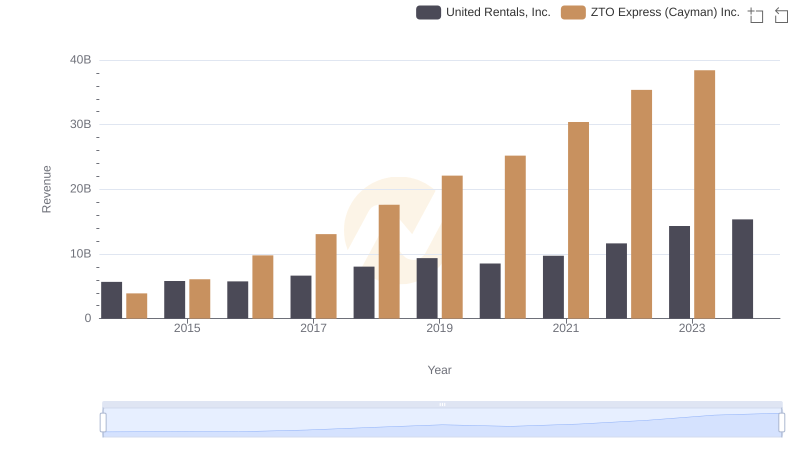

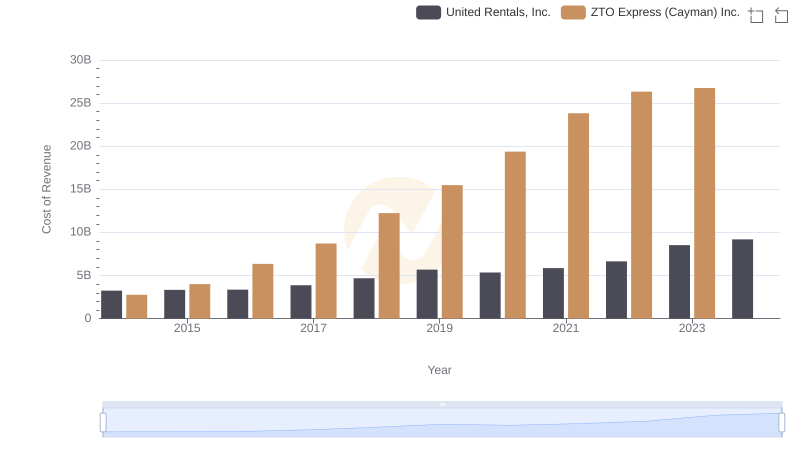

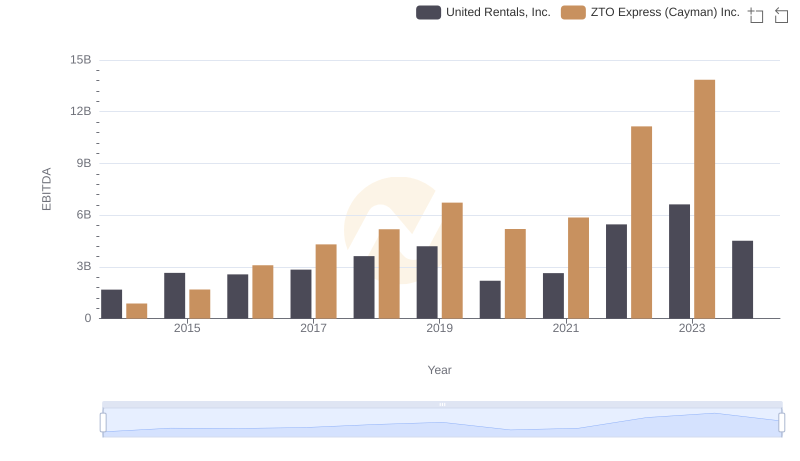

| __timestamp | United Rentals, Inc. | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2432000000 | 1133042000 |

| Thursday, January 1, 2015 | 2480000000 | 2087718000 |

| Friday, January 1, 2016 | 2403000000 | 3442869000 |

| Sunday, January 1, 2017 | 2769000000 | 4345584000 |

| Monday, January 1, 2018 | 3364000000 | 5364883000 |

| Tuesday, January 1, 2019 | 3670000000 | 6621168000 |

| Wednesday, January 1, 2020 | 3183000000 | 5837106000 |

| Friday, January 1, 2021 | 3853000000 | 6589377000 |

| Saturday, January 1, 2022 | 4996000000 | 9039275000 |

| Sunday, January 1, 2023 | 5813000000 | 11662526000 |

| Monday, January 1, 2024 | 6150000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of global business, understanding financial performance metrics is crucial for investors, analysts, and stakeholders alike. One of the key indicators of a company's operational efficiency is its gross profit, which reflects the revenue remaining after deducting the cost of goods sold. This article delves into the gross profit trends of two prominent companies: United Rentals, Inc. and ZTO Express (Cayman) Inc., over the past decade.

From 2014 to 2023, both United Rentals and ZTO Express have showcased remarkable growth trajectories, albeit in different sectors. United Rentals, a leader in equipment rental services, has seen its gross profit rise from approximately $2.43 billion in 2014 to an impressive $6.15 billion in 2024. This represents a staggering increase of around 153%, highlighting the company's robust expansion and market penetration strategies.

Conversely, ZTO Express, a major player in the logistics and express delivery sector, has experienced even more dramatic growth. Starting at about $1.13 billion in gross profit in 2014, ZTO Express's figures soared to an estimated $11.66 billion in 2024, marking an astronomical increase of over 931%. This growth can be attributed to the booming e-commerce sector and the increasing demand for efficient logistics solutions in China and beyond.

Analyzing the year-on-year performance reveals interesting insights. For instance, in 2018, United Rentals reported a gross profit of approximately $3.36 billion, while ZTO Express achieved about $5.36 billion. This indicates that ZTO Express was already outperforming United Rentals by roughly 60% at that time. Fast forward to 2023, and the gap has widened significantly, with United Rentals at $5.81 billion and ZTO Express at $11.66 billion, showcasing a remarkable 100% increase in the latter's gross profit compared to the former.

The data also indicates that while United Rentals has maintained a steady growth rate, ZTO Express has shown more volatility, particularly in the years following the pandemic, where demand for logistics surged. The fluctuations in ZTO's gross profit can be attributed to the rapid scaling of operations and the challenges posed by supply chain disruptions.

The contrasting growth patterns of these two companies underscore the impact of market dynamics and sector-specific trends. United Rentals benefits from a diversified portfolio and a strong presence in the North American market, while ZTO Express capitalizes on the exponential growth of e-commerce and the increasing reliance on logistics services.

Despite the impressive figures, it is essential to note that the data for 2024 is not fully available for ZTO Express, leaving a gap in the comparative analysis. This missing data could potentially alter the narrative of growth and profitability if future reports reveal unexpected downturns or challenges.

In conclusion, the gross profit trends of United Rentals and ZTO Express provide valuable insights into their operational efficiencies and market positioning. Investors should consider these trends, along with the broader economic context, when making informed decisions. As both companies continue to navigate their respective industries, their ability to adapt to changing market conditions will be pivotal in sustaining their growth trajectories.

Understanding these financial metrics not only aids in investment decisions but also highlights the importance of strategic planning and market responsiveness in achieving long-term success.

United Rentals, Inc. and ZTO Express (Cayman) Inc.: A Comprehensive Revenue Analysis

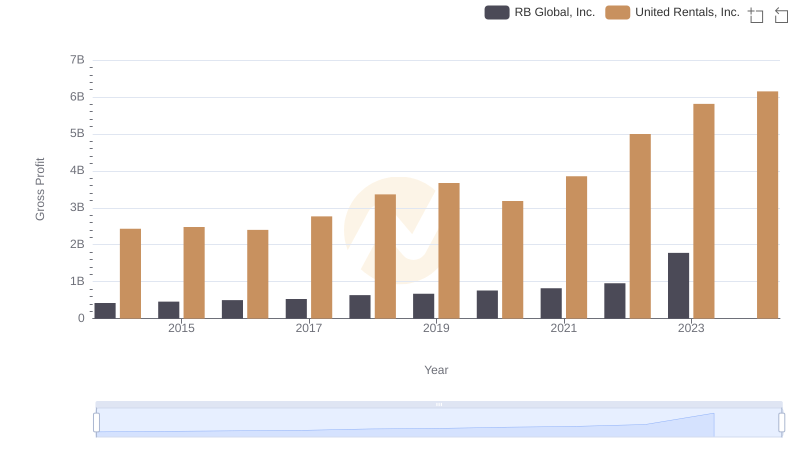

Who Generates Higher Gross Profit? United Rentals, Inc. or RB Global, Inc.

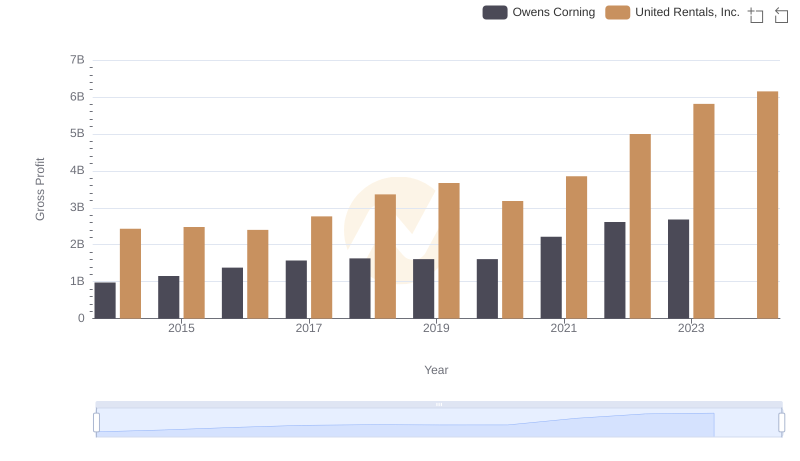

United Rentals, Inc. and Owens Corning: A Detailed Gross Profit Analysis

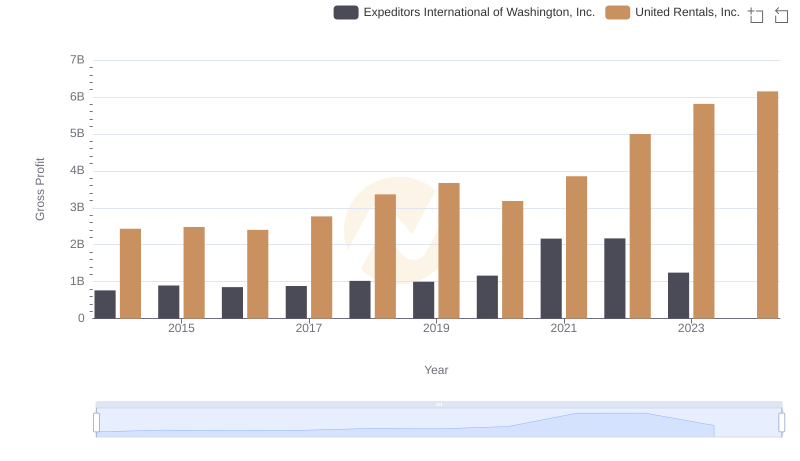

United Rentals, Inc. vs Expeditors International of Washington, Inc.: A Gross Profit Performance Breakdown

Comparing Cost of Revenue Efficiency: United Rentals, Inc. vs ZTO Express (Cayman) Inc.

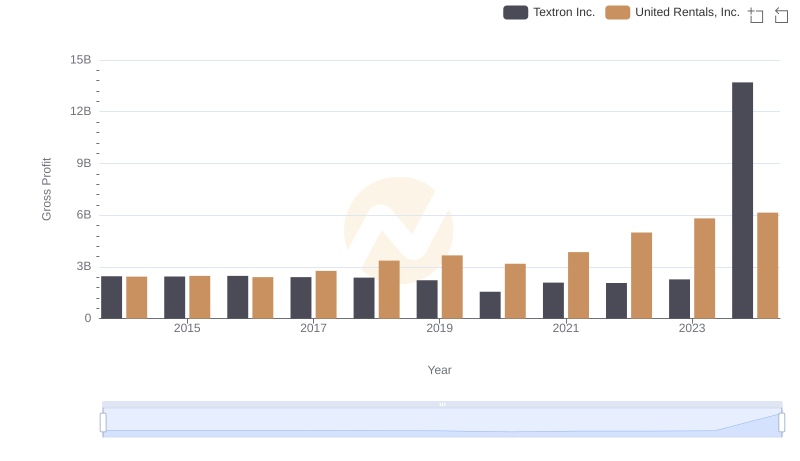

United Rentals, Inc. vs Textron Inc.: A Gross Profit Performance Breakdown

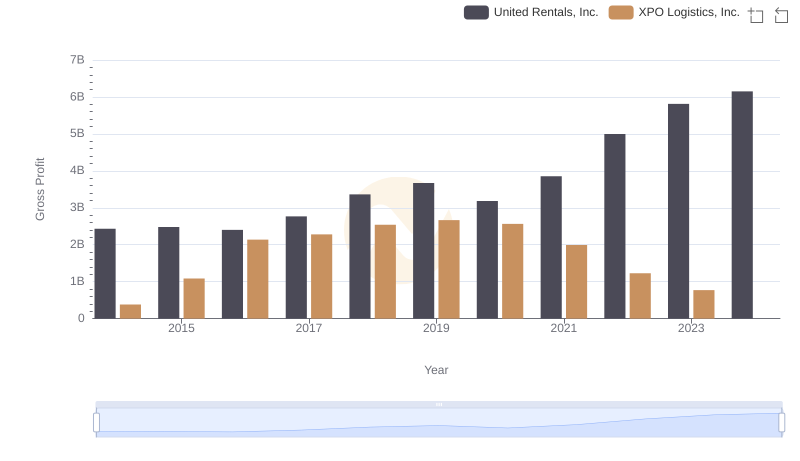

United Rentals, Inc. vs XPO Logistics, Inc.: A Gross Profit Performance Breakdown

United Rentals, Inc. and Avery Dennison Corporation: A Detailed Gross Profit Analysis

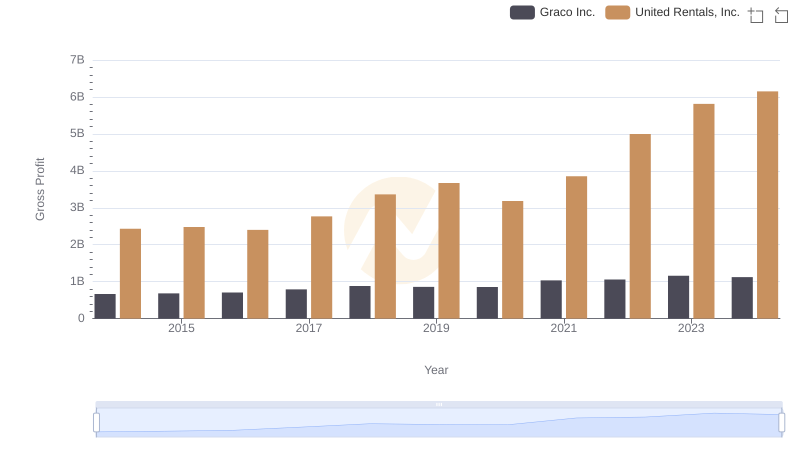

Gross Profit Comparison: United Rentals, Inc. and Graco Inc. Trends

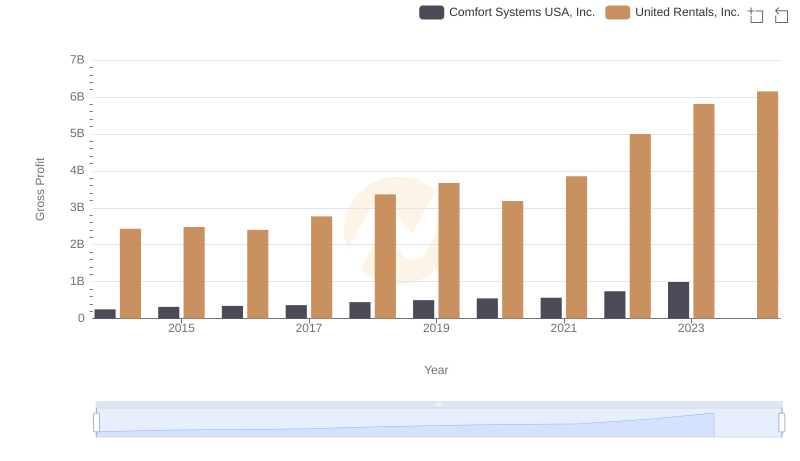

Gross Profit Trends Compared: United Rentals, Inc. vs Comfort Systems USA, Inc.

Comparative EBITDA Analysis: United Rentals, Inc. vs ZTO Express (Cayman) Inc.