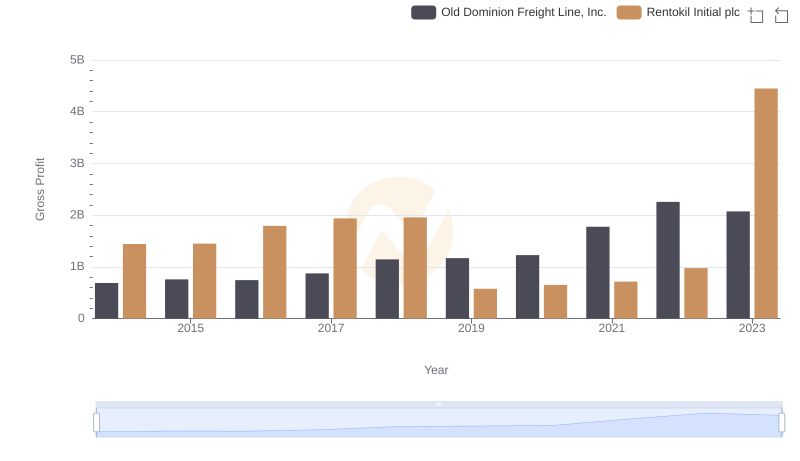

| __timestamp | Old Dominion Freight Line, Inc. | Rentokil Initial plc |

|---|---|---|

| Wednesday, January 1, 2014 | 144817000 | 935700000 |

| Thursday, January 1, 2015 | 153589000 | 965700000 |

| Friday, January 1, 2016 | 152391000 | 1197600000 |

| Sunday, January 1, 2017 | 177205000 | 1329600000 |

| Monday, January 1, 2018 | 194368000 | 1364000000 |

| Tuesday, January 1, 2019 | 206125000 | 322500000 |

| Wednesday, January 1, 2020 | 184185000 | 352000000 |

| Friday, January 1, 2021 | 223757000 | 348600000 |

| Saturday, January 1, 2022 | 258883000 | 479000000 |

| Sunday, January 1, 2023 | 281053000 | 2870000000 |

Unlocking the unknown

In the competitive world of logistics and services, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Old Dominion Freight Line, Inc. and Rentokil Initial plc, two industry giants, showcase contrasting strategies over the past decade. From 2014 to 2023, Old Dominion Freight Line, Inc. maintained a steady increase in SG&A expenses, peaking at approximately $281 million in 2023. This represents a growth of nearly 94% from 2014. In contrast, Rentokil Initial plc experienced a more volatile trajectory, with expenses surging to $2.87 billion in 2023, marking a staggering 207% increase from 2014. This divergence highlights Old Dominion's consistent cost management approach, while Rentokil's fluctuations suggest a more dynamic strategy. As businesses navigate economic uncertainties, these insights offer valuable lessons in balancing growth with cost efficiency.

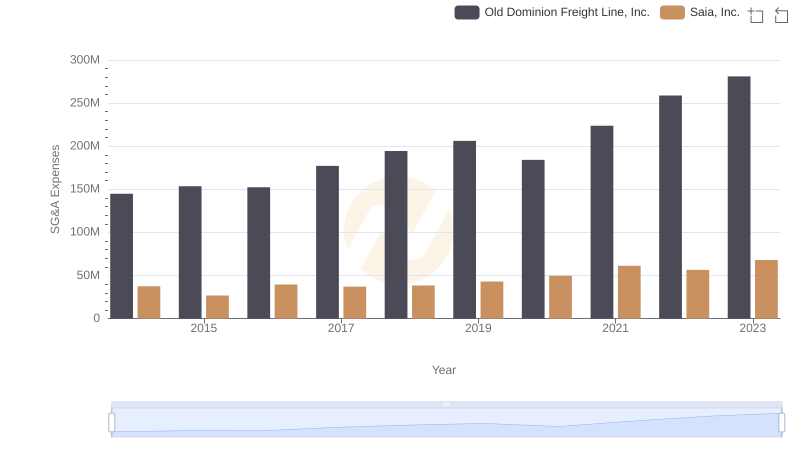

Breaking Down SG&A Expenses: Old Dominion Freight Line, Inc. vs Saia, Inc.

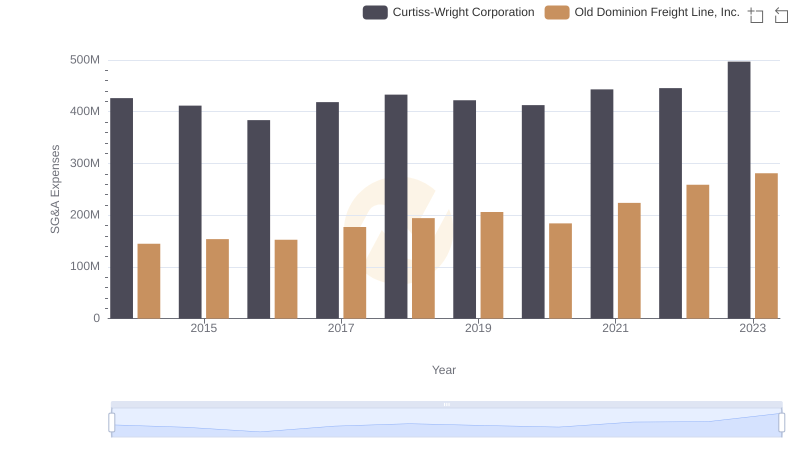

Cost Management Insights: SG&A Expenses for Old Dominion Freight Line, Inc. and Curtiss-Wright Corporation

Gross Profit Comparison: Old Dominion Freight Line, Inc. and Rentokil Initial plc Trends

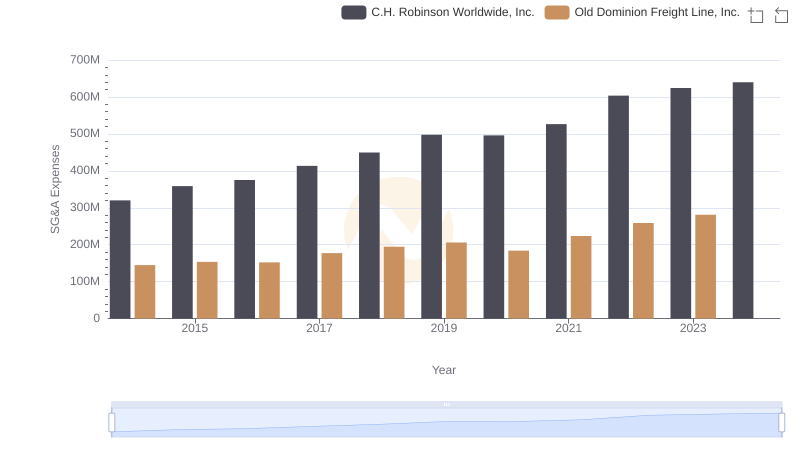

Comparing SG&A Expenses: Old Dominion Freight Line, Inc. vs C.H. Robinson Worldwide, Inc. Trends and Insights

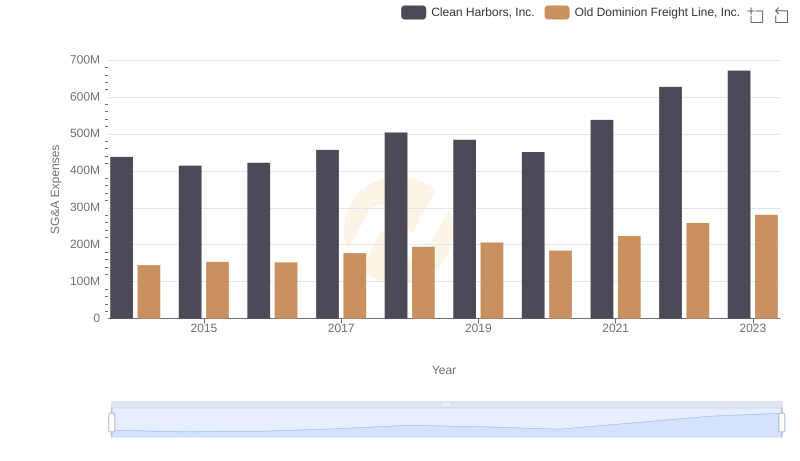

Selling, General, and Administrative Costs: Old Dominion Freight Line, Inc. vs Clean Harbors, Inc.

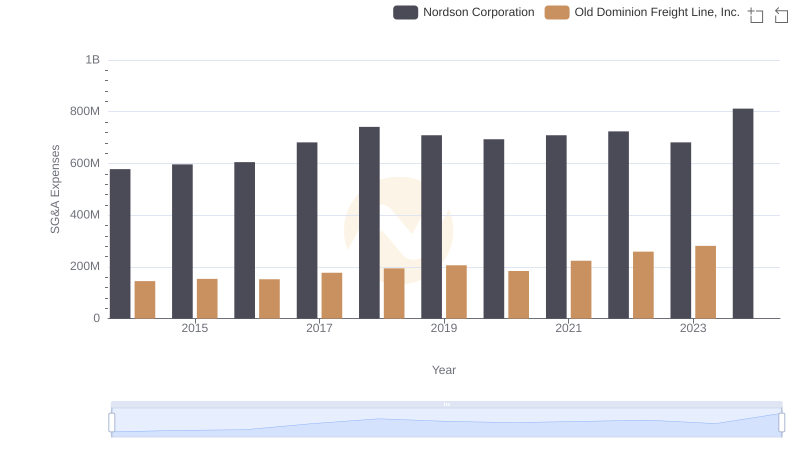

Breaking Down SG&A Expenses: Old Dominion Freight Line, Inc. vs Nordson Corporation

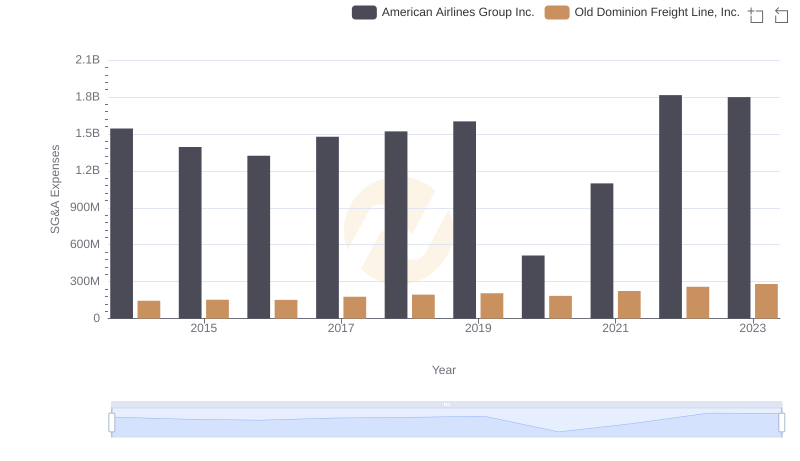

Old Dominion Freight Line, Inc. and American Airlines Group Inc.: SG&A Spending Patterns Compared

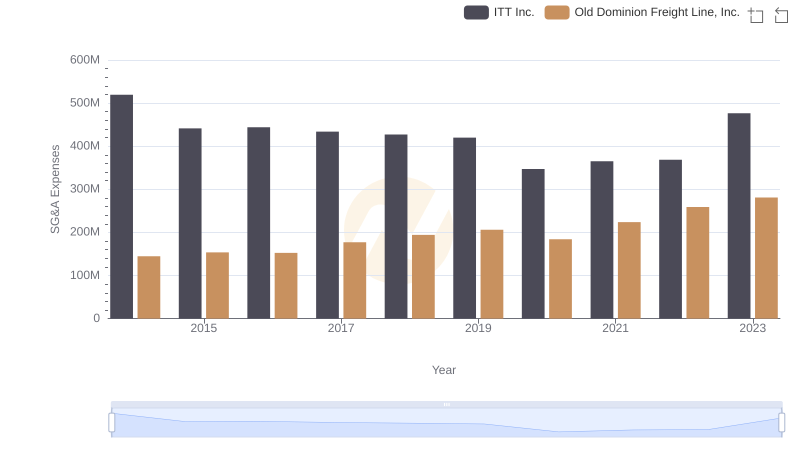

Old Dominion Freight Line, Inc. and ITT Inc.: SG&A Spending Patterns Compared