| __timestamp | ON Semiconductor Corporation | Seagate Technology Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 380900000 | 722000000 |

| Thursday, January 1, 2015 | 386600000 | 857000000 |

| Friday, January 1, 2016 | 468300000 | 635000000 |

| Sunday, January 1, 2017 | 600800000 | 606000000 |

| Monday, January 1, 2018 | 618000000 | 562000000 |

| Tuesday, January 1, 2019 | 585000000 | 453000000 |

| Wednesday, January 1, 2020 | 537400000 | 473000000 |

| Friday, January 1, 2021 | 598400000 | 502000000 |

| Saturday, January 1, 2022 | 631100000 | 559000000 |

| Sunday, January 1, 2023 | 641500000 | 491000000 |

| Monday, January 1, 2024 | 649800000 | 460000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of technology, operational efficiency is paramount. Over the past decade, ON Semiconductor Corporation and Seagate Technology Holdings plc have showcased distinct trajectories in their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2023, ON Semiconductor's SG&A expenses have grown by approximately 68%, reflecting strategic investments in growth and innovation. In contrast, Seagate Technology's expenses have decreased by about 32%, indicating a focus on cost optimization and efficiency.

This analysis provides a window into how these tech giants are navigating the competitive landscape, balancing growth with operational efficiency.

Operational Costs Compared: SG&A Analysis of Apple Inc. and ON Semiconductor Corporation

NVIDIA Corporation vs ON Semiconductor Corporation: SG&A Expense Trends

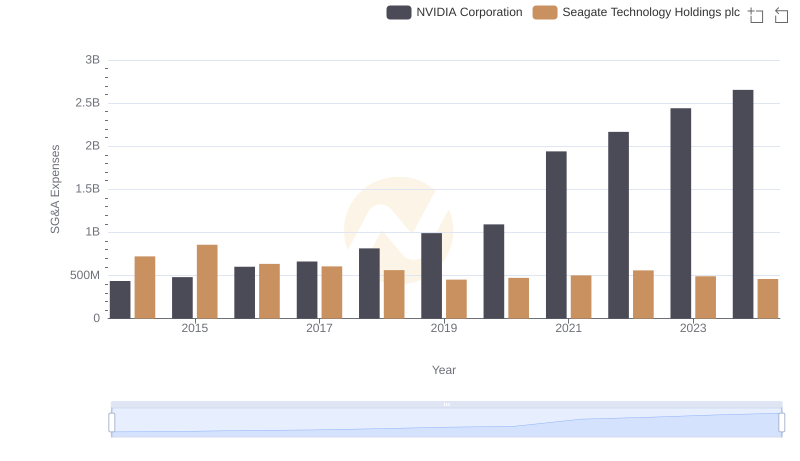

SG&A Efficiency Analysis: Comparing NVIDIA Corporation and Seagate Technology Holdings plc

Who Optimizes SG&A Costs Better? Taiwan Semiconductor Manufacturing Company Limited or ON Semiconductor Corporation

Taiwan Semiconductor Manufacturing Company Limited and Seagate Technology Holdings plc: SG&A Spending Patterns Compared

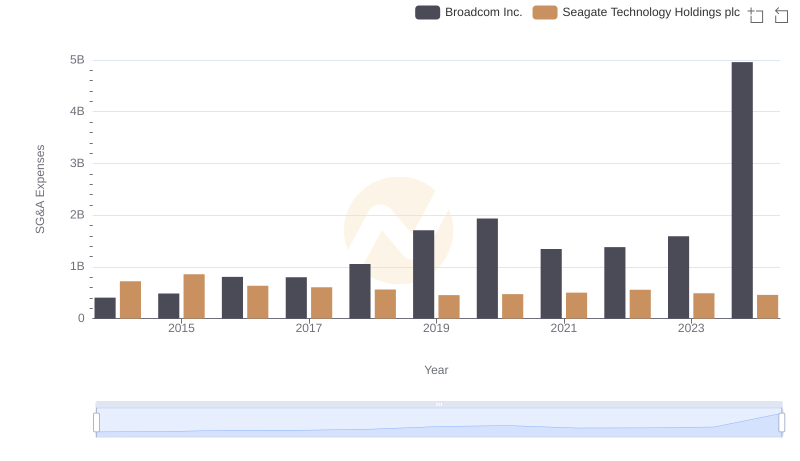

Who Optimizes SG&A Costs Better? Broadcom Inc. or Seagate Technology Holdings plc

SG&A Efficiency Analysis: Comparing Broadcom Inc. and ON Semiconductor Corporation

Who Generates More Revenue? ON Semiconductor Corporation or Seagate Technology Holdings plc

Cost of Revenue Comparison: ON Semiconductor Corporation vs Seagate Technology Holdings plc

ON Semiconductor Corporation vs Seagate Technology Holdings plc: A Gross Profit Performance Breakdown

Research and Development: Comparing Key Metrics for ON Semiconductor Corporation and Seagate Technology Holdings plc

EBITDA Metrics Evaluated: ON Semiconductor Corporation vs Seagate Technology Holdings plc