| __timestamp | ON Semiconductor Corporation | Seagate Technology Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 564800000 | 2665000000 |

| Thursday, January 1, 2015 | 631800000 | 2312000000 |

| Friday, January 1, 2016 | 727800000 | 1488000000 |

| Sunday, January 1, 2017 | 1196700000 | 1981000000 |

| Monday, January 1, 2018 | 1366800000 | 2328000000 |

| Tuesday, January 1, 2019 | 1210600000 | 2006000000 |

| Wednesday, January 1, 2020 | 1043400000 | 1761000000 |

| Friday, January 1, 2021 | 1981800000 | 1897000000 |

| Saturday, January 1, 2022 | 3338900000 | 2409000000 |

| Sunday, January 1, 2023 | 3220100000 | 301000000 |

| Monday, January 1, 2024 | 1767700000 | 1030000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of technology, two titans, ON Semiconductor Corporation and Seagate Technology Holdings plc, have showcased intriguing EBITDA trends over the past decade. From 2014 to 2023, ON Semiconductor's EBITDA surged by nearly 470%, peaking in 2022, while Seagate's performance exhibited more volatility, with a notable dip in 2023.

ON Semiconductor's EBITDA growth reflects its strategic positioning in the semiconductor industry, capitalizing on the increasing demand for electronic components. The company saw a remarkable increase from 2014 to 2022, with a significant leap in 2022, marking a 68% rise from the previous year.

Conversely, Seagate Technology, a leader in data storage solutions, experienced a more erratic EBITDA trajectory. Despite a strong start in 2014, Seagate faced challenges, culminating in a sharp decline in 2023, where EBITDA fell by 87% compared to 2022.

This comparative analysis highlights the dynamic nature of the tech industry, where strategic foresight and adaptability are key to sustained growth.

Apple Inc. and ON Semiconductor Corporation: A Detailed Examination of EBITDA Performance

Professional EBITDA Benchmarking: NVIDIA Corporation vs ON Semiconductor Corporation

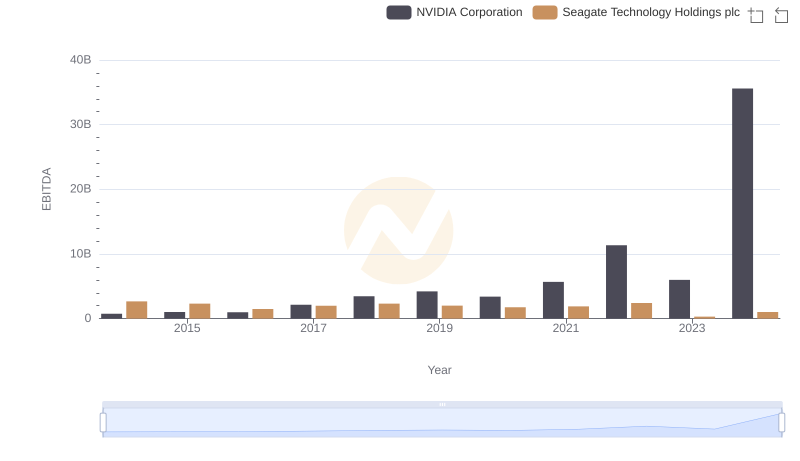

A Side-by-Side Analysis of EBITDA: NVIDIA Corporation and Seagate Technology Holdings plc

Professional EBITDA Benchmarking: Taiwan Semiconductor Manufacturing Company Limited vs ON Semiconductor Corporation

A Side-by-Side Analysis of EBITDA: Taiwan Semiconductor Manufacturing Company Limited and Seagate Technology Holdings plc

Professional EBITDA Benchmarking: Broadcom Inc. vs ON Semiconductor Corporation

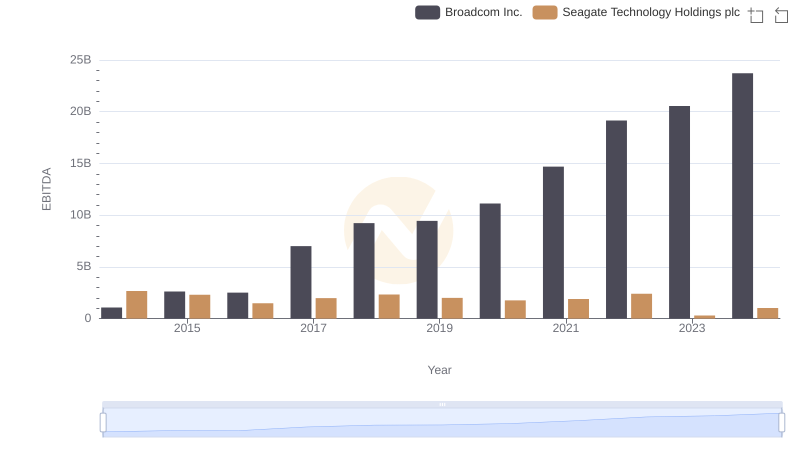

Comparative EBITDA Analysis: Broadcom Inc. vs Seagate Technology Holdings plc

Who Generates More Revenue? ON Semiconductor Corporation or Seagate Technology Holdings plc

Cost of Revenue Comparison: ON Semiconductor Corporation vs Seagate Technology Holdings plc

ON Semiconductor Corporation vs Seagate Technology Holdings plc: A Gross Profit Performance Breakdown

Research and Development: Comparing Key Metrics for ON Semiconductor Corporation and Seagate Technology Holdings plc

Operational Costs Compared: SG&A Analysis of ON Semiconductor Corporation and Seagate Technology Holdings plc