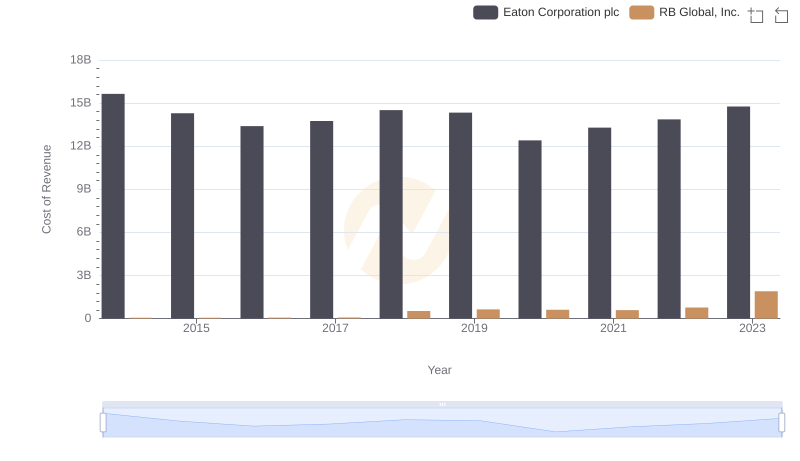

| __timestamp | Eaton Corporation plc | RB Global, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3586000000 | 178851000 |

| Thursday, January 1, 2015 | 3302000000 | 211417000 |

| Friday, January 1, 2016 | 3176000000 | 174791291 |

| Sunday, January 1, 2017 | 3418000000 | 168379000 |

| Monday, January 1, 2018 | 3875000000 | 263653000 |

| Tuesday, January 1, 2019 | 2827000000 | 322140110 |

| Wednesday, January 1, 2020 | 1674000000 | 358617000 |

| Friday, January 1, 2021 | 2423000000 | 339928424 |

| Saturday, January 1, 2022 | 3031000000 | 557399151 |

| Sunday, January 1, 2023 | 4904000000 | 975874087 |

| Monday, January 1, 2024 | 5547999771 | 761100000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of industrial giants, Eaton Corporation plc and RB Global, Inc. have carved distinct paths over the past decade. From 2014 to 2023, Eaton's EBITDA has shown a robust growth trajectory, peaking in 2023 with a staggering 53% increase from its 2014 figures. This growth underscores Eaton's strategic prowess in navigating market challenges and capitalizing on opportunities.

Conversely, RB Global, Inc. has experienced a more modest yet steady rise, with its EBITDA nearly quintupling over the same period. This growth reflects RB Global's resilience and adaptability in a competitive market.

The data reveals a compelling narrative of two companies with different growth strategies, yet both achieving significant financial milestones. As we look to the future, these trends offer valuable insights into the strategic directions and market positions of these industrial titans.

Cost Insights: Breaking Down Eaton Corporation plc and RB Global, Inc.'s Expenses

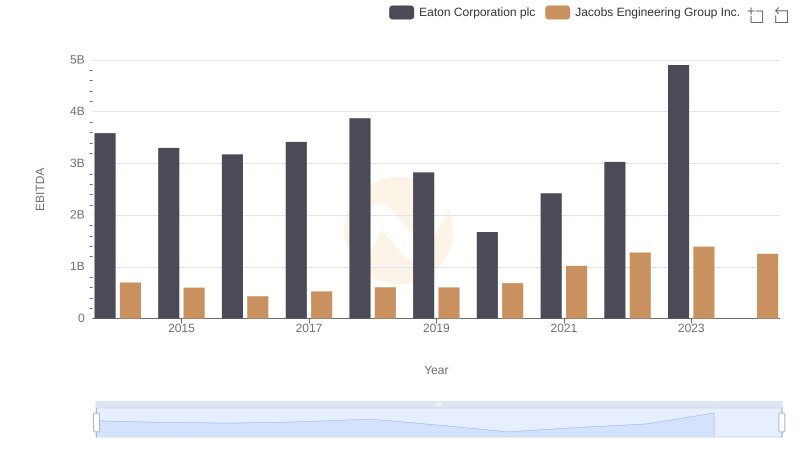

EBITDA Metrics Evaluated: Eaton Corporation plc vs Jacobs Engineering Group Inc.

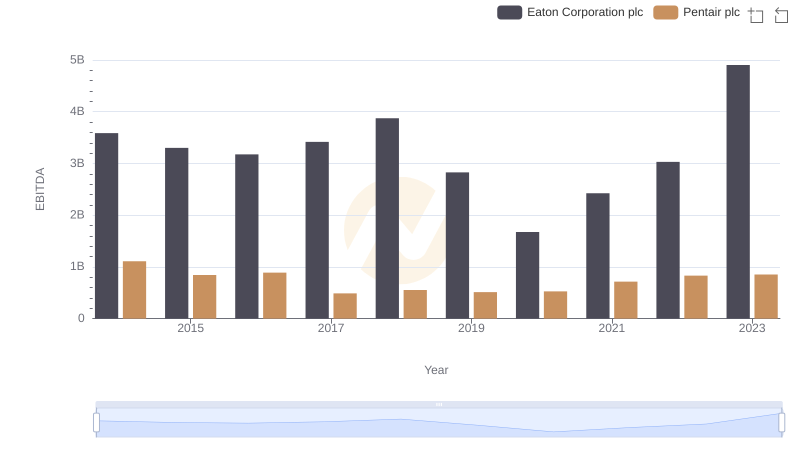

Eaton Corporation plc and Pentair plc: A Detailed Examination of EBITDA Performance

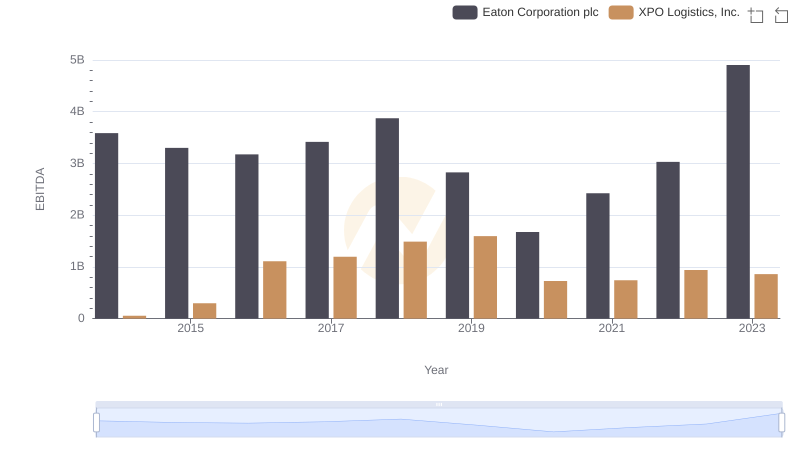

Comprehensive EBITDA Comparison: Eaton Corporation plc vs XPO Logistics, Inc.