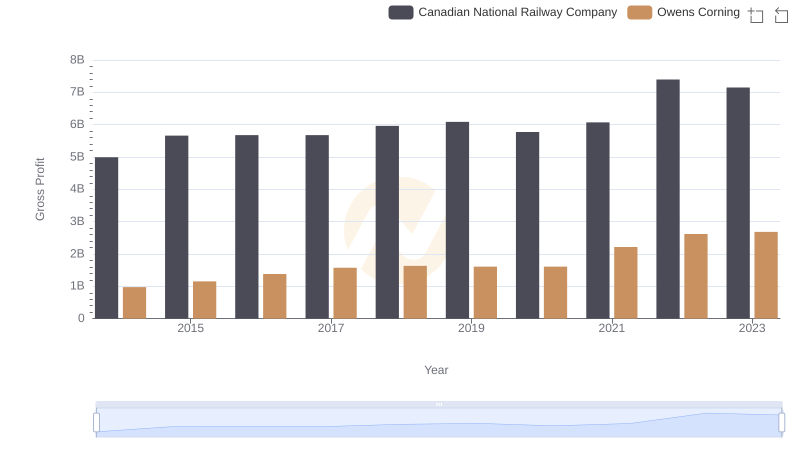

| __timestamp | Canadian National Railway Company | Owens Corning |

|---|---|---|

| Wednesday, January 1, 2014 | 12134000000 | 5276000000 |

| Thursday, January 1, 2015 | 12611000000 | 5350000000 |

| Friday, January 1, 2016 | 12037000000 | 5677000000 |

| Sunday, January 1, 2017 | 13041000000 | 6384000000 |

| Monday, January 1, 2018 | 14321000000 | 7057000000 |

| Tuesday, January 1, 2019 | 14917000000 | 7160000000 |

| Wednesday, January 1, 2020 | 13819000000 | 7055000000 |

| Friday, January 1, 2021 | 14477000000 | 8498000000 |

| Saturday, January 1, 2022 | 17107000000 | 9761000000 |

| Sunday, January 1, 2023 | 16828000000 | 9677000000 |

Unlocking the unknown

In the competitive landscape of North American industries, Canadian National Railway Company (CNR) and Owens Corning have showcased remarkable revenue trajectories over the past decade. From 2014 to 2023, CNR's revenue surged by approximately 39%, peaking in 2022 with a notable 17% increase from the previous year. This growth underscores CNR's strategic expansion and operational efficiency in the rail transport sector.

Conversely, Owens Corning, a leader in building materials, experienced a robust 84% revenue growth over the same period. The company reached its revenue zenith in 2022, marking a 38% rise since 2017. This impressive performance highlights Owens Corning's adaptability and innovation in a dynamic market.

Both companies exemplify resilience and strategic foresight, navigating economic fluctuations and industry challenges to achieve sustained growth. As we look to the future, these insights offer valuable lessons in corporate strategy and market adaptation.

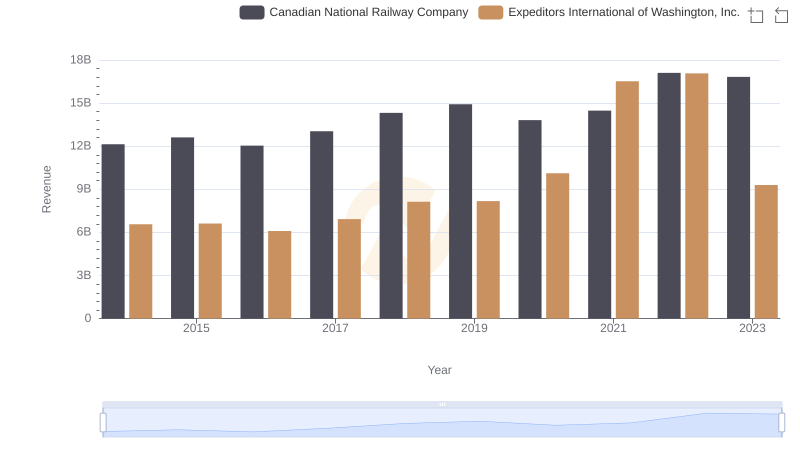

Canadian National Railway Company and Expeditors International of Washington, Inc.: A Comprehensive Revenue Analysis

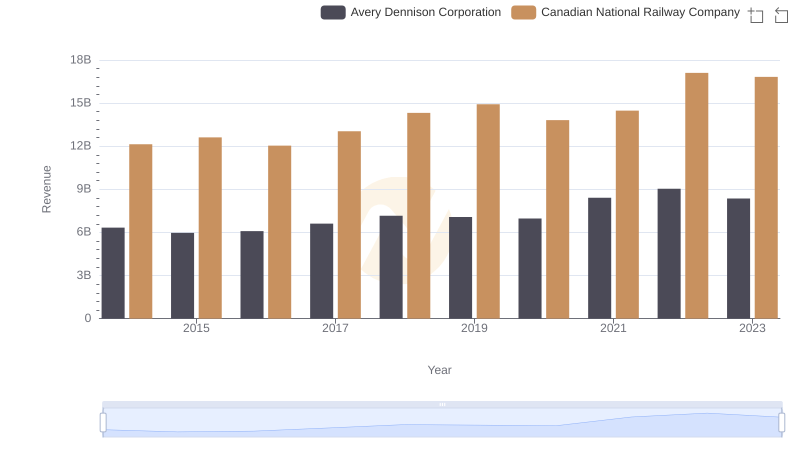

Canadian National Railway Company and Avery Dennison Corporation: A Comprehensive Revenue Analysis

Cost Insights: Breaking Down Canadian National Railway Company and Owens Corning's Expenses

Canadian National Railway Company and Owens Corning: A Detailed Gross Profit Analysis