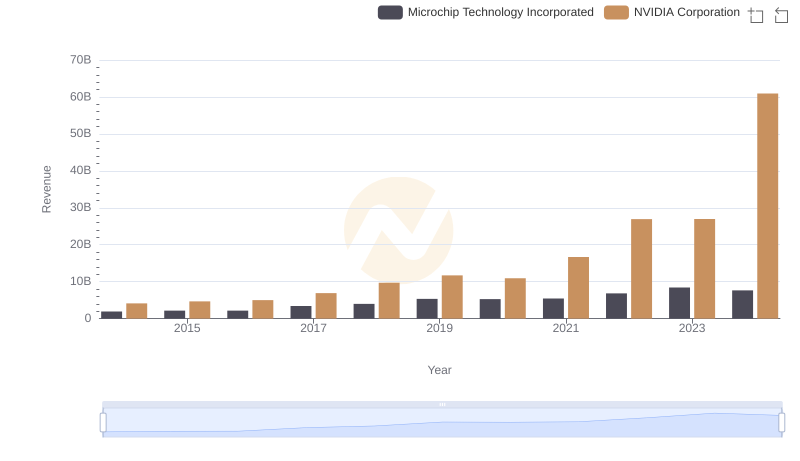

| __timestamp | Microchip Technology Incorporated | STMicroelectronics N.V. |

|---|---|---|

| Wednesday, January 1, 2014 | 1931217000 | 7404000000 |

| Thursday, January 1, 2015 | 2147036000 | 6897000000 |

| Friday, January 1, 2016 | 2173334000 | 6973000000 |

| Sunday, January 1, 2017 | 3407807000 | 8347000000 |

| Monday, January 1, 2018 | 3980800000 | 9664000000 |

| Tuesday, January 1, 2019 | 5349500000 | 9556000000 |

| Wednesday, January 1, 2020 | 5274200000 | 10219000000 |

| Friday, January 1, 2021 | 5438400000 | 12761000000 |

| Saturday, January 1, 2022 | 6820900000 | 16128000000 |

| Sunday, January 1, 2023 | 8438700000 | 17286000000 |

| Monday, January 1, 2024 | 7634400000 |

Unveiling the hidden dimensions of data

In the ever-evolving semiconductor industry, Microchip Technology Incorporated and STMicroelectronics N.V. have been pivotal players. Over the past decade, these companies have showcased distinct revenue trajectories. From 2014 to 2023, Microchip Technology's revenue surged by approximately 337%, peaking in 2023. Meanwhile, STMicroelectronics experienced a robust 133% growth, reaching its zenith in the same year.

Microchip Technology's revenue growth was particularly notable between 2018 and 2023, with a 112% increase, reflecting its strategic market expansions and innovations. On the other hand, STMicroelectronics demonstrated consistent growth, with a remarkable 70% rise from 2020 to 2023, underscoring its resilience and adaptability in a competitive landscape.

While 2024 data for STMicroelectronics remains elusive, the trends thus far highlight the dynamic nature of the semiconductor sector, where innovation and strategic foresight are key to sustained growth.

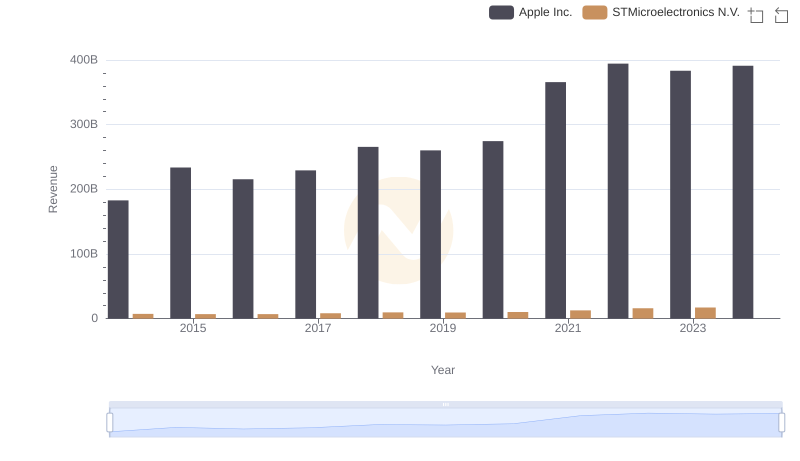

Revenue Insights: Apple Inc. and STMicroelectronics N.V. Performance Compared

NVIDIA Corporation and Microchip Technology Incorporated: A Comprehensive Revenue Analysis

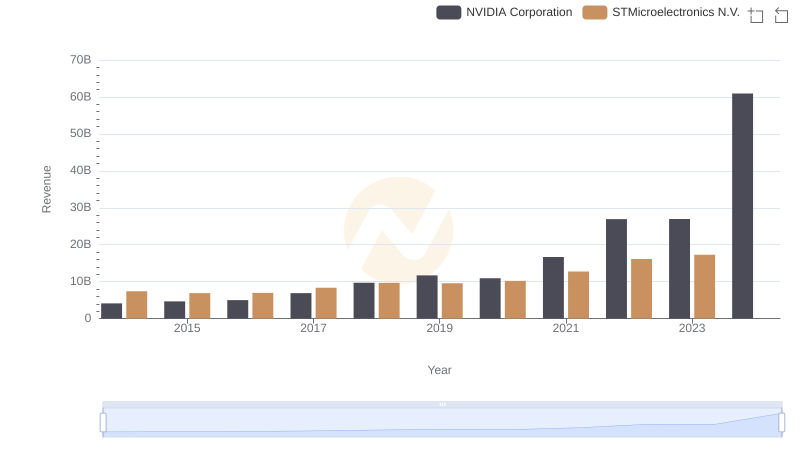

Comparing Revenue Performance: NVIDIA Corporation or STMicroelectronics N.V.?

Taiwan Semiconductor Manufacturing Company Limited vs Microchip Technology Incorporated: Examining Key Revenue Metrics

Taiwan Semiconductor Manufacturing Company Limited and STMicroelectronics N.V.: A Comprehensive Revenue Analysis

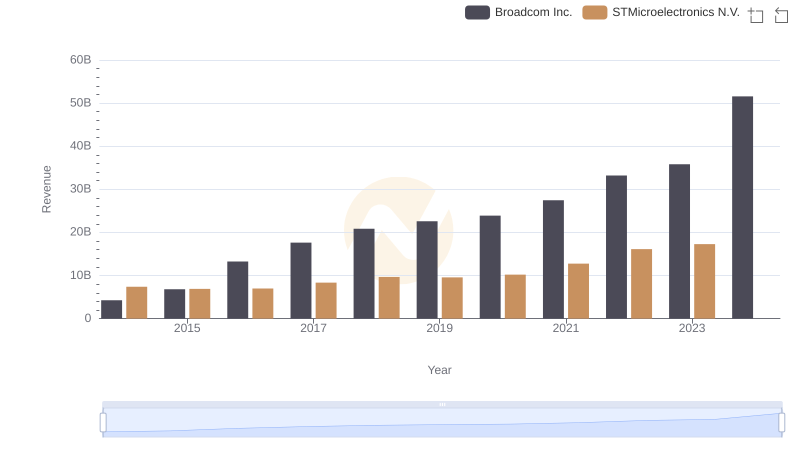

Annual Revenue Comparison: Broadcom Inc. vs STMicroelectronics N.V.

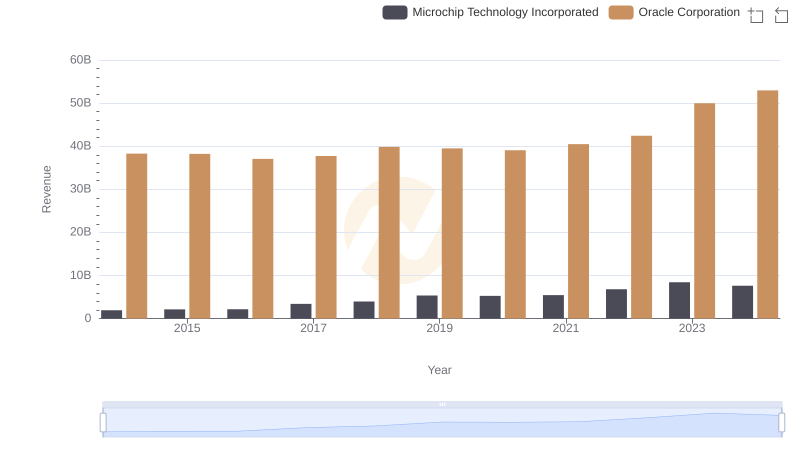

Revenue Insights: Oracle Corporation and Microchip Technology Incorporated Performance Compared

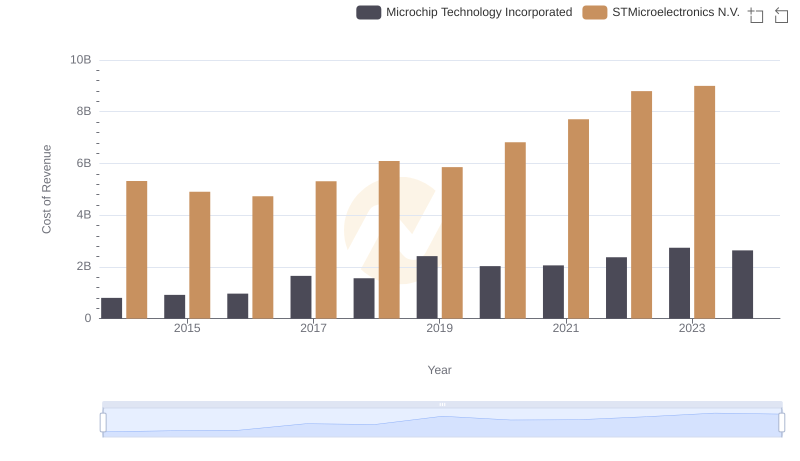

Cost of Revenue Comparison: Microchip Technology Incorporated vs STMicroelectronics N.V.

Key Insights on Gross Profit: Microchip Technology Incorporated vs STMicroelectronics N.V.

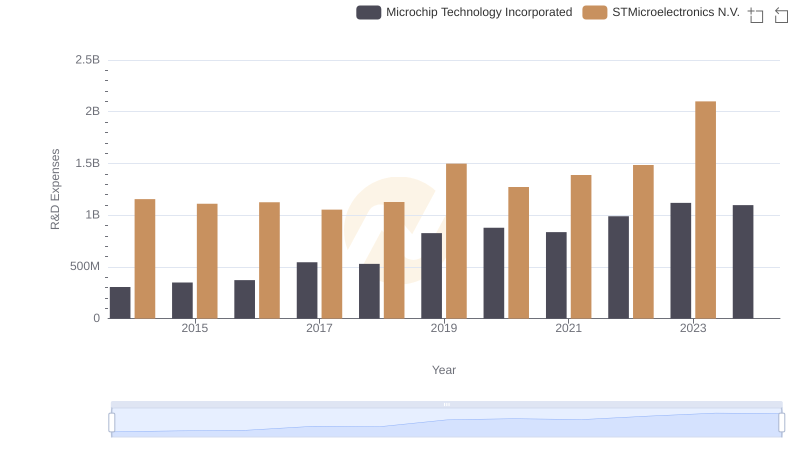

Microchip Technology Incorporated or STMicroelectronics N.V.: Who Invests More in Innovation?

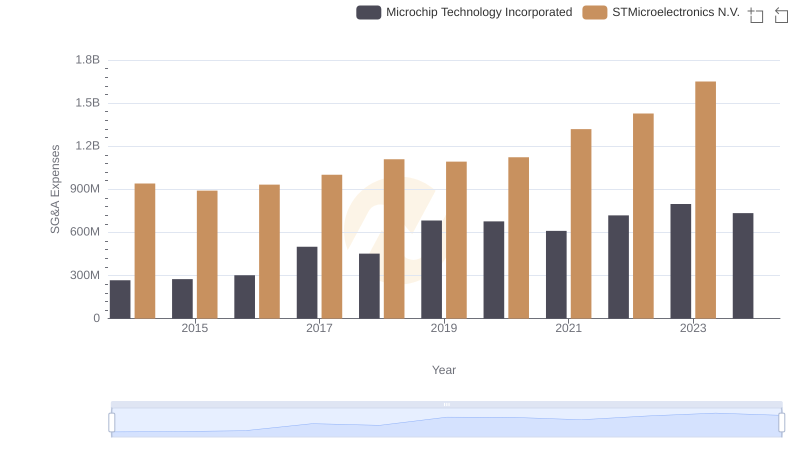

Breaking Down SG&A Expenses: Microchip Technology Incorporated vs STMicroelectronics N.V.

Microchip Technology Incorporated vs STMicroelectronics N.V.: In-Depth EBITDA Performance Comparison