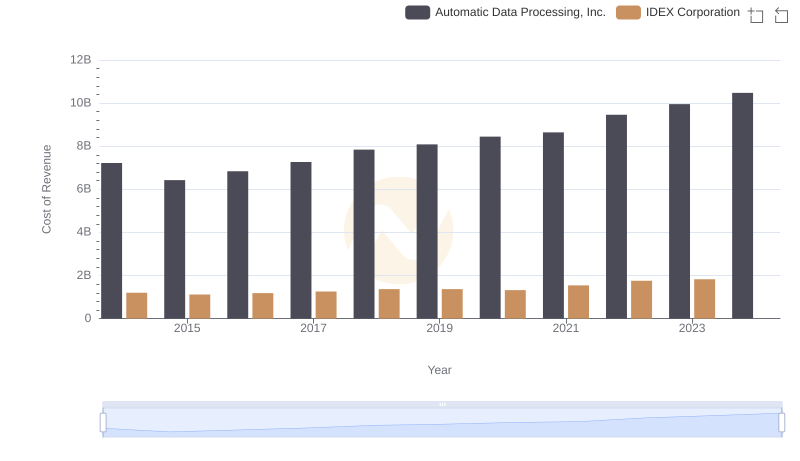

| __timestamp | Automatic Data Processing, Inc. | IDEX Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 11832800000 | 2147767000 |

| Thursday, January 1, 2015 | 10560800000 | 2020668000 |

| Friday, January 1, 2016 | 11290500000 | 2113043000 |

| Sunday, January 1, 2017 | 11982400000 | 2287312000 |

| Monday, January 1, 2018 | 12859300000 | 2483666000 |

| Tuesday, January 1, 2019 | 13613300000 | 2494573000 |

| Wednesday, January 1, 2020 | 14589800000 | 2351646000 |

| Friday, January 1, 2021 | 15005400000 | 2764800000 |

| Saturday, January 1, 2022 | 16498300000 | 3181900000 |

| Sunday, January 1, 2023 | 18012200000 | 3273900000 |

| Monday, January 1, 2024 | 19202600000 | 3268800000 |

Unveiling the hidden dimensions of data

In the competitive landscape of the U.S. stock market, Automatic Data Processing, Inc. (ADP) and IDEX Corporation have showcased intriguing revenue trends over the past decade. Since 2014, ADP has consistently demonstrated robust growth, with its revenue surging by approximately 62% by 2023. This growth trajectory highlights ADP's strategic prowess in adapting to market demands and expanding its service offerings.

Conversely, IDEX Corporation, while smaller in scale, has also shown commendable progress. From 2014 to 2023, IDEX's revenue increased by about 52%, reflecting its stronghold in niche markets and innovative product lines. However, data for 2024 remains elusive, leaving room for speculation on future performance.

These trends underscore the dynamic nature of the financial landscape, where strategic innovation and market adaptability are key to sustained growth.

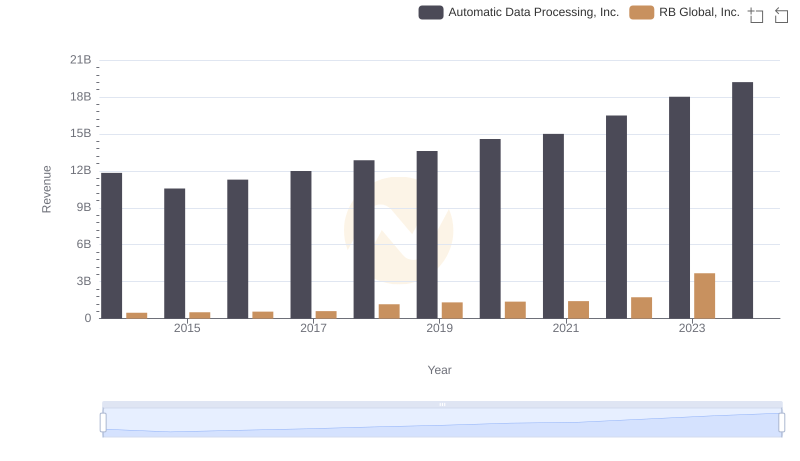

Annual Revenue Comparison: Automatic Data Processing, Inc. vs RB Global, Inc.

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and IDEX Corporation

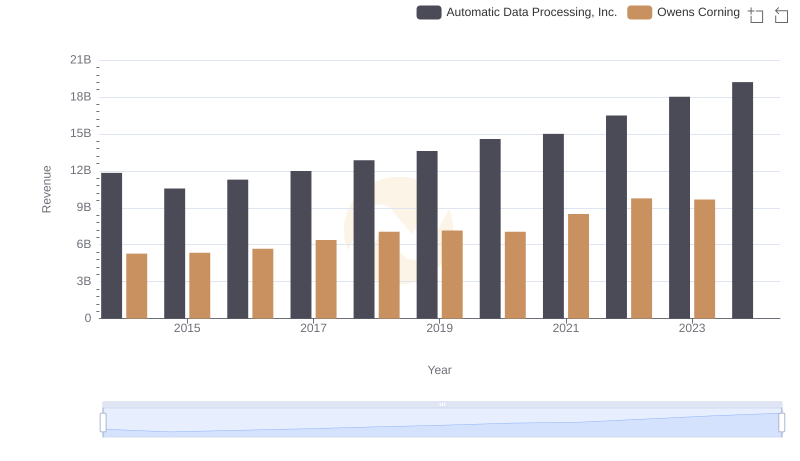

Automatic Data Processing, Inc. vs Owens Corning: Annual Revenue Growth Compared

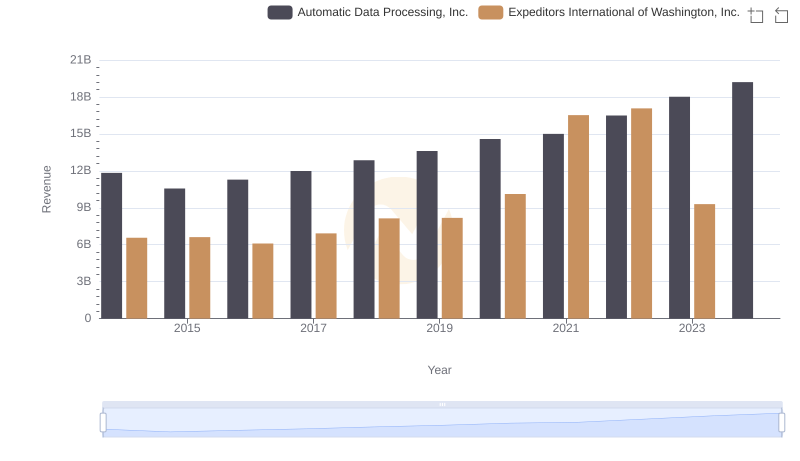

Comparing Revenue Performance: Automatic Data Processing, Inc. or Expeditors International of Washington, Inc.?

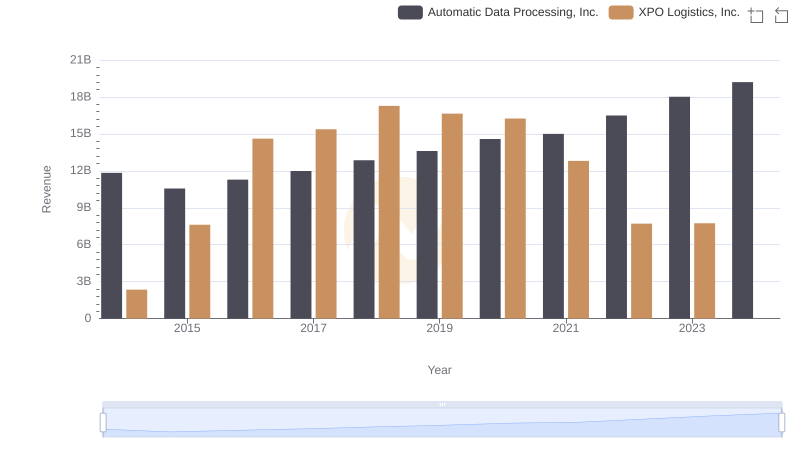

Automatic Data Processing, Inc. and XPO Logistics, Inc.: A Comprehensive Revenue Analysis

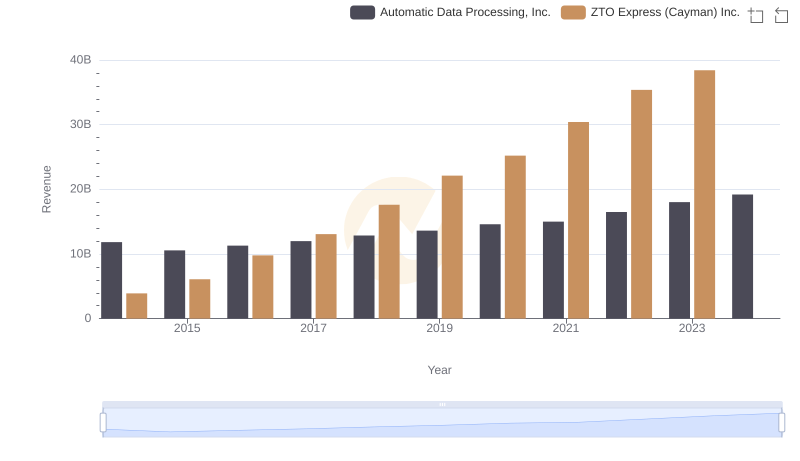

Revenue Insights: Automatic Data Processing, Inc. and ZTO Express (Cayman) Inc. Performance Compared

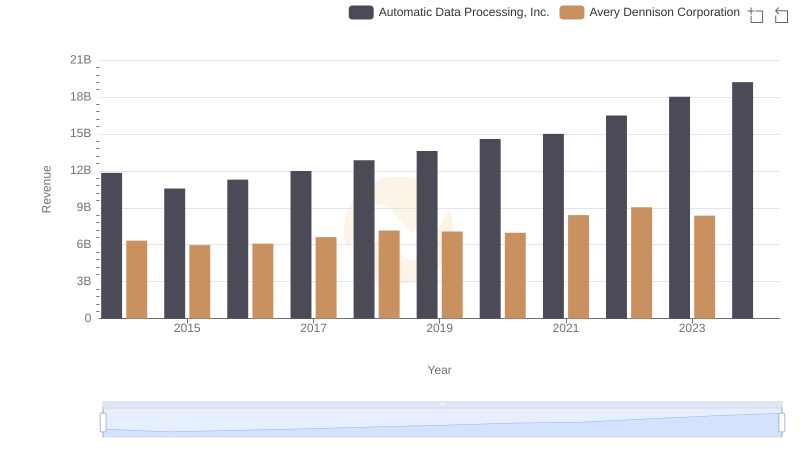

Automatic Data Processing, Inc. or Avery Dennison Corporation: Who Leads in Yearly Revenue?

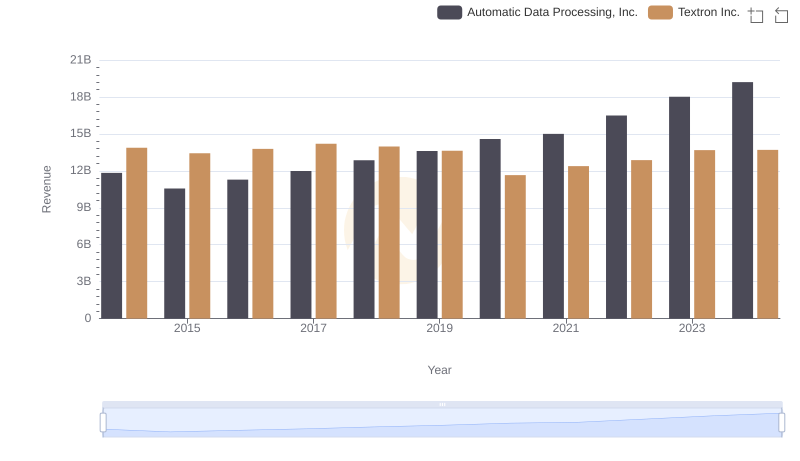

Revenue Showdown: Automatic Data Processing, Inc. vs Textron Inc.

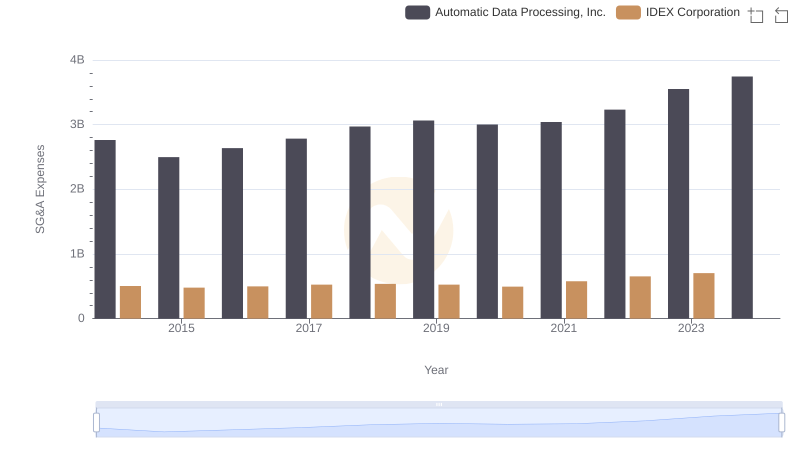

Selling, General, and Administrative Costs: Automatic Data Processing, Inc. vs IDEX Corporation