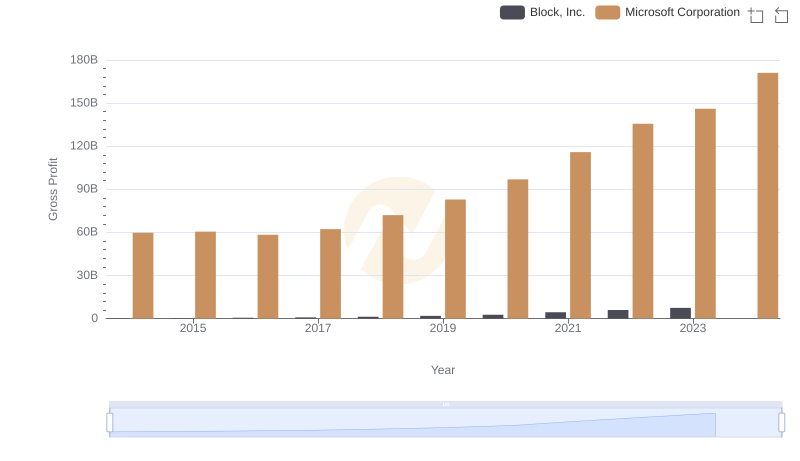

Microsoft Corporation and Block, Inc.: A Detailed Gross Profit Analysis

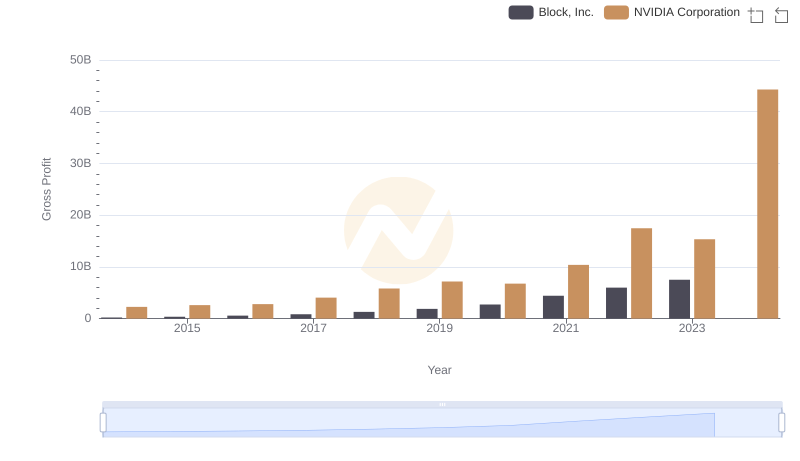

Gross Profit Analysis: Comparing NVIDIA Corporation and Block, Inc.

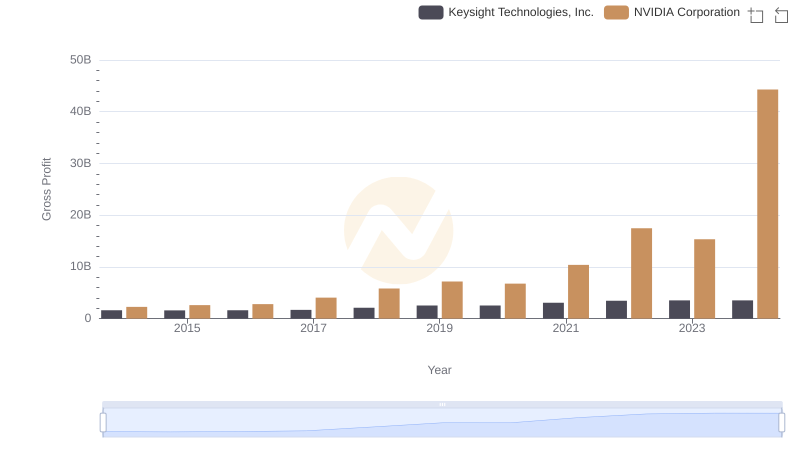

Gross Profit Comparison: NVIDIA Corporation and Keysight Technologies, Inc. Trends

Taiwan Semiconductor Manufacturing Company Limited and Block, Inc.: A Detailed Gross Profit Analysis

Gross Profit Comparison: Taiwan Semiconductor Manufacturing Company Limited and Keysight Technologies, Inc. Trends

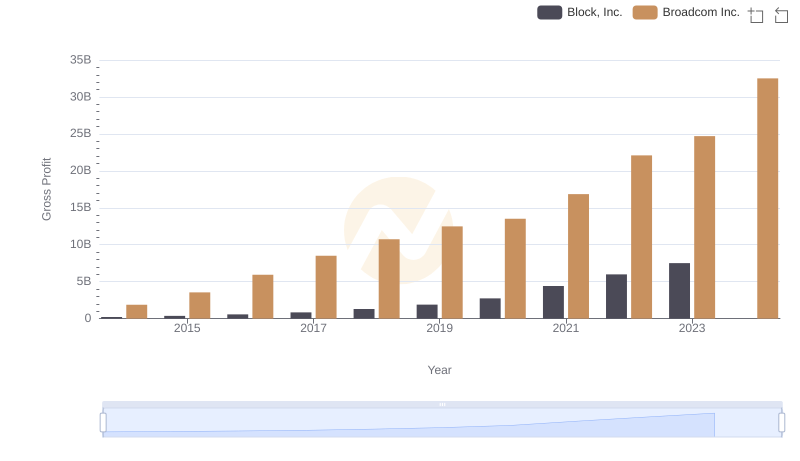

Gross Profit Comparison: Broadcom Inc. and Block, Inc. Trends

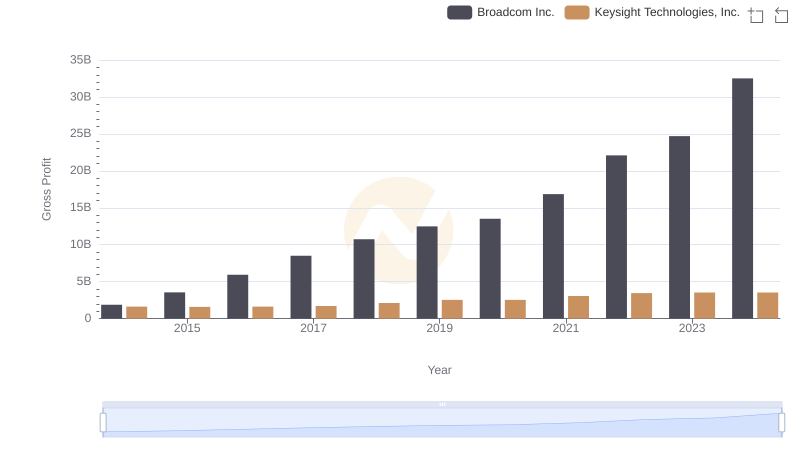

Broadcom Inc. vs Keysight Technologies, Inc.: A Gross Profit Performance Breakdown

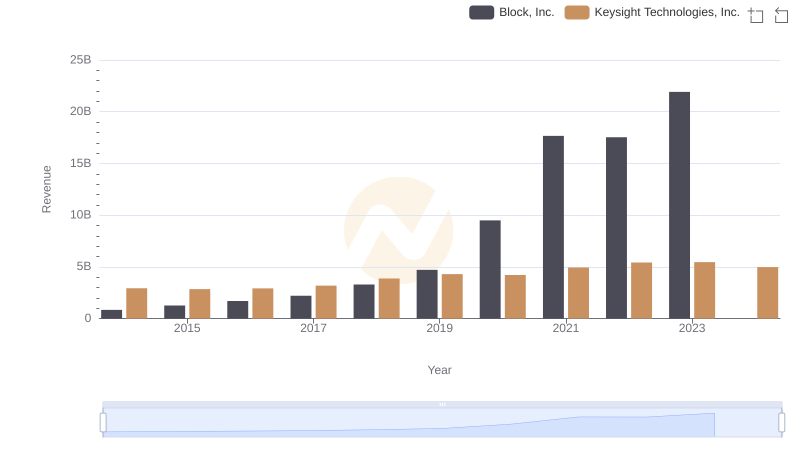

Block, Inc. and Keysight Technologies, Inc.: A Comprehensive Revenue Analysis

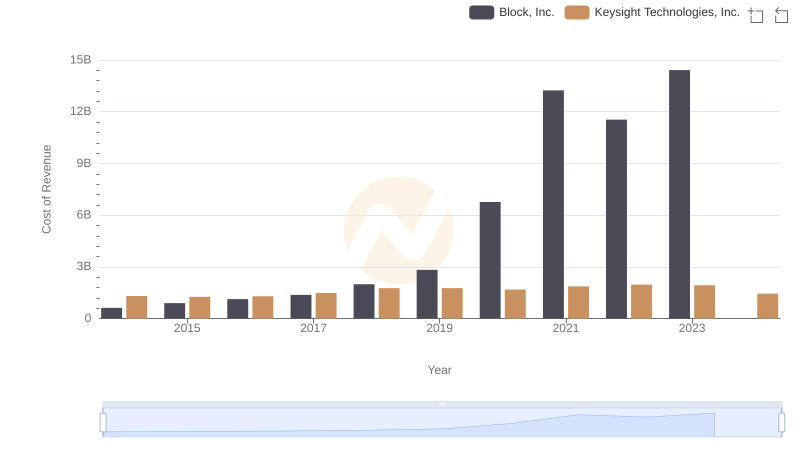

Comparing Cost of Revenue Efficiency: Block, Inc. vs Keysight Technologies, Inc.

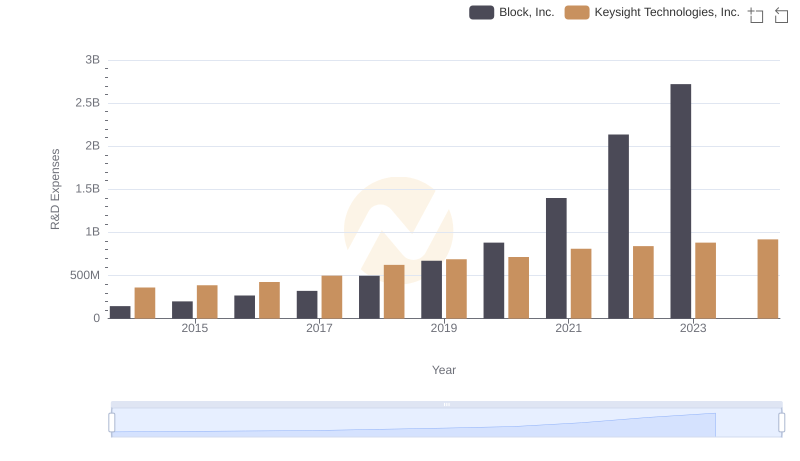

Research and Development Investment: Block, Inc. vs Keysight Technologies, Inc.

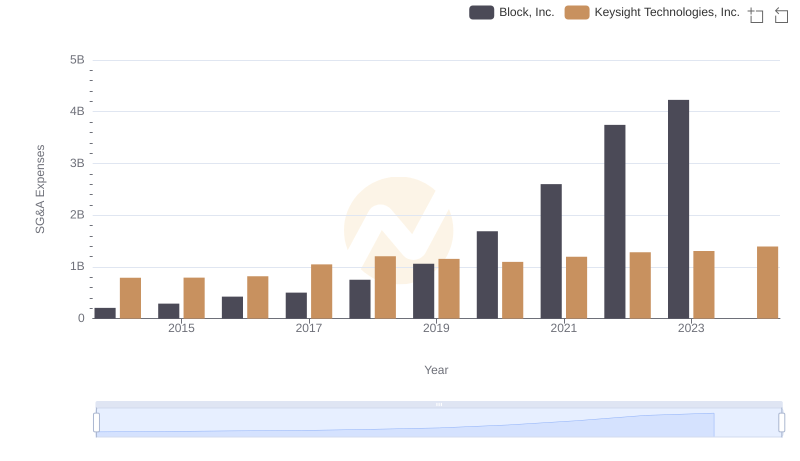

Selling, General, and Administrative Costs: Block, Inc. vs Keysight Technologies, Inc.