| __timestamp | Microchip Technology Incorporated | STMicroelectronics N.V. |

|---|---|---|

| Wednesday, January 1, 2014 | 305043000 | 1155000000 |

| Thursday, January 1, 2015 | 349543000 | 1111000000 |

| Friday, January 1, 2016 | 372596000 | 1125000000 |

| Sunday, January 1, 2017 | 545293000 | 1054000000 |

| Monday, January 1, 2018 | 529300000 | 1127000000 |

| Tuesday, January 1, 2019 | 826300000 | 1498000000 |

| Wednesday, January 1, 2020 | 877800000 | 1272000000 |

| Friday, January 1, 2021 | 836400000 | 1388000000 |

| Saturday, January 1, 2022 | 989100000 | 1485000000 |

| Sunday, January 1, 2023 | 1118300000 | 2100000000 |

| Monday, January 1, 2024 | 1097400000 |

Unleashing insights

In the ever-evolving semiconductor industry, innovation is the key to staying ahead. Microchip Technology Incorporated and STMicroelectronics N.V. are two titans in this field, each with a unique approach to research and development (R&D) investment. Over the past decade, STMicroelectronics has consistently outpaced Microchip Technology in R&D spending, investing nearly 70% more on average. In 2023, STMicroelectronics reached a peak, allocating 2.1 billion dollars to R&D, a 90% increase from 2014. Meanwhile, Microchip Technology has shown a steady growth, with its R&D expenses rising by approximately 266% over the same period. This trend highlights STMicroelectronics' aggressive strategy in innovation, while Microchip Technology's gradual increase suggests a more conservative approach. As we look to the future, these investment patterns will likely shape the competitive landscape of the semiconductor industry.

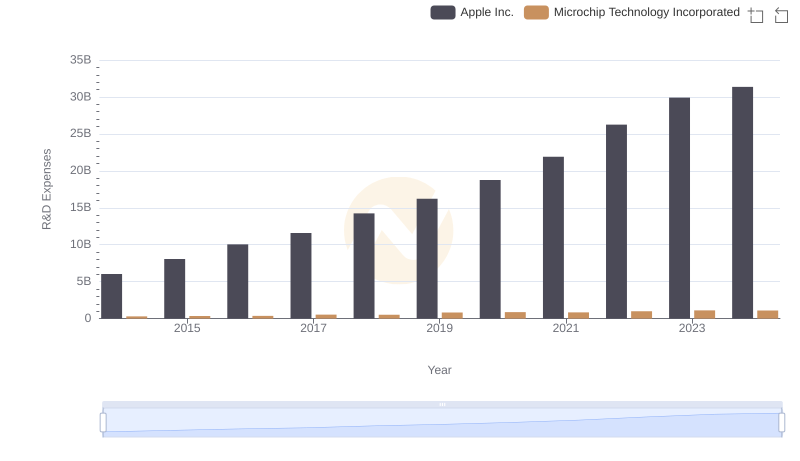

Comparing Innovation Spending: Apple Inc. and Microchip Technology Incorporated

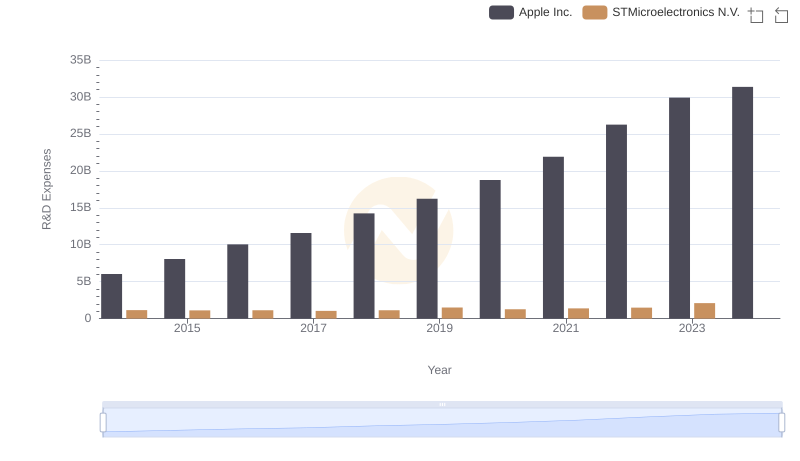

R&D Insights: How Apple Inc. and STMicroelectronics N.V. Allocate Funds

Who Prioritizes Innovation? R&D Spending Compared for NVIDIA Corporation and STMicroelectronics N.V.

Analyzing R&D Budgets: Taiwan Semiconductor Manufacturing Company Limited vs Microchip Technology Incorporated

Taiwan Semiconductor Manufacturing Company Limited vs STMicroelectronics N.V.: Strategic Focus on R&D Spending

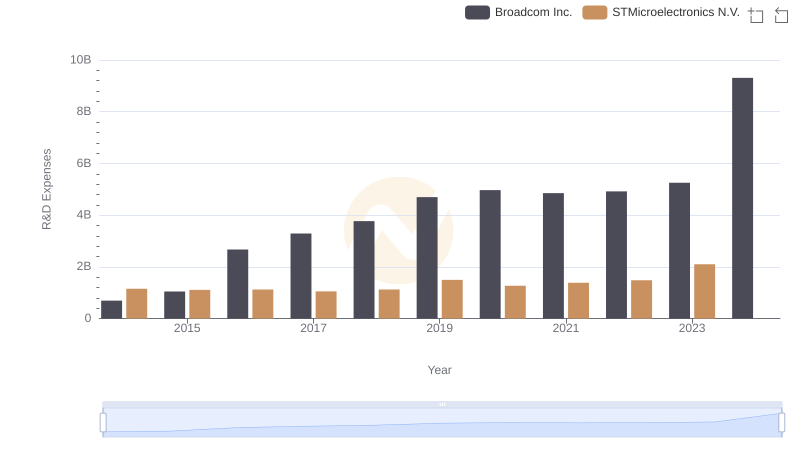

Comparing Innovation Spending: Broadcom Inc. and STMicroelectronics N.V.

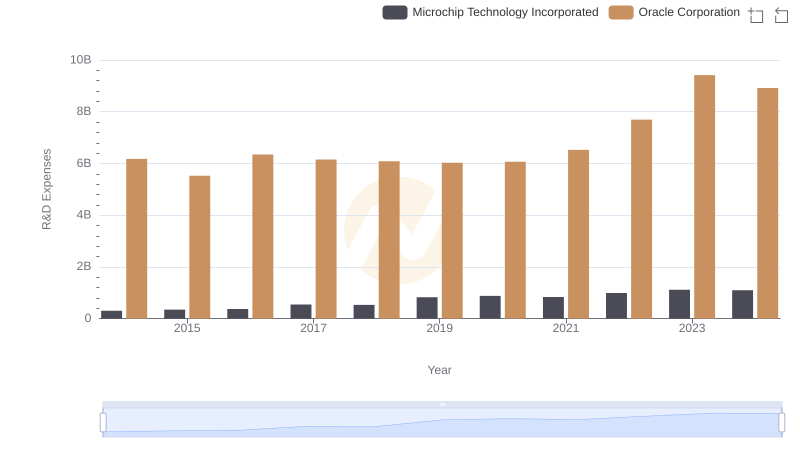

Oracle Corporation or Microchip Technology Incorporated: Who Invests More in Innovation?

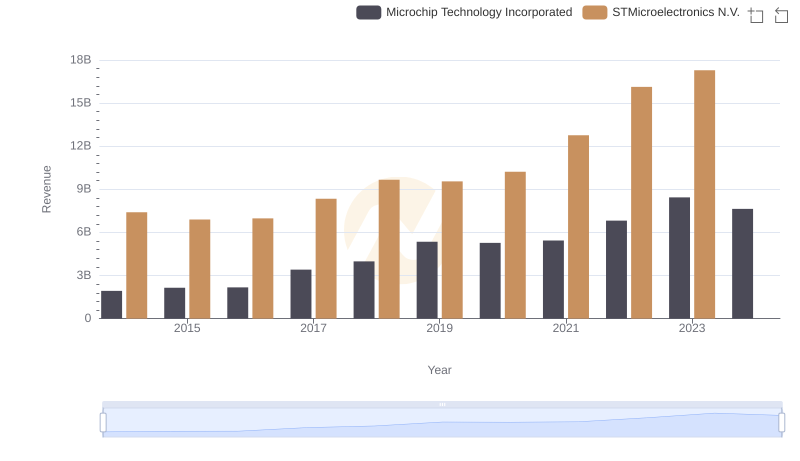

Breaking Down Revenue Trends: Microchip Technology Incorporated vs STMicroelectronics N.V.

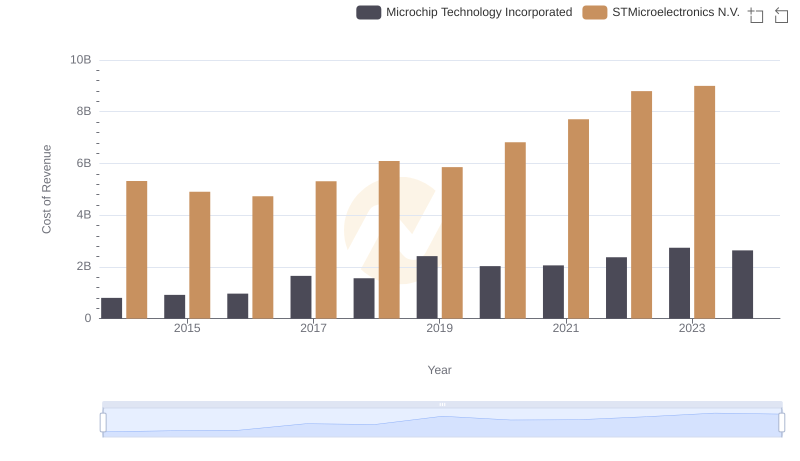

Cost of Revenue Comparison: Microchip Technology Incorporated vs STMicroelectronics N.V.

Key Insights on Gross Profit: Microchip Technology Incorporated vs STMicroelectronics N.V.

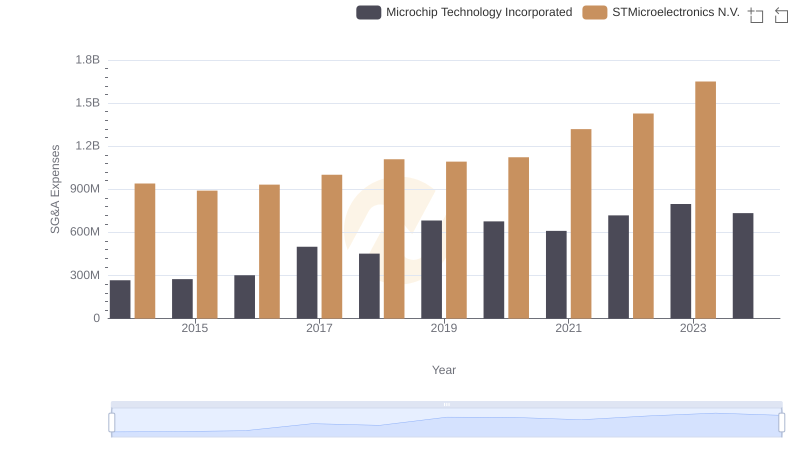

Breaking Down SG&A Expenses: Microchip Technology Incorporated vs STMicroelectronics N.V.

Microchip Technology Incorporated vs STMicroelectronics N.V.: In-Depth EBITDA Performance Comparison