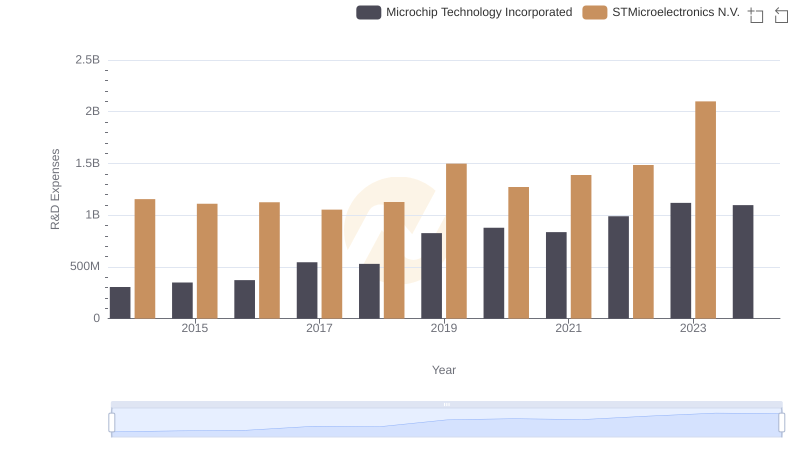

| __timestamp | Microchip Technology Incorporated | STMicroelectronics N.V. |

|---|---|---|

| Wednesday, January 1, 2014 | 651027000 | 1069000000 |

| Thursday, January 1, 2015 | 731158000 | 887000000 |

| Friday, January 1, 2016 | 668482000 | 1001000000 |

| Sunday, January 1, 2017 | 705341000 | 1655000000 |

| Monday, January 1, 2018 | 1552200000 | 2197000000 |

| Tuesday, January 1, 2019 | 1624400000 | 2040000000 |

| Wednesday, January 1, 2020 | 1909400000 | 2266000000 |

| Friday, January 1, 2021 | 2153100000 | 3611000000 |

| Saturday, January 1, 2022 | 3022600000 | 6397000000 |

| Sunday, January 1, 2023 | 4112000000 | 6379000000 |

| Monday, January 1, 2024 | 3438200000 |

In pursuit of knowledge

In the ever-evolving semiconductor industry, two titans, Microchip Technology Incorporated and STMicroelectronics N.V., have been vying for dominance. Over the past decade, their EBITDA performance has painted a fascinating picture of growth and competition.

From 2014 to 2023, Microchip Technology's EBITDA surged by over 530%, peaking in 2023. Meanwhile, STMicroelectronics saw an impressive 497% increase, with its highest EBITDA recorded in 2022. This growth underscores the robust demand for semiconductors in a tech-driven world.

While both companies have shown remarkable growth, STMicroelectronics consistently outperformed Microchip Technology in EBITDA, except in 2023, when the gap narrowed significantly. This shift highlights the dynamic nature of the industry and the potential for Microchip Technology to close the gap further.

As we move into 2024, the absence of data for STMicroelectronics leaves room for speculation. Will Microchip Technology seize the opportunity to lead, or will STMicroelectronics maintain its edge? The coming years promise to be as exciting as the last.

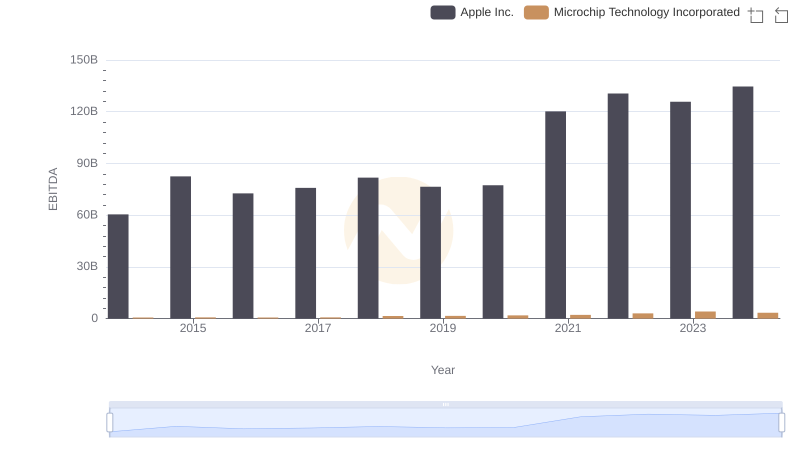

EBITDA Analysis: Evaluating Apple Inc. Against Microchip Technology Incorporated

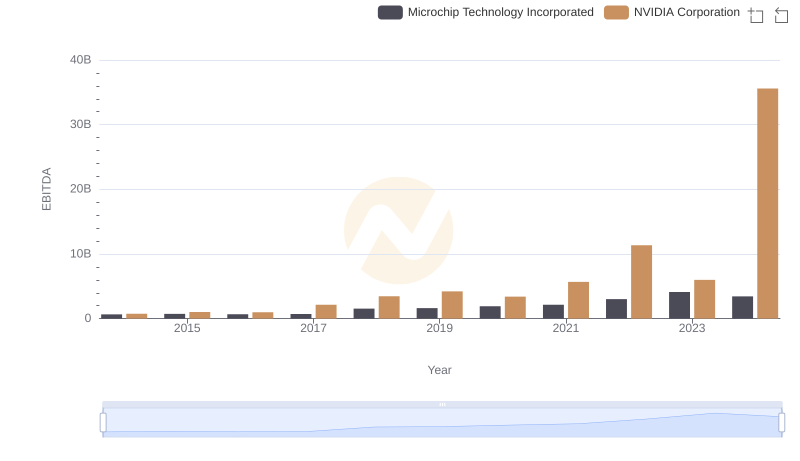

NVIDIA Corporation and Microchip Technology Incorporated: A Detailed Examination of EBITDA Performance

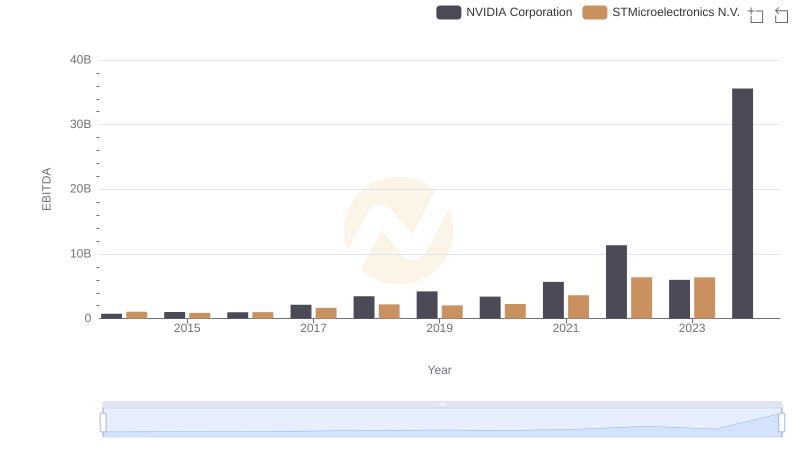

A Side-by-Side Analysis of EBITDA: NVIDIA Corporation and STMicroelectronics N.V.

EBITDA Analysis: Evaluating Taiwan Semiconductor Manufacturing Company Limited Against Microchip Technology Incorporated

EBITDA Performance Review: Taiwan Semiconductor Manufacturing Company Limited vs STMicroelectronics N.V.

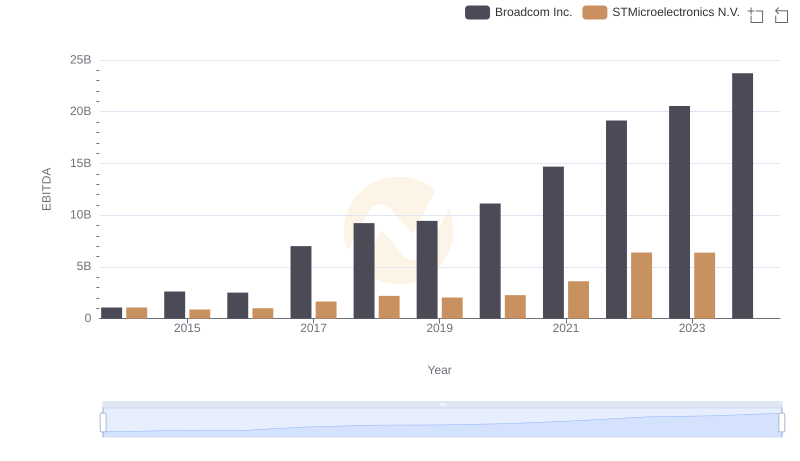

EBITDA Performance Review: Broadcom Inc. vs STMicroelectronics N.V.

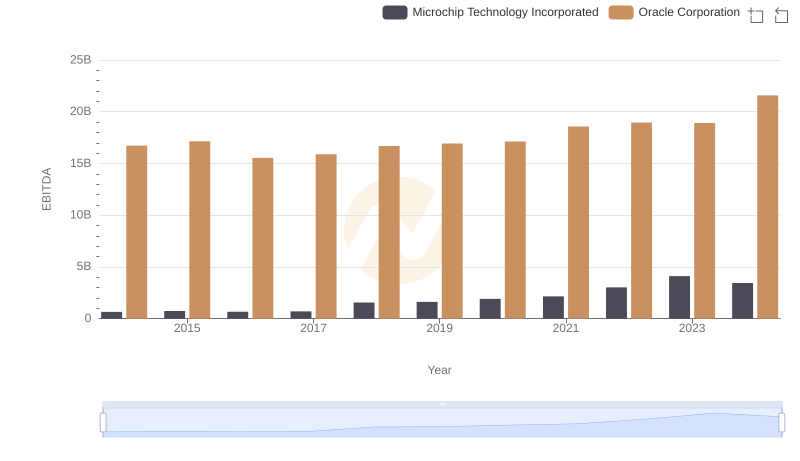

Oracle Corporation and Microchip Technology Incorporated: A Detailed Examination of EBITDA Performance

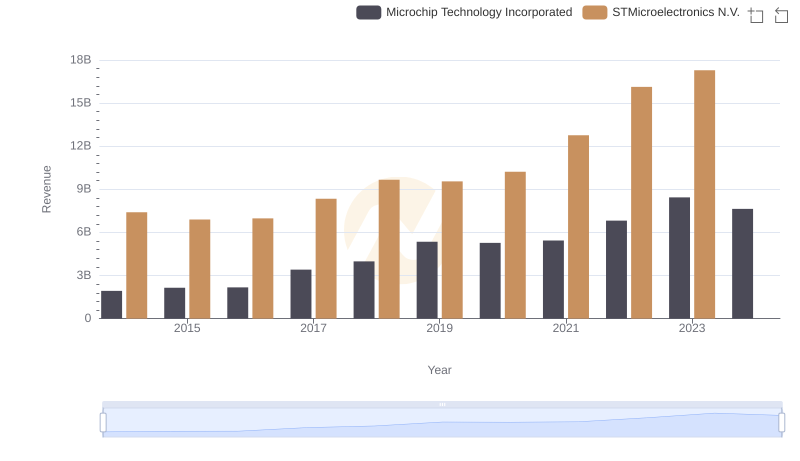

Breaking Down Revenue Trends: Microchip Technology Incorporated vs STMicroelectronics N.V.

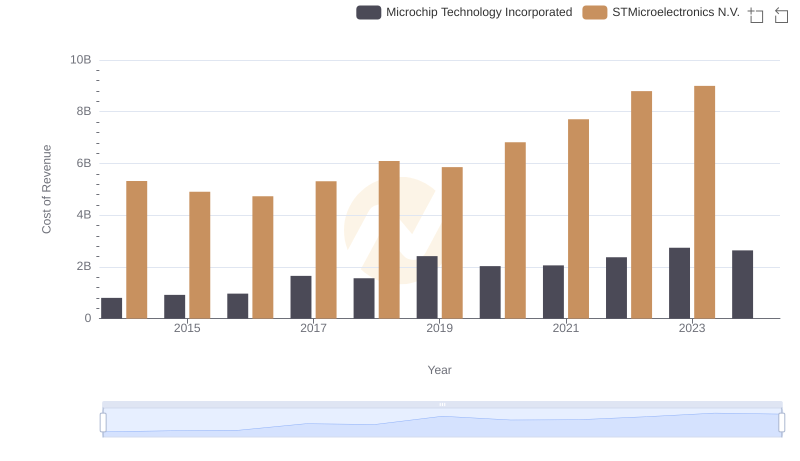

Cost of Revenue Comparison: Microchip Technology Incorporated vs STMicroelectronics N.V.

Key Insights on Gross Profit: Microchip Technology Incorporated vs STMicroelectronics N.V.

Microchip Technology Incorporated or STMicroelectronics N.V.: Who Invests More in Innovation?

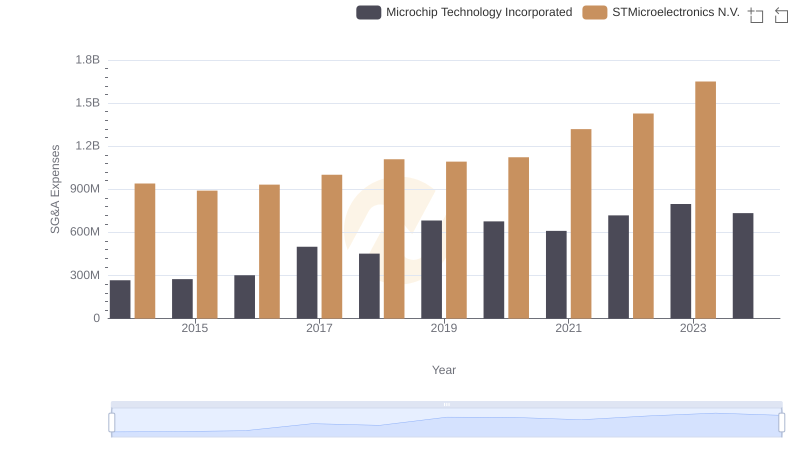

Breaking Down SG&A Expenses: Microchip Technology Incorporated vs STMicroelectronics N.V.