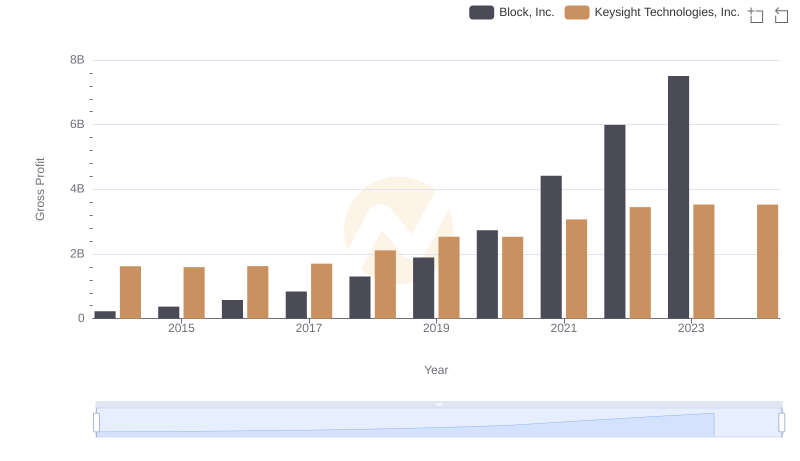

| __timestamp | Block, Inc. | Keysight Technologies, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 624118000 | 1313000000 |

| Thursday, January 1, 2015 | 897088000 | 1264000000 |

| Friday, January 1, 2016 | 1132683000 | 1294000000 |

| Sunday, January 1, 2017 | 1374947000 | 1487000000 |

| Monday, January 1, 2018 | 1994477000 | 1767000000 |

| Tuesday, January 1, 2019 | 2823815000 | 1769000000 |

| Wednesday, January 1, 2020 | 6764169000 | 1688000000 |

| Friday, January 1, 2021 | 13241380000 | 1872000000 |

| Saturday, January 1, 2022 | 11539695000 | 1970000000 |

| Sunday, January 1, 2023 | 14410737000 | 1932000000 |

| Monday, January 1, 2024 | 1452000000 |

Igniting the spark of knowledge

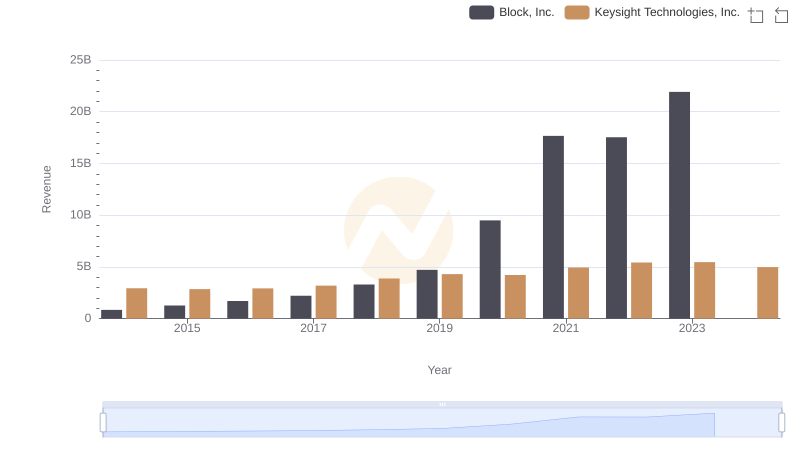

In the ever-evolving landscape of technology, understanding cost efficiency is crucial. Block, Inc. and Keysight Technologies, Inc. offer a fascinating study in contrasts. From 2014 to 2023, Block, Inc. saw its cost of revenue skyrocket by over 2,200%, peaking in 2023. This rapid growth reflects its aggressive expansion and scaling strategies. In contrast, Keysight Technologies, Inc. maintained a more stable trajectory, with costs increasing by just 47% over the same period, highlighting its steady and controlled growth approach.

The data reveals a missing entry for Block, Inc. in 2024, suggesting potential reporting delays or strategic shifts. Meanwhile, Keysight's consistent reporting underscores its reliability. This comparison not only highlights differing business models but also offers insights into how companies manage growth and efficiency in a competitive market.

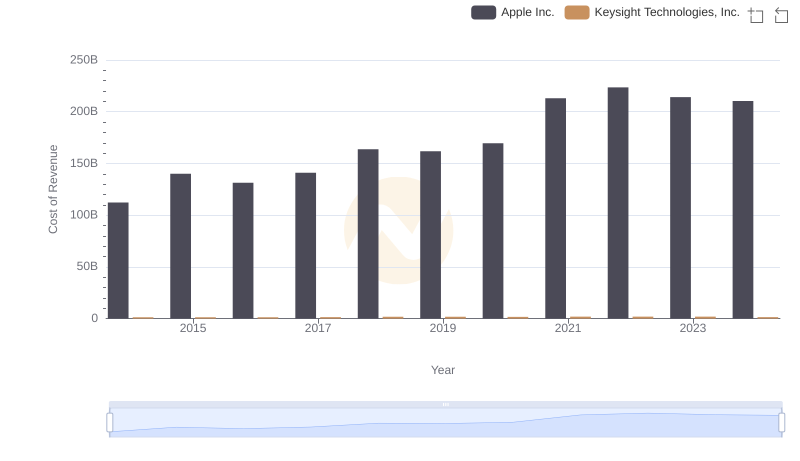

Cost of Revenue: Key Insights for Apple Inc. and Keysight Technologies, Inc.

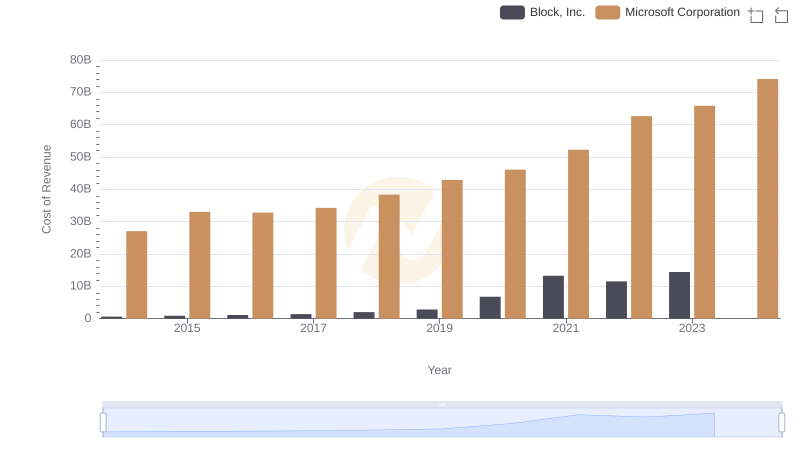

Cost of Revenue Trends: Microsoft Corporation vs Block, Inc.

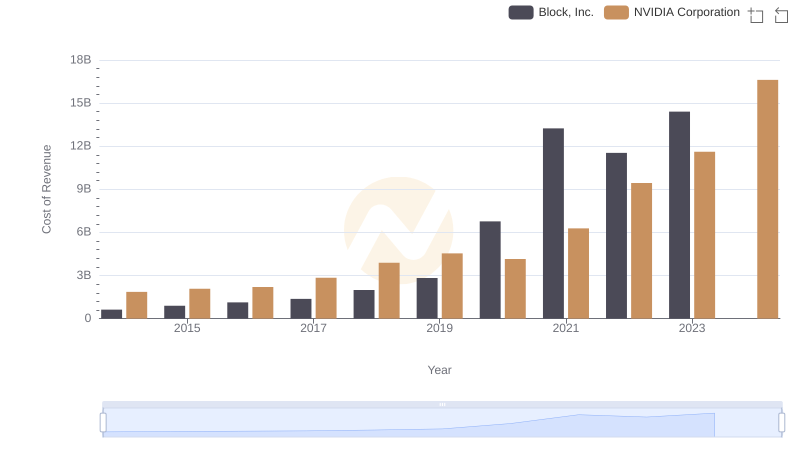

Cost of Revenue Comparison: NVIDIA Corporation vs Block, Inc.

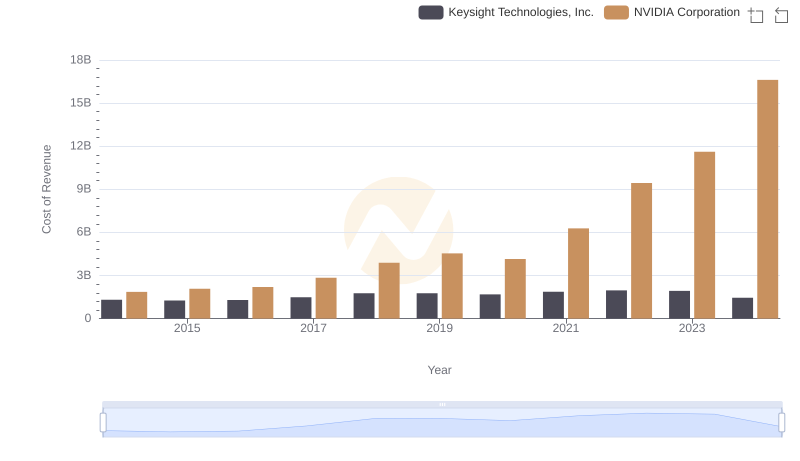

Comparing Cost of Revenue Efficiency: NVIDIA Corporation vs Keysight Technologies, Inc.

Comparing Cost of Revenue Efficiency: Taiwan Semiconductor Manufacturing Company Limited vs Block, Inc.

Comparing Cost of Revenue Efficiency: Taiwan Semiconductor Manufacturing Company Limited vs Keysight Technologies, Inc.

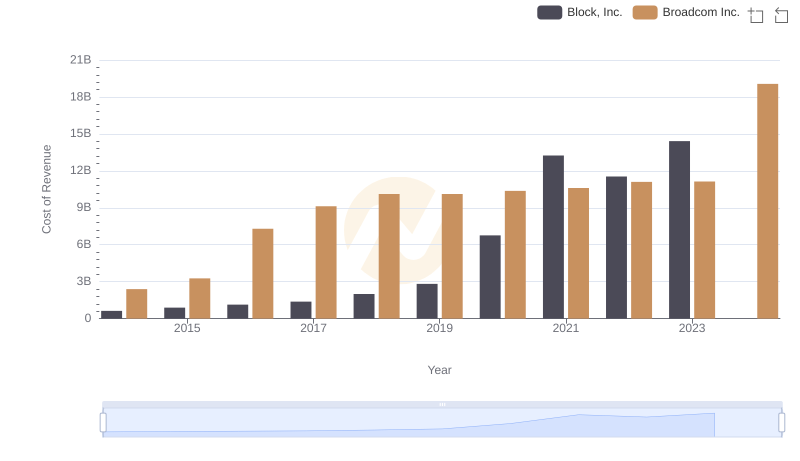

Comparing Cost of Revenue Efficiency: Broadcom Inc. vs Block, Inc.

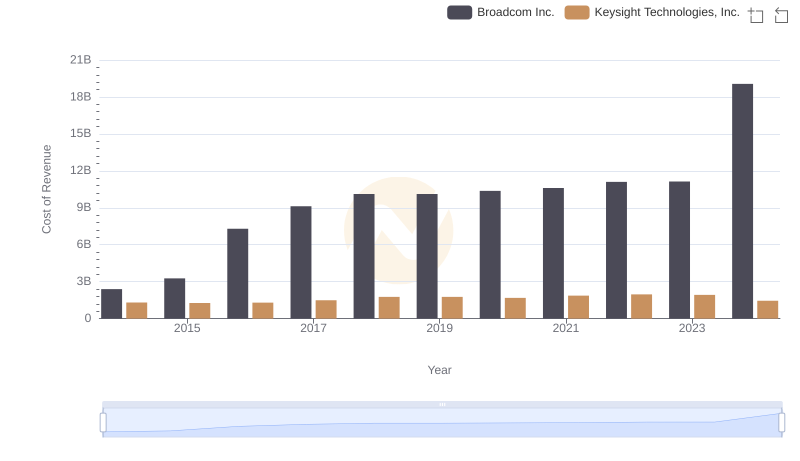

Analyzing Cost of Revenue: Broadcom Inc. and Keysight Technologies, Inc.

Block, Inc. and Keysight Technologies, Inc.: A Comprehensive Revenue Analysis

Key Insights on Gross Profit: Block, Inc. vs Keysight Technologies, Inc.

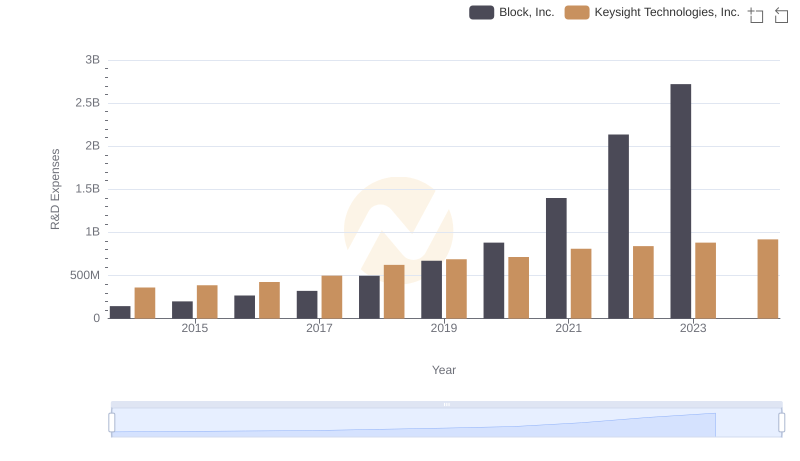

Research and Development Investment: Block, Inc. vs Keysight Technologies, Inc.

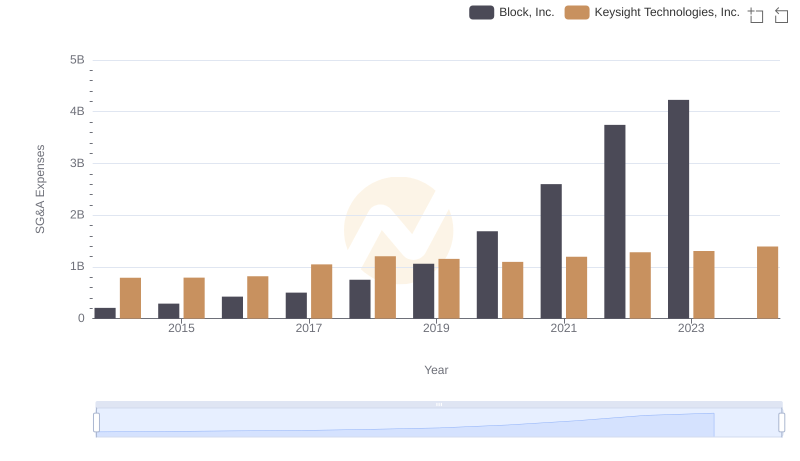

Selling, General, and Administrative Costs: Block, Inc. vs Keysight Technologies, Inc.