| __timestamp | Canadian National Railway Company | Owens Corning |

|---|---|---|

| Wednesday, January 1, 2014 | 4992000000 | 976000000 |

| Thursday, January 1, 2015 | 5660000000 | 1153000000 |

| Friday, January 1, 2016 | 5675000000 | 1381000000 |

| Sunday, January 1, 2017 | 5675000000 | 1572000000 |

| Monday, January 1, 2018 | 5962000000 | 1632000000 |

| Tuesday, January 1, 2019 | 6085000000 | 1609000000 |

| Wednesday, January 1, 2020 | 5771000000 | 1610000000 |

| Friday, January 1, 2021 | 6069000000 | 2217000000 |

| Saturday, January 1, 2022 | 7396000000 | 2616000000 |

| Sunday, January 1, 2023 | 7151000000 | 2683000000 |

Data in motion

In the ever-evolving landscape of North American industries, Canadian National Railway Company and Owens Corning stand as titans in their respective fields. From 2014 to 2023, Canadian National Railway's gross profit surged by approximately 43%, peaking in 2022. This growth underscores the resilience and strategic prowess of the railway sector in adapting to economic shifts. Meanwhile, Owens Corning, a leader in building materials, witnessed a remarkable 175% increase in gross profit over the same period, reflecting the booming demand in construction and home improvement sectors.

The data reveals a fascinating narrative of industrial growth and adaptation. Canadian National Railway's consistent performance highlights the stability of transportation infrastructure, while Owens Corning's impressive gains showcase the dynamic nature of consumer-driven markets. As we delve into these insights, it becomes evident that both companies have adeptly navigated the challenges and opportunities of the past decade.

Revenue Insights: Canadian National Railway Company and Owens Corning Performance Compared

Cost Insights: Breaking Down Canadian National Railway Company and Owens Corning's Expenses

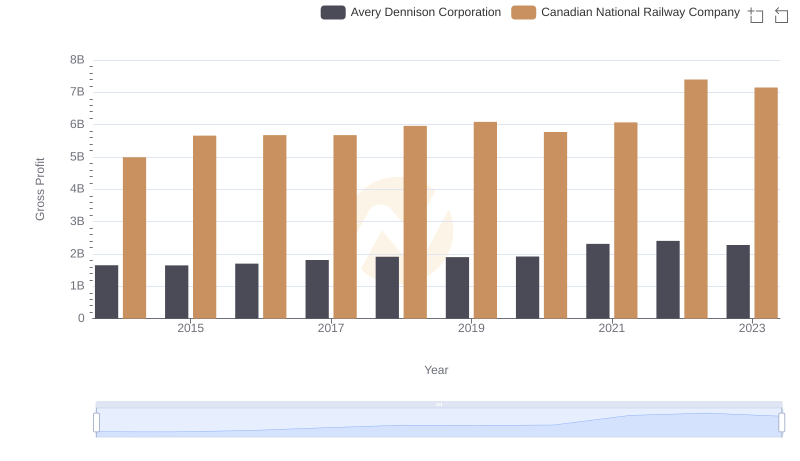

Gross Profit Comparison: Canadian National Railway Company and Avery Dennison Corporation Trends

Key Insights on Gross Profit: Canadian National Railway Company vs Comfort Systems USA, Inc.

Gross Profit Trends Compared: Canadian National Railway Company vs ZTO Express (Cayman) Inc.

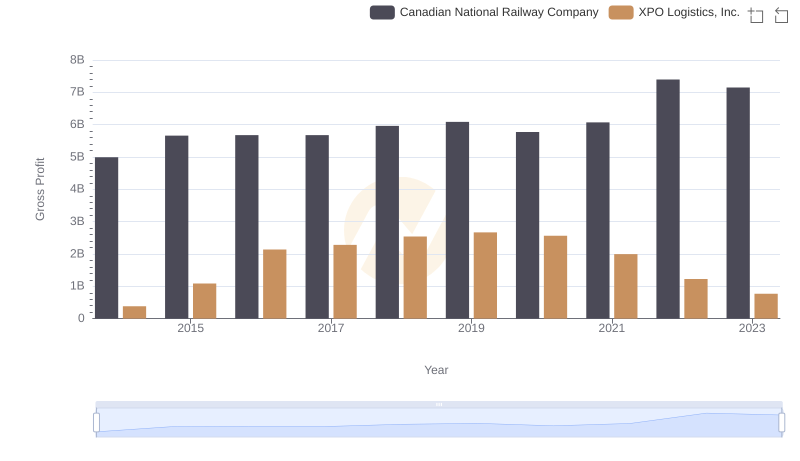

Who Generates Higher Gross Profit? Canadian National Railway Company or XPO Logistics, Inc.